Food Service Packaging Market Key Insights:

Get More Information on Food Service Packaging Market - Request Sample Report

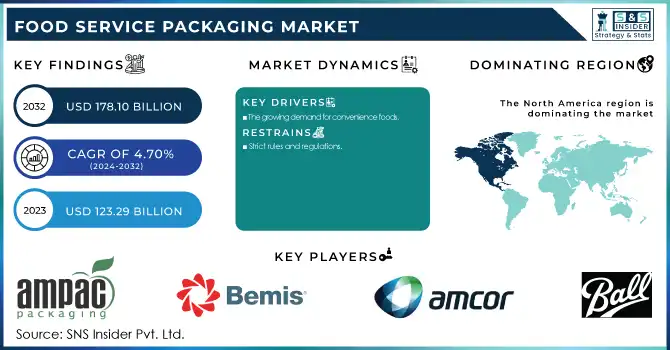

The global Food Service Packaging Market was valued at USD 123.29 billion in 2023 and is projected to reach USD 178.10 billion by 2032, growing at a robust CAGR of 4.70% during the forecast period of 2024-2032.

Food service packaging is mainly used for all kinds of food including vegetables, dairy products, fruits, etc. The main purpose of the food packaging market is to enable food to be preserved for a long period of time. The packaging protects the food from dust, UV rays, moisture and other contaminants, keeping it fresh and intact. Food service packages are very convenient and come in a wide variety of options and conveniences for consumers. In addition, most of this packaging is single-use, so it is very hygienic and has a low germ count compared to other reusable items. Such favourable properties of food packaging will drive the growth of the fresh food packaging industry.

The long shelf life of the product and the low material cost of food packaging increase its market value. In addition, the increasing number of restaurants and the takeaway service of these restaurants increases the market potential. Packaging is typically made of materials such as plastic and metal that greatly reduce the risk of food spoilage. Food packaging facilitates transportation and provides adequate protection against contamination. Declining raw material costs for manufacturing such packages will also contribute to market growth.

According to the market outlook, proper packaging of food products is given more and more importance in modern times, and the market size is expanding more and more. Over the years, the increasing demand for processed and ready-to-eat packaged foods has also increased the need for food packaging. Liquid and oil-based foods require rigorous storage, and the market offers just that, protecting them from light exposure, spoilage and other quality-impairments. Its light weight and easy handling increase its potential in the food packaging market.

MARKET DYNAMICS

KEY DRIVERS:

-

Food packaging cost efficiency

Consumer choices are gradually shifting from traditional methods of cooking food at home to purchasing packaged products. Food packaging media are made from recycled materials, requiring less resources and energy. Therefore, boxed and single-use packages are available cheaply and take up less retail space, making them cost-effective. It also provides a perfect presentation alternative with more options for eye-catching graphics, ultimately increasing the marketability of your product. A movable lifestyle will drive the growth of food service packaging technology and equipment.

-

The growing demand for convenience foods.

RESTRAIN:

-

Strict rules and regulations

Increased enforcement of stringent environmental regulations imposed on the industry regarding the packaging waste generated will hamper the market growth. Additionally, stringent product approval regulations limit the market's room for growth. Furthermore, tightening government regulations on the use of plastics as packaging materials will also limit market growth.

OPPORTUNITY:

-

Sustainable packaging solutions are increasingly in demand.

-

Emphasis on the use of latest technologies in packaging.

Increased strategic market linkages are increasing funds allocated for the growth and development of advanced and automated packaging lines and machinery. Moreover, increased investment in R&D skills will pave the way for innovation related to such packaging solutions.

-

The potential for growth of businesses is huge in emerging markets.

CHALLENGES:

-

There is an increasing incidence of food waste

Increasing food waste in the world is also a factor hindering market growth. According to the report, the United States wastes $45 billion worth of food each year. This will hinder the market growth.

IMPACT OF RUSSIA-UKRAINE WAR

The Russia-Ukraine war has the potential to impact the food service packaging market in several ways. It may cause disruptions in the supply chain, leading to shortages and increased costs for packaging materials. Sourcing and manufacturing strategies may need to be adjusted, resulting in shifts in production facilities and global supply chains. Price fluctuations in raw materials could occur, influencing the profitability and pricing strategies of packaging manufacturers. Changing consumer behaviour and regulatory measures may also affect demand and market dynamics. Ultimately, the war's impact on the economy and business environment could lead to market contraction or expansion.

