Ceramic Chucks Market Report Scope & Overview:

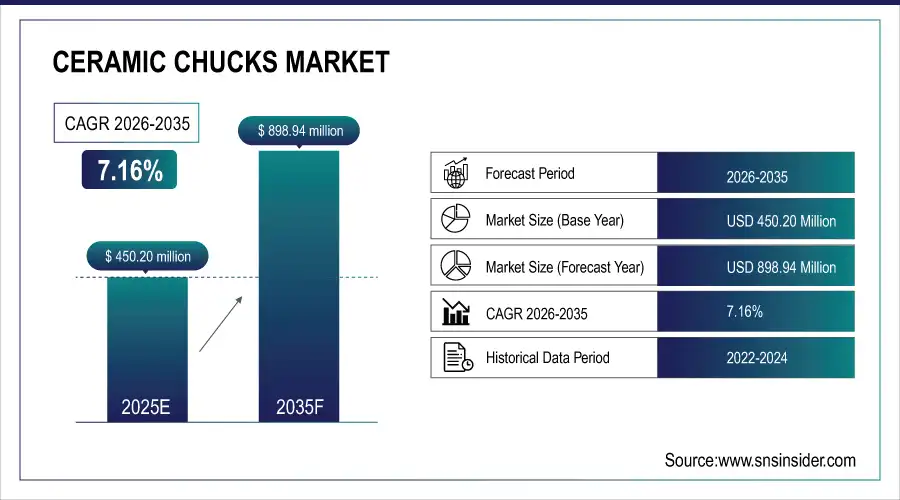

The Ceramic Chucks Market size was valued at USD 450.20 Million in 2025 and is projected to reach USD 898.94 Million by 2035, growing at a CAGR of 7.16% during 2026-2035.

Ceramic Chucks Market is witnessing growth due to growing demands of semiconductor, needs of precision manufacturing, and thermal stability, whereas, ceramics chucks have been adopted rapidly in electronic, medical devices, and EV applications fueling the demand.

The increasing demand for high-precision components in the semiconductor manufacturing and electronics industries is primarily driving the expansion of the Ceramic Chucks Market growth. This drives the extensive utilization of ceramic chucks along with the scalable adoption of evolved wafer processing technology, which needs higher thermal resistance combined with dimensional stability. The growing demand also drives away from electric trucks (EVs), medical devices, and even aerospace. Market expansion is further supported by the ever-increasing investments made by the governments for the production of chips as well as the growing industrial automation trends from across the globe.

The U.S. Department of Commerce has awarded USD 325 million to Hemlock Semiconductor under the CHIPS Incentives Program for the construction of a new manufacturing facility.

Ceramic Chucks Market Size and Forecast:

-

Market Size in 2025: USD 450.20 Million

-

Market Size by 2035: USD 898.94 Million

-

CAGR: 7.16% (from 2026 to 2035)

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information On Ceramic Chucks Market - Request Free Sample Report

Ceramic Chucks Market Highlights:

-

Ceramic and electrostatic chucks are indispensable in advanced semiconductor fabrication facilities, used to securely hold wafers without mechanical contact—a critical requirement for processes such as EUV lithography, plasma etching, and CVD/PVD deposition.

-

Specialized ceramic manufacturing expertise, originally developed for other industrial applications, is now generating substantial revenue from electrostatic chuck production, highlighting the growing commercial importance of this segment within the semiconductor equipment ecosystem.

-

Additive manufacturing (AM) is increasingly being adopted in semiconductor production equipment, including wafer tables, manifolds, and vacuum chucks, enabling greater design complexity, reduced component weight, and improved thermal management.

-

Ceramic additive manufacturing is enabling the production of large, complex components such as gas distribution rings and vacuum chucks that meet stringent vacuum integrity, thermal stability, and contamination control requirements in semiconductor manufacturing.

-

The integration of AM technologies allows semiconductor equipment manufacturers to achieve higher precision, shorter production cycles, and lower overall costs through part consolidation and geometry optimization.

