CBD Skin Care Product Market Size & Overview:

The CBD Skin Care Product Market size was valued at USD 2297.8 million in 2023 and is projected to reach USD 22191.0 million by 2032, with a growing CAGR of 28.7% over the forecast period 2024-2032. There is growing demand for CBD skincare, as more people become aware of the benefits associated with CBD-infused personal care items. Indeed, a brand launched in November 2022 by entrepreneurs Yann Moujawaz and Juana Martini, UAE-based Juana Skin, reflects the interest in CBD-based skincare solutions. Increased cannabis sales and cultivation in North America have also led to a strong demand for CBD skincare products, more so for serious skin conditions. Companies are responding with new innovative products. Bombay Hemp Company, for instance, in July 2021 expanded its portfolio of skincare products including facial creams and balms lotions due to high demand among consumers interested in hemp oil and CBD beauty products.

Get more information on CBD Skin Care Product Market - Request Sample Report

According to research, cannabis seed extract-based creams have a high preference among customers, and around 20% of consumers reported having a high demand for cannabis seed extract-based creams due to their natural ingredient composition. Public and private support for focused efforts in research along with frequent novelties of product innovation, which is precipitated by breakthroughs in modern technology across the globe, also supports this trend. Avicanna Inc. is launching its clinically tested CBD dermo-cosmetics under the 'Pura Earth' brand, which was launched in May 2021.

That sets the scene for potential cannabinoid solutions. Retailers such as Sephora and Ulta Beauty are also getting behind this emerging trend, by featuring CBD skincare products in differentiated store sections, thereby making products more accessible to shoppers. The ever-increasing market for medical and recreational cannabis use remains a key driver of product demand.

Additionally, with consumers searching for a chemical-free alternative, there is a larger macro trend toward natural skincare products. This is followed in product lines that integrate hemp, like Beardo's new personal care line launched in November 2021 and Irwin Naturals' HydroCanna line unveiled in January 2020, focusing on the therapeutic and soothing properties of CBD for various skin conditions. The increasing investment of the business entities operating in the CBD skincare market would raise the acceptance among consumers. In this regard, increasing research studies with positive results will nurture such an outcome. Therefore, the enhanced awareness and demand for healthy skincare products are quite positive for the prospect of significant growth opportunities for the CBD skincare product market soon.

CBD Skin Care Product Market Dynamics

Drivers

-

Rising Consumer Awareness and Legalization of CBD Fueling Growth in the CBD Skincare Market

The main driver behind the rise in demand for CBD skincare products is increased awareness of all the multiple benefits their use brings. These include soothing, anti-aging, skin cleansing, anti-inflammatory attributes, and antioxidant capabilities. The high antioxidant levels in hemp oil make it a popular choice to be used in skincare formulations as well. CBD also offers some other therapeutic benefits, for example, enhancing sleep and treatment of skin-related ailments such as psoriasis, acne, and eczema. The increasing trend has compelled market players to increase their product lines; for instance, in March 2022, Lotus Organics+, an Indian organic skincare brand, introduced the Hemp Youth Glow range of hemp-infused skincare products.

Mass legalization of the production of hemp and cannabidiol across the globe is hugely favoring the growth of the market. As more countries legalize CBD production, more access has been made to the products, thereby fueling market growth. More than 40 countries, according to the United Nations Conference on Trade and Development, had been involved in the production of hemp and cannabidiol by 2021. Large companies are involving themselves with raw material suppliers to better enhance production and sales. An example of this is Kulture Wave Beauty, a beauty company based in the US, which was established by famous rapper Cardi B. The company has just recently partnered in March 2023 with Hemp, Inc. as its premium hemp supplier. This partnership will provide CBD and MCT oil to KWB's skincare and feminine hygiene lines. In July 2022, Australian medical cannabis company Can Global announced its CBD-hemp skincare brand, Fuss Pot, which premiered with a lineup of products designed to fight aging and repair the skin.

Restraints

-

Complex Government Regulations Impeding Market Growth

CBD Skin Care Product Market - Key Segmentation

By Product

In 2023, the oils category dominated the CBD skincare market with a market share of more than 38.8%. The high efficacy of CBD from the hemp source enables these to fight numerous issues related to the skin, such as dryness, aging, and acne. For example, in September 2020, Amway rolled out its line of products to ensure glowing skin, among which was the CBD facial oil to create bright and glowing skin. A growth driver for the industry includes technological improvements in manufacturing. The further technical improvements aimed towards minimizing waste and reducing production costs, along with the increment of industrialization, have increased the scope of applying hemp-based products to various industries, which may favorably impact the market outlook.

Masks and serums should carry the highest CAGR of all during 2024. Such a trend is cherished as deeper levels of facial mask sheets and serums penetrate the skin layer with ease. For instance, in August 2020, Czech-based Moia Elixirs created a nanofiber face mask infused with cannabidiol, which activates upon contact with water to achieve a very impressive absorption rate of 97%. The same improvement in the outlook from a continuous technology and strong investment in research and development perspective will remain the biggest contributors to this segment's growth prospects in the future.

By Distribution Channel

The department stores segment accounted for the largest share of total revenue, surpassing 29.0% in 2023. The company has recorded growth in this business because more and more consumers have been preferring department stores as their top destination for shopping for beauty and personal care products. Shopify reported in February 2022 that 54% of consumers are likely to browse skincare products online before purchasing them in a physical store, which would include department stores. This allows the customer to easily decide on their purchase of skin care needs since such retailers have varieties.

