Medical Image Management Market Size Analysis:

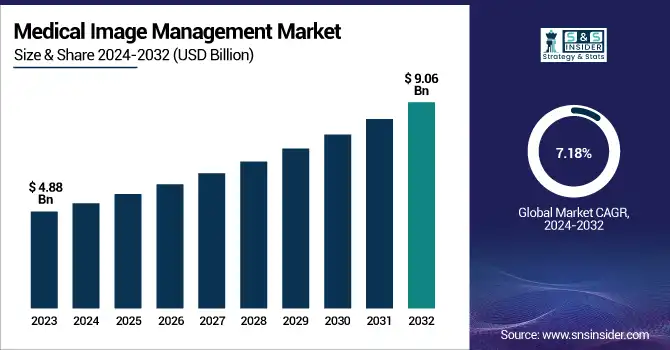

The Medical Image Management Market was valued at USD 4.88 billion in 2023 and is expected to reach USD 9.06 billion by 2032, growing at a CAGR of 7.18% from 2024-2032.

The Medical Image Management Market is highly on the growth curve with its expansion due to advanced technologies in healthcare and an increasing demand for digital imaging solutions. The adoption of electronic health records (EHR) and digital imaging systems by healthcare institutions increases the market rapidly. Its growth is further boosted due to the increasing prevalence of chronic diseases, like diabetes. This disease affected almost 31.9 million adults in 2023, which means about 11.5% of adults suffer from this disease. Similarly, the fact that depression alone accounted for 21.7% of the adult population, or 54.2 million adults in 2023 further contributes to the increasing need for regular imaging for diagnosis and monitoring. Also, the move from film-based systems to digital systems is pushing the demand for efficient and scalable image management solutions.

To Get more information on Medical Image Management Market - Request Free Sample Report

The medical image management solution is majorly driven by the need to deal with patient care that requires storing, retrieving, and sharing images efficiently. Some 40 to 50 percent of imaging volume is performed in outpatient imaging centers and physician clinics while 50 to 60 percent is conducted within the hospital. This distribution has necessitated scalable and efficient systems for image management within varied healthcare environments. Imaging modalities are on the increase to include CT scans, MRIs, and X-rays, among others, and healthcare providers will require reliable systems for the management of large amounts of data. These systems will improve workflow and diagnose cases accurately through better collaboration by healthcare professionals.

Prospects in the Medical Image Management Market look great and huge, as advancements in AI and machine learning hold a pivotal place in them. The introduction of AI-powered image analysis tools in the management platform will revolutionize diagnosis accuracy and speed. With a growing trend in telemedicine and remote patient monitoring, new opportunities have emerged in terms of sharing medical images for consultation purposes across geographies. Increased investments in healthcare IT infrastructure coupled with the ongoing digitization of health care are to fuel future market expansion and innovation in the following years.

Medical Image Management Market Dynamics:

DRIVERS

-

Rising Healthcare Demand and Aging Population Fueling Growth in Medical Image Management

The growing global aging population and the escalating prevalence of chronic conditions like cancer, cardiovascular diseases, and neurological disorders are significantly driving the demand for advanced medical imaging tools. As these healthcare needs intensify, there is a greater need for efficient systems to manage the increasing volume and complexity of diagnostic images. This shift toward more complex medical data is pushing healthcare providers to adopt advanced image management solutions. These solutions not only improve diagnostic accuracy but also enhance the overall quality of patient care. The demand for such systems continues to grow as healthcare evolves to address these challenges.

-

Technological Advancements in Imaging and AI Driving Demand for Advanced Medical Image Management Systems

The current innovations in imaging technologies like high-definition and 3D imaging, to name a few, change medical diagnostics by increasing the demand for even more advanced solutions in managing images. Advanced AI and machine learning algorithms used in diagnosis have significantly enhanced diagnostic precision and efficiency and reduced errors from image analysis. As the complexity of the data increases in imaging technologies, healthcare providers need to be equipped with more complex systems that will manage the data. The pressure for medical image management solutions that can accommodate AI, enabling easy workflows, creates demand in the market. As such, the adoption of AI-driven imaging technologies is becoming one of the key drivers of the growth in the market.