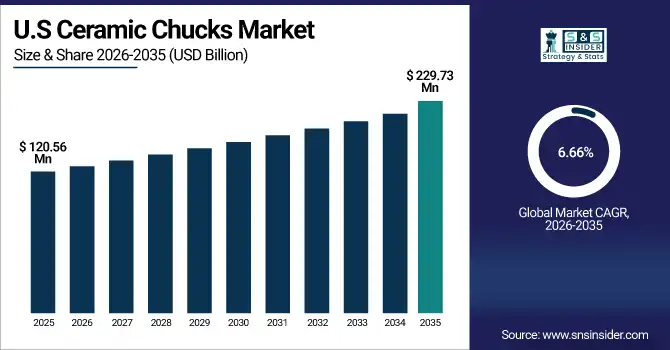

The U.S. Ceramic Chucks Market size is estimated to be valued at USD 120.56 million in 2025 and is projected to grow at a CAGR of 6.66%, reaching USD 229.73 million by 2035. The semiconductor industry in the U.S. is building on a resurgence in domestic manufacturing and research driven by the CHIPS and Science Act, which is fueling the growth of the U.S. Ceramic Chucks Market.

Ceramic Chucks Market Drivers:

-

Rising Demand for Ceramic Chucks Drives Growth in Semiconductor Electronics EV Medical and Aerospace Industries

High demand for high precision components from several industries including semiconductor manufacturing and electronics vertical segments is expected to be one of the key driving factors for Ceramic Chucks Market trends. Due to their superior thermal stability, dimensional stability, and wear resistance, ceramic chucks are widely used for processing wafers. Semiconductor technologies are also advancing rapidly as they move towards smaller nodes and transition to silicon carbide (SiC) wafers, significantly increasing the requirement for ceramic chucks that can withstand high thermal and mechanical loads. EVs, medical devices, and aerospace segments continue to advance precision and complex geometries, creating another lifeline of demand.

In Q2 2024, global silicon wafer shipments increased by 7.1% compared to the previous quarter, indicating a robust demand for semiconductor components, which directly influences the need for precision equipment like ceramic chucks.

Ceramic Chucks Market Restraints:

-

Manufacturing High Quality Ceramic Chucks Faces Challenges Due to Complexity Technology Expertise and Supply Bottlenecks

Manufacturing high quality ceramic chucks with desirable thermal and dimensional stability is one of the biggest problems. This means that the manufacturing of such components is not just complex but requires a high level of technology and expertise, hence there are very few suppliers who can deliver these types of products, thus creating bottlenecks in the supply chain. Besides, the new generations of semiconductor materials (silicon carbide (SiC) or gallium nitride (GaN)) require having ceramic chucks with improved properties which presents a technical challenge for research and development.

Ceramic Chucks Market Opportunities:

-

Global Government Investments and Industrial Automation Boost Opportunities for Advanced Ceramic Chuck Market Growth

There is considerable room for growth in government investments globally, such as the U.S. CHIPS Act and China`s National Integrated Circuit Fund, which are building up domestic semiconductor production capacities. The rising industrial automation and smart manufacturing also provide opportunities for the application of ceramic chuck. In addition, the increasing emphasis on sustainable and energy-efficient production solutions offers additional market opportunities for advanced ceramic chuck designs.

In 2024, the U.S. Department of Commerce awarded up to USD 8.5 billion in direct funding to Intel under the CHIPS and Science Act to support the construction and expansion of semiconductor facilities across multiple states, including Arizona, Ohio, New Mexico, and Oregon.

Ceramic Chucks Market Segment Analysis:

By Type

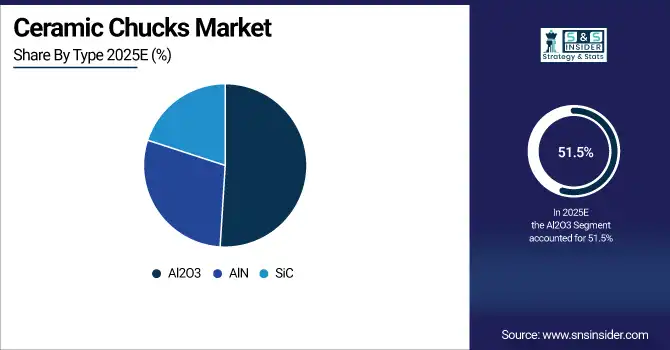

In 2025, aluminum oxide (Al2O3) was the most significant contributing ceramic in the Global Ceramic Chucks Market share due to its excellent thermal stability, wear resistance, and cost-effectiveness, contributing to around 51.5% of the overall market. Due to their high-temperature stability and excellent resistances to mechanical loads, Al2O3 ceramic chucks are popularly used in semiconductor and electronics industries for wafer processing.

