Sodium Gluconate Market Analysis:

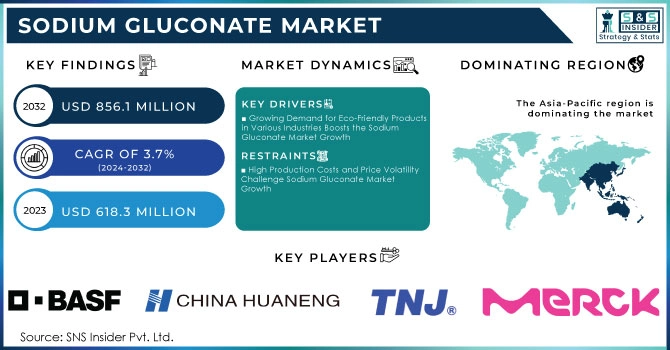

The Sodium Gluconate Market Size was valued at USD 618.3 million in 2023 and is expected to reach USD 856.1 million by 2032 and grow at a CAGR of 3.7% over the forecast period 2024-2032.

The sodium gluconate market is experiencing notable dynamics driven by multiple factors, including applications in the construction and food industries. Increasing demand for sodium gluconate as a flavor-masking ingredient has emerged as a key trend, particularly within the food and beverage sector. In May 2024, Jungbunzlauer emphasized sodium gluconate's effectiveness in addressing flavor enhancement challenges, showcasing its versatility in improving taste and aiding healthier product formulations, which has fostered its adoption across various food applications.

To Get More Information on Sodium Gluconate Market - Request Sample Report

In the Asian market, particularly China, sodium gluconate prices have seen an upward trend, attributed largely to soaring freight costs. As reported in July 2024, high freight rates led to a 3.4% increase in sodium gluconate prices, despite sluggish demand in the construction sector. This spike in freight costs has complicated the supply chain, impacting both import and export processes for sodium gluconate. The increased shipping expenses are reminiscent of disruptions observed during the pandemic era, creating challenges for manufacturers and consumers alike.

Moreover, the demand from the construction sector, which traditionally utilizes sodium gluconate as a concrete admixture, has shown weakness. Reports indicate that real estate development investment in China decreased significantly in early 2024, reflecting a 7.2% decline compared to the previous year. While the sales area for residential properties saw a slight increase, the overall performance in commercial housing has limited support for sodium gluconate usage. The ongoing challenges in the real estate sector have further compounded the issues related to supply and demand, impacting the sodium gluconate market's stability.

Recent weather patterns have also played a role in shaping market dynamics. Increased rainfall has led to higher inventory levels for sodium gluconate producers, complicating the short-term demand outlook. In this context, analysts suggest that the market may experience slight declines as demand remains subdued amid excess supply. The ongoing shipping and logistical issues, along with fluctuating demand in key sectors, continue to influence the pricing and availability of sodium gluconate, making it essential for stakeholders to adapt to these evolving market conditions.

Sodium Gluconate Market Dynamics

Drivers:

-

Growing Demand for Eco-Friendly Products in Various Industries Boosts the Sodium Gluconate Market Growth

The increasing emphasis on sustainable and eco-friendly products across industries is significantly driving the sodium gluconate market. Sodium gluconate, being biodegradable and non-toxic, aligns well with the global shift towards environmentally friendly alternatives. This trend is particularly evident in sectors such as construction, where sodium gluconate is used as an efficient concrete admixture that enhances workability and durability without introducing harmful chemicals. Additionally, the food and beverage industry has recognized sodium gluconate as a versatile flavor enhancer and preservative, further increasing its demand. As consumers become more environmentally conscious, manufacturers are increasingly adopting sodium gluconate to meet regulatory standards and consumer preferences for sustainable products. This transition not only aids in reducing environmental footprints but also opens up new avenues for market growth and innovation, as businesses explore novel applications for sodium gluconate that align with sustainability goals.

-

Rising Application in the Food and Beverage Sector Drives Sodium Gluconate Demand

The food and beverage sector's expanding need for sodium gluconate is a significant driver of market growth. Its functionality as a flavor enhancer and stabilizer has garnered attention among food manufacturers seeking to improve the sensory qualities of their products. Sodium gluconate masks undesirable tastes while enhancing overall flavor profiles, making it ideal for various applications, including sauces, dressings, and processed foods. As health trends shift towards low-sodium and clean-label products, sodium gluconate presents an attractive alternative for achieving flavor without compromising nutritional value. Moreover, with the growing focus on healthier food options, manufacturers are incorporating sodium gluconate to cater to consumer preferences for products that offer enhanced taste and better quality. This rising application is expected to bolster the sodium gluconate market as companies innovate to develop new formulations and food products that utilize this ingredient, thus tapping into a growing consumer base that prioritizes flavor without negative health impacts.

