Probe Reprocessing Market Size Analysis:

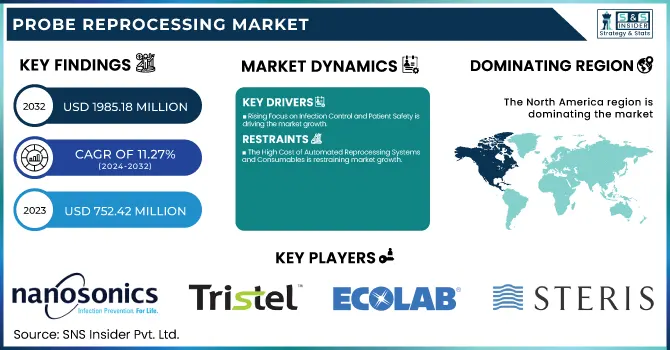

The Probe Reprocessing Market was valued at USD 752.42 million in 2023 and is expected to reach USD 1985.18 million by 2032, growing at a CAGR of 11.27% from 2024 to 2032.

This report provides insights into the Probe Reprocessing Market through analysis of the adoption and compliance rate of automated probe reprocessing devices for major geographies, setting out regulatory enforcement and industry best practices. It analyzes the volume of probe reprocessing equipment and provides a forward-looking outlook for market growth. Furthermore, it examines healthcare expenditure on infection prevention and reprocessing products by government, commercial, private, and out-of-pocket spending and provides a detailed financial breakdown. In addition, the report also investigates the role of healthcare-associated infections (HAIs) that are caused by inadequate probe reprocessing, focusing on the prevalence of cross-contamination cases and their economic burden on healthcare systems.

To Get more information on Probe Reprocessing Market - Request Free Sample Report

Probe Reprocessing Market Dynamics

Drivers

-

Rising Focus on Infection Control and Patient Safety is driving the market growth.

The increasing focus on infection prevention within healthcare environments is a major driving force for the probe reprocessing market. Semi-critical and critical probes, in particular, reusable ultrasound probes, need to be subjected to strict reprocessing procedures to avoid healthcare-associated infections (HAIs). The CDC states that there are almost 1.7 million HAIs in U.S. hospitals every year, which result in 99,000 deaths. Regulatory bodies like the FDA, CDC, and WHO are strengthening regulations, pushing healthcare establishments to implement high-level disinfection (HLD) and sterilization options. In a new move in June 2023, Parker Laboratories Inc. secured FDA clearance of Tristel ULT, a foam-based disinfectant for ultrasound probes used in cavity locations. With healthcare practitioners focusing on adherence to infection control rules, there remains increasing demand for automated as well as chemical-based probe reprocessing products, which further drive market growth.

-

Technological Advancements in Automated Reprocessing Solutions are accelerating the market to grow.

Technological advancements in automated probe reprocessing technologies are fueling market growth. Manual disinfection processes are time-consuming and susceptible to human error, which raises the risk of cross-contamination. Sophisticated automated reprocessors like Nanosonics' trophon2 and Olympus' OER-Pro provide standardized high-level disinfection (HLD) with minimal user interaction. Automated reprocessing systems lower contamination risks by as much as 99.9% compared to manual processes, as per a 2024 study. Regulatory approvals additionally increase adoption—Nanosonics released in May 2024 that the trophon device is the first significant development in ultrasound probe disinfection in 20 years. As the healthcare sector transitions toward automation, real-time tracking, and AI-based disinfection programs, diagnostic centers and hospitals are investing more in automated reprocessing systems for probes, hence accelerating market growth.

Restraint

-

The High Cost of Automated Reprocessing Systems and Consumables is restraining market growth.

Among the major constraints in the probe reprocessing market is the expense involved in automated disinfection systems and consumables. Sophisticated automated reprocessors like Nanosonics' trophon2 and Olympus' OER-Pro provide better infection control but entail high initial costs. The price of such systems is anywhere from USD 10,000 to USD 50,000 per system, thus rendering them inaccessible for small diagnostic imaging centers, outpatient clinics, and small hospitals, especially in the developing world. The repeated expenditure on quality assurance tests, enzymatic cleaners, probe covers, and disinfectants is an added financial input. The absence of reimbursement policies covering disinfection protocols in most countries also discourages mass adoption, slowing down the growth of the market, particularly in cost-cutting healthcare establishments.

Opportunities

-

Increasing Demand for Portable and Point-of-Care Ultrasound Devices, creating opportunities in the probe reprocessing market.

