Brain Pacemaker Market Report Scope & Overview:

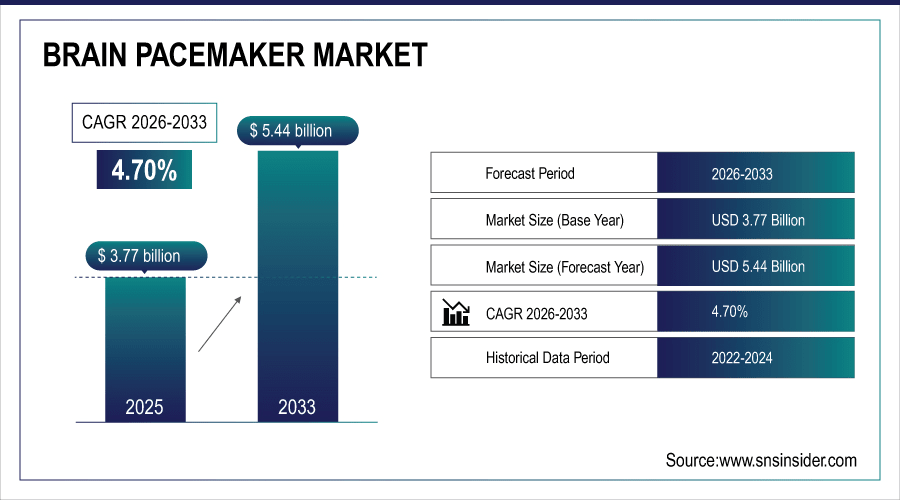

The Global Brain Pacemaker Market size was valued at USD 3.77 billion in 2025E and is projected to reach USD 5.44 billion by 2033, growing at a CAGR of 4.70% during the forecast period 2026–2033.

Pacemakers for the brain are used to treat debilitations such as Parkinson’s and epilepsy and even depression. In 2025, more than 85,000 worldwide patients received brain pacemaker implantations, approximately 38% of which have undergone dual-channel procedure. Nearly 47% (implantations) was performed by minimally invasive surgery. Growing incidence of neurological disorders, growing demand for personalized neurostimulation treatments and its higher adoption in the hospitals, neurology clinics and homecare settings are some of the key market growth drivers.

Parkinson’s disease patients made up 38% of all implantations, underscoring the high demand for neuromodulation in movement disorders.

To Get More Information On Brain Pacemaker Market - Request Free Sample Report

Brain Pacemaker Market Size and Forecast:

-

Market Size in 2025: USD 3.77 Billion

-

Market Size by 2033: USD 5.44 Billion

-

CAGR: 4.70% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Brain Pacemaker Market Trends:

-

Estimated world brain pacemaker implantations shall exceed by 92,000 procedures in 2025 with epilepsy cases accounting roughly about the third of it.

-

About 28,000 per year in U.S. with treatment- resistant depression and essential tremor leading the way.

-

Europe (encompassing France and Italy), is set to carry out approximately 20,500 procedures per annum, driven by the increasing use of dual- and multi-channel implants.

-

Rechargeable systems make up almost 49% of new implants indicating a preference towards durable neuromodulation.

-

Home-care setting and specialized neurology centres manage over 62% of follow-up rates reflecting increased outpatient experience.

U.S. Brain Pacemaker Market Insights:

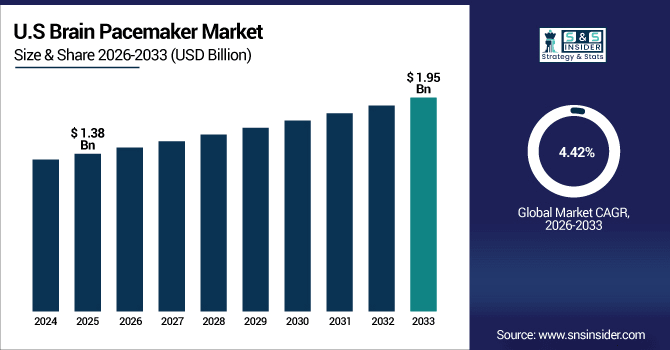

The U.S. Brain Pacemaker Market was USD 1.38 billion in 2025E, expected to reach USD 1.95 billion by 2033 at a CAGR of 4.42%. In 2025, over 33,000 implantations were performed, driven by Parkinson’s disease prevalence, epilepsy cases, dual-/multi-channel adoption, minimally invasive procedures, and advanced neurostimulation investments.

Brain Pacemaker Market Growth Drivers:

-

Increasing Parkinson’s Disease and Epilepsy Cases Boost Demand for Implantable Brain Pacemaker Therapies.

