Bearings Market Report Scope & Overview:

Get More Information on Bearings Market - Request Free Sample Report

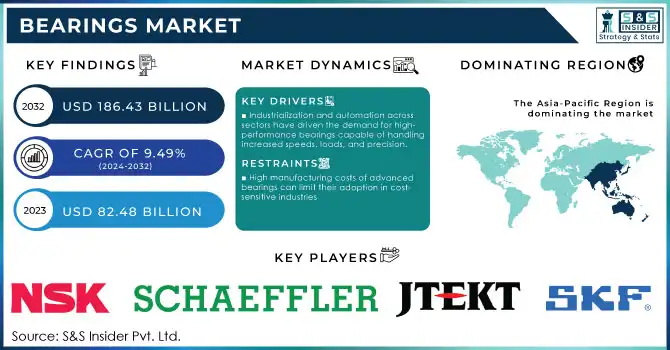

The Bearings Market Size was valued at USD 82.48 Billion in 2023 and is expected to reach USD 186.43 Billion by 2032 and grow at a CAGR of 9.49% over the forecast period 2024-2032.

The Bearings market is experiencing significant growth driven by increasing industrialization and advancements in automotive, aerospace, and manufacturing sectors. As industries continue to adopt automation and smart technologies, the demand for high-performance bearings has escalated. Bearings are essential components in machines and systems, providing support for rotating or moving parts, reducing friction, and ensuring smooth operation. This has made them critical for applications ranging from automotive engines to turbines in energy sectors. Key trends shaping the market include a growing focus on energy efficiency and sustainability. Bearings with advanced materials, such as ceramic and hybrid variants, are gaining traction due to their ability to withstand high temperatures and harsh conditions, offering improved performance and longevity. Additionally, the rise of electric vehicles (EVs) has spurred demand for specialized bearings designed for higher speeds and reduced friction.

The expansion of the renewable energy sector, particularly wind and solar power, has also created opportunities for bearing manufacturers, as these applications require durable bearings capable of handling fluctuating loads and extreme environments. Moreover, 3D printing technologies are gaining prominence in the bearings market, enabling more customized designs and cost-effective production. The automotive industry remains a major driver, with bearings playing an integral role in improving fuel efficiency and performance. Additionally, the increasing emphasis on noise reduction and vibration control in automotive systems further fuels the demand for high-quality bearings. As technology continues to evolve, the market is poised to witness further innovations aimed at enhancing performance and durability across various industries.

Bearings Market Dynamics

DRIVERS

-

Industrialization and automation across sectors have driven the demand for high-performance bearings capable of handling increased speeds, loads, and precision.

The rapid growth of industrialization and automation across various sectors, including automotive, aerospace, manufacturing, and energy, has greatly boosted the demand for bearings. As industries evolve, machinery becomes more advanced, requiring bearings that can handle higher speeds, heavier loads, and greater precision. In the automotive sector, for example, the push for energy-efficient and high-performance vehicles, including electric vehicles, demands bearings that reduce friction and enhance operational efficiency. Similarly, automation in manufacturing processes relies heavily on high-quality bearings to ensure the smooth operation of robots, conveyor systems, and other machinery. The aerospace industry, with its emphasis on reliability and performance in extreme conditions, has seen increased demand for specialized bearings. Additionally, the energy sector, particularly in wind and solar power, relies on durable bearings for turbines and other critical systems. These trends underscore the growing need for bearings that can support the evolving demands of modern industries, driving market expansion.

RESTRAIN

-

High manufacturing costs of advanced bearings can limit their adoption in cost-sensitive industries

High manufacturing costs are a significant challenge in the bearings market, especially with the growing demand for advanced bearings made from materials like ceramic and hybrid composites. These materials offer superior performance in terms of durability, temperature resistance, and reduced friction, making them ideal for high-end applications in industries like aerospace, automotive, and renewable energy. However, the production of these advanced bearings requires specialized manufacturing processes and materials, which increases their overall cost. For industries with budget constraints, such as small and medium-sized enterprises or cost-sensitive sectors, these higher costs can be a deterrent. While the demand for advanced bearings is on the rise, especially with trends towards energy efficiency and performance optimization, the initial expense of these bearings remains a key factor limiting their widespread adoption. Despite this, the trend towards technological innovation is likely to drive down manufacturing costs over time, making these bearings more accessible across various industries.

