Microdisplay Market Size & Overview:

Get More Information on Microdisplay Market - Request Sample Report

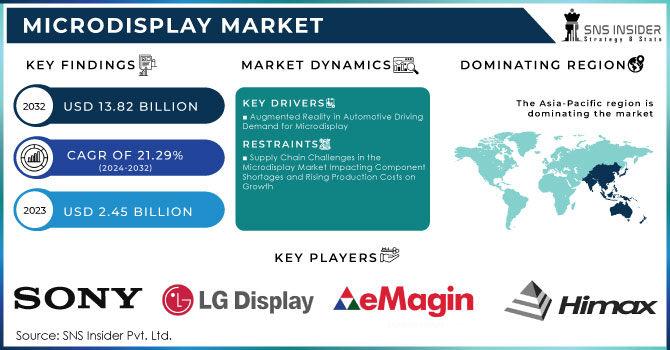

The Microdisplay Market Size was valued at USD 2.45 Billion in 2023 and it is expected to reach USD 13.82 Billion by 2032 with a growing CAGR of 21.29% over the forecast period 2024-2032.

The microdisplay market is experiencing significant growth, driven by the increasing demand for innovative wearable devices that enhance user experiences through technologies like eye-tracking, voice commands, and hand gestures. Key advancements in microdisplay types—such as micro OLEDs, liquid crystal on silicon (LCoS), and microLEDs—are expanding applications in sectors like military, medical, and consumer electronics. For example, high-performance head-mounted displays (HMDs) are crucial in military settings, exemplified by the USD 400,000 mixed reality helmet used by pilots. Major tech players like Apple and Google are pioneering developments, notably with products like Apple's Vision Pro, which integrates sophisticated microdisplay technology for augmented reality (AR) and virtual reality (VR) applications. Despite challenges such as high production costs, innovations in automotive microdisplay applications, like Head-Up Displays (HUDs) and Advanced Driver Assistance Systems (ADAS), signal strong market potential. Overall, the microdisplay market is set to thrive, shaping future display technologies across diverse industries.

Microdisplay Market Dynamics

Drivers

-

Augmented Reality in Automotive Driving Demand for Microdisplay

The integration of augmented reality (AR) in the automotive sector is a significant driver for the microdisplay market. As AR technologies enhance driver awareness and safety, the demand for advanced microdisplay solutions, particularly in Head-Up Displays (HUDs) and Advanced Driver Assistance Systems (ADAS), is surging. For instance, Volkswagen is at the forefront, employing high-resolution data glasses and planning to incorporate 3D HUDs that merge critical information with real-world environments. Similarly, DHL has reported a 15% productivity increase using AR "Vision Picking" smart glasses in its global warehouses, demonstrating AR's transformative potential. As companies increasingly recognize the value of AR in real-time data visualization and enhanced training, the microdisplay market is poised for substantial growth. This sector's evolution is vital for the seamless integration of digital elements into physical surroundings, thereby fostering innovation in safety features and operational efficiency. by leveraging advanced microdisplay technologies, the automotive industry can significantly improve driver engagement and safety outcomes, highlighting the essential role of microdisplay in the future of transportation.

Restraints

-

Supply Chain Challenges in the Microdisplay Market Impacting Component Shortages and Rising Production Costs on Growth

Effectively addressing the significant supply chain challenges in the microdisplay market is essential, as these issues can disrupt production schedules and lengthen lead times. A major concern is the shortage of critical components, particularly specialized materials such as semiconductors, OLED films, and MicroLED chips. The increasing demand for these components, coupled with limited manufacturing capacity, has caused notable production disruptions across various sectors. Furthermore, the manufacturing process for advanced microdisplays heavily depends on rare materials like indium and gallium. Variability in the availability of these raw materials can severely affect production capabilities, especially as the demand for high-performance displays continues to grow.

Logistical issues exacerbate the supply chain complications, with transportation disruptions stemming from geopolitical tensions and natural disasters causing delays in shipping vital components. These delays not only escalate costs but also extend lead times for manufacturers. The inherent volatility in the microdisplay market adds another layer of complexity, making accurate demand forecasting difficult and resulting in potential overstock or shortages. As a consequence, rising production costs emerge from these challenges, driving manufacturers to invest in more resilient supply chains or diversify their supplier networks. The increase in logistics costs has been particularly significant, with a 2021 report by the American Transportation Research Institute indicating a 21% rise in transportation expenses year-over-year. This surge further complicates manufacturers' ability to sustain profitability amidst ongoing supply chain disruptions. Addressing these challenges is critical for the microdisplay market to continue its growth trajectory and meet customer demands effectively.

