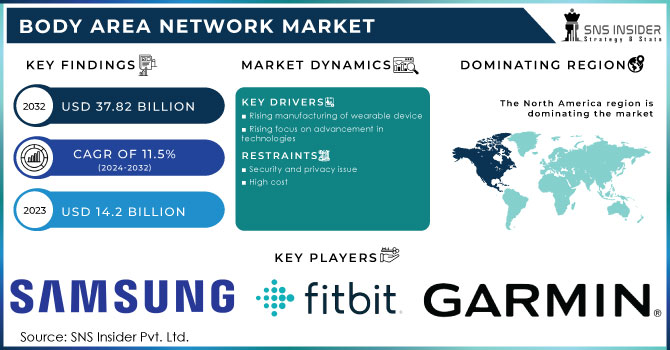

Body Area Network Market Report Scope & Overview:

The Body Area Network Market was valued at USD 13.9 Billion in 2023 and is expected to reach USD 39.2 Billion by 2032, growing at a CAGR of 12.24% from 2024-2032. The Body Area Network Market analysis covers key statistical insights, including regional production volumes of wearable and implantable sensor components, advancements in sensor miniaturization and low-power chip design, and fab capacity utilization for medical-grade semiconductors in 2023. Additionally, it examines supply chain metrics such as component availability, integration challenges, and regulatory compliance. The report also explores market drivers, challenges, competitive landscape, emerging technologies, and future growth opportunities.

Get more information on Body Area Network Market - Request Sample Report

Market Dynamics

Drivers

-

The rising demand for wearable health devices, driven by preventive healthcare and chronic disease management, is boosting the adoption of Body Area Networks.

Wearable health monitoring devices including smartwatches, fitness bands, and medical-grade biosensors will also significantly contribute to the positive trend for the Body Area Network market. Driven by growing consciousness about preventive healthcare and chronic disease management, consumers and healthcare providers are adopting BAN technologies to continuously monitor vital signs such as heart rate, glucose, blood pressure, etc. Combining AI & IoT also enhances real-time analytics & remote patient & monitoring facilitating better healthcare outcomes. This trend enables secure and effortless communication between devices and healthcare systems, encouraged by improvements in wireless communication protocols for data transfer.

Restraints

-

Data privacy concerns and cybersecurity threats limit BAN adoption, necessitating robust encryption and regulatory compliance.

Body Area Networks are beneficial; however, data privacy and security risks are major opponents. Such networks are used to transmit sensitive health-related data wirelessly, thus making them vulnerable to cyber threats, data breaches, and unauthorized access. Compliance has also become tough to maintain as strict regulatory requirements like HIPAA, GDPR, etc. increase the compliance burden on manufacturers and visiting services. Moreover, users are typically reluctant to share personal health data, leading to limited market adoption. Solving these will take strong encryption, secure access authentication procedures, and following regulatory guidelines to ensure trust levels are high in BAN systems, paving the way to making widely adopted healthcare solutions available practical, and feasible for many other application fields.

Opportunities

-

Innovations in miniaturized, low-power sensors enhance BAN adoption across healthcare, sports, and military applications.

The emergence of energy-efficient and miniaturized sensors is both emerging opportunities for the Body Area Network market. For remote patient monitoring (RPM) and even implantable devices, the increasing size comfort, and power efficiency of BAN devices, should increase adoption. Advances in nanotechnology and flexible electronics allow for ultra-thin, lightweight sensors with long-lasting batteries, which limits the necessity for routine charging or replacement. Such innovations not only enhance user comfort but also broaden the scope of BAN applications such as military, sports, and elderly care as well as continue to push the boundaries of the market and the technology forward.

Challenges

-

Lack of standardization and compatibility between BAN devices hinders seamless data exchange and integration into healthcare systems.

The absence of Interoperability among diverse devices and platforms is one of the key challenges the worldwide Body Area Network market is facing at present. Proprietary technologies used by various manufacturers result in incompatibility between sensors, communication protocols, and data management systems. This fragmentation reduces the seamless data exchange and integration into healthcare ecosystems, undermining the full potential of BAN solutions. We need some standardization to keep them in the same world and be able to communicate. Common protocols through a collaboration of industry players, regulators, and technology players will make it more efficient and easier to utilize BAN technology in different areas.

Segmentation Analysis

BY Device Type

The wearable devices segment dominated the market and accounted for a revenue share of more than 65% in 2023, owing to its applications in fitness tracking, remote health monitoring, and chronic disease management. Growing demand for smartwatches, fitness bands, and medical-grade devices combined with AI-based analytics is expected to drive the market growth over the forecast period. Progress in wireless connection, sensor precision, and battery longevity helps to accelerate. The global healthcare IT integration solutions market size is expected to maintain its market dominance owing to the increasing digitalization of the healthcare industry and high consumer awareness during the forecast period with continuous innovation which is anticipated to improve real-time health monitoring functionality.

The implantable devices are anticipated to record the fastest CAGR during the forecast period, owing to improvements in bioelectronics, miniaturized sensors, and personalized medicine. Such as pacemakers, neurostimulators, glucose monitors, etc, that require little involvement by the user and allow constant monitoring of health. The growth is mostly driven by the increasing incidence of chronic diseases, the increase in the aged population, and the demand for minimally invasive medical solutions. Advancements in biocompatible materials and wireless charging techniques will further improve the efficiency and acceptance of such devices and will ultimately make implantable BAN solutions a major enabler of next-generation healthcare innovations.

By Components

The Sensors segment dominated the market and accounted for a significant revenue share in 2023, due to their role as the primary components in real-time health monitoring and data acquisition. Technological advancements in biosensors, motion sensors, and physiological monitoring sensors for wearable and implantable devices have fueled the growth. The adoption of the technology is also driven by rising demand for non-invasive health tracking, advancements in miniaturization, and better accuracy of the sensors.

