Cloud Radio Access Network (C-RAN) Ecosystem Market Report Scope & Overview:

Get more information on Cloud Radio Access Network (C-RAN) Ecosystem Market - Request Sample Report

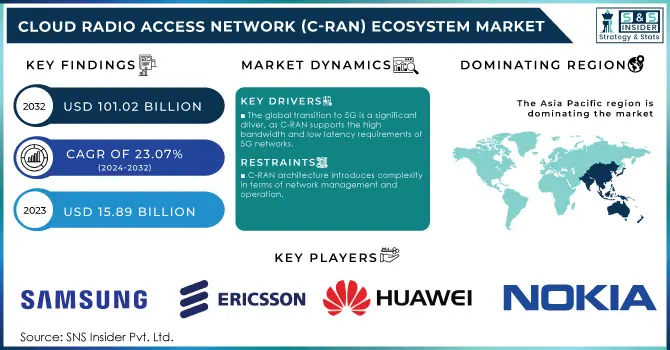

The Cloud Radio Access Network (C-RAN) Ecosystem Market Size was valued at USD 15.89 Billion in 2023 and is expected to reach USD 101.02 Billion by 2032 and grow at a CAGR of 23.07% over the forecast period 2024-2032.

C-RAN Adoption Surges with 5G Rollouts, Driving Energy Efficiency and Network Performance

The adoption of Cloud Radio Access Network (C-RAN) is accelerating as telecom operators worldwide continue to expand 5G Services. Currently, over 60% of major telecom operators are implementing C-RAN in their 5G deployments, driven by the need for efficient network architectures to handle the surge in data traffic and bandwidth demand. Enterprises are also adopting private 5G networks, with increasing reliance on C-RAN due to its ability to manage complex network environments effectively. The small-cell 5G paradigm is used in the C-RAN architecture, which is seen as a potential way to address 5G requirements

C-RAN provides significant energy efficiency and cost-saving benefits. Compared to traditional RAN architectures, C-RAN can reduce energy consumption by up to 30%, according to real-world deployments. This energy savings translates into operational cost reductions, particularly in urban areas where network densification is critical. Infrastructure investment savings are also reported, as C-RAN minimizes the need for redundant hardware, resulting in more centralized, scalable networks

Investment in C-RAN infrastructure, particularly in software-defined networking (SDN) and Network Function Virtualization (NFV) is increasing among telecom operators. Leading players like AT&T, Verizon, and Vodafone have significantly ramped up R&D expenditure in these areas.

In terms of network performance, C-RAN delivers a marked improvement, increasing bandwidth capacity by up to 50% in high-density urban environments. With data traffic expected to grow to 4.8 zettabytes annually by 2032, C-RAN’s ability to manage network scalability efficiently will be crucial

However, the high upfront costs and operational complexity associated with deploying C-RAN are barriers, especially for smaller operators. Addressing these challenges requires advancements in open standards and more affordable deployment models

MARKET DYNAMICS

KEY DRIVERS:

- The global transition to 5G is a significant driver, as C-RAN supports the high bandwidth and low latency requirements of 5G networks.

The global transition to 5G is a key driver for C-RAN adoption, with 5G expected to become the dominant mobile access technology by subscription in the coming years. Estimates suggest that by 2026, 5G will cover approximately 60% of the global population, driven by the need for low latency and high bandwidth. In particular, North America is projected to have the highest 5G penetration at 90%, followed closely by the Gulf Cooperation Council (GCC) at 89%, and Western Europe at 86%.

C-RAN's ability to support these 5G networks is crucial, as it enhances network capacity to deliver speeds of up to 10 Gbps while optimizing resource allocation. C-RAN's centralized architecture reduces delays by 30-50% compared to traditional RAN systems, making it an essential solution for telecom operators. This is particularly important in urban areas, where more than 80% of the population in high-income regions such as Western Europe, the Americas, Japan, and the Middle East live. Similarly, upper-middle-income regions like Eastern Europe, East Asia, and parts of Africa and South America see between 50-80% of their populations in urban areas, further amplifying the need for efficient, scalable network solutions like C-RAN.

Moreover, with global mobile data traffic expected to reach 4.8 zettabytes per year by 2032, the demand for C-RAN's ability to centralize base station control and maintain consistent service quality while lowering operational costs will only increase.

- Increased Investments from Telecom Operators.

Telecom operators are increasingly recognizing the importance of investing in C-RAN infrastructure to support their 5G networks, although many are relying heavily on industry vendors for research and development (R&D). Notably, major telecom vendors like Huawei, Ericsson, and Nokia have made significant R&D investments, with Huawei spending over USD 23 billion in 2022, Ericsson investing approximately USD 4.6 billion (SEK 47.3 billion), and Nokia contributing around USD 4.9 billion (4.5 billion euros) to their R&D efforts.

