Cathode Materials Market Report Scope & Overview:

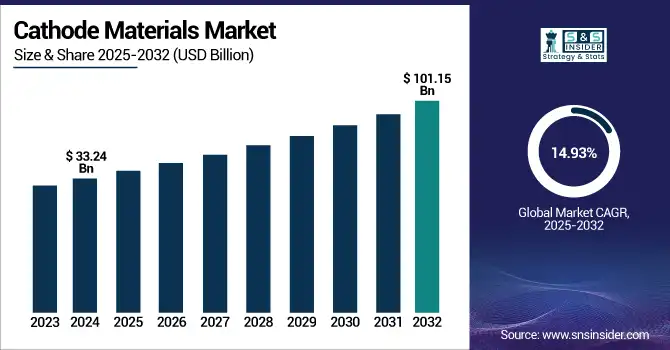

The Cathode Materials Market size was valued at USD 33.24 billion in 2024 and is expected to reach USD 101.15 billion by 2032, growing at a CAGR of 14.93% over the forecast period of 2025-2032.

To Get more information on Cathode Materials Market - Request Free Sample Report

The cathode materials market is advancing rapidly with increasing EV penetration and grid storage needs. Some of the important trends in the market are the domination of LFP and the high growth of NCA chemistries in lithium-ion battery cathode materials. Cathode materials market companies are primarily focusing on high-density cathode active materials to offer efficient and recyclable technology.

The U.S. cathode materials market's value is USD 10.88 billion, and the market share is 78.5% during the forecast period of 2025-2032. The U.S. Department of Energy stated in January 2025 that it would spend USD 725 million to kick-start domestic battery material production. According to the IEA, China has about 90% of global cathode capacity, with Korea (9%) and Japan (3%) being the next biggest players.

These factors are playing an important role in forming the market share for cathode materials. Breakthroughs within the battery materials industry and strategic SC moves are among the key driving forces for the atomicity materials market. These are the kind of developments that change the face of the market, moving sustainable technologies to a leading heart of energy storage development.

Cathode Materials Market Dynamics:

Drivers:

-

Government Initiatives and Policies Stimulate Cathode Materials Market Share Expansion

Government policies and investments are also contributing significantly to the growth of the cathode materials market size. In January 2025, the U.S. Department of Energy issued a notice of intent to provide up to USD 725 million to support the U.S. production of battery-critical materials. This investment is intended to create a supply chain for electric vehicles and energy storage in the U.S. and to decrease reliance on foreign imports. Governments are increasingly supporting cathode materials companies to set up business in their country, which is helping in the growth of the market. These policies help in building domestic capabilities in the cathode materials market, thereby driving the overall cathode materials market growth and ensuring a steady supply of Cathode Active Materials for different applications.

-

Expansion of Domestic Battery Supply Chains Enhances Cathode Materials Market Growth

With the high growth prospects, the Cathode Materials market appears to be highly promising and is being eyed on by several large and small manufacturers. In December 2024, the U.S. Department of Energy proposed to lend up to USD 7.54 billion to a joint venture by Stellantis and Samsung SDI to build two lithium-ion battery plants in Indiana. These plants will have an annual battery production capacity of about 67 GWh for a million EVs. This is part of a wider push to boost domestic production capacity, decrease reliance on foreign supply chains, and drive the cathode materials market demand. These investments do not just expand the cathode materials market size, but also passionately promote innovation and maintain competition. Need to establish local infrastructure to fulfil the growing demand for electric vehicles and also energy storage systems, which will boost the cathode materials market.

Restraints:

-

Overreliance on Chinese Supply Chains Challenges Cathode Materials Market Stability

The cathode materials market has to overcome the challenge of heavy reliance on the Chinese supply lines. China now controls electrode material production, which represents close to 90% of the global production capacity. This concentration exposes them to geopolitical frictions, trade controls, and supply disruptions. For example, any policy adjustment or export limitation of China may impose a great impact on the supply and price of cathode active materials globally. These weaknesses undermine the stability and predictability of the market and the ability of cathode materials companies everywhere to function. Diversifying sources of supply and enhancing domestic production capacity are among the strategic measures necessary to reduce risks and address the cathode materials market growth.

