Biocompatible Coatings Market Report Scope & Overview:

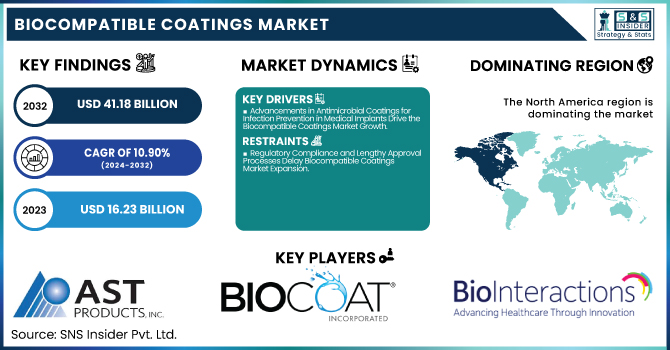

The Biocompatible Coatings Market Size was valued at USD 16.23 Billion in 2023 and is expected to reach USD 41.18 Billion by 2032, growing at a CAGR of 10.90% over the forecast period of 2024-2032.

To Get more information on Biocompatible Coatings Market - Request Free Sample Report

The biocompatible coatings market is evolving rapidly with technological advancements and sustainability initiatives. Our report explores funding and investment trends, showcasing capital inflows driving innovation in antimicrobial and hydrophilic coatings. As regulations tighten, regulatory compliance and certifications like FDA and CE approvals are crucial for market entry. Medical device manufacturers are expanding R&D efforts, with future adoption plans focusing on next-gen biomaterials. Meanwhile, government incentives for eco-friendly coatings are accelerating sustainable alternatives. The industry is also adapting to recycling and disposal regulations, ensuring responsible waste management. Our report provides a comprehensive analysis of these dynamics, offering insights into the market’s future growth and the key factors shaping its development.

The US Biocompatible Coatings Market Size was valued at USD 5.08 Billion in 2023 and is expected to reach USD 12.39 Billion by 2032, growing at a CAGR of 10.42% over the forecast period of 2024-2032. The U.S. biocompatible coatings market is experiencing significant growth, driven by advancements in medical device technology, stringent FDA regulations, and increasing demand for infection-resistant coatings. Organizations like the Advanced Medical Technology Association (AdvaMed) emphasize innovation in biomaterials, while the National Institute of Health (NIH) funds research on antimicrobial coatings for implants. Companies such as Surmodics, Inc. and Hydromer, Inc. are developing advanced hydrophilic and antibacterial coatings for catheters and stents, improving patient outcomes. Additionally, the rising adoption of minimally invasive surgeries and government incentives for eco-friendly coatings are fueling the market, ensuring sustainable and high-performance medical solutions.

Biocompatible Coatings Market Dynamics

Drivers

-

Advancements in Antimicrobial Coatings for Infection Prevention in Medical Implants Drive the Biocompatible Coatings Market Growth

The rising concerns regarding healthcare-associated infections (HAIs) have significantly driven the demand for antimicrobial biocompatible coatings in medical implants. Hospitals and healthcare facilities in the United States have reported an increasing number of infections related to implantable medical devices such as catheters, orthopedic implants, and cardiovascular stents. To address this issue, companies like Surmodics, Inc. and Biocoat Incorporated are investing in coatings that incorporate silver ions and hydrophilic materials to resist bacterial adhesion. The Centers for Disease Control and Prevention (CDC) has emphasized the importance of infection control measures, further accelerating the adoption of these coatings. Additionally, regulatory agencies such as the U.S. Food and Drug Administration (FDA) are actively supporting antimicrobial-coated devices by streamlining approval processes. The rising prevalence of chronic diseases like diabetes and cardiovascular disorders, which necessitate long-term implantable medical devices, is also contributing to market growth. Innovations such as nanostructured antimicrobial coatings that continuously release antibacterial agents over time are being explored to enhance device longevity. This trend positions antimicrobial biocompatible coatings as a key growth driver in the industry.