Bearings Market Segmentation Overview

By Application

The Automotive Aftermarket segment dominated with the market share over 45% in 2023, driven by the ongoing need for maintenance and replacement of automotive components. Bearings play a crucial role in the functionality and durability of various automotive parts, such as engines, transmissions, and wheel hubs. As vehicles age, wear and tear naturally occur, leading to a consistent demand for replacement bearings to ensure smooth operation. The automotive aftermarket is particularly significant as it caters to a broad range of vehicles, from passenger cars to commercial fleets, all of which require regular servicing. Additionally, advancements in automotive technologies, such as electric and hybrid vehicles, further increase the need for specialized bearings, boosting the demand in this segment.

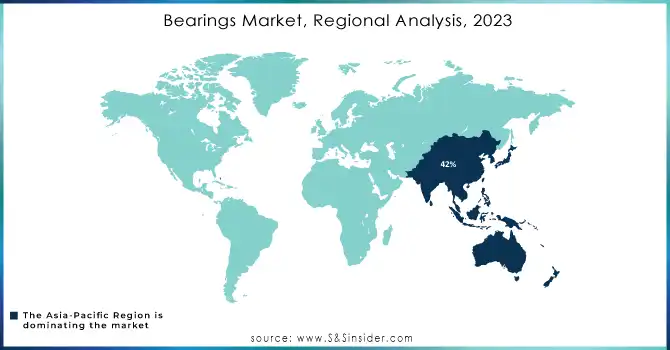

Bearings Market Regional Analysis

The Asia-Pacific region dominated with the market share over 42% in 2023. This dominance is driven by the region's robust industrial landscape, with key manufacturing giants like China, Japan, and India at the forefront. These countries are major producers of automotive, machinery, and industrial equipment industries that are significant consumers of bearings. The ongoing industrialization, coupled with the growing demand for automation and advanced manufacturing technologies in China and India, plays a crucial role in expanding the bearings market. Furthermore, Asia-Pacific benefits from cost-effective production, a high concentration of bearing manufacturers, and an extensive supply chain, further reinforcing its leadership position.

Europe is experiencing the fastest growth in the Bearings Market, driven by several key factors. Advancements in technology are leading to the development of more efficient and durable bearings, which are in high demand across various industries. The rise of electric vehicles (EVs) is significantly influencing this growth, as EVs require specialized bearings for their motors and drivetrains. Additionally, the increasing focus on renewable energy solutions, such as wind turbines, is boosting the need for high-performance bearings that can withstand harsh operating conditions. Countries like Germany, Italy, and France play a central role in this expansion due to their strong automotive and industrial machinery sectors.

Need any customization research on Bearings Market - Enquiry Now

Some of the major key players of Bearings Market

-

NSK Ltd (Ball Bearings, Roller Bearings, Linear Motion Bearings)

-

Schaeffler AG (Ball Bearings, Needle Bearings, Tapered Roller Bearings)

-

JTEKT Corporation (Ball Bearings, Cylindrical Roller Bearings, Tapered Roller Bearings)

-

SKF (Radial Ball Bearings, Angular Contact Bearings, Spherical Bearings)

-

The Timken Company (Tapered Roller Bearings, Spherical Roller Bearings, Mounted Bearings)

-

NBI Group (Deep Groove Ball Bearings, Angular Contact Bearings, Cylindrical Roller Bearings)

-

NTN Bearing Corporation (Ball Bearings, Tapered Roller Bearings, Cylindrical Roller Bearings)

-

RBC Bearings Incorporated (Ball Bearings, Roller Bearings, Thin Section Bearings)