Aluminum Nitride (AlN) is anticipated to witness the fastest growth during 2026–2035. Such growth is powered by the higher thermal conductivity of AlN over Al2O3 which allows for better heat removal in high precision manufacturing processes. Demand for sophisticated semiconductor devices is growing, and the movement to smaller nodes necessitates thermal load balancing, further driving AlN in the wider marketplace.

By Application

In 2025, the largest share of the ceramic chucks market was attributed to the construction sector, with a share of about 31.8%. The segment is witnessing high demand since most high-precision components for construction machinery and equipment are made using ceramic chucks. Ceramic chucks are known for their durability, thermal stability, and wear resistance, making ceramic chucks ideal for the high-demand nature and conditions of a construction application.

The electronics segment is anticipated to reach the highest growth rate during the period over 2026-2035. This rapid development is facilitated by the escalating miniaturization of electronic devices and the increased demand for advanced semiconductor components, that strongly depend on accurate processing of wafers. With the electronics industry moving toward increasingly complicated and smaller designs, new ceramic chucks that offer better thermal performance and more dimensional stability are driving their adoption.

By Material

Ceramics accounted for the largest segment in ceramic chucks in 2025 and held a share of about 43.8%, owing to their superior thermal stability, high hardness, and resistance to wear and corrosion. This combination of characteristics makes ceramic materials perfectly suited to high-precision applications in many industries, including semiconductor manufacture, aerospace, and medical devices. They are capable of withstand high temperature or mechanical stresses and are thus indispensable in wafer processing and related manufacturing tasks.

It is predicted that the fastest growth over 2026-2035 would be seen in Aluminum. Aluminum lightweight, superior thermal conductivity and cost-effective properties are making it an attractive choice for applications where heat dissipation efficiency and ease of handling are required, thereby fueling the growth of the market. The increasing use of aluminum is further driven by trends in automotive, aerospace and electronics where weight reduction and energy efficiency are a priority. With the advancements in manufacturing technologies, ceramic chucks using aluminum-based materials would emerge as a strong competitor in terms of performance and manufacturing scale.

Ceramic Chucks Market Regional Analysis:

North America Ceramic Chucks Market Trends:

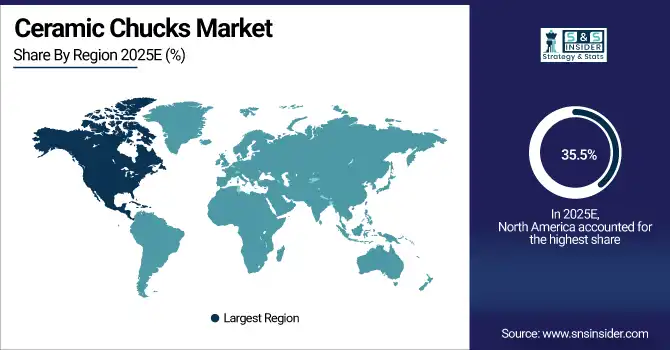

In 2025, the ceramic chucks market was dominated by the North America accounting for a significant 35.5% share. This leadership comes as a result of its well-established semiconductor manufacturing ecosystem and well-developed key industries, such as electronics, aerospace and automotive. This area has a lot of research and development investment, producing high-precision manufacturing technologies that strongly rely on ceramic chucks. Apart from this, rapid adoption of advanced ceramic materials in manufacturing processes can be attributed to government initiatives promoting semiconductor fabrication and industrial automation.

Get Customized Report as per Your Business Requirement - Enquiry Now

Continued strong demand for next-generation semiconductor devices, electric vehicles, and components used in aerospace and satellite technology continue to drive growth in the market. Ceramic chuck manufacturers also have the opportunity of adopting advanced, eco-friendly solutions to cater to the need for sustainable and energy-efficient production methods in the region. Due to its established supply chain and technological know-how, this is a crucial market that establishes trends that the rest of the world might later adopt.

The U.S. held the largest revenue share of the North American Global Ceramic Chucks Market due to the advancement of the semiconductor manufacturing industry, increasing government support and investments in high precision industrial automation and technology development.