In contrast, while companies like AT&T and Telefonica are among the few telecoms that have made substantial R&D investments, many operators opt to acquire promising technologies instead of developing them in-house. This trend leads to a scenario where telecom operators may become indistinguishable outside of their network reliability, limiting innovation in service differentiation. However, the urgency to implement efficient network architectures is evident, as over 50% of North American telecom operators had adopted C-RAN in at least part of their 5G network by 2023. This dual approach of leveraging vendor expertise while increasing investments in C-RAN deployment reflects a strategic shift in the industry as operators strive to enhance their service offerings amidst the burgeoning demands of 5G technology.

RESTRAIN:

- C-RAN architecture introduces complexity in terms of network management and operation.

The C-RAN architecture introduces significant complexity in terms of network management and operation, posing challenges for many telecom operators. The transition to C-RAN often requires substantial changes in network architecture, necessitating specialized skills and tools. As highlighted by the GSMA, this transition can lead to extended deployment timelines and increased operational costs due to the need for advanced software and analytical tools.

Moreover, research indicates that many operators struggle with a skills gap in their workforce, which hinders the successful implementation of C-RAN technologies. This shortage of expertise poses a significant barrier to the adoption of new technologies like C-RAN. Additionally, a study by Telecoms.com emphasizes that effective resource allocation within a C-RAN setup requires sophisticated algorithms and real-time data analytics, further complicating network management. These factors contribute to the operational burden on telecom operators, making the transition to C-RAN a complex endeavor that demands careful planning and significant investment in training and resources.

MARKET SEGMENTATION ANALYSIS

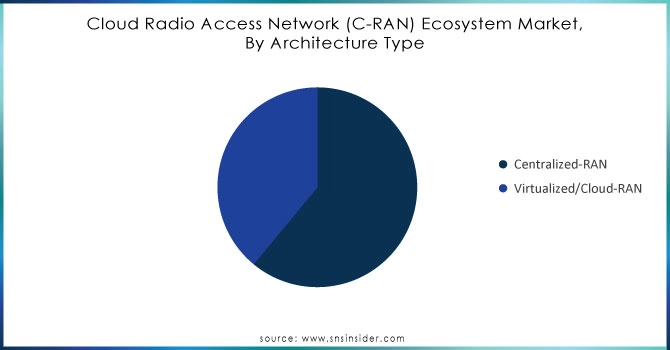

BY ARCHITECTURE TYPE

The Centralized RAN segment leads the market with a substantial 61% market share in 2023, driven by its resource efficiency and enhanced network performance. By centralizing processing resources, operators can optimize resource allocation and significantly reduce latency, which is critical for supporting the high demands of 5G networks.

In contrast, the Virtualized/Cloud RAN segment is experiencing rapid growth, projected to have the highest CAGR of 25%. This surge is fueled by the flexibility and scalability that cloud solutions offer, allowing telecom operators to adapt quickly to changing demands without the need for significant hardware investments. Additionally, the rise of IoT and edge computing is driving interest in cloud-based architectures, which can efficiently support these emerging technologies.

Do You Need any Customization Research on Cloud Radio Access Network (C-RAN) Ecosystem Market - Inquire Now

BY END USER

The Infrastructure segment dominates the Cloud Radio Access Network (C-RAN) ecosystem market, accounting for 55% of the total market share in 2023. This substantial share reflects the critical role of physical infrastructure in supporting the centralized architecture of C-RAN systems. Infrastructure investments are essential for building and upgrading base stations, fronthaul networks, and data centers that handle massive data traffic, particularly in urban areas experiencing rapid network densification.

The Software segment is poised for remarkable growth, boasting the highest projected CAGR of 28%. This growth is driven by the increasing demand for virtualization and software-defined networking solutions, which enable operators to optimize network performance and resource management. Software solutions also facilitate the deployment of advanced analytics and artificial intelligence capabilities, further enhancing operational efficiency. As telecom operators transition to 5G and beyond, the need for flexible and scalable software solutions becomes paramount, enabling them to adapt to evolving technological landscapes and customer demands.

