Hydrophilic Coating Market Report Scope & Overview:

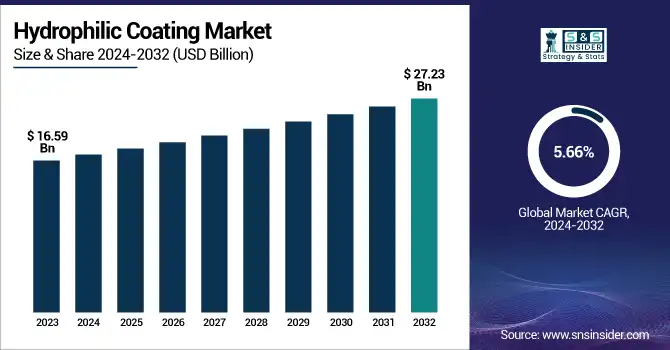

The Hydrophilic Coating Market Size was valued at USD 16.59 Billion in 2023 and is expected to reach USD 27.23 Billion by 2032, growing at a CAGR of 5.66% over the forecast period of 2024-2032.

To Get more information on Hydrophilic Coating Market - Request Free Sample Report

The Hydrophilic Coating Market is evolving rapidly, driven by advancements in medical devices, automotive safety, and optical applications. With a growing emphasis on sustainability, eco-friendly coatings are gaining popularity, offering biodegradable and water-based alternatives. Regulatory standards such as FDA and REACH are shaping product innovation, ensuring compliance across industries. Meanwhile, regional investment hotspots are emerging, with North America and Europe leading, while Asia Pacific sees rapid expansion in manufacturing and R&D. A detailed comparison of hydrophilic and hydrophobic coatings reveals their unique benefits, guiding industries in selecting the right solutions. Our report explores these market dynamics, key players, and future opportunities, offering a deep dive into the trends shaping the hydrophilic coating industry.

The US Hydrophilic Coating Market Size was valued at USD 5.28 Billion in 2023 and is expected to reach USD 8.44 Billion by 2032, growing at a CAGR of 5.35% over the forecast period of 2024-2032.

The U.S. Hydrophilic Coating Market is witnessing steady growth, driven by rising demand in medical devices, automotive safety, and optical applications. The expanding healthcare sector, backed by organizations like the U.S. Food and Drug Administration (FDA), is pushing for advanced biocompatible coatings in catheters and guidewires. In the automotive industry, companies like Tesla and General Motors are exploring anti-fog and self-cleaning coatings for improved visibility. Additionally, the National Institute of Standards and Technology (NIST) supports innovation in nanotechnology-based coatings, enhancing durability and performance. With strong R&D investments and regulatory support, the U.S. remains a key hub for hydrophilic coating advancements.

Hydrophilic Coating Market Dynamics

Drivers

-

Rising Adoption of Smart and Self-Cleaning Coatings in Consumer Electronics Enhances Market Growth

The consumer electronics industry is increasingly adopting hydrophilic coatings due to their self-cleaning, anti-fingerprint, and moisture-resistant properties. Leading manufacturers such as Apple, Samsung, and Sony are integrating these coatings into smartphones, tablets, smartwatches, and wearable devices, enhancing their durability and functionality. Hydrophilic coatings prevent smudging, reduce moisture accumulation, and improve screen visibility, making them particularly useful in high-touch devices. With the rising demand for water-resistant electronics, these coatings play a crucial role in extending product lifespan. Additionally, research organizations like the Massachusetts Institute of Technology (MIT) are developing hydrophilic nanocoatings to improve heat dissipation and energy efficiency in electronic devices, preventing overheating and improving performance. As consumers seek low-maintenance and long-lasting gadgets, hydrophilic coatings are emerging as a preferred solution in next-generation electronic products. The expansion of wearable technology, smart home devices, and touch-sensitive screens will further drive demand for these coatings, positioning them as a key growth area in the Hydrophilic Coating Market.