Restraints

-

Regulatory Compliance and Lengthy Approval Processes Delay Biocompatible Coatings Market Expansion

The biocompatible coatings market is subject to strict regulatory frameworks, particularly from the FDA, European Medicines Agency (EMA), and International Organization for Standardization (ISO 10993). Compliance with biocompatibility testing, safety assessments, and clinical trials is mandatory for product approval, leading to extended market entry timelines. Companies must conduct extensive cytotoxicity, irritation, and sensitization tests before launching new coatings, which increases development costs. Additionally, evolving safety standards and changing regulatory policies further complicate the approval process. Delays in obtaining patents and intellectual property rights also hinder innovation, making it difficult for manufacturers to introduce next-generation biocompatible coatings. The FDA's stringent policies require long-term stability testing, which prolongs commercialization, especially for nanotechnology-based coatings. Small manufacturers struggle to navigate complex regulatory landscapes, limiting their market reach. While regulatory bodies aim to ensure product safety and efficacy, the extended approval time slows market adoption and revenue growth. Companies investing in compliance-driven innovations and regulatory collaborations may overcome these challenges, but navigating the strict approval process remains a key restraint.

Opportunities

-

Growing Demand for Smart and Stimuli-Responsive Coatings Creates New Opportunities in the Biocompatible Coatings Market

The development of smart coatings that respond to external stimuli, such as temperature, pH, or moisture, is opening new growth avenues in the biocompatible coatings market. Research by the National Institute of Biomedical Imaging and Bioengineering (NIBIB) suggests that these coatings can release therapeutic agents when triggered by physiological conditions. Companies like Innovative Surface Technologies are developing stimuli-responsive biocompatible coatings that improve drug delivery and wound healing applications. These coatings enhance treatment efficacy and patient outcomes, making them highly desirable in regenerative medicine and implantable devices. The ability of smart coatings to actively interact with biological environments provides a customized healing experience, reducing the need for follow-up procedures. Additionally, nanotechnology-based coatings with embedded biosensors are being explored to provide real-time monitoring of patient health, further expanding application potential. The increasing research collaborations between biotechnology firms and academic institutions are accelerating the development of advanced responsive coatings, offering lucrative opportunities in this market.

Challenge

-

Intellectual Property and Patent Protection Issues Hinder Innovation in the Biocompatible Coatings Market

The biocompatible coatings market is highly competitive, with companies facing intellectual property disputes that restrict innovation and market expansion. Patent conflicts over coating formulations and application techniques create legal uncertainties, affecting research investments. The U.S. Patent and Trademark Office (USPTO) has recorded multiple patent disputes in biomedical coatings, limiting the ability of small and emerging players to introduce novel biocompatible coatings in the industry. As medical coatings become more complex and multifunctional, companies must navigate overlapping patents and licensing agreements, increasing legal costs. Some firms hesitate to invest in new coating technologies due to the risk of infringement lawsuits, slowing innovation. Additionally, cross-border patent laws create further complexities, making it difficult for companies to expand internationally. To overcome this challenge, industry players are focusing on collaborative research partnerships, licensing agreements, and patent-sharing initiatives to foster innovation. However, intellectual property constraints continue to be a significant barrier, particularly for startups and small-scale manufacturers in the biocompatible coatings market.

Biocompatible Coatings Market Segmental Analysis

By Type

Hydrophilic biocompatible coatings dominated the market in 2023 with a 50.3% market share, primarily due to their superior lubricity, biocompatibility, and infection resistance. These coatings are widely used in catheters, guidewires, stents, and endoscopic instruments, where reducing friction and preventing bacterial adhesion are critical. The U.S. Food and Drug Administration (FDA) has emphasized the role of hydrophilic coatings in preventing catheter-associated infections, leading to their increased adoption in minimally invasive surgeries and long-term implants. Companies like Surmodics, Inc. and DSM Biomedical have developed advanced hydrophilic polymer coatings that improve blood compatibility and device durability. Additionally, research from the National Institutes of Health (NIH) highlights their ability to enhance drug-eluting properties in cardiovascular applications, further driving demand. The rising incidence of cardiovascular diseases, urinary disorders, and neurological conditions has increased the need for low-friction, biocompatible medical devices, reinforcing the segment’s market dominance. Growing investments in next-generation polymer coatings with antimicrobial and drug-eluting capabilities will further strengthen the demand for hydrophilic coatings in medical applications.