Segment Analysis of Microdisplay Industry

by Product

In 2023, the microdisplay market experienced remarkable growth, particularly driven by the Near-To-Eye (NTE) segment, which captured approximately 57% of total revenue. This surge is attributed to significant advancements and product launches from key industry players in augmented reality (AR) and virtual reality (VR). Companies like Meta and Sony have been instrumental in this growth. Meta's Meta Quest 3, featuring advanced NTE microdisplay technology, enhances resolution and provides a more immersive experience for gaming and social interactions. In parallel, Sony's PlayStation VR2 incorporates a high-resolution OLED display that improves visual clarity and realism, securing a substantial share of the gaming market. Furthermore, MicroVision recently announced a new line of MicroLED displays specifically designed for NTE applications, promising enhanced brightness and energy efficiency. The rising consumer demand for AR glasses, particularly in gaming and training sectors, has prompted increased investments in this segment. As the appetite for immersive experiences continues to grow, ongoing research and development will likely drive further innovations across all microdisplay segments, ensuring sustained growth in this dynamic market.

by Technology

In 2023, the microdisplay market witnessed significant growth, with Liquid Crystal Displays (LCDs) capturing the largest revenue share, accounting for approximately 40% of the total market. This dominance can be attributed to several factors, including the widespread adoption of LCD technology across various applications, such as consumer electronics, automotive displays, and wearable devices.

LCDs are favored for their ability to provide high-quality images with excellent color reproduction and energy efficiency, making them ideal for a range of applications. Companies like Samsung, LG Display, and Sharp have been at the forefront of LCD technology, continuously enhancing display resolution and energy efficiency. For instance, LG Display's innovations in LCD technology have enabled the production of ultra-thin displays that are lightweight and suitable for portable devices, thus driving demand in sectors such as smartphones and tablets. In addition to traditional LCDs, advancements in specialized LCD technologies, such as IPS (In-Plane Switching) and VA (Vertical Alignment), have further enhanced viewing angles and contrast ratios, making these displays highly sought after in the gaming and professional markets. As consumer demand for high-performance displays continues to rise, manufacturers are investing in R&D to develop next-generation LCD technologies that will maintain their competitive edge in the microdisplay market. The expansion of applications in augmented reality (AR) and virtual reality (VR) has prompted innovations in LCD technology to improve refresh rates and reduce latency.

Microdisplay Market - Regional Outlook

In 2023, the Asia-Pacific region emerged as the dominant for microdisplay market, securing approximately 49% of the global revenue share. This significant growth is fueled by technological advancements, surging demand for consumer electronics, and noteworthy product developments across various countries. Major companies such as Sony, Samsung, and LG Display are at the forefront of innovation, with Sony introducing its Crystal LED microdisplay technology tailored for immersive entertainment experiences. Meanwhile, Samsung's innovations in MicroLED technology are enhancing display resolution and color accuracy, meeting consumer expectations for high-quality visuals.

Countries like China, Japan, and India are witnessing robust growth in their consumer electronics markets, prompting manufacturers to adopt advanced microdisplay solutions. Notable investments in augmented reality (AR) and virtual reality (VR) are evident in Japan, with companies like Panasonic developing AR glasses featuring high-performance microdisplay. The automotive sector in South Korea and Japan is rapidly integrating microdisplay technologies into advanced driver-assistance systems (ADAS) and head-up displays (HUDs). This regional focus on innovation and investment positions the Asia-Pacific region as a key player in the global microdisplay market, poised for sustained growth.

In 2023, North America established itself as the fastest-growing region in the microdisplay market, driven by the escalating demand for advanced display technologies across multiple sectors. This growth is primarily attributed to the rising popularity of augmented reality (AR) and virtual reality (VR) applications, particularly in head-mounted displays (HMDs) and head-up displays (HUDs) within the automotive industry. These innovations have significantly increased the need for compact, high-resolution, and energy-efficient microdisplays.

The United States and Canada are leading this expansion, with considerable investments in the consumer electronics market. Key industry players, such as eMagin Corporation and Kopin Corporation, are at the forefront of advancements in microdisplay technology, focusing on enhancing resolution and brightness tailored for AR and VR applications. Moreover, the growing adoption of wearable devices and smart glasses further propels market growth, as these technologies increasingly incorporate microdisplay solutions to elevate user experiences. With ongoing technological innovations and rising consumer demand, North America is poised for sustained growth in the microdisplay market.