Restraints

-

Limited Long-Term Durability and Performance of Hydrophilic Coatings Restricts Market Growth

Despite their functional advantages, hydrophilic coatings suffer from limited long-term durability, especially when subjected to harsh environmental conditions, mechanical wear, and frequent cleaning cycles. In automotive and aerospace applications, exposure to UV radiation, high humidity, and chemical pollutants accelerates coating degradation, leading to frequent reapplications and increased maintenance costs. Similarly, in medical devices, repeated sterilization processes can erode hydrophilic coatings over time, potentially affecting device functionality and patient safety. For instance, catheters and guidewires require hydrophilic coatings for enhanced lubricity and biocompatibility, but their longevity remains a challenge in long-term medical use. Industries such as marine and industrial manufacturing demand coatings with high resistance to chemical exposure and mechanical stress, but current formulations often fall short. Researchers are exploring self-replenishing hydrophilic coatings to improve lifespan, but widespread adoption remains limited due to technical and cost constraints. Without breakthrough advancements in material longevity, many industries may hesitate to transition fully to hydrophilic coatings, slowing overall market growth.

Opportunities

-

Growing Demand for Hydrophilic Nanocoatings in Advanced Medical and Industrial Applications Expands Market Scope

The development of hydrophilic nanocoatings is creating new growth opportunities across medical, industrial, and consumer electronics sectors. These coatings offer enhanced adhesion, improved durability, and superior water-attracting properties, making them highly beneficial for applications requiring moisture control and surface protection. In the medical industry, hydrophilic nanocoatings are being used in catheters, stents, and microfluidic devices, significantly improving lubricity, biocompatibility, and performance. Research initiatives led by the National Nanotechnology Initiative (NNI) in the United States are driving innovations in self-cleaning, anti-fouling, and bioactive nanocoatings, broadening their market potential. Similarly, in industrial applications, hydrophilic nanocoatings enhance corrosion resistance, anti-fog properties, and wear resistance, making them ideal for marine, aerospace, and automotive components. Additionally, the consumer electronics industry is adopting these coatings for smartphone screens, camera lenses, and wearable devices, preventing fingerprints and moisture accumulation. As industries recognize the advantages of nanoscale hydrophilic coatings, investments in next-generation materials and advanced surface engineering will drive long-term market expansion.

Challenge

-

Complex Manufacturing and Quality Control Processes in Hydrophilic Coating Production Pose Technical Challenges

The manufacturing and quality control of hydrophilic coatings present significant technical challenges, particularly in industries requiring high precision and regulatory compliance. The production process involves complex chemical formulations, advanced surface treatment methods, and stringent quality assurance protocols, making large-scale manufacturing difficult. In medical applications, coatings must meet strict biocompatibility and sterility requirements, leading to lengthy approval processes by the U.S. Food and Drug Administration (FDA). Similarly, in the automotive and aerospace industries, hydrophilic coatings must withstand extreme environmental conditions while maintaining durability and effectiveness, requiring extensive material testing and validation. The integration of hydrophilic coatings into existing manufacturing lines often necessitates specialized equipment and skilled personnel, increasing operational costs. Additionally, ensuring uniform coating thickness, adhesion, and long-term stability across different substrates remains a challenge. Companies are investing in automated coating technologies and nanomaterial-based solutions to enhance production efficiency and quality consistency, but widespread adoption of cost-effective and scalable solutions remains a significant hurdle in market expansion.