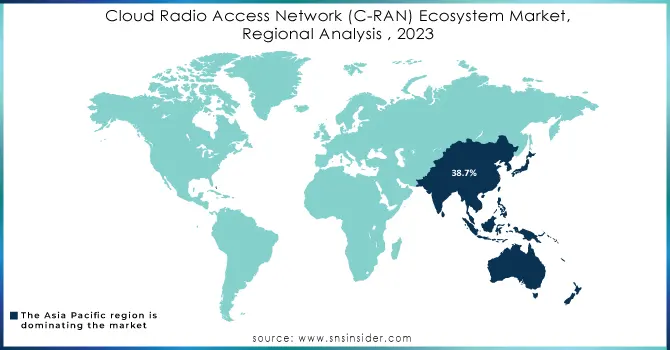

REGIONAL ANALYSIS

In 2023, the Asia Pacific region leads the Cloud Radio Access Network (C-RAN) market, capturing approximately 38.7% of the total market share. This dominance stems from robust investments in 5G infrastructure, particularly in countries like China, India, and South Korea, which are actively rolling out C-RAN to enhance network performance. For instance, China has made significant strides, with reports indicating that over 800,000 5G base stations were deployed in the first half of 2023 alone. This rapid deployment aligns with the rising demand for high-capacity networks, driven by increasing urbanization and the need for efficient data management in densely populated areas.

Conversely, North America holds the second-largest share of the C-RAN market at around 29.5%. Major telecom operators, such as Verizon and AT&T, are heavily investing in advanced C-RAN infrastructures to support their 5G initiatives. Notably, Verizon has announced plans to increase its investment in C-RAN technologies, aiming for a more efficient network capable of handling future data demands. A recent report suggests that by 2023, more than 50% of North American telecom operators had already integrated C-RAN into at least part of their 5G networks, illustrating a significant shift towards modernized telecommunications.

Key Players

Some of the major players in the Cloud Radio Access Network (C-RAN) Ecosystem Market are:

-

Nokia

-

NEC

-

CISCO

-

Altiostar

-

Fujitsu

-

Intel

-

ASOCS

-

Radisys

-

Arzita Networks

-

Anritsu

-

6WIND

-

EXFO

-

Airspan

-

VIAVI

-

Infinera

-

Texas Instruments

-

Amphenol

-

Xilinex

-

Dali Wireless

-

Casa Systems

RECENT TRENDS

-

In 2024, Nvidia introduced a new research platform for 6G technology that enables telecommunications companies to explore the integration of artificial intelligence into radio access network systems. This initiative aims to enhance network efficiency and performance through AI-driven innovations.

-

In July 2024, Nokia and Bharti Airtel successfully conducted a trial of 5G Non-Standalone (NSA) Cloud RAN in India. The trial was performed in an over-the-air environment, utilizing the 3.5 GHz spectrum for 5G and the 2100 MHz band for 4G. This test involved data calls made with commercial user devices on Airtel's live network, achieving impressive throughput rates exceeding 1.2 Gbps.

-

In August 2024, Ericsson provided both hardware and software, carrying out demonstrations, test cases, and performance evaluations for a trial deployment. The Swedish vendor collaborated with Turkish operator Turkcell to successfully implement the Ericsson 5G Cloud Radio Access Network (RAN) technology on Turkcell's network.

-

EchoStar, a satellite communications company, is delivering television services through a standalone cloud-native Open RAN 5G network on Amazon Web Services (AWS). This innovative technology enables the company to provide television entertainment and wireless communications to both residential and business customers across the United States. EchoStar claims this is the first instance of such a use case in the industry.

-

Verizon has deployed over 130,000 O-RAN-capable radios, including massive MIMO radios, as part of its commitment to O-RAN standards. This rollout complements its previous announcement of 15,000 O-RAN-compliant virtualized cell sites, promoting competition and innovation in the Radio Access Network ecosystem through open, interoperable interfaces.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 15.89 Billion |

| Market Size by 2032 | US$ 101.02 Billion |

| CAGR | CAGR of 23.07% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Infrastructure, Software, Services) • By Deployment (Indoor, Outdoor) • By End User (Telecom Operators, Enterprises) • By Network Type (5G, 4G, 3G/2G) • By Architecture Type (Centralized-RANVirtualized/Cloud-RAN) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nokia, Huawei, Ericsson, NEC, CISCO, Samsung, Altiostar, Fujitsu, Intel, Mavenir, ASOCS, Radisys, CommScope, Arzita Networks, Anritsu, 6WIND, EXFO, Airspan,VIAVI, Infinera, Texas Instruments, Amphenol, Xilinex, Dali Wireless, Casa Systems |

| Key Drivers | • The global transition to 5G is a significant driver, as C-RAN supports the high bandwidth and low latency requirements of 5G networks. • Increased Investments from Telecom Operators. |

| Restraints | • C-RAN architecture introduces complexity in terms of network management and operation. |