Cathode Materials Market Segmentation Analysis:

By Material

In 2024, the cathode material market was dominated by lithium iron phosphate (LFP), which occupied 35.8% of the total market share. Due to its cheapness, high thermal stability, and safety aspects, it has become a popular selection for EVs and energy storage systems. Big carmakers, such as Tesla and BYD, have been using LFP batteries in their standard-range electric vehicles, at lower costs but with better safety. The technology is commonly installed in EVs and stationary storage systems, proving its leading position in the cathode material market.

Lithium Nickel Cobalt Aluminum Oxide (NCA) emerged as the fastest growing type of the cathode material market in 2024 with a CAGR of 16.2%. Its high energy density, free of cobalt, and ultra-long cycle life make it particularly well-suited for high-end applications, in particular premium electric vehicles. Corporations, for example, Panasonic and Tesla, employ NCA cathodes in their battery packs to get optimum performance and long driving range. The growing automotive industry, with the demand for high-energy-dense batteries, drives the NCA segment growth in the market.

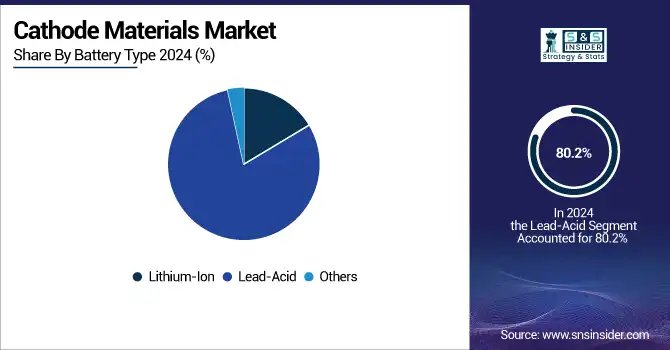

By Battery Type

Lead-acid batteries was the leading segment in the cathode materials market in 2024, with a share of 80.2%. Their domination can be attributed to their general application in automobile self-starters, emergency power supplies, industry, and others. The advanced technology, good economy, and industrial recycling system of lead-acid battery guarantee its further development and broad application in the coming decade. While alternative battery technologies have evolved, lead-acid batteries continue to serve as a bedrock for many applications where cost and reliability are paramount.

The lithium-ion batteries are expected to be the fastest-growing segment during the forecast period of 2025-2032, registering a CAGR of 15.62%. Better energy densities, longer lifespans, and decreasing costs are pushing their use in consumer electronics, electric vehicles, and storage for renewable energy. No less than the government's push and investment in lithium-ion battery manufacturing is driving this growth. Versatility and performance advantages of lithium-ion batteries make them the ideal choice for the emerging energy storage applications.

By Application

Automotive applications dominated the cathode materials market in 2024, accounting for 46.2% of the market share. The surge in electric vehicle adoption, driven by environmental regulations and consumer demand for sustainable transportation, fuels this dominance. Automakers are increasingly investing in battery technologies to enhance vehicle performance and range, thereby boosting the demand for advanced cathode materials. The automotive sector's focus on electrification underscores its significant role in shaping the market.

Consumer electronics is projected to be the fastest-growing application segment in the forecast period of 2025-2032, with a CAGR of 15.33%. The proliferation of smartphones, laptops, wearable devices, and other portable electronics drives the demand for compact, high-capacity batteries. Advancements in cathode materials enhance battery performance, meeting consumer expectations for longer device usage and faster charging. The continuous innovation in consumer electronics propels the growth of this segment within the market.