RESTRAINTS

-

Data Security and Privacy Concerns Limiting the Growth of Medical Image Management Systems

As the amount of confidential patient information being stored and exchanged through medical image management systems increases, worries regarding data security and privacy are becoming more prominent. Stringent guidelines like GDPR in Europe and HIPAA in the U.S. require healthcare providers to maintain top-level data protection, emphasizing the importance of security when implementing systems. The consequences of a patient data breach can include severe legal, financial, and reputational harm, which can deter healthcare organizations from fully adopting new technologies. Furthermore, the added expenses and difficulties organizations face stem from the intricate nature of implementing strong security measures. Concerns about privacy and security could potentially hinder the widespread acceptance of sophisticated image management tools, especially in areas with strict data protection laws.

Medical Image Management Market Segmentation Analysis:

By Product

In 2023, the Picture Archiving and Communication System (PACS) sector dominated with approximately 50% of the revenue due to its extensive use and crucial function in handling medical images. PACS allows for effective storage, access, and distribution of images, smoothly merging with hospital information systems (HIS) and electronic health records (EHR). PACS has become a fundamental element of diagnostic processes in healthcare facilities due to its interoperability and well-established infrastructure.

The VNA market is projected to experience the highest compound annual growth rate (CAGR) of 8.91% between 2024 and 2032 due to its adaptability and capacity to store images regardless of vendor systems. As healthcare systems place more importance on interoperability, VNAs enable smooth data sharing among different platforms. This feature is appealing to companies looking for scalable and future-proof image management systems, making VNAs a great option.

By End-Use

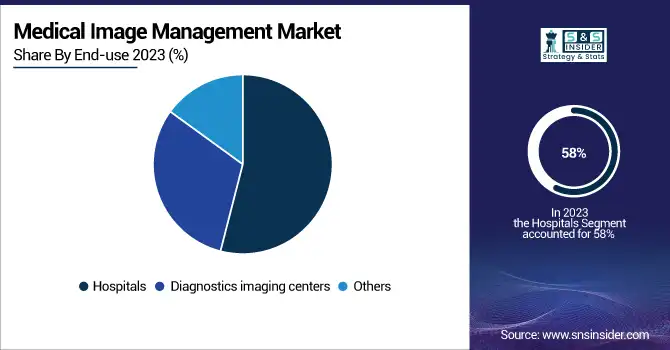

In 2023, hospitals were the primary players in the Medical Image Management Market, accounting for approximately 58% of the revenue share. This is because they have widely embraced advanced imaging technologies and require integrated systems to handle vast amounts of medical data. Hospitals manage large amounts of patient imaging, needing effective storage, retrieval, and sharing solutions, which help to strengthen their strong market position.

The Diagnostic Imaging Centers sector is projected to experience the highest CAGR of 8.59% between 2024 and 2032. The rise is fueled by growing demand for outpatient services and the requirement for quick, precise diagnostics. In response to patients' increasing desire for specialized and convenient care, imaging centers are implementing advanced image management systems to enhance workflow efficiency and address increasing demand.

By Technology

In 2023, the X-ray Devices sector dominated the Medical Image Management Market, accounting for around 31% of the revenue share. This control is credited to the common utilization of X-ray technology in regular medical tests and its effectiveness in identifying a range of conditions. X-ray devices are often combined with image management systems, providing hospitals and clinics with affordable, top-notch solutions that help solidify their competitive edge in the market.

On the other hand, the Ultrasound sector is anticipated to experience the highest CAGR of 8.68% between 2024 and 2032. The rise is fueled by the growing favor for non-invasive diagnostic techniques and the increasing need for point-of-care ultrasound options. Ultrasound machines are becoming increasingly moveable, cost-effective, and flexible, enabling healthcare professionals to provide quicker, more readily available imaging services, driving the rapid growth of the sector.

By Application

The Orthopedics segment dominated the Medical Image Management Market in 2023, with a 33% market share due to the high demand for imaging in diagnosing musculoskeletal conditions, such as fractures and joint replacements. Orthopedic practices mostly rely on advanced imaging for precise diagnostics, driving the need for efficient image management solutions.