The global Brain Pacemaker market is growing steadily, driven by rising neurological disorder prevalence and advanced neurostimulation adoption. More than 92,000 brain pacemakers were inserted around the world by 2025 with Parkinson’s disease as the indication in 38% of cases. Rechargeable implanted systems accounted for 49% of new devices, revealing a patient choice for long-term therapies. Hospitals, and neurology centers are taking care of approximately 65% of the procedures covered in the surgical treatment procedures market; thereby sustaining growth globally.

Epilepsy patients represented nearly 33% of global brain pacemaker implantations in 2025, underscoring its growing market contribution.

Brain Pacemaker Market Restraints:

-

High Implantation Risks and Complex Neurological Procedures Limit Broader Adoption of Brain Pacemakers Globally.

Safety concerns and complex surgical procedures remain key challenges for broader Brain Pacemaker adoption. By 2025, research found almost 12% of those receiving implants face complications like infection or device malfunction, which led the U.S. and EU to introduce more stringent regulatory rules. Demanding surveillance raises procedural expense and may limit acceptance in smaller neurology clinics. Eligibility criteria for patients, risks of surgery and the need for follow-up are stringent; these restraining factors reduce global growth potential for Brain Pacemaker market, despite increasing neurological disorders.

Brain Pacemaker Market Opportunities:

-

Rising Adoption of Dual- and Multi-Channel Brain Pacemakers Expands Treatment Options and Market Growth Opportunities.

Growing acceptance of not only dual- but multi-channel brain pacemakers is widening possibilities and increasing the likelihood for success as well. More than 40,000 multisite implants were reported globally by 2025 accounting for nearly 44% of all brain pacemaker procedures. It is projected to rise to 65,000 implants in the technologically advancing minimally invasive era with growing patient awareness. A wide-ranging access in hospitals and neurology clinics has shown a huge market expansion opportunity all over the world.

Multi-channel brain pacemaker adoption is expected to grow at over 6.5% annually, enhancing treatment effectiveness and expanding market reach globally.

Brain Pacemaker Market Segmentation Analysis:

-

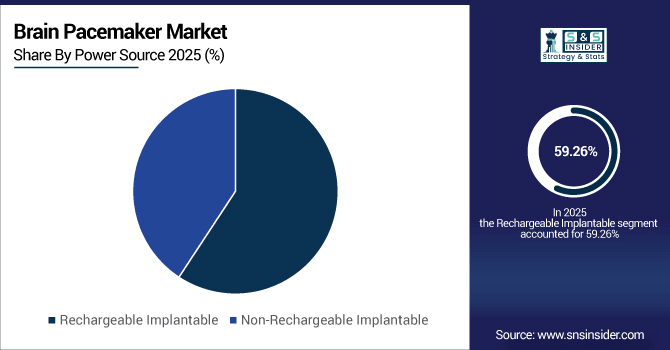

By Power Source, Rechargeable Systems held the largest share of 59.26% in 2025, while Wireless Power Transfer Systems are anticipated to grow at the fastest CAGR of 6.12%.

-

By Device Type, Dual-Channel Brain Pacemakers held the largest market share of 34.72% in 2025, while Multi-Channel Brain Pacemakers are expected to grow at the highest CAGR of 6.47%.

-

By Implantation Type, Invasive Procedures accounted for the largest market share of 50.28% in 2025, and Minimally Invasive Procedures are projected to grow at the fastest CAGR of 5.53%.

-

By Indication, Parkinson’s Disease contributed the highest market share of 39.81% in 2025, while Epilepsy is forecasted to expand at the fastest CAGR of 5.04%.

-

By End User, Hospitals accounted for the largest share of 44.63% in 2025, while Specialty Neurology Clinics are expected to grow at the fastest CAGR of 5.79%.

By Power Source, Rechargeable Systems Dominate While Wireless Systems Expand:

Rechargeable brain pacemakers were the choice in 51,800 implants by 2025 because they last and save fewer replacements. Wireless power transfer systems (a fast-growing segment) had 30,500 implants in 2025 and will grow to be 53,100 by 2033. Non-rechargeable systems were 28,200 implants and continues to be relevant for classical neuromodulation and a variety of patient usages throughout the world.

By Device Type, Dual-Channel Leads While Multi-Channel Expands Rapidly:

The dominant device type was Dual-Channel Brain Pacemakers, which had more than 42,300 global implantations in 2025 for various symptoms of Parkinson’s disease. Multi-channel devices will rapidly expand, with 29,800 implants in 2025 and a projected number of 54,200 by 2033 for advanced neuromodulation abilities. The 36,700 Single-Channel implants demonstrate a broad range of approvals providing patient-specific neurostimulation therapies across the globe.

