Class D Audio Amplifier Market Size & Growth:

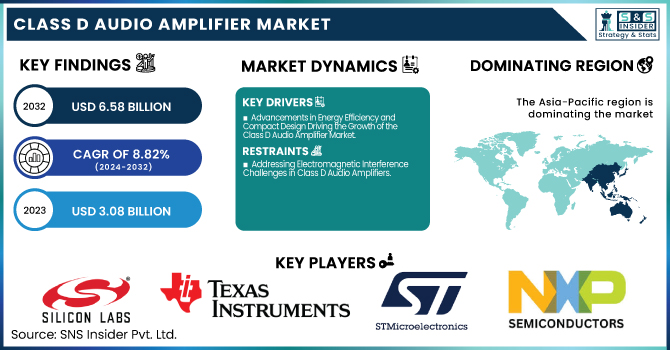

The Class D Audio Amplifier Market was valued at USD 3.08 Billion in 2023 and is projected to reach USD 6.58 Billion by 2032, growing at a CAGR of 8.82% from 2024 to 2032. This growth is primarily driven by the rising demand for energy-efficient, compact, and high-performance audio systems across consumer electronics, automotive infotainment, and smart home applications.

To Get More Information About Class D Audio Amplifier Market - Request Free Sample Report

Technological advancements such as improved adoption rates, enhanced signal-to-noise ratio (SNR), and reduced latency are significantly enhancing audio quality and device responsiveness. In the United States, the market stood at USD 0.39 billion in 2023 and is expected to grow to USD 0.83 billion by 2032 at a CAGR of 8.72%.The increasing integration of Class D amplifiers into smart devices, including smart speakers, wireless earbuds, and connected TVs, is also accelerating market expansion. Battery drain efficiency has become a crucial factor, especially in portable and wearable devices, where these amplifiers provide extended usage with minimal power consumption. Furthermore, the reduction in design-in cycle time is encouraging faster product development and quicker time-to-market for OEMs, particularly in the competitive U.S. landscape.

Class D Audio Amplifier Market Dynamics:

Drivers:

-

Advancements in Energy Efficiency and Compact Design Driving the Growth of the Class D Audio Amplifier Market

The growing demand for energy-efficient audio solutions, especially in compact and battery-powered devices, is a key driver of the Class D Audio Amplifier Market. Known for their superior power efficiency, often exceeding 90%, Class D amplifiers significantly reduce energy consumption and heat generation compared to traditional linear amplifiers. This makes them ideal for portable electronics like smartphones, earbuds, and smart speakers. Recent innovations, such as optimizing MOS full-bridge circuits and incorporating Gallium Nitride (GaN) and Silicon Carbide (SiC) devices, have pushed efficiency beyond 80%, reaching up to 91.8%. Additionally, the use of a full-bridge output structure has improved power output and frequency response. With a focus on reducing power loss and enhancing performance, these advancements are making Class D amplifiers the standard in modern audio engineering, offering both higher efficiency and compact designs.

Restraints

-

Addressing Electromagnetic Interference Challenges in Class D Audio Amplifiers

Electromagnetic Interference (EMI) a significant challenge for Class D amplifiers due to their high switching frequencies, which can generate unwanted electromagnetic radiation. This interference can affect the operation of nearby circuitry, causing signal distortion, compromising audio clarity, or even causing system malfunctions. To prevent EMI from affecting stable functioning, manufacturers need to deploy extra mechanisms such as advanced filtering techniques and electromagnetic shielding. These solutions also add complexity to the amplifier’s design, raising the cost of manufacture. This is especially challenging when it comes to mobile or compact devices with little surface area for effective EMI protection. EMI may require adding extra components, leading to larger and heavier devices. Thus, with high efficiency comes the challenge of EMI management, making EMI control a significant factor in the adoption of Class D amplifiers across a range of applications, and especially in sensitive and high-performance audio applications.

Opportunities:

-

The automotive industry is adopting Class D amplifiers in audio systems for their energy efficiency, compact design, and high-quality sound in limited vehicle space.

The automotive industry is increasingly adopting Class D amplifiers for infotainment and in-car audio systems, driven by their high efficiency and compact design. As vehicles become more technology-driven, the demand for advanced audio systems that deliver superior sound quality while optimizing power consumption has grown. Class D amplifiers are perfect for that purpose: While highly efficient, even at high volumes, we can get loud, powerful audio without burning away a lot of room. These amplifiers take advantage of modern space-efficient automotive interiors, promoting system integration in an ever-diminishing package. Second, Class D amplifiers produce low amounts of heat, which is vital in confined spaces that may also have temperature changes like a car. With increasing consumer demands for in-car infotainment systems, Class D amplifiers are becoming ever more widespread amongst automotive audio applications.