By Material

Polymer-based dominated the biocompatible coatings market and held a 48.6% market share in 2023, owing to their versatility, biocompatibility, and ease of processing. These coatings are widely applied in surgical implants, drug delivery systems, orthopedic devices, and biosensors due to their low toxicity, flexibility, and ability to integrate with biological tissues. The American Chemical Society (ACS) and National Science Foundation (NSF) have highlighted the growing use of polymeric coatings in bioelectronics and tissue engineering, supporting market expansion. Leading manufacturers such as Covestro, Evonik, and Solvay are developing biodegradable polymer coatings that help reduce inflammatory responses and improve long-term implant performance. The increasing adoption of sustainable and non-toxic polymer coatings, along with government incentives for eco-friendly medical materials, further strengthens this segment’s growth. Additionally, advancements in 3D printing of polymer-coated implants are revolutionizing personalized medicine, enhancing demand for biocompatible polymer coatings in prosthetics and regenerative therapies. The shift toward smart coatings with antimicrobial and drug-eluting capabilities positions polymers as the preferred material for next-generation biocompatible coatings.

By End-use Industry

Medical devices dominated the biocompatible coatings market in 2023, capturing a 50.4% market share, driven by increasing demand for implantable and minimally invasive medical technologies. The U.S. Food and Drug Administration (FDA) has reinforced regulations requiring biocompatibility assessments for coatings used in implantable and disposable medical devices, boosting their adoption. Companies like BASF, Harland Medical Systems, and Materion Corporation are investing in antimicrobial, thromboresistant, and drug-eluting coatings to enhance the performance of cardiac stents, orthopedic implants, and diagnostic equipment. Additionally, biocompatible coatings are essential for extending the lifespan and safety of pacemakers, biosensors, and prosthetic devices, further driving demand. Research from the National Institute of Biomedical Imaging and Bioengineering (NIBIB) highlights the importance of biocompatible coatings in reducing post-surgical infections and enhancing wound healing, which is particularly crucial in orthopedic and cardiovascular applications. The rise of 3D-printed and bioelectronic medical devices has further spurred innovation in biocompatible coatings, enabling better integration with human tissues and enhanced therapeutic efficacy.

Biocompatible Coatings Market Regional Outlook

North America dominated the biocompatible coatings market in 2023 with an estimated market share of 38.5%, driven by high healthcare expenditure, strong regulatory frameworks, and rapid adoption of advanced medical devices. The United States dominated the regional market, primarily due to the presence of leading biocompatible coatings manufacturers such as Surmodics, Inc., Harland Medical Systems, and DSM Biomedical. The U.S. Food and Drug Administration (FDA) enforces strict biocompatibility testing and compliance standards, encouraging innovations in antimicrobial, hydrophilic, and thromboresistant coatings for cardiovascular and orthopedic implants. According to the Centers for Medicare & Medicaid Services (CMS), U.S. healthcare spending exceeded $4.5 trillion in 2023, fueling demand for high-performance, biocompatible medical coatings in surgical implants and diagnostic devices. Canada followed as the second-largest market, driven by government-backed healthcare investments, particularly in minimally invasive surgical technologies and bioelectronic implants. Mexico, the fastest-growing North American country, saw increased foreign direct investment (FDI) in medical device manufacturing, with companies such as Medtronic and Stryker expanding production to meet regional demand. The region’s dominance is further bolstered by advancements in 3D printing for biocompatible prosthetics, ongoing collaborations between universities and biotech firms, and the integration of nanocoatings for enhanced drug delivery applications.