Restraint:

-

High Production Costs and Price Volatility Challenge Sodium Gluconate Market Growth

High production costs and price volatility present significant challenges to the sodium gluconate market. The manufacturing process involves complex procedures and raw materials that contribute to elevated production costs. Fluctuations in the prices of these raw materials can impact overall profitability and pricing strategies for manufacturers. Additionally, the market has recently witnessed sharp increases in transportation costs, further inflating product prices and affecting demand. As manufacturers face pressures to maintain competitive pricing while ensuring quality, they may struggle to balance profitability with affordability. This financial strain can deter smaller players from entering the market, limiting overall competition and innovation. Moreover, end-users, particularly in price-sensitive industries, may seek alternative ingredients or substitutes that can fulfill similar functions at lower costs. Such trends threaten to restrict market expansion, as consumers become more discerning about ingredient sourcing and pricing. Addressing these challenges requires strategic planning, cost management, and innovation in production techniques to ensure sustainability and competitiveness within the sodium gluconate market.

Opportunity:

-

Expanding Use of Sodium Gluconate in the Pharmaceutical and Personal Care Industries

The growing acceptance of sodium gluconate in pharmaceutical and personal care products represents a promising opportunity for market expansion. In pharmaceuticals, sodium gluconate is used as a chelating agent and stabilizer, enhancing the efficacy and stability of various formulations. Its non-toxic nature and compatibility with active ingredients make it a preferred choice among formulators. Additionally, as the personal care industry increasingly shifts towards natural and sustainable ingredients, sodium gluconate's biodegradable properties align well with consumer demand for eco-friendly alternatives. Its role in moisturizing creams, shampoos, and other cosmetic formulations highlights its versatility and potential for growth. As regulatory pressures intensify around the use of harmful chemicals in personal care products, sodium gluconate emerges as a viable option, opening up avenues for innovative product development. This expanding application across multiple sectors not only enhances market potential but also positions sodium gluconate as a critical ingredient in developing safe and effective products that meet evolving consumer preferences.

Challenge:

-

Supply Chain Disruptions and Increased Freight Costs Hinder Sodium Gluconate Market Growth

Supply chain disruptions and rising freight costs pose substantial challenges for the sodium gluconate market. Recent global events have highlighted vulnerabilities in logistics and transportation networks, leading to delays and increased shipping expenses. As freight rates have surged due to a combination of factors such as fuel price increases and limited shipping capacity, manufacturers face elevated operational costs that threaten profitability. These disruptions complicate the import and export processes, making it difficult for producers to maintain consistent supply levels and meet market demand. Furthermore, industries that rely heavily on sodium gluconate, such as construction and food production, may experience delays in project timelines and product availability, affecting overall business operations. The fluctuating nature of shipping costs can also deter potential investors or new entrants in the market, as the financial uncertainty makes it challenging to project future profitability. Addressing these supply chain challenges requires strategic partnerships, diversification of suppliers, and innovative logistics solutions to enhance resilience and ensure the smooth operation of the sodium gluconate market.

Sodium Gluconate Market Segmentation Analysis

By Form

In 2023, the powder segment dominated the sodium gluconate market, accounting for a market share of approximately 65%. The preference for powder form is primarily due to its versatility and ease of use in various applications. Powdered sodium gluconate is widely utilized in the construction industry as a concrete admixture, where it enhances the workability and strength of concrete mixtures. Additionally, the powder form is favored in the food and beverage sector for flavor enhancement, making it a crucial ingredient in various food formulations and packaged goods.

By Application

In 2023, the food and beverages segment dominated the sodium gluconate market, with a market share of around 45%. This dominance is largely attributed to the growing consumer demand for flavor enhancers and stabilizers in processed foods and beverages. Sodium gluconate serves as an effective flavor-masking agent, particularly in products like sauces, dressings, and dairy items, helping to improve taste without adding harmful preservatives. As the focus on healthier food options intensifies, the food and beverage sector's reliance on sodium gluconate for clean-label products drives its market share higher.

By End-use Industry

In 2023, the construction industry segment dominated the sodium gluconate market, with a market share of about 50%. Sodium gluconate is widely used in construction as a concrete admixture due to its ability to improve workability, reduce water usage, and enhance the overall performance of concrete. The rapid growth in construction activities globally, particularly in emerging markets, has significantly contributed to the demand for sodium gluconate. Moreover, as infrastructure projects continue to expand, the reliance on effective additives like sodium gluconate in construction applications is expected to remain strong, further solidifying its position in the market.