Challenges:

-

Addressing Consumer Perceptions of Sound Quality to Boost Class D Audio Amplifier Adoption

Class D amplifier technology has come a long way since its early introduction, filling a niche for the many of consumers who feel it offers less sound quality than conventional Class A or AB amplifier designs. This view, which is particularly common among audiophiles and sound engineers, derives from the established reputation of amplifiers of the Class A and AB type for greater audio fidelity, warmth, and clarity. While Class D amplifiers excel in efficiency and compact design, their digital nature can sometimes lead to concerns about distortion and a lack of smoothness in the audio output. As a result, their adoption is limited in high-end audio markets where sound quality is critical. For Class D amplifiers to gain wider acceptance, manufacturers must focus on enhancing sound clarity, reducing distortion, and educating consumers about the capabilities of modern Class D technology in achieving high-quality audio performance.

Class D Audio Amplifier Market Segment Analysis:

By Amplifier Type

The 2-channel segment of the Class D audio amplifier market dominates with a significant market share of 38% in 2023. The prominence of this segment is due to its major usage in numerous consumer electronics such as home audio systems, portable speakers, and automotive infotainment systems, where balanced audio output is of critical importance. Their 2-channel amplifiers are a cost-effective way to meet high-power, small, and high-quality sound challenges, making them very attractive for mass-market products. With the increasing demand for audio systems (especially due to the emergence of smart speakers and wireless audio system) in consumer electronics, the 2-channel Class D amplifiers will continue to hold the top position in the market. In addition, a surge in energy-efficient designs and space-saving features is reinforcing the growth of the 2-channel segment.

The 4-channel segment of the Class D audio amplifier market is projected to experience the fastest growth during the forecast period from 2024 to 2032. This rapid expansion is primarily driven by the increasing demand for multi-channel audio systems that deliver immersive sound experiences in various applications, including home theaters, automotive infotainment systems, and professional audio equipment. The ability of 4-channel amplifiers to efficiently power multiple speakers without significant heat generation makes them particularly attractive for modern audio setups. As consumers seek more sophisticated and high-fidelity audio solutions, manufacturers are focusing on enhancing the performance and affordability of 4-channel Class D amplifiers, further fueling their adoption and contributing to the segment's robust growth.

By Devices

The Home Audio Systems segment leads the Class D audio amplifier market, holding the largest revenue share of 31% in 2023, and is projected to be the fastest-growing segment from 2024 to 2032. his expansion, driven by approaching consumers demands for quality loudspeaker options, and home environments where energy-efficient, compact designs are essential for loud-sound and crystal clear loudspeaker systems. They work well for home audio because they produce very little heat and are very energy efficient, making class D amplifiers very strong in high peak performance. As technology progresses for home entertainment, the demand for high-end audio equipment, like smart speakers, soundbars, and home cinema systems, is growing. Advances in audio technology, the proliferation of smart home technology, and the rising demand for energy-efficient consumer electronics complement these factors.

By End Use

The Consumer Electronics segment dominates the Class D audio amplifier market with the largest revenue share of 59% in 2023. This leadership is driven by the increasing demand for energy-efficient, high-performance audio solutions in various consumer electronics, including smartphones, tablets, smart speakers, and other portable devices. Class D amplifiers are favored for their compact design, power efficiency, and ability to deliver high-quality audio without excessive heat generation. As consumer electronics continue to evolve, the integration of advanced audio technologies in these devices is expected to fuel further growth in this segment.

The Automotive segment is the fastest-growing in the Class D audio amplifier market over the forecast period from 2024 to 2032. The demand can be attributed to the need for sophisticated in-car sound systems and infotainment solutions that offer energy-efficient, high-quality sound. Class D amplifiers, thanks to their size, high power efficiency, and ability to pump out clear, rich sound with minimal heat, are perfect to be used in an auto setup. With the automotive industry shifting towards advanced technology like EVs and autonomous driving, the need for smarter audio systems are increasing as well. The rapidly evolving segment of car audio is witnessing the hike due to the blend of high-performance requirements in conjunction with optimized power consumptions, both of which are targeted by Class D amplifiers.

Class D Audio Amplifier Market Regional Overview:

The Asia-Pacific region dominates the Class D audio amplifier market with the largest revenue share of around 46% in 2023. This dominance is also due to the explosive growth of sectors such as consumer electronics and automotive in countries such as China, Japan, and South Korea, where demand for energy-efficient and high-quality audio solutions is on the rise. The region boasts a solid manufacturing base, as well as technological advances in audio systems are driving growth of the Class D amplifier in a range of applications, including home audio systems, smartphones, and automotive infotainment. Additionally, the expanding middle-class population and the rise of smart home technology further fuel the demand for advanced audio products in Asia-Pacific, ensuring continued market growth.