The communication & interface segment is anticipated to register the fastest CAGR during the forecast period, owing to the demand for smooth and secure wireless data transmission in Body Area Networks. Progress in BLE, 5G, and NFC technologies is improving on-the-spot connectivity and compatibility. With the growth in remote healthcare and IoT-based medical applications, the requirement for weekly low-latency and power-efficient communication modules will also increase.

By Connectivity

Bluetooth segment held the largest market share of more than 43% of revenue in 2023, due to its high development in wearable health devices which include sensors for health monitoring that operate on low power consumption, secured data transmission, and connectivity with smartphones of the point of care. Meanwhile, Bluetooth Low Energy made it even more power-efficient to the point where it's great for constant health monitoring use cases. The rising adoption of Bluetooth-enabled members of the family of watches, fitness tracks, and medical wearables prop up its convenience.

Wi-Fi is expected to register the fastest CAGR during the forecast period, Driven by the rising requirement for high-speed and real-time health data transmission from telemedicine and remote patient management. Increased adoption in healthcare IoT driven by the ongoing shift toward cloud-based analytics and Internet of Things access ensures substantial penetration of Wi-Fi-enabled BAN devices in hospital and home healthcare settings.

By End-Use

The healthcare segment dominated the market and accounted for a significant revenue share in 2023, This is due to a significant increase in the adoption of wearable and implantable medical devices for continuous remote patient monitoring, chronic disease management, and geriatric care that helps achieve standard status in healthcare. An increasing number of cardiovascular diseases, diabetes, and neurological disorders has led its customers toward their health, thereby increasing the incidence of real-time tracking. The growth will be powered by artificial intelligence-based diagnostics, expansion of telemedicine, and regulatory push for digital health innovations, leading to the incorporation of BAN technology in customized and preventive medical care.

The fitness segment is projected to register the fastest CAGR largely due to the sharp rise in consumer attention on health, wellness, and performance maximization. Demand is being fueled by the increasing use of smartwatches, fitness bands, and biometric wearables to monitor physical activity and level of personalized coaching gain. Advancements in AI-driven analytics, non-invasive biometrics, and energy-efficient wearables in the future will help even more with adoption.

Regional Analysis

North America dominated the market and accounted for a revenue share of more than 36% in 2023, fueled by the growing adoption of advanced healthcare technologies, rising incidence of chronic disorders, and presence of key market players. These are due to well-established healthcare infrastructure, government initiatives supporting remote patient monitoring, and increasing consumer demand for wearable health devices in the region.

Asia-Pacific is projected to witness the fastest CAGR due to growing healthcare awareness, rising disposable income, and increasing adoption of wearable and implantable devices. Expanding investments in digital healthcare, increasing the elderly populace, and technological advances in its sensors are the contributing factors. The use of smart health devices is booming in China, Japan and India. Sustainable growth will be driven by 5G connectivity, AI-based health monitoring, and government initiatives to promote telehealth and remote healthcare solutions throughout the region.

Need any customization research on Body Area Network Market - Enquiry Now

Key players

The major key players in Body Area Network along with their products are

-

Apple Inc. – Apple Watch Series 9

-

Fitbit (Google LLC) – Fitbit Charge 6

-

Samsung Electronics Co., Ltd.– Samsung Galaxy Watch 6

-

Garmin Ltd. – Garmin Venu 3

-

Huawei Technologies Co., Ltd. – Huawei Watch GT 4

-

Medtronic plc – MiniMed 780G (Insulin Pump)

-

Abbott Laboratories – FreeStyle Libre 3 (Glucose Monitor)

-

Dexcom, Inc. – Dexcom G7 (Continuous Glucose Monitor)

-

Biotronik SE & Co. KG – BIOMONITOR III (Implantable Cardiac Monitor)

-

Philips Healthcare – IntelliVue Guardian (Wearable Biosensor)

-

Omron Healthcare, Inc. – HeartGuide (Wearable Blood Pressure Monitor)

-

Masimo Corporation – Masimo MightySat (Fingertip Pulse Oximeter)

-

Withings – ScanWatch 2 (Hybrid Smartwatch)

-

Polar Electro Oy – Polar Vantage V3 (Multisport Watch)

-

NeuroMetrix, Inc. – Quell 2.0 (Wearable Pain Relief Device)

Recent Developments

-

In January 2024, Robert Bosch GmbH introduced a cutting-edge full-body motion tracking system featuring smart connected sensors, enhancing real-time monitoring and analysis of body movements.

-

In January 2025, Samsung Electronics Co., Ltd. launched the "Galaxy Watch for Kids" mode for the Galaxy Watch 7, enabling children to make calls, send texts, and be tracked via GPS, catering to the growing demand for safety-focused wearable technology.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 13.9 Billion |

| Market Size by 2032 | USD 39.2 Billion |

| CAGR | CAGR of 12.24% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device Type (Implantable Devices, Wearable Devices) v By Components (Processors, Memory Modules, Displays, Sensors, Electromechanicals, Communication & Interface Components, Others) • By Connectivity (Bluetooth, Wi-Fi, ZigBee, Others) • By End-User (Healthcare, Sports, Fitness, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Apple Inc., Fitbit (Google LLC), Samsung Electronics Co., Ltd., Garmin Ltd., Huawei Technologies Co., Ltd., Medtronic plc, Abbott Laboratories, Dexcom, Inc., Biotronik SE & Co. KG, Philips Healthcare, Omron Healthcare, Inc., Masimo Corporation, Withings, Polar Electro Oy, NeuroMetrix, Inc. |