By Implantation Type, Invasive Dominates While Minimally Invasive Grows Fast:

Invasive procedures continued to be the most frequent type of implantation, with 48,900 surgeries worldwide in 2025, mainly performed for PD and epilepsy. Minimally Invasive procedures are the fastest growing, with 33,600 operations in 2025 rising to an anticipated volume of 58,900 in year 2033 through reduced recovery times and patient choice. Of those, 21,400 were non-invasive. This is a small but growing component of neurostimulation therapy.

By Indication, Parkinson’s Disease Leads While Epilepsy Expands:

Parkinson’s disease was the leading indication, with 37,200 implantations globally projected for 2025 due to an increasing incidence of movement disorders. There were 27,900 epilepsy-related operations (4600 more by 2033 due to rising prevalence and improved early intervention). Depression treatment implants were 19,600; essential tremor and other neurological conditions together accounted for 16,500 procedures.

By End User, Hospitals Lead While Specialty Clinics Grow Fast:

Hospitals established 40,700 implantations worldwide in 2025, once again characterizing the surgical infrastructure. Specialty neurology practices conducted 26,800 procedures and grew significantly from minimally invasive methods and personalized care. There were 17,900 follow-ups in home care settings and 15,300 treatments administered in rehab facilities as our global network of IPs increasingly gains traction among those who need access to brain pacemaker therapy.

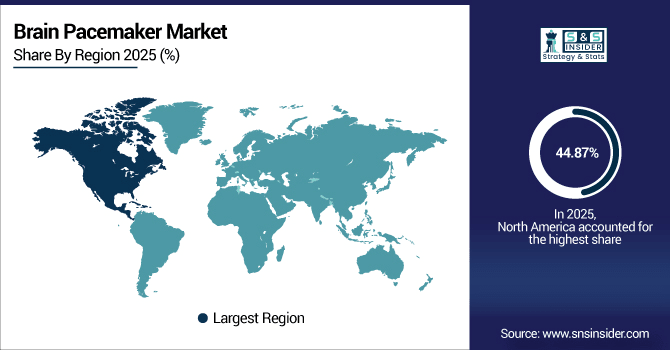

Brain Pacemaker Market Regional Analysis:

North America Brain Pacemaker Market Insights:

North America dominates the Brain Pacemaker market with a 44.87% share in 2025, driven by advanced neurology infrastructure and high prevalence of Parkinson’s disease and epilepsy. In 2025, more than 42,300 brain pacemaker surgeries were carried out in hospitals and specialized neurology departments. An increasing uptake of dual- and multi-channel products, renewed growth in minimally invasive procedures and rising investment in neurostimulation technologies will ensure continued expansion and innovation through 2033. In 2025, more than 1,250 U.S. hospitals and specialty neurology clinics that conducted brain pacemaker implantations mostly for Parkinson’s disease and epilepsy. Growing preference for minimally invasive and multi and dual channel devices, increasing patients’ awareness along with substantial healthcare expenditure is projected to have a positive impact over the U.S. Brain Pacemaker market.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia-Pacific Brain Pacemaker Market Insights:

The Asia-Pacific Brain Pacemaker market is projected to grow at a CAGR of 6.14% during 2026–2033, making it the fastest-growing region globally. More than 12,800 brain pacemakers were implanted in hospitals and specialty neurology clinics and outpatient centers in 2025. High growth is attributed to prevalence of Parkinson’s disease and epilepsy, the adoption of minimally invasive, multi-channel devices, growing patient awareness as well as government healthcare funding in the developing countries.

Japan Brain Pacemaker Market Insights:

Leading Asia Pacific Brain Pacemaker market- Japan with more than 5,200 implantations by 2025. Rising prevalence of Parkinson’s disease and epilepsy, excellent neurology infrastructure, as well as early introduction of dual- and multi-channel devices are propelling growth. Increasing minimally invasive procedures and growing patient awareness are estimated to further fuel market growth.

Europe Brain Pacemaker Market Insights:

In 2025, the Europe Brain Pacemaker market reports more than 17,100 procedures in Germany, France and UK The growth is attributed to the ageing population in Europe along with better neurology research infrastructure and increasing insurance coverage of neurostimulation therapy. Growing penetration of multi-channel and rechargeable stimulators, adoption of neurorehabilitation programs and active clinical trial landscape for movement & seizure disorders is generating innovation in the market ensuring Europe’s leadership in global Brain Pacemaker market.

Germany Brain Pacemaker Market Insights:

Germany is the largest market in Europe for Brain Pacemaker and is expected to have around 6,300 procedures conducted across hospitals, specialized neurology centers and ambulatory care facilities. High incidence of Parkinsons disease and epilepsy, infrastructure of advanced neurology, early acceptance of dual- and multi-channel devices and government support towards healthcare are the factors responsible for Germany to lead Europe’s market.