The increasing utilization of point-of-care ultrasound (POCUS) devices in emergency care, critical care, and ambulatory services offers a key opportunity for the probe reprocessing market. The use of POCUS is rising in bedside diagnosis, sports medicine, and home healthcare, requiring effective and transportable reprocessing solutions. As per a 2023 industry report, the worldwide POCUS market is estimated to expand at a CAGR of more than 8%, owing to its increasing applications. Nevertheless, appropriate disinfection of handheld and portable ultrasound probes poses a challenge, which enhances cross-contamination risks. This has prompted the development of technologies such as single-use probe covers, UV-C disinfection, and small-footprint automated reprocessors designed for portable ultrasound systems. With regulatory agencies prioritizing infection control in the outpatient environment, manufacturers can create affordable, rapid, and convenient reprocessing options.

Challenges

-

Compliance with Stringent Regulatory Standards Challenging the market growth.

The probe reprocessing market is challenged by stringent and dynamic regulatory standards established by organizations like the FDA, CDC, WHO, and ECDC. High-level disinfection (HLD) and sterilization procedures are region-specific, with manufacturers needing to navigate complex approval procedures for their reprocessing devices and disinfectants. For example, Parker Laboratories Inc. received FDA clearance for Tristel ULT in June 2023, emphasizing the long and rigorous regulatory processes for new disinfection technology. Moreover, hospitals and diagnostic facilities have to provide staff training, documentation, and compliance with reprocessing procedures, which may be labor intensive. Noncompliance with disinfection protocols may result in penalties, equipment recall, and damage to reputation. The frequent revisions of infection control standards make it difficult for healthcare workers to remain in compliance, retarding the uptake of new probe reprocessing technology.

Probe Reprocessing Market Segmentation Analysis

By Classification

The Semi-Critical segment dominated the probe reprocessing market with a 46.52% market share in 2023 because semi-critical ultrasound probes are heavily utilized in interventional and diagnostic procedures. Transvaginal, transrectal, and transesophageal (TEE) probes are examples of semi-critical probes that touch mucous membranes and need high-level disinfection (HLD) to avoid cross-contamination. As ultrasound-guided procedures gained popularity in the fields of gynecology, cardiology, and urology, demand for good probe reprocessing solutions skyrocketed. Regulatory agencies like the CDC, FDA, and WHO have imposed stringent infection control measures, rendering HLD a normative requirement for semi-critical probe reprocessing. In addition, technological advancements in automated high-level disinfectors, including Nanosonics' trophon2 and Tristel's Trio Wipes System, have enhanced efficiency and compliance, further solidifying the segment's market leadership.

The Non-Critical segment is anticipated to record the fastest growth in the forecast period with 11.58% CAGR with increasing adoption of ultrasound in point-of-care, primary care, and outpatient environments. Non-critical probes, such as linear and convex probes for external imaging, usually need low- or intermediate-level disinfection. Demand for cost-effective and effective disinfection is being fueled by the rising application of ultrasound in emergency medicine, physiotherapy, and sports medicine. Moreover, heightened infection control consciousness and regulatory revision highlighting proper sterilization of all medical devices, including non-critical probes, are driving the market forward. With improvements in UV-C sterilization, single-use probe caps, and ready-to-use wipe disinfectant products, healthcare facilities are increasingly adopting faster and easier-to-use reprocessing solutions, stimulating the growth of the non-critical segment.

By Probe Type

The Transesophageal (TEE) Probes segment dominated the probe reprocessing market with a 27.10% market share in 2023 because of the excessive demand for TEE procedures in critical care and cardiology and the strict reprocessing standards for TEE probes. TEE probes are widely used in echocardiography for the diagnosis of cardiovascular disease, guiding interventions, and monitoring critically ill patients in ICUs. More than 10 million echocardiography procedures were conducted in the U.S. alone, with a considerable number involving TEE imaging, as per a 2023 report published by the American College of Cardiology (ACC). As TEE probes are in direct contact with mucous membranes and body fluids, they are semi-critical devices that need to be subjected to high-level disinfection (HLD) after each use to avoid cross-contamination.

By Product

The Instruments segment dominated the probe reprocessing market with a 42.15% market share in 2023 with the growing uptake of automated disinfection systems and reprocessing units in healthcare facilities. As a result of mounting concerns regarding healthcare-associated infections (HAIs) and cross-contamination, hospitals and diagnostic centers have moved towards sophisticated automated high-level disinfection (HLD) systems to provide standardized and effective probe reprocessing. Regulatory agencies like the CDC, FDA, and WHO require severe disinfection cycles for semi-critical and critical ultrasound probes, adding to the demand for automatic reprocessing equipment. Technologies like Nanosonics' trophon2, STERIS's Revital-Ox Reprocessors, and Germitec's Antigermix AS1 are becoming increasingly used as they enable reliable, validated, and instant high-level disinfection with fewer opportunities for human error and handling toxic chemicals.

