BATTERY MATERIALS MARKET KEY INSIGHTS:

To get more information on Battery Materials Market - Request Sample Report

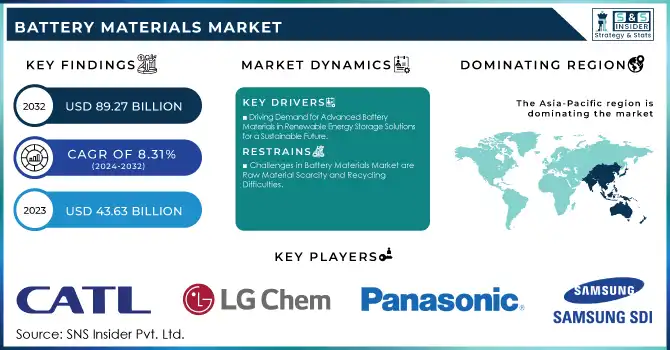

The Battery Materials Market size was valued at USD 43.63 billion in 2023 and is expected to reach USD 89.27 billion by 2032, with growing at a CAGR of 8.31% over the forecast period 2024-2032.

The battery materials market is growing because of the increasing need for energy storage in many industries. Consequently, an increasing number of people and companies are making the transition to using EVs, and the demand for better batteries has also increased, plus the materials used to make them. In 2023, the demand for critical metals driven by electric vehicle (EV) batteries was significant, lithium demand reached approximately 140 kilotonnes (kt), making up 85% of total lithium demand and increasing by over 30% compared to 2022. Cobalt demand for batteries stood at 150 kt, accounting for 70% of total cobalt demand and reflecting a 15% increase from the previous year. These figures underscore the growing influence of the EV market on the demand for essential metals.

The governments of the world are getting innovative in providing cleaner solutions to transportation to fight carbon emissions. The total life-cycle emissions of hybrid and electric vehicles can be reduced by as much as 89% when compared to vehicles powered by internal combustion engines. Additionally, modern battery recycling methods can mitigate the emissions produced during battery production by approximately 60% to 65%. This creates a huge demand for high-performance battery-lithium-ion variants right on top. The other significant driver relates to the need for portable electronics, especially mobile phones, laptops, and wearables. With this widespread penetration of consumer electronics, there arises a steady demand for efficient, long-life, and lightweight batteries that require advanced battery materials for enhanced performance and safety of the batteries. It can be attributed to more concentration on renewable sources of energy, such as solar energy and wind energy. The more the generation of solar and wind energy, the greater the requirement for the stabilization of grids through battery energy storage systems.

Technological advancements such as next-generation batteries including solid-state and silicon-anode batteries are crucial for market growth in the stated period. Along with higher energy density, faster charging, and enhanced safety features, the requirement for advanced battery materials to fuel next-generation technologies in these applications has been driving it further.

MARKET DYNAMICS

KEY DRIVERS:

-

Driving Demand for Advanced Battery Materials in Renewable Energy Storage Solutions for a Sustainable Future

Renewable energy is indeed intermittent and increases in demand as it is associated with intermittent access by people to solar-powered energy and wind speed. the global renewable energy capacity rose by 295 GW to some 3,405 GW. The largest contribution, with 141 GW, came from Asia, primarily from China. In terms of technology, solar power accounted for the largest portion of the new capacity, namely, 191 GW. Furthermore, wind energy increased by 75 GW. Overall, renewables made up 83 of the overall capacity growth, suggesting that they are at the center of any energy plans. This creates a critical demand for large-scale battery storage that can store excess energy generated during peak production periods and can release it when needed. As the energy storage system is developed to be used in grid stabilization and backup power, the demand for high-quality battery materials increases with the need for better performance, durability, and energy efficiency. For instance, Tesla has developed the Megapack, big batteries for storing excess renewable energy generated by solar and wind power plants. One of the world's largest lithium-ion battery installs can be found in the Hornsdale Power Reserve in South Australia.

-

Rising Demand for Advanced Battery Materials Fuels Innovation in Consumer Electronics and Smart Devices

Another driving force is that the ever-increasing demand for consumer electronics increases the demand for more advanced and more efficient batteries. As new technologies evolve, smartphones, laptops, and wearables require smaller, lighter, and longer-life batteries. Advancements in battery materials facilitate manufacturers in meeting such requirements by offering higher energy density, faster charging capacity, and higher safety. Further accelerations are also witnessed with the increase in smart devices and the Internet of Things (IoT), demanding more advanced materials for the batteries. In 2023, smartwatches are adopted by 30% of working-age internet users, over a quarter of the population, and 22.5% own one. Meanwhile, the share of those who own a gaming console is estimated at 20.3%. Therefore, the role of developing advanced battery technologies for them is critical. The evolution of these devices and their usage require batteries to be more efficient, compact, and durable. These kinds of devices rely on efficient energy storage to function properly, thus propelling the development of new battery technologies and materials essential factor that drives the demand for better-performing batteries across the electronics industry. where there is more demand for advanced battery materials due to consumer electronics, it can be found in Apple's new products in terms of its iPhone, Apple Watch, and so on. With innovative upgrades for every new generation of the device, slimmer, lighter, and more powerful is what each new device offers with the need for batteries that store more energy in a much smaller space.