Need Any Customization Research On Microdisplay Market - Inquiry Now

Key Players:

Some of the major key players in Microdisplay market who provide product and offering:

-

Sony Corporation (Micro OLED Displays, Head-Mounted Displays)

-

LG Display (OLED Panels, Tandem OLED Displays)

-

eMagin Corporation (OLED Microdisplay , Virtual Reality Headsets)

-

Kopin Corporation (Microdisplay for AR/VR, Backplane Controllers)

-

Himax Technologies (LCOS Microdisplay , Driver ICs)

-

AU Optronics (LCD Panels, OLED Displays)

-

Seiko Epson Corporation (Micro OLED Displays, Smart Glasses)

-

Syndiant (LCOS Microdisplay , Pico Projectors)

-

MicroVision (Laser Scanning Displays, AR Technology)

-

Texas Instruments (Digital Light Processing (DLP) Chips)

-

Panasonic Corporation (OLED Displays, Projectors)

-

Universal Display Corporation (PHOLED Materials, OLED Technologies)

-

Oculus VR (VR Headsets, Oculus Quest Series)

-

Vuzix Corporation (Smart Glasses, AR Glasses)

-

Google LLC (Google Glass, AR/VR Technologies)

-

Apple Inc. (AR Glasses, VR Headsets)

-

Samsung Electronics (QLED Displays, MicroLED Displays)

-

Microchip Technology Inc. (Display Controllers, Microcontrollers for Displays)

-

Nikon Corporation (Micro OLED Displays, Optical Instruments)

-

Sharp Corporation (IGZO LCDs, OLED Panels)

List of Suppliers

-

Corning Incorporated

-

3M

-

Materialise NV

-

LITE-ON Technology Corporation

-

Applied Materials

-

Nippon Electric Glass Co.

-

Avery Dennison Corporation

-

Sumitomo Chemical

-

Novaled GmbH

-

Sharp Electronics

Recent Development

-

In June 2024, LG Display, a leading organization in display technologies, announced the start of mass production for the world's first 13-inch Tandem OLED panel designed for laptops. The company is concentrating on the OLED market by leveraging the enhanced performance and lower power consumption offered by Tandem OLED technology.

-

In January 2024, Kopin Corporation and MICLEDI Microdisplay unveiled a collaborative initiative aimed at creating advanced micro-LED displays for an immersive augmented reality experience, even in high-brightness light conditions. This partnership merges MICLEDI's CMOS manufacturing process with Kopin's expertise in backplane control and driving capabilities to develop high-performance microLED displays.

-

In May 2024, VueReal introduced its groundbreaking ColourFusion microDisplay, marking a significant leap forward in augmented reality (AR) display technology. This new microDisplay employs VueReal's proprietary MicroSolid Printing technology, enabling the efficient manufacturing of full-color microLED displays.

-

In April 2024, researchers at the Fraunhofer Institute for Photonic Microsystems (IPMS) achieved noteworthy progress in the development of semi-transparent OLED microdisplay . They successfully enhanced the transparency of their OLED microdisplay to 45%, resulting in a high-resolution microdisplay that is considerably lighter than conventional optical see-through systems used in augmented reality (AR) applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.45 Billion |

| Market Size by 2032 | USD 13.82 Billion |

| CAGR | CAGR of 21.29%From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Near-To-Eye, Projection, Others) • By Technology (Liquid Crystal Display (LCD), Organic Light-emitting Diode (OLED), Digital Light Processing (DLP), Liquid Crystal on Silicon (LCoS)) • By Application (Consumer Electronics, Military & Defense, Medical Applications, Industrial Systems, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sony Corporation, LG Display, eMagin Corporation, , Himax Technologies, AU Optronics, Seiko Epson Corporation, Syndiant, MicroVision, Texas Instruments, Panasonic Corporation, Universal Display Corporation, Oculus VR, Vuzix Corporation, Google LLC, Apple Inc., Samsung Electronics, Microchip Technology Inc., Nikon Corporation, Sharp Corporation. |

| Key Drivers | • Augmented Reality in Automotive Driving Demand for Microdisplay |

| RESTRAINTS | • Supply Chain Challenges in the Microdisplay Market Impacting Component Shortages and Rising Production Costs on Growth |