Asia Pacific emerged as the fastest-growing region in the biocompatible coatings market, with a significant growth rate during the forecast period, driven by expanding healthcare infrastructure, rising medical tourism, and increasing demand for cost-effective, high-quality medical coatings. China dominates the region, supported by significant government funding for biotechnology and advanced material research, with institutions like the Chinese Academy of Sciences (CAS) and the National Natural Science Foundation of China (NSFC) investing in biocompatible and antimicrobial coatings for medical devices. India is emerging as the second-largest contributor, with the Make in India initiative attracting foreign investments in medical device manufacturing, particularly in hydrophilic coatings for catheters and orthopedic implants. The Japan Bioplastics Association (JBPA) has also reported a surge in biopolymer coatings for biodegradable medical products, aligning with sustainability trends. Additionally, South Korea, backed by the Korea Health Industry Development Institute (KHIDI), is investing in nanocoatings for precision medicine applications. The region’s rapid growth is further propelled by lower production costs, a high patient pool, and government-led initiatives to boost domestic medical device innovation.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

AST Products, Inc. (LubriLAST, HydroLAST, UltraLAST)

-

Biocoat Incorporated (Hydak, Hydak UV, Hydak AM)

-

BioInteractions Limited (AvertPlus, AssistPlus, TridAnt)

-

Carmeda AB (Carmeda BioActive Surface, Heparin Coating, Antithrombogenic Coatings)

-

Coatings2Go LLC (Hydrophilic Coating Kits, Antimicrobial Coating Kits)

-

Covalon Technologies Ltd. (AquaGuard, IV Clear, Collagen Coatings)

-

DSM Biomedical (ComfortCoat, BioSpan, Arnitel)

-

Formacoat (Custom Hydrophilic Coatings, Drug-Loaded Coatings, Antimicrobial Coatings)

-

FSI Coating Technologies, Inc. (HydroKlear, Visgard, Optic+)

-

Harland Medical Systems (LubriSkin, HydroGlide, HydroSleek)

-

Heraeus Holding (Heraeus BioCoat, PALACOS R, MicroSilver BG)

-

Hemoteq AG (Hemoteq Drug-Eluting Coatings, Hydrophilic Coatings, Antithrombogenic Coatings)

-

Hydromer, Inc. (Hydromer Hydrophilic, Biosearch, Antimicrobial Coatings)

-

Innovative Surface Technologies (ISurGlide, ISurCoat, Antifouling Coatings)

-

Surmodics, Inc. (Serene, PhotoLink, Duraflo)

-

Surface Solutions Group, LLC (Nusil, ProGlide, FluoroMed)

-

SDC Technologies, Inc. (Mitsui Chemicals, Inc.) (CrystalCoat, UV-Curable Hydrophilic Coatings, Anti-Fog Coatings)

-

AdvanSource Biomaterials Corp. (ChronoFlex, HydroMed, HydroThane)

-

Evonik Industries AG (RESOMER, EUDRAGIT, VESTAKEEP)

-

BioCote Ltd. (BioCote Antimicrobial Coatings, Silver-Based Coatings, Polymer Additives)

Recent Developments

-

March 2025: Smart reactors revolutionized medical device coatings in the UK, improving application precision, quality, and efficiency for manufacturers and patients.

-

August 2024: Hydromer introduced next-gen medical device coatings with superior lubricity, durability, and biocompatibility, addressing evolving healthcare industry needs.

-

October 2023: Surmodics launched Preside hydrophilic coatings, enhancing lubricity and durability for neurovascular and coronary medical devices. The UV-cured coatings integrate easily into manufacturing, reducing costs and improving performance.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 16.23 Billion |

| Market Size by 2032 | USD 41.18 Billion |

| CAGR | CAGR of 10.90% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Antibacterial, Hydrophilic, Others) •By Material (Polymer, Ceramics, Metal, Others) •By End-use Industry (Healthcare, Food & Beverage, Medical Devices, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Surmodics, Inc., DSM Biomedical, Hydromer, Inc., AST Products, Inc., Biocoat Incorporated, BioInteractions Limited, Covalon Technologies Ltd., Heraeus Holding, Harland Medical Systems, Hemoteq AG and other key players |