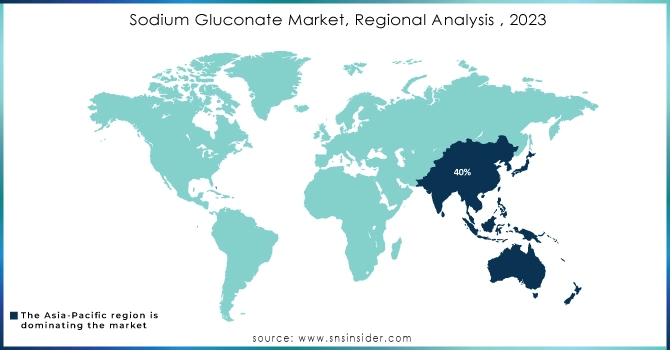

Sodium Gluconate Market Regional Analysis

In 2023, the Asia-Pacific region dominated the sodium gluconate market, holding a market share of approximately 40%. This dominance is primarily driven by the rapid industrialization and growth in construction activities across countries like China and India. The region's robust demand for sodium gluconate in concrete production as a workability enhancer is a significant factor. Additionally, the expanding food and beverage industry in this region utilizes sodium gluconate for flavor enhancement and preservation, further solidifying its market position.

Do You Need any Customization Research on Sodium Gluconate Market - Inquire Now

Key Players

-

BASF SE (Sodium Gluconate, Concrete Admixtures)

-

Food Ingredients Solutions (Sodium Gluconate, Food Grade Sodium Gluconate)

-

Fujian Huaneng Group (Sodium Gluconate, Industrial Grade Sodium Gluconate)

-

Gulbrandsen Technologies Inc. (Sodium Gluconate, Chelating Agents)

-

Hefei TNJ Chemical Industry Co., Ltd. (Sodium Gluconate, Food Additives)

-

Jiangsu Nandian Chemical Group (Sodium Gluconate, Pharmaceutical Grade Sodium Gluconate)

-

Merck KGaA (Sodium Gluconate, Reagent Grade Sodium Gluconate)

-

Nanjing Tiansheng Chemical Co., Ltd. (Sodium Gluconate, Feed Grade Sodium Gluconate)

-

Shandong Qilu Pharmaceutical Co., Ltd. (Sodium Gluconate, Pharmaceutical Intermediates)

-

The Dow Chemical Company (Sodium Gluconate, Specialty Chemicals)

-

Shaanxi Tiansheng Pharmaceutical Co., Ltd. (Sodium Gluconate, Pharmaceutical Grade)

-

Zhejiang Jianye Chemical Co., Ltd. (Sodium Gluconate, Industrial Sodium Gluconate)

-

Zhejiang Hongyuan Pharmaceutical Co., Ltd. (Sodium Gluconate, Food Grade)

-

Wuxi Aibota Chemical Co., Ltd. (Sodium Gluconate, Feed Additives)

-

Karnataka Antibiotics & Pharmaceuticals Limited (Sodium Gluconate, Medicinal Grade)

-

Hubei Chengxin Chemical Co., Ltd. (Sodium Gluconate, Technical Grade)

-

Ningxia Biyuan Chemical Co., Ltd. (Sodium Gluconate, Food Applications)

-

Hangzhou Huanan Pharmaceutical Co., Ltd. (Sodium Gluconate, Pharmaceutical Additives)

-

Yixing Xinyuan Chemical Co., Ltd. (Sodium Gluconate, Industrial Use)

-

Chongqing Zhenhua Chemical Co., Ltd. (Sodium Gluconate, Chemical Grade)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 618.3 Million |

| Market Size by 2032 | US$ 856.1 Million |

| CAGR | CAGR of 3.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Form (Powder, Liquid) •By Application (Construction, Food & Beverages, Pharmaceuticals, Personal Care Products, Agriculture, Others) •By End-Use Industry (Construction Industry, Food Industry, Chemical Industry, Healthcare Industry, Agriculture Industry, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, The Dow Chemical Company, Shandong Qilu Pharmaceutical Co., Ltd., Hefei TNJ Chemical Industry Co., Ltd., Merck KGaA, Fujian Huaneng Group, Jiangsu Nandian Chemical Group, Gulbrandsen Technologies Inc., Nanjing Tiansheng Chemical Co., Ltd., Food Ingredients Solutions and other key players |

| Key Drivers | • Growing Demand for Eco-Friendly Products in Various Industries Boosts the Sodium Gluconate Market Growth • Rising Application in the Food and Beverage Sector Drives Sodium Gluconate Demand |

| Restraints | • High Production Costs and Price Volatility Challenge Sodium Gluconate Market Growth |