The Cardiology segment is expected to grow at the fastest CAGR of 8.95% over the forecast period driven by the rising prevalence of cardiovascular diseases and the increasing need for advanced imaging techniques. Cardiology practices are adopting more sophisticated image management systems to enhance diagnostic accuracy and improve patient care.

Regional Insights:

North America dominated the Medical Image Management Market in 2023, accounting for about 41% of the revenue share. This dominance is attributed to the region's advanced healthcare infrastructure, high adoption of cutting-edge imaging technologies, and significant investments in digital health. Additionally, the presence of major market players and strong government support for healthcare digitization has solidified North America's leading position in the market.

Meanwhile, the Asia Pacific region is expected to grow at the highest CAGR of 8.96% from 2024 to 2032. This growth is driven by rapid advancements in healthcare infrastructure, increasing healthcare awareness, and the rising demand for medical imaging services in emerging economies. As the region's healthcare systems modernize and more patients seek advanced diagnostic solutions, the adoption of medical image management technologies is accelerating, making Asia Pacific the fastest-growing market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Medical Image Management Market Key Players:

-

GE Healthcare (Centricity PACS, GE Healthcare Imaging Solutions)

-

Subtle Medical (SubtleMR, SubtlePET)

-

Carestream Health (Carestream PACS, Vue Cloud)

-

Agfa-Gevaert Group (Enterprise Imaging, Agfa PACS)

-

Aidoc (AI-based Radiology Solutions, Aidoc AI for CT scans)

-

RapidAI Vision (RapidAI, RapidStroke)

-

Siemens Healthineers (Syngo Imaging, Radiology IT Solutions)

-

Verily (Verily Vision AI, Verily Health Cloud)

-

Arterys (Arterys Cardio AI, Arterys Imaging Cloud)

-

Basic AI (AI-PACS, AI-based diagnostic tools)

-

Brainomix (Brainomix e-ASPECTS, Brainomix Stroke Imaging AI)

-

Change Healthcare (Change Healthcare PACS, Radiology Workflow Solutions)

-

FUJIFILM Holding Corporation (Synapse PACS, Synapse 3D)

-

KA Imaging (Reveal 35C, RevealXR)

-

Koninklijke Philips N.V. (IntelliSpace PACS, Philips Radiology Information System)

-

Lunit (Lunit INSIGHT, Lunit Chest AI)

-

Medtronic (Medtronic Imaging, Medtronic CareLink)

-

Philips Healthcare (IntelliSpace PACS, Philips Radiology Information System)

-

Siemens Healthcare (Syngo Imaging, Siemens Healthineers PACS)

-

AZmed (Chest AI, AZmed Imaging Solutions)

-

Baxter (Baxter Imaging Solutions, Baxter Healthcare Imaging Systems)

-

BD (BD Radiology Solutions, BD Image Sharing)

-

Caption Health (Caption AI, Caption Guidance)

Recent Developements in the Medical Image Management Market:

-

In November 2024, GE HealthCare and RadNet announced a collaboration to enhance medical imaging with AI-driven innovations, focusing on improving breast cancer screening. Their partnership aims to integrate SmartTechnology solutions to boost diagnostic accuracy and workflow efficiency

-

At RSNA 2024, Subtle Medical launched its AI-powered MRI suite, Subtle-ELITE, which reduces scan times by up to 80% while enhancing image quality.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.88 Billion |

| Market Size by 2032 | USD 9.06 Billion |

| CAGR | CAGR of 7.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Application-Independent Clinical Archives, Picture Archiving and Communication System, Vendor Neutral Archive) • By Technology (X-ray Devices, Ultrasound, Computed Tomography, Magnetic Resonance Imaging, Nuclear Imaging) • By Application (Cardiology, Oncology, Neurology, Orthopedics, Gastroenterology, Gynecology) • By End-use (Hospitals, Diagnostic Imaging Centers, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GE Healthcare, Subtle Medical, Carestream Health, Agfa-Gevaert Group, Aidoc, RapidAI Vision, Siemens Healthineers, Verily, Arterys, Basic AI, Brainomix, Change Healthcare, FUJIFILM Corporation, FUJIFILM Holdings, KA Imaging, Koninklijke Philips N.V., Lunit, Medtronic, Philips Healthcare, Siemens Healthcare, AZmed, Baxter, BD, Caption Health. |