RESTRAIN:

-

Challenges in Battery Materials Market are Raw Material Scarcity and Recycling Difficulties

As with any other product, a battery requires certain materials for its manufacturing. For high-performance batteries, such as those by Tesla, metals like lithium, cobalt, and nickel are needed. However, mining and extracting these materials can be troublesome for a variety of reasons. First of all, these metals are not equally distributed, as each of them comes from a particular region in the world. This problem is particularly prominent in the case of cobalt. Currently, cobalt is primarily being mined in the Democratic Republic of Congo, a nation ravished by political instability and plagued with ethical concerns over the cobalt mining procedure. As demand for batteries rises due to the increase in electric automobile and electronic device sales, the issue is becoming more noticeable.

KEY SEGMENTATION ANALYSIS

BY BATTERY TYPE

Lead Acid batteries segment dominated the market, holding 62% market share in 2023. They dominated sales in many applications, including automotive and industrial. Their long history in the marketplace stems from their reliability, relatively low initial cost, and strong performance under demanding conditions. Lead Acid batteries are widely used for SLI applications in vehicles and as a source of backup power for UPS systems. Their proven technology and ability to deliver high surge currents make them the preferred option for many traditional industries, reinforcing their significant market share.

Lithium-ion batteries segment is likely to increase at a strong rate and maintain the fastest CAGR from 2024 to 2032. This is because of increasing requirements for high-end energy storage technologies for electric vehicles, portable electronics, and renewable energy applications. They have several advantages over Lead Acid, including higher energy density, lower weight, longer cycle life, and faster charging abilities. Lithium-ion batteries will lead in this changing energy landscape because the momentum for a clean technology-based industry with efficient energy storage is moving fast.

BY TYPE

The Cathode segment dominated the total market share with 37% in 2023, This is mainly because cathode materials are vital to battery performance and efficiency, especially within the context of lithium-ion technology. The cathode is what stores and desorbs or rather releases lithium ions during charging and discharging and remains an important part of high-energy-density applications in electric vehicles and portable electronics. The high growth in such applications has compelled manufacturers to make serious investments in the development of high-tech cathode materials and ensure a market leadership position in the future as well.

The anode segment is likely to register the fastest growth rate from 2024 to 2032. The overall growth rate of the product is founded on continuous innovation regarding anode materials, primarily those silicon-based, that support much higher energy capacities than those from traditional graphite anodes. As the requirement for high-energy-density batteries with fast-charging capabilities takes on an increasingly more critical role, especially in emerging EVs, anode technologies seem to steal the spotlight of manufacturers intent on churning out better anodes and, thus, meeting such rising expectations. An improvement in overall battery performance and lifespan will also be driven by advances in anode technologies, which are likely to continue fueling demand in the category in the next several years.

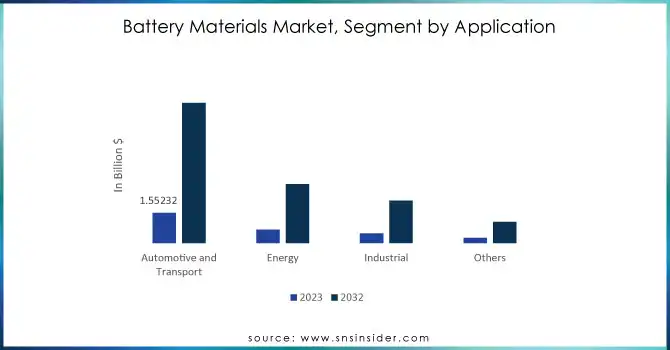

BY Application

The automotive sector dominated the market with a share of 43% in 2023, and it is also supposed to grow at the fastest CAGR from 2024 to 2032. Reasonably, the demand for e-vehicles would increase rapidly due to increasing consumers as well as governments' focus on seeking sustainable transportation solutions. Companies like Tesla are taking the lead, showing where improvements in battery technology are so desperately needed for better performance, range, and efficiency of the vehicle. As more manufacturers of electric vehicles come on board, good quality materials for batteries, particularly lithium-ion batteries, will be hotly sought.