Asia-Pacific Ceramic Chucks Market Trends:

The Global Ceramic Chucks Market in Asia Pacific is anticipated to grow the fastest during the period over 2026-2035, having a CAGR of roughly 7.93%. Factors such as rapid industrialization, increasing semiconductor manufacturing hubs, and increasing investments in the electronics, automotive, and aerospace sectors in the region are driving this growth. Increased demand for high-precision components, such as ceramic-based chucks, is further being driven by rising adoption of electric vehicles (EVs), smart manufacturing concepts, and advanced technologies. Furthermore, domestic production capability enhancement and supply chain improvements by government organizational bodies are also propelling the growth of the market, which will make Asia Pacific an important growth hub for ceramic chuck manufacturers internationally.

Driven by fastest growing electronics, automotive and industrial automation industry, coupled with huge semiconductor manufacturing base and several government investments in electronic devices, China held the largest share in Asia Pacific Global Ceramic Chucks Market.

Europe Ceramic Chucks Market Trends:

Europe is one of the largest contributors to the overall ceramics chucks market backed up by well-established industrial and advanced level manufacturing sector. Strict regulations regarding energy efficiency and sustainable production in the region are pushing market players to adopt high-performance ceramic materials. Geographically, ceramic chucks are made from low friction solid materials and are not in high demand, however, they do have an electronic application in key industries, such as automotive, aerospace and electronics. Moreover, continual investments in semiconductor fabrication and industrial automation support the market growth. The innovation and quality focus of Europe will ensure the growth of ceramic chuck applications in several segments of the market.

Latin America and Middle East & Africa Ceramic Chucks Market Trends:

Emerging markets for ceramic chucks are found in Latin America and the Middle East & Africa (MEA) regions where industrialization is on the rise and the electronics, automotive & aerospace sectors are also witnessing escalating investments (in terms of both, international players setting up local subsidiaries and initiatives from local players). Demand for infrastructure and semiconductor fabrication equipment is driving growth. At the same time, some regions struggle with insufficient local manufacturing capacity and dependence on imports. Meanwhile, increasing government support and growing industrial activities will significantly uplift the demand for ceramic chucks in these markets in the coming years.

Ceramic Chucks Market Competitive Landscape:

SMW Autoblok Established in 1953 is a global leader in precision workholding solutions, offering chucks, clamping systems, and automation components for CNC machines and industrial applications. Known for innovation and high-quality engineering, the company serves automotive, aerospace, and general manufacturing sectors, ensuring efficiency, reliability, and precision in machining operations.

-

In July 2024, SMW Autoblok introduced the KIT-RR Chuck System, featuring an RR Adapter and RR soft top jaws for quick and easy chuck jaw changes, enhancing precision and safety.

Okuma America Corporation Established in 1898, is a leading manufacturer of CNC machine tools, including lathes, machining centers, and automation solutions. Renowned for precision, reliability, and advanced technology, the company serves aerospace, automotive, and general manufacturing industries, delivering high-performance equipment that enhances productivity and machining accuracy globally.

-

In September 2024, Okuma America Corporation launched new horizontal lathes, the LB2000 EX III and LB4000 EX III, expanding their CNC machine lineup.

Ceramic Chucks Market Key Players:

-

Tokyo Seimitsu

-

Okuma

-

SMW Autoblok

-

Schunk

-

Renishaw

-

Pfeiffer Vacuum

-

Hoffmann Group

-

Trelleborg

-

Nakamura-Tome

-

Kitagawa Iron Works

-

Kyocera Corporation

-

CeramTec GmbH

-

CoorsTek, Inc.

-

NTK Technical Ceramics

-

Mitsubishi Materials

-

Royal Products

-

GKS Tooling

-

Hardinge

-

RPS Co., Ltd.

-

Kinik Company

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 450.20 Million |

| Market Size by 2035 | USD 898.94 Million |

| CAGR | CAGR of 7.16% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Al2O3, AlN, and SiC) • By Application (Aerospace, Automotive, Contruction, Medical, and Electronic) • By Material (Aluminum, Steel, Ceramics, and Titanium) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Tokyo Seimitsu, Okuma, SMW Autoblok, Schunk, Renishaw, Pfeiffer Vacuum, Hoffmann Group, Trelleborg, Nakamura-Tome, Kitagawa Iron Works, Kyocera Corporation, CeramTec GmbH, CoorsTek, Inc., NTK Technical Ceramics, Mitsubishi Materials, Royal Products, GKS Tooling, Hardinge, RPS Co., Ltd. |