The ongoing conflict between Russia and Ukraine has reduced exports of plastics to the country, including resins, plastic machinery, plastic moulds and plastic products. Plastic exports to Russia fell 61.4 % from $100 million to $37.8 million, while exports to Ukraine fell 50.4 % from $20.3 million to $9.4 million. So far, 2022 will be the last time Russia and Ukraine will accept exports of plastic machinery and moulds. This will affect the food service packaging industry since plastic contributes more in this market.

Polytetrafluoroethylene (PTFE) and other fluoropolymers are among the top 10 sources from Russia. A total of 950 thousand kg of his PTFE and other fluoropolymers were produced in Russia. This is down from 1.16 million kg for the same period in 2021.

The war also had a major impact on the import and export of metals around the world. This is mainly due to trade disruptions and increased transportation costs.

Russia accounts for about 10% of global nickel production and 5% of aluminum exports. Declining aluminum imports from Russia by other countries have reduced the production of this packaging material, impacting the food and beverage sector. The food and beverage segment has the highest market share in the end-use industry, accounting for approximately 25%. The overall cost of packaging has increased, and so has the cost of the final product manufactured by the end user. One of the materials used to manufacture this package is a petroleum-based polymer. Rising oil prices affect production costs. As a result of the war, crude oil prices rose to $112 a barrel.

IMPACT OF ONGOING RECESSION

The recession has not affected businesses. Comparing the annual sales of major companies dealing with food service packaging, it increased by an average of 3.5 % compared to 2021. This is due to an increase in QSR and food takeaway services which created the demand for food service packaging. However, companies are having trouble coping with rising commodity prices. Most of the manufacturer's revenue comes from sales. The recession pushed up commodity prices, impacting overall profitability. Prices for commodities such as aluminIum and polymers depend on changing economic conditions and the availability of resources. The cost of aluminIum has been on the rise since 2022 and now stands at $4,100, boding badly for manufacturers as it could impact their business.

KEY MARKET SEGMENTATION

By Material

-

Plastic

-

Metal

-

Paperboard

-

Aluminium

-

Others

By Packaging Type

-

Flexible

-

Rigid

-

Others

By End Use

-

Beverages

-

Fruits & Vegetables

-

Baked Goods

-

Others

REGIONAL ANALYSIS

North America dominated the food packaging market. This is due to the large consumer base of processed foods. There is an increasing focus on eco-friendly materials such as bioplastics and compostable packaging. Strict food safety and quality regulations and consumer preferences are driving innovation in packaging technology.

The Asia-Pacific region is expected to have the highest growth rate due to changing consumer preferences and rapid urbanization. Changing lifestyles and a growing middle class are driving the adoption of portable packaging solutions. There is a growing trend towards single-use plastic regulation and a shift towards sustainable packaging materials.

Europe has a mature food packaging market with a strong focus on sustainability and waste reduction. The region has strict regulations regarding packaging and recycling. There is a growing demand for lightweight, recyclable packaging and reusable packaging options.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The Major Players are Ball Corporation, Amcor Limited, Bemis Company Incorporated, Ampac Packaging LLC, Rock-Tenn Company, Sealed Air Corporation, Hinojosa Packaging Group, Envoy Solutions, Crown Holdings Incorporated, Letica Corporation and other players.

RECENT DEVELOPMENTS

-

The Hinojosa Packaging Group has introduced a paper-based and recyclable primary packaging product line for catering, which is intended to be used in both fourth and fifth heat layers as well as chilled beverages and quick meals.

-

US-Based Foodservice Packaging Provider Envoy Solutions Plans to Acquire Mooney General Paper (MGP)

-

The Heirloom Coffee Roasters company, a leader in regenerative coffee roasting, announces the launch of an exclusive 100% paper packaging for soft drinks from cafés and restaurants.

| Report Attributes | Details |

| Market Size in 2023 | US$ 123.29 Billion |

| Market Size by 2032 | US$ 178.10 Billion |

| CAGR | CAGR of 4.70% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Plastic, Metal, Paperboard, Aluminium, Others) • By Packaging Type (Paper & Paperboard, Flexible, Rigid, Others) • By Technology (Active, Controlled Release) • By End Use (Beverages, Dairy Products, Fruits & Vegetables, Baked Goods, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Ball Corporation, Amcor Limited, Bemis Company Incorporated, Ampac Packaging LLC, Rock-Tenn Company, Sealed Air Corporation, Hinojosa Packaging Group, Envoy Solutions, Crown Holdings Incorporated, Letica Corporation |

| Key Drivers | • Food packaging cost efficiency • The growing demand for convenience foods |

| Market Restraints | • Strict rules and regulations |