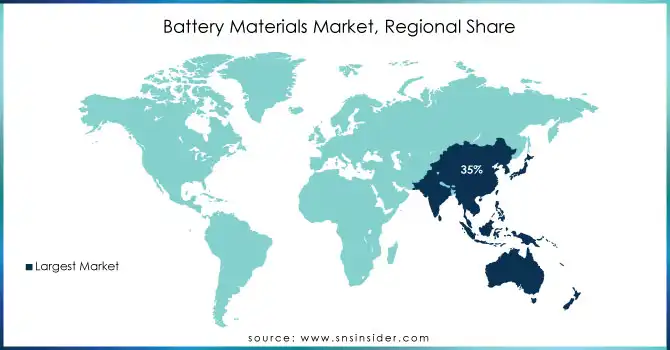

REGIONAL ANALYSIS

Asia-Pacific dominated the market share of battery materials, with a 35% share in 2023. Some of the reasons for this heavy share are robust manufacturing capacity, strong demand for electric vehicles, and investment in renewable energy solutions. Notable countries around the globe, like China, Japan, and South Korea, are leading in terms of production and technology development. For instance, China accounts for about the world's largest supply of lithium-ion batteries and also is a significant lithium producer, supplying a considerable amount of the globe's battery materials. The rapid growth in the adoption of EVs in China, boosted by government incentives and infrastructure development, has further deepened the Asian-Pacific region as the leader in battery materials.

North America is expected as the fastest growing market for battery materials during the forecast period. This shall primarily be due to a growing interest in sustainability and clean energy sources, especially in the automobile sector. Efforts undertaken by the U.S. government toward encouraging electric vehicles through programs, such as the Biden Administration's plan for charging infrastructure as well as offering financial incentives to purchase EVs, have given the best backdrop for battery manufacturers. Increasing production of EVs by companies such as Tesla and General Motors are driving the market in high demand for advanced battery material. Moreover, the growing battery recycling initiatives in North America contribute to an extended market because it builds up a sustainable supply chain for battery material.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Battery Materials Market are:

-

CATL (Lithium Iron Phosphate, NMC)

-

LG Chem (NCM, LFP)

-

Panasonic (Lithium-ion batteries, EV Batteries)

-

Samsung SDI (NCA, LFP)

-

SK Innovation (NCM, Lithium-ion Batteries)

-

BYD (Li-ion batteries, NMC)

-

A123 Systems (LiFePO4 batteries, PHEV Batteries)

-

Northvolt (Lithium-ion batteries, NMC)

-

Sion Power (Lithium-sulfur batteries, Battery technology)

-

Toshiba (SCiB, Lithium-ion batteries)

-

Contemporary Amperex Technology Co. Limited (CATL) (NCM, LFP)

-

Umicore (NMC, Cobalt)

-

FMC Corporation (Lithium, Lithium Hydroxide)

-

Tianqi Lithium (Lithium Hydroxide, Lithium Carbonate)

-

Albemarle Corporation (Lithium Hydroxide, Bromine)

-

Livent (Lithium Hydroxide, Lithium Carbonate)

-

Ganfeng Lithium (Lithium Hydroxide, Lithium Carbonate)

-

Ferroglobe (Graphite, Carbon materials)

-

Korean Chemicals (NCM, Li-ion battery materials)

-

EVE Energy Co., Ltd. (Lithium-ion batteries, LiFePO4 batteries)

-

Sila

-

TDK

Some of the Raw Material Suppliers for Battery Materials Companies:

-

Albemarle

-

SQM (Sociedad Química y Minera)

-

Livent

-

Ganfeng Lithium

-

Tianqi Lithium

-

FMC Corporation

-

Umicore

-

BASF

-

Manganese Metal Company

-

Nyrstar

RECENT TRENDS

-

In 2024, TDK Corporation unveils a new material for its next-gen CeraCharge solid-state SMD battery, boasting an energy density of up to 1,000 Wh/L—100 times higher than its current solid-state battery offerings.

-

In 2024, Sila Launches Advanced Battery Engineering Services to Aid Innovators in Adopting Next-Generation Anode Materials

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 43.63 Billion |

| Market Size by 2032 | USD 89.27 Billion |

| CAGR | CAGR of 8.31% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Battery Type (Lithium Ion, Lead Acid, Other Batteries) • By Type (Cathode, Anode, Electrolyte, Separator, other) • By Application (Portable Devices, Automotive, Electronics Items, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | CATL, LG Chem, Panasonic, Samsung SDI, SK Innovation, BYD, A123 Systems, Northvolt, Sion Power, Toshiba, Umicore, FMC Corporation, Tianqi Lithium, Albemarle Corporation, Livent, Ganfeng Lithium, Ferroglobe, Korean Chemicals, EVE Energy Co., Ltd. |

| Key Drivers | • Driving Demand for Advanced Battery Materials in Renewable Energy Storage Solutions for a Sustainable Future • Rising Demand for Advanced Battery Materials Fuels Innovation in Consumer Electronics and Smart Devices |

| Restraints | • Challenges in Battery Materials Market Driven by Raw Material Scarcity and Recycling Difficulties |