By Reprocessing Method

The high-level disinfection (HLD) segment dominated the probe reprocessing market with a 42.55% market share in 2023 because of high regulatory requirements, growing adoption of semi-critical ultrasound probes, and growing demand for infection control measures. High-level disinfection is a mandatory process for semi-critical probes like transesophageal (TEE), transvaginal, and transrectal probes that touch mucous membranes and have a potential for high-level cross-contamination if not sufficiently disinfected. Regulatory agencies like the CDC, FDA, and European Medicines Agency (EMA) impose stringent guidelines mandating validated HLD processes, which has prompted healthcare facilities to invest in automated high-level disinfectors. The common use of ultrasound imaging in emergency care, cardiology, and gynecology has also heightened the demand for efficient HLD solutions to protect patients.

Technological advances in automated high-level disinfection technologies have spurred market growth. Automated HLD equipment, like Nanosonics' trophon2, Germitec's Antigermix AS1, and Ecolab's OxyCide, offer effective, standardized, and fast probe reprocessing, minimizing human error and enhancing infection control compliance. The increasing prevalence of HAIs further underscores the critical need for high-level disinfection, as research shows that poor probe reprocessing can lead to cross-contamination and infection transmission. With the increasing focus on patient safety, regulatory compliance, and efficiency of workflow, the HLD segment was the most prevalent reprocessing method in 2023 and is poised to maintain its robust growth pace in the ensuing years.

By End-Use

The Hospitals and Clinics segment dominated the probe reprocessing market with a 41.70% market share in 2023 because of the large patient load, widespread application of ultrasound imaging, and rigorous infection control measures in these institutions. Hospitals conduct a broad spectrum of diagnostic and interventional procedures, such as cardiology, gynecology, urology, and critical care applications, where ultrasound probes—particularly semi-critical and critical probes such as transesophageal (TEE), transvaginal, and transrectal probes—need stringent high-level disinfection (HLD). Regulatory bodies like the CDC, FDA, and Joint Commission require strict probe reprocessing standards, compelling hospitals to invest in automated disinfection systems to provide standardized and efficient reprocessing workflows. In addition, hospitals will be more inclined to implement sophisticated automated probe reprocessors, including Nanosonics' trophon2 and STERIS's Revital-Ox systems, to minimize human error and maximize patient safety, solidifying their market dominance.

The Diagnostic Imaging Centers segment is expected to witness the fastest growth over the forecast years based on the growing role of outpatient imaging, the adoption of point-of-care ultrasound (POCUS), and the mounting demand for value-priced diagnostic testing. As healthcare becomes more inclined towards value-based care and outpatient, diagnostic imaging centers are also observing increased patient traffic for ultrasound scans, such as musculoskeletal, vascular, and abdominal imaging. Moreover, the expansion of portable and handheld ultrasound machines in outpatient facilities has increased the utilization of non-critical and semi-critical probes, creating the need for effective probe reprocessing solutions. The increased infection prevention awareness in ambulatory care and the implementation of automatic disinfection technologies, i.e., UV-C and hydrogen peroxide vapor systems, are additionally driving this segment to grow at a high pace, becoming a driving force in the probe reprocessing market's future growth.

Probe Reprocessing Market Regional Insights

North America dominated the probe reprocessing market with a 37.41% market share in 2023 because of rigorous infection control laws, sophisticated medical infrastructure, and high levels of adoption of automated disinfection systems. Professional bodies like the U.S. FDA, CDC, and Health Canada impose stringent standards for high-level disinfection (HLD) and sterilization of ultrasound probes, fueling demand for automated reprocessors and chemical disinfectants. The region also witnessed a high incidence of healthcare-associated infections (HAIs), as the CDC reports that 1 out of 31 U.S. hospitalized patients acquire an HAI each day, supporting the necessity for efficient probe reprocessing solutions. Most importantly, main market participants, including Nanosonics, STERIS, and Ecolab, are all based in North America, and thus the technologies develop faster in this region. The increasing use of point-of-care ultrasound (POCUS) across emergency care and outpatient facilities further drives market expansion, as transportable probes must be reprocessed frequently and efficiently.