The North America segment is expected to be the fastest-growing region in the Class D audio amplifier market from 2024 to 2032. This growth is attributed to factors such as the growing adoption of energy-efficient, high-performance audio solutions and rise in demand for audio systems in numerous applications, like home audio systems, automotive infotainment, and consumer electronic devices. Rising demand for smart home devices in North America, backed by sound technological infrastructure, is contributing to the proliferation of Class D amplifiers. Moreover, the region's emphasis on sustainability and energy efficiency in electronics is accelerating the shift toward Class D amplifiers, which offer superior power efficiency and compact designs. The automotive sector, in particular, is driving growth with the demand for high-quality in-car audio systems and infotainment solutions, contributing significantly to the regional market expansion.

Get Customized Report As Per Your Business Requirement - Enquiry Now

Major Players in Class D Audio Amplifier Market along with their Products:

-

Silicon Labs (US) - Audio Amplifiers, Integrated Circuits, Microcontrollers, Wireless Chips

-

STMicroelectronics (Switzerland) - Power Management ICs, Digital Audio Processors, Class D Audio Amplifiers

-

Texas Instruments (US) - Audio Amplifiers, Power Management ICs, Digital Signal Processors (DSP), Analog ICs

-

NXP Semiconductor (Netherlands) - Car Audio Amplifiers, Power Amplifiers, Audio ICs, Semiconductors for Automotive and Consumer Electronics

-

Qualcomm (US) - Mobile Processors, Wireless Audio Solutions, Bluetooth Chips, Audio Amplifiers for Consumer Electronics

-

ON Semiconductor (US) - Power Management ICs, Audio Amplifiers, Image Sensors, Signal Processing ICs

-

ROHM Semiconductor (Japan) - Audio Amplifiers, Power Devices, Integrated Circuits, Automotive and Consumer Electronics Components

-

Monolithic Power Systems (US) - Power Management Solutions, Class D Amplifiers, Audio Power Amplifiers

-

Tempo Semiconductor (US) - Power Management ICs, Digital Audio Solutions, Class D Audio Amplifiers, Home Entertainment Components

-

Nuvoton Technology (Taiwan) - Audio Amplifiers, Microcontrollers, Power ICs, Semiconductor Solutions for Consumer Electronics

-

Dioo Microcircuits (China) - Audio Amplifiers, Power Management ICs, Consumer Electronics Components

-

Icepower A/S (Denmark) - Class D Audio Amplifiers, Audio Power Solutions, High-Efficiency Audio Components for Home Audio and Professional Audio

-

Dialog Semiconductor (UK) - Audio Power Amplifiers, Power Management ICs, Connectivity Solutions for Consumer Electronics

-

Integrated Silicon Solution Inc. (US) - Audio Amplifiers, Memory ICs, Power Management Solutions, Semiconductor Solutions for Consumer Electronics

-

Renesas Electronics (Japan) - Audio Amplifiers, Automotive Audio Systems, Microcontrollers, Semiconductor Solutions for Automotive and Consumer Electronics

-

Toshiba Corporation (Japan) - Audio Amplifiers, Power Semiconductors, Automotive Electronics, Consumer Electronics Solutions

List of companies that produce RAM and related components for the Class D Audio Amplifiers market:

-

Micron Technology

-

Samsung Electronics

-

SK hynix

-

Kingston Technology

-

Toshiba Corporation

-

Nanya Technology

-

Renesas Electronics

-

Infineon Technologies

-

Elpida Memory

-

ADATA Technology

-

Corsair Memory

-

Zhenhua

-

Sandisk

-

Micron Memory

Recent Trends:

-

On 7 Jan 2025, Texas Instruments (TI) has introduced innovative automotive chips, including a 60GHz mmWave radar sensor for in-cabin safety and an audio amplifier with one-inductor modulation for enhanced Class-D audio. These technologies provide scalable, cost-effective solutions for safer, more immersive in-cabin experiences across all vehicle types.

-

NXP Semiconductors has unveiled the S32K5 family of microcontrollers, featuring the first 16nm FinFET MCU with embedded MRAM, enhancing zonal and electrification architectures for software-defined vehicles (SDVs). This new family enables scalable solutions with improved latency, efficiency, and faster time-to-market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.07 Billion |

| Market Size by 2032 | USD 6.58 Billion |

| CAGR | CAGR of 8.82% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Amplifier Type (Mono-Channel, 2-Channel, 4-Channel, 6-Channel, Others) • By Devices (Television Sets, Home Audio Systems, Desktop and Laptops, Automotive Infotainment Systems, Others) • By End Use (Automotive, Consumer Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Silicon Labs (US), STMicroelectronics (Switzerland), Texas Instruments (US), NXP Semiconductors (Netherlands), Qualcomm (US), ON Semiconductor (US), ROHM Semiconductor (Japan), Monolithic Power Systems (US), Tempo Semiconductor (US), Nuvoton Technology (Taiwan), Dioo Microcircuits (China), Icepower A/S (Denmark), Dialog Semiconductor (UK), Integrated Silicon Solution Inc. (US), Renesas Electronics (Japan), Toshiba Corporation (Japan). |