Cathode Materials Market Regional Outlook:

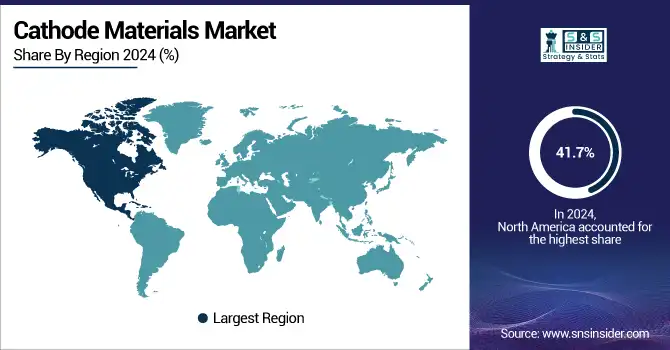

The cathode materials market is dominated by North America with a market share of 41.7% attributed to the increasing demand for lithium-ion batteries in electric vehicles and energy storage in the region. U.S. also has a powerful support from government, such as initiative of the department of energy. Tesla and General Motors, as well as battery companies including Panasonic and LG Chem, were driving forces behind efforts to increase production capacity, keeping the region’s dominance intact.

Europe represents a 23.8% market share with demand from the EU’s Green Deal and the use of electric vehicles (EVs) and energy storage. Other countries, such as Germany, France, and the Netherlands, are investing quite heavily in green technologies. Driving the regional market include major companies, including BASF and Umicore, which are boosting regional capacity, and automakers, such as Volkswagen and BMW, which are consuming lithium-ion battery cathodes, driving additional market share.

The Asia Pacific emerged as the fastest growing region with the highest growth rate of 15.79% due to the high demand for lithium-ion batteries in China, Japan, South Korea. Production is dominated by China, where companies including CATL and BYD dominate the market. Government subsidies and improvements in battery technology are also spurring the region’s rapid expansion, with Japan and South Korea fueling global growth as well.

In Latin America, the cathode materials market is developing into a major region, in part because of lithium reserves in Brazil driving demand for battery materials. Further, with the increasing lithium production in countries, such as Argentina and Chile, along with governments making significant investments in electric vehicle infrastructure, the region is increasingly finding a place in the global supply chain, which would foster the demand for electric vehicles in the region in coming years, thereby driving market growth over the coming years.

The cathode materials market in the Middle East & Africa is expanding, led by the enrollment of government-sponsored programs for adoption of electric vehicles and renewable energy investment in line with Saudi Arabia's Vision 2030. Though market share in the region is currently small, the growing requirement for energy storage and EVs is likely to make the market more critical in the future.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major competitors in the cathode materials market include BASF SE, Umicore, Sumitomo Metal Mining Co., Ltd., POSCO Holdings Inc. (via POSCO Future M), LG Chem Ltd., Mitsubishi Chemical Corporation, Nichia Corporation, Shenzhen Dynanonic Co., Ltd., Ningbo Shanshan Co., Ltd., and Zhejiang Huayou Cobalt Co., Ltd.

Recent Developments:

-

March 2025: LG Chem unveiled precursor-free cathode material to boost battery performance while reducing environmental impact; mass production planned for 2025.

-

February 2025: HPQ Silicon patented a one-step process for fumed alumina/titania production, improving lithium-ion battery cathode efficiency and cost-effectiveness.

-

January 2025: NIT Rourkela developed a cobalt-free cathode using magnesium-nickel for sustainable EV batteries, enhancing stability and supporting India's self-reliance.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 33.24 billion |

| Market Size by 2032 | USD 101.15 billion |

| CAGR | CAGR of 14.93% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Material (Lithium Cobalt Oxide (LCO), Lithium Iron Phosphate (LFP), Lithium Manganese Oxide (LMO), Lithium Nickel Manganese Cobalt Oxide (NMC), Lithium Nickel Cobalt Aluminum Oxide (NCA), Others) •By Battery Type (Lithium-Ion, Lead-Acid, Others) •By Application (Automotive, Consumer Electronics, Power Tools, Energy Storage, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | BASF SE, Umicore, Sumitomo Metal Mining Co., Ltd., POSCO Holdings Inc. (via POSCO Future M), LG Chem Ltd., Mitsubishi Chemical Corporation, Nichia Corporation, Shenzhen Dynanonic Co., Ltd., Ningbo Shanshan Co., Ltd., Zhejiang Huayou Cobalt Co., Ltd. |