Latin America Brain Pacemaker Market Insights:

The Latin America Brain Pacemaker market reached over 4,350 implantations in 2025, with Brazil, Mexico, and Argentina leading adoption. Private hospital investment, government efforts for the management of neurological disorders, increasing number of trained neurosurgeons and growing awareness about minimally invasive brain pacemaker procedures are fueling market growth. Rechargeable and dual-channel devices are also increasingly adopted early to improve patient access and therapy results in the entire region.

Middle East and Africa Brain Pacemaker Market Insights:

The Middle East & Africa Brain Pacemaker market recorded over 2,750 procedures in 2025, led by Saudi Arabia and South Africa. Rise in incidence of Parkinson's disease and epilepsy, growing neurology facilities, increasing number of trained neuro-surgeons and Adoption of minimally invasive & dual-channel devices for better patient outcomes across the region contribute to growth.

Brain Pacemakers Market Competitive Landscape:

Medtronic is the global leader in the Brain Pacemaker industry, with over 18,500 implantations in 2025 using its deep brain stimulation systems. The firm specializes in developing the treatment of Parkinson’s disease, epilepsy and essential tremor with both dual and multi-channel offerings. Strong R&D, new device launches, and huge hospital networks are ways through which Medtronic continues gaining market shares, increasing patient access in Global Brain Pacemaker market.

-

In February 2025, Medtronic received FDA approval for its BrainSense Adaptive DBS system, enhancing therapy for Parkinson’s patients globally.

Boston Scientific Corporation is a top company in the Brain Pacemaker industry, performing over 7,200 procedures in 2025 across North America and Europe. Its neurostimulation systems are directed at such treatments as Parkinson’s, epilepsy and depression. Strategic alliances, design optimization and involvement in clinical trials will pave the way for rapid adoption of Rechargeable and Dual brain pacemakers globally consolidating its presence in the Brain Pacemaker market.

-

In March 2025, Boston Scientific updated its Vercise Genus DBS System with MR-conditional IPGs, supporting precise targeting and personalized therapy.

Abbott Laboratories is a key player in the Brain Pacemaker industry, recording more than 5,100 implantations in 2025. The firm specializes in advanced neurostimulation therapy for treatment of movement and seizure disorder with a focus on rechargeable and multi-channel devices. Abbott is growing and reinforcing its leading market position in Brain Pacemaker worldwide as a result of clinician education initiatives, neurology outpatient expansion, government partnerships.

-

In September 2024, Abbott initiated the TRANSCEND clinical trial for its DBS system to treat resistant depression, expanding neurostimulation applications.

Brain Pacemakers Market Key Players:

Some of the Brain Pacemakers Market Companies are:

-

NeuroPace, Inc.

-

Renishaw plc

-

Beijing PINS Medical Co., Ltd.

-

SceneRay Co., Ltd.

-

LivaNova PLC

-

BrainsWay Ltd.

-

Functional Neuromodulation Ltd.

-

NeuroSigma

-

Synapse Biomedical Inc.

-

Synteract

-

Alpha Omega Engineering Ltd.

-

Newronika S.p.A.

-

Soterix Medical

-

AlphaDBS Solutions (Deep Brain Innovations)

-

Neuronetics, Inc.

-

Fisher Wallace Laboratories, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 3.77 Billion |

| Market Size by 2033 | USD 5.44 Billion |

| CAGR | CAGR of 4.70% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device Type (Single-Channel Brain Pacemaker, Dual-Channel Brain Pacemaker, Multi-Channel Brain Pacemaker, Next-Generation Neurostimulator Systems) • By Implantation Type (Invasive, Minimally Invasive, Non-Invasive) • By Indication (Parkinson’s Disease, Epilepsy, Depression, Essential Tremor, Obsessive-Compulsive Disorder, Chronic Pain, Other Neurological Disorders) • By Power Source (Rechargeable Implantable, Non-Rechargeable Implantable) • By End User (Hospitals, Neurology Clinics / Specialty Clinics, Home Care Settings, Rehabilitation Centers, Academic & Research Institutes) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Medtronic plc, Boston Scientific Corporation, Abbott Laboratories, NeuroPace, Inc., Renishaw plc, SceneRay Co., Ltd., ALEVA Neurotherapeutics SA, Newronika S.p.A., Beijing PINS Medical Co., Ltd., LivaNova PLC, Alpha Omega Engineering Ltd., Blackrock Neurotech, NEVRO CORP., Soterix Medical, Cala Health, Inc., Bioness Medical, Inc., Neuronetics, Inc., Functional Neuromodulation Ltd., BrainsWay Ltd., Synapse Biomedical Inc. |