The e-commerce segment is expected to record the highest CAGR during the forecast period. The massive growth in the e-commerce sector for personal care and skin care products has brought forth companies to sell products online across various platforms and shopping applications, thereby increasing visibility among customers. Recently, Can Global, a medical cannabis company, launched Fuss Pot, its CBD-hemp skincare brand, in stores as well as online. It has two separate lines of skincare: the hemp-based range for aging and the CBD-based line for repair. Cleansers, serums, creams, and body oils are available through the product lines.

By Source

Hemp-based products segment dominated the market in 2023 with more than 63.5% of the share due to high fatty acid content in hemp that gives aging skin a healthy appearance, provides moisturization, free radical defense, and healthy cell function. Hemp-infused products are also very effective at soothing and rejuvenating dry and damaged skin, hence reducing discomfort. For instance, in November 2022, Lotus introduced the 'Hemp Youth Glow' range that incorporates organic cold-pressed hemp seed oil. Such products also contribute majorly to anti-aging-related issues that are going to see their demand in the coming times.

Conversely, marijuana-based products are going to face sheer growth shortly. These products help reduce the production of sebum, reduce cellular inflammation, reduce redness, and inhibit itching. They further enhance the body's innate healing capability of the skin and shorten the periods for which they remain during an outbreak; therefore, they are more appealing. The most significant example is the Elemental Skincare series that Nature of Things released in April 2021, comprising face creams designed for different types of skin, that include constituents like vitamin C, cannabis, and squalene.

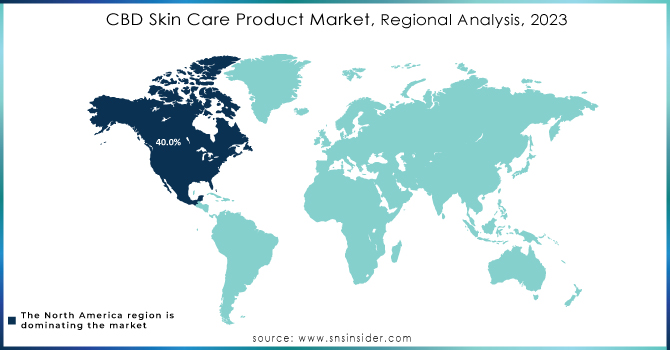

CBD Skin Care Product Market Regional Analysis

In 2023, North America accounted for the largest market share, exceeding 40.0%. The high demand for CBD skincare products in this region is primarily driven by a substantial customer base and the legalization of cannabis in both the U.S. and Canada. As reported by Esquire in July 2021, approximately 33 states and the District of Columbia have legalized cannabis, positioning the U.S. as the largest market globally. The combination of legalization and the presence of major beauty care manufacturers is expected to significantly contribute to the industry’s growth in the coming years.

Conversely, the Asia Pacific region is projected to experience the fastest compound annual growth rate (CAGR) during the forecast period. Key countries in this region, including China, India, Japan, and South Korea, are anticipated to provide promising opportunities for market expansion over the next seven years. Despite the largely illegal status of cannabis across Asia, influential beauty trends such as J-beauty and K-beauty continue to lead the global market, encouraging competitors to introduce innovative products. For example, in May 2019, MGC Pharmaceuticals launched its CBD-based skincare line in China, aiming to establish a foothold in the Asia Pacific market.

Need any customization research on CBD Skin Care Product Market - Enquiry Now

Key Players

-

Earthly Body

-

Josie Maran

-

Kapu Maku LLC. (Populum)

-

Kiehl’s

-

LEEF

-

Sephora USA, Inc.

-

The CBD Skincare Co

-

Kush Creams

-

Isodiol International Inc.

-

Endoca

-

Kapu Maku LLC.

-

LEEF organics

-

Vertly

-

Lily CBD

-

Kana Skincare

-

L’Oréal SA

-

Elixinol

-

Green Growth Brands

-

IldiPekar Skin Care & Spa

-

Isodiol International Inc

-

Josie Maran Cosmetics

-

CBD for Life and others.

Recent Developments

In October 2022, Amanda Health, a subsidiary of Ecofibre, a prominent hemp production company, introduced Green II Gold, a new CBD-based skincare line designed for spas and salons. This product line features full-spectrum hemp extract combined with botanical-based ingredients.

In November 2022, Juana Skin launched its product line in the Middle East with the approval of Dubaian authorities, marking the introduction of CBD (cannabidiol) to consumers in the region. The range includes night creams, brightening moisturizers, body butter, and face oils. The company's strategy focuses on entering a previously closed market rather than competing in areas where consumers already have ample choices.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2297.8 Million |

| Market Size by 2032 | USD 22191.0 Million |

| CAGR | CAGR of 28.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Oils, Creams & Moisturizers, Masks & Serums, Cleansers, Others) • By Distribution Channel (Department Stores, Hypermarkets/Supermarkets, E-commerce, Retail Pharmacies, Others) • By Source (Hemp, Marijuana) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cannuka, LLC, Earthly Body, Josie Maran, Kapu Maku LLC. (Populum), Kiehl’s, LEEF, Lord Jones, Sephora USA, Inc., The CBD Skincare Co, Kush Creams, Isodiol International Inc., Endoca, Kapu Maku LLC., LEEF organics, Vertly, Lily CBD, Kana Skincare, L’Oréal SA, Elixinol, Green Growth Brands, Herbivore botanicals, IldiPekar Skin Care & Spa, Isodiol International Inc, Josie Maran Cosmetics, CBD for Life and Others |

| Key Drivers | • Rising Consumer Awareness and Legalization of CBD Fueling Growth in the CBD Skincare Market |

| Restraints | • Complex Government Regulations Impeding Market Growth |