Asia Pacific is the fastest-growing region in the probe reprocessing market with 12.41% CAGR throughout the forecast period because of increased healthcare growth, rising infection control awareness, and expanding investments in medical technology. China, India, and Japan are witnessing a rise in diagnostic imaging procedures due to an aging population, rising burden of chronic diseases, and healthcare reforms initiated by the government. A 2023 report by the WHO indicates that healthcare expenditure in the Asia Pacific is increasing at a rate of more than 6% every year, which allows hospitals and diagnostic centers to invest in automated disinfection technologies. In addition, positive regulatory policies—like India's Medical Devices Rules 2023, which focus on preventing infection—are encouraging healthcare facilities to implement standardized probe reprocessing practices. The availability of local players and increasing medical tourism also drive the region's rapid market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Probe Reprocessing Market Key Players

-

Nanosonics Ltd. (Trophon EPR, Trophon2)

-

CIVCO Medical Instruments Co., Inc. (ASTRA VR, Ultra-Probe Covers)

-

Tristel plc (Tristel Trio Wipes System, Tristel Duo)

-

Ecolab Inc. (OxyCide Daily Disinfectant Cleaner, Endozime AW Plus)

-

Germitec S.A.S. (Antigermix AE1, Antigermix AS1)

-

CS Medical LLC (TEEClean Automated TEE Probe Cleaner, QwikDry TEE Probe Drying Cloth)

-

Steelco S.p.A. (EW 1 Endoscope Washer, EW 2 Endoscope Washer)

-

STERIS plc (Revital-Ox Resert High-Level Disinfectant, Prolystica Ultra Concentrate)

-

Advanced Sterilization Products (ASP) (STERRAD 100NX System, CIDEX OPA Solution)

-

Medivators Inc. (Advantage Plus Endoscope Reprocessing System, Rapicide PA High-Level Disinfectant)

-

Soluscope SAS (Serie 4 Automated Endoscope Reprocessor, Soluscope TEE Probe Cleaner)

-

Getinge AB (ED-FLOW AER, Cleanascope Transport System)

-

Belimed AG (WD 290 Washer-Disinfector, Protect 360)

-

Olympus Corporation (OER-Pro Endoscope Reprocessor, ETD Double Endoscope Washer)

-

Cantel Medical Corp. (RapidAER Endoscope Reprocessor, DSD Edge Automated Endoscope Reprocessor)

-

ARC Healthcare Solutions (ProbeGuard, ScopeSafe)

-

Metrex Research, LLC (CaviWipes, MetriCide OPA Plus)

-

Tuttnauer (Plasma Sterilizer, T-Edge Autoclave)

-

Sotera Health (Sterigenics Sterilization Services, Nordion Cobalt-60)

-

Miele Professional (PG 8582 Washer-Disinfector, PG 8591 Washer-Disinfector)

Suppliers (These suppliers play a significant role in providing equipment and solutions essential for effective probe reprocessing in medical settings.) in the Probe Reprocessing Market.

-

Nanosonics Ltd.

-

STERIS plc

-

Ecolab Inc.

-

Getinge AB

-

Olympus Corporation

-

UltraAutosonic

-

Medisafe International

-

HuFriedyGroup

-

SPI Supplies

-

JS Process Equipment Pvt. Ltd.

Recent Development in the Probe Reprocessing Market

-

May 2024: Nanosonics continues evolving infection prevention innovation, promoting its trophon device as the largest breakthrough in the high-level disinfection of ultrasound probes in over two decades.

-

June 2023: Parker Laboratories Inc., a world-leading supplier of ultrasound accessories and supplies, has achieved U.S. Food and Drug Administration (FDA) clearance for Tristel ULT, a proprietary disinfecting foam intended for high-level disinfection of ultrasound probes applied in body cavities and on skin-surface transducers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 752.42 million |

| Market Size by 2032 | US$ 1985.18 million |

| CAGR | CAGR of 11.27% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Classification (Semi-Critical, Non-Critical, Critical) • By Probe Type (Convex Probes, Linear Probes, Transesophageal (TEE) Probes, Phased Array/Cardiac Probes, Endocavitary Probes, Others) • By Product (Instruments, Consumables, Service) • By Reprocessing Method (Sterilization, High-Level Disinfection, Intermediate Level Disinfection, Low-Level Disinfection) • By End-Use (Hospitals and Clinics, Diagnostic Imaging Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nanosonics Ltd., CIVCO Medical Instruments Co., Inc., Tristel plc, Ecolab Inc., Germitec S.A.S., CS Medical LLC, Steelco S.p.A., STERIS plc, Advanced Sterilization Products (ASP), Medivators Inc., Soluscope SAS, Getinge AB, Belimed AG, Olympus Corporation, Cantel Medical Corp., ARC Healthcare Solutions, Metrex Research, LLC, Tuttnauer, Sotera Health, Miele Professional, and other players. |