-

Regal Rexnord Corporation (Mounted Bearings, Flanged Bearings, Spherical Bearings)

-

LYC Bearings Corporation (Ball Bearings, Cylindrical Roller Bearings, Tapered Roller Bearings)

-

INA Bearings (Schaeffler Group) (Needle Bearings, Radial Bearings, Spherical Bearings)

-

Harbin Bearing Manufacturing Co., Ltd. (HRB Bearings) (Ball Bearings, Cylindrical Roller Bearings, Tapered Roller Bearings)

-

ZKL Bearings (Ball Bearings, Spherical Bearings, Tapered Roller Bearings)

-

FAG Bearings (Schaeffler Group) (Angular Contact Bearings, Needle Bearings, Spherical Roller Bearings)

-

China National Petroleum Corporation (CNPC) (Thrust Ball Bearings, Cylindrical Roller Bearings, Tapered Roller Bearings)

-

Barden Corporation (Ball Bearings, Precision Bearings, Angular Contact Bearings)

-

Koyo Bearings (JTEKT Corporation) (Deep Groove Ball Bearings, Cylindrical Roller Bearings, Tapered Roller Bearings)

-

Gamet Bearings (Tapered Roller Bearings, Spherical Bearings, Thrust Bearings)

-

Timken India Ltd (Tapered Roller Bearings, Spherical Roller Bearings, Mounted Bearings)

-

Nachi-Fujikoshi Corp (Ball Bearings, Roller Bearings, Precision Bearings)

Suppliers (Expertise in high-performance and precision bearings for various industries) Bearings Market

-

SKF Group

-

NSK Ltd.

-

Schaeffler Group

-

Timken Company

-

JTEKT Corporation

-

NTN Corporation

-

MinebeaMitsumi Inc.

-

RBC Bearings Incorporated

-

Harbin Bearing Manufacturing Company

-

FAG Bearings (Schaeffler Group)

RECENT DEVELOPMENT

-

In August 2023: RBC Bearings Incorporated acquired Specline, Inc., expanding its portfolio in the commercial and defense aerospace markets with engineered precision bearings and components.

-

In September 2023: Schaeffler AG enhanced its product range by introducing new rotary table bearings, torque motors, and linear motors, along with expanded sizes and integrated angular measuring systems, strengthening its comprehensive offerings.

-

In November 2023: The Timken Company completed the acquisition of Engineered Solutions Group (iMECH), enhancing its position in the energy sector with specialized bearings and coatings, while anticipating a revenue of approximately USD 30 million for 2023

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 82.48 Billion |

| Market Size by 2032 | USD 186.53 Billion |

| CAGR | CAGR of 9.49% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Ball Bearings [Deep Groove Bearings, Others] Roller Bearings [Split, Tapered, Others] Plain Bearings [Journal Plain Bearings, Linear Plain Bearings, Thrust Plain Bearings, Others] Others) • By Application (Automotive, Agriculture, Electrical, Mining & Construction, Railway & Aerospace, Automotive Aftermarket, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | NSK Ltd, Schaeffler AG, JTEKT Corporation, SKF, The Timken Company, NBI Group, NTN Bearing Corporation, RBC Bearings Incorporated, Regal Rexnord Corporation, LYC Bearings Corporation, INA Bearings (Schaeffler Group), Harbin Bearing Manufacturing Co., Ltd. (HRB Bearings), ZKL Bearings, FAG Bearings (Schaeffler Group), China National Petroleum Corporation (CNPC), Barden Corporation, Koyo Bearings (JTEKT Corporation), Gamet Bearings, Timken India Ltd, Nachi-Fujikoshi Corp. |

| Key Drivers | • Industrialization and automation across sectors have driven the demand for high-performance bearings capable of handling increased speeds, loads, and precision. |

| RESTRAINTS | • High manufacturing costs of advanced bearings can limit their adoption in cost-sensitive industries, despite increasing demand for performance and energy efficiency. |