Hydrophilic Coating Market Segmental Analysis

By Substrate

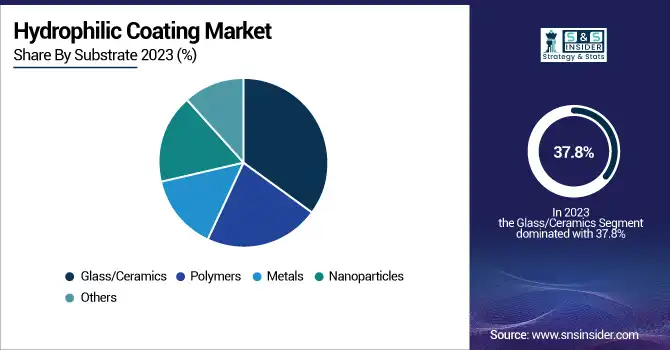

Glass/Ceramics dominated the Hydrophilic Coatings Market in 2023 with a market share of 37.8%. The dominance of this segment is attributed to its widespread use in medical, automotive, and optical applications, where durability, chemical resistance, and moisture retention properties are essential. Hydrophilic coatings on ceramic-based medical devices, including surgical tools and implants, enhance biocompatibility and reduce friction, improving patient outcomes. The National Institutes of Health (NIH) and U.S. Food and Drug Administration (FDA) have encouraged advancements in bioactive ceramic coatings, boosting adoption. In automotive applications, hydrophilic coatings on glass windshields and mirrors improve visibility by preventing fogging and water accumulation, a growing concern addressed by manufacturers like PPG Industries and Saint-Gobain. Additionally, in the optical industry, leading companies such as EssilorLuxottica and Zeiss have incorporated hydrophilic coatings on eyeglasses and camera lenses to repel dust, oil, and moisture, driving market growth. The high surface energy and strong adhesion of hydrophilic coatings on glass and ceramics have positioned this segment as the preferred choice across multiple industries.

By Application

Automotive dominated the Hydrophilic Coatings Market in 2023 with a market share of 34.9%. The rising demand for advanced vehicle safety and visibility features has significantly fueled the adoption of hydrophilic coatings on windshields, mirrors, and sensor covers. Automakers such as Tesla, General Motors, and Ford have invested in self-cleaning and anti-fogging coatings, improving driver safety in adverse weather conditions. The National Highway Traffic Safety Administration (NHTSA) has emphasized the role of visibility-enhancing coatings in reducing accident risks, further propelling market growth. Additionally, the integration of hydrophilic coatings in LiDAR sensors and camera lenses is crucial for autonomous vehicles, with companies like Waymo and Mobileye prioritizing moisture-resistant solutions. Toyota and Honda have also developed hydrophilic-coated side mirrors, minimized water droplets and enhanced visibility. The push for sustainable, water-based hydrophilic coatings to replace traditional chemical treatments aligns with stringent environmental regulations by the U.S. Environmental Protection Agency (EPA), reinforcing the dominance of the automotive segment.

Hydrophilic Coating Market Regional Outlook

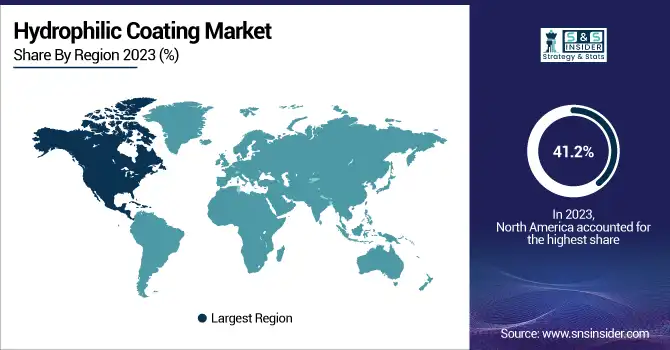

North America dominated the Hydrophilic Coatings Market in 2023 with a market share of 41.2%. The region’s leadership is driven by strong demand from the medical devices, automotive, and aerospace industries, coupled with stringent regulatory standards ensuring product quality and safety. The U.S. accounts for the highest market share, supported by major players such as Surmodics, Inc., Harland Medical Systems, and Hydromer, Inc., who are investing in next-generation biocompatible hydrophilic coatings for medical applications. The U.S. Food and Drug Administration (FDA) has stringent approval processes for medical coatings used in catheters, guidewires, and stents, boosting demand for high-performance hydrophilic coatings. The National Science Foundation (NSF) has funded projects focusing on self-healing and antimicrobial hydrophilic coatings, further driving innovation. Canada is the fastest-growing market in North America, with increased investments in automotive hydrophilic coatings by companies like Magna International, aligning with zero-emission vehicle mandates. Mexico, an emerging hub for automotive and aerospace manufacturing, has seen a surge in hydrophilic coatings for visibility-enhancing applications, supported by government incentives for advanced manufacturing. The robust industrial base, coupled with technological advancements, continues to drive North America's dominance in the hydrophilic coatings market.

Moreover, Asia Pacific emerged as the fastest-growing region in the Hydrophilic Coatings Market in 2023 with a significant CAGR during the forecast period. The region’s rapid expansion is fueled by booming medical device manufacturing, increasing automotive production, and rising infrastructure developments. China dominates the Asia Pacific market, driven by government-backed investments in advanced materials and medical technology. The Made in China 2025 initiative supports the development of biocompatible coatings for medical implants and high-tech automotive components, propelling demand. Japan, known for its pioneering research in nanocoatings, has seen significant growth in hydrophilic coatings for anti-fogging optical lenses and electronics. Companies like Nippon Paint Holdings and Daikin Industries are expanding their hydrophilic coating portfolios to cater to automotive and industrial applications. India, the fastest-growing country in the region, is witnessing increased adoption of hydrophilic coatings in medical textiles, automotive windshields, and water treatment applications, supported by initiatives like Make in India and government funding for healthcare and industrial innovation. With rising investments from international players and growing domestic demand, Asia Pacific is set to outpace other regions in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Aculon, Inc. (NanoProof, Hydrophilic Surface Treatment)

-

AdvanSource Biomaterials Corporation (Hydrophilic Polymers, ChronoFlex AL Hydrophilic Coating)

-

Applied Medical Coatings, LLC (HydroMed, HydroThane)

-

AST Products, Inc. (HydroLAST, LubriLAST)

-

Biocoat, Inc. (HydroSIL, Hydak Coatings)

-

BioInteractions Ltd. (AqCure, Multi-functional Coatings)

-

Coatings2Go (Coatings2Go Hydrophilic Coatings, Ready-to-Use Hydrophilic Coatings)

-

Dontech, Inc. (ClearShield Hydrophilic Coatings, Optical Hydrophilic Coatings)

-

Formacoat LLC (Custom Hydrophilic Coating Solutions, Formacoat Medical Coatings)

-

FSI Coating Technologies, Inc. (HydroKlear, Visgard Hydrophilic Coatings)

-

Harland Medical Systems, Inc. (UltraCoat, HydroTite)

-

Henkel AG & Co. KGaA (Loctite Medical Coatings, Bonderite Hydrophilic Coatings)

-

Hydromer, Inc. (Hydromer Hydrophilic Coatings, HydroGlyde)

-

Innovative Surface Technologies, Inc. (InnoLast, InnoCoat Hydrophilic)

-

Medical Surface Inc. (MSI Hydrophilic Coatings, Biocompatible Surface Treatments)

-

Sono-Tek Corporation (SonoCoat for Medical Devices, Ultrasonic Hydrophilic Coatings)

-

Surface Solutions Group, LLC (SILKY Hydrophilic Coatings, Glidecoat)

-

Surmodics, Inc. (Serene, Duraflo)

-

Teleflex, Inc. (HydroGlide, GlideRite Hydrophilic Coatings)

-

TUA Systems, Inc. (TUA Hydrophilic Coatings, Custom Hydrophilic Coatings)

Recent Developments

-

November 2024: Medeologix teamed up with Biocoat to enhance hydrophilic coating services for catheter solutions, strengthening its presence in the Bay Area’s medical device market.

-

September 2024: Biocoat received a patent for a non-PFAS thermal hydrophilic coating, offering high lubricity and eco-friendly benefits for medical devices.

-

November 2023: Surmodics introduced Preside, a hydrophilic coating for neurovascular and coronary applications, enhancing lubricity and durability in minimally invasive procedures.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 16.59 Billion |

| Market Size by 2032 | USD 27.23 Billion |

| CAGR | CAGR of 5.66% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Substrate (Polymers, Glass/Ceramics, Metals, Nanoparticles, Others) •By Application (Aerospace, Automotive, Marine, Medical devices & equipment, Optical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Surmodics, Inc., Hydromer, Inc., Harland Medical Systems, Inc., Biocoat, Inc., AST Products, Inc., Formacoat LLC, Surface Solutions Group, LLC, FSI Coating Technologies, Inc., BioInteractions Ltd., Sono-Tek Corporation and other key players |