Co-packaged Optics Market Size & Trends:

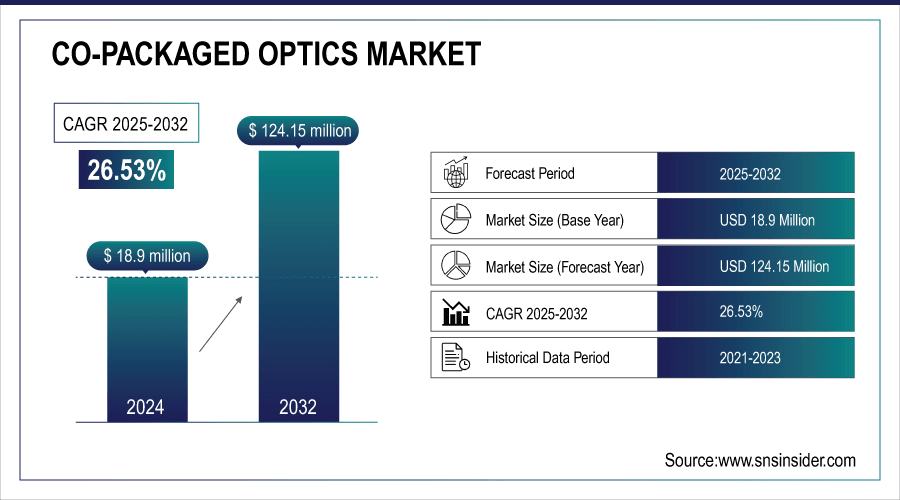

The Co-packaged Optics Market size was valued at USD 18.9 Million in 2024 and is projected to reach USD 124.15 Million by 2032, growing at a CAGR of 26.53% during 2025-2032.

The Co-Packaged Optics (CPO) market is witnessing significant growth, driven by the rising demand for high-bandwidth, low-latency data transmission in AI, cloud computing, and hyper scale data centers. By integrating optical components directly into semiconductor packages, CPO enhances power efficiency, signal integrity, and system reliability. Increasing adoption of GPU-driven infrastructures, large-scale AI workloads, and optical interconnects is reshaping data center architectures, positioning co-packaged optics as a key technology for next-generation high-performance computing and network-defined AI factories.

AMD acquires Enosemi to scale photonics and CPO solutions for AI, enabling higher bandwidth, better power efficiency, and tighter compute-network integration; collaboration with Jabil and GlobalFoundries supports advanced photonics packaging and 1.6 Tb/s chiplets.

To Get More Information On Co-packaged Optics Market - Request Free Sample Report

Key Co-Packaged Optics (CPO) Market Trends

-

Rising AI workloads and high-performance computing demands are driving growth in the Co-Packaged Optics market by enabling faster data transfer and energy-efficient operations.

-

Integration of wafer-scale technology with co-packaged optics overcomes memory and communication bottlenecks, supporting real-time simulations, large-scale AI inference, and robotics applications.

-

Adoption is increasing across defense and commercial sectors, fueling investment in high-capacity, energy-efficient optical interconnects.

-

High implementation costs and technical complexities, such as precise alignment, thermal management, and signal integrity, restrain market adoption.

-

Integration of optical components within AI accelerator packages allows scaling of AI server density across multiple racks while reducing latency and power consumption.

-

Innovations like Marvell’s custom AI XPU with Co-Packaged Optics enhance bandwidth, reach, and energy efficiency, creating long-term growth opportunities in commercial and hyper scale computing.

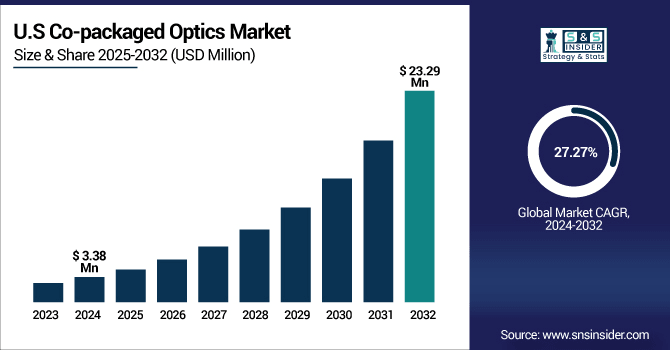

The U.S Co-packaged Optics market size was valued at USD 3.38 Million in 2024 and is projected to reach USD 23.29 Million by 2032, growing at a CAGR of 27.27% during 2025-2032. Rising demand for high-speed data transmission, increased adoption of hyperscale data centers, and advancements in integrated optical solutions are driving market expansion and technological innovation in the U.S.

The U.S. Co-packaged Optics market Trends is driven by rising demand for high-speed data transmission, growing deployment of hyper scale data centers, increasing network traffic, and the need for energy-efficient, compact optical solutions. Advances in integrated photonics, silicon photonics, and high-bandwidth transceivers are fueling adoption, while industry focus on reducing latency and improving data center efficiency further accelerates market growth and innovation.

Co-packaged Optics Market Growth Drivers:

-

Rising AI Workloads and Energy Efficiency Driving Co-Packaged Optics Market Growth

Rising AI and high-performance computing demands are fueling growth in the Co-Packaged Optics market. Integration of wafer-scale technology with co-packaged optics interconnects enhances compute speed while reducing power consumption, overcoming memory and communication bottlenecks. This enables real-time simulations, large-scale AI inference, and advanced robotics applications. Increasing adoption across defense and commercial sectors drives investment in energy-efficient, high-capacity optical interconnects, accelerating innovation, market expansion, and deployment of next-generation Co-Packaged Optics solutions globally.

03 Apr 2025 – DARPA selects Cerebras Systems and Ranovus to develop high-performance computing systems using wafer-scale co-packaged optics, enhancing AI compute performance and energy efficiency for defense and commercial applications.

Co-Packaged Optics Market Restraints:

-

High Implementation Costs and Technical Complexity Restrain Co-Packaged Optics Adoption

The Co-Packaged Optics market faces restraints due to high implementation costs and technical complexities associated with integrating photonic interconnects into wafer-scale packages. Advanced manufacturing requirements, precise alignment, and compatibility with existing electronic architectures increase development timelines and expenditures. Additionally, ensuring reliability, thermal management, and signal integrity in dense optical-electronic systems presents engineering challenges. This cause-and-effect scenario, where cost and technical hurdles limit adoption, slows market penetration and constrains widespread deployment in AI, high-performance computing, and defense applications, despite strong demand for high-speed, energy-efficient optical interconnect solutions.

Intelligent Electronic Devices Market Opportunities:

-

Rising Demand for High-Density AI Servers Drives Co-Packaged Optics Adoption

The rapid growth of AI and high-performance computing is creating substantial opportunities for the Co-Packaged Optics (CPO) market. As traditional copper interconnects limit bandwidth and increase power consumption, integrating optical components directly within AI accelerator packages enables faster data transfer, reduced latency, and higher energy efficiency. Cloud and data center operators can scale AI server density across multiple racks while optimizing power use. This cause-and-effect relationship—AI-driven demand prompting advanced optical integration—supports the expansion of CPO adoption, accelerates innovation in silicon photonics, and positions the market for long-term growth across commercial and computing applications.

Jan. 6, 2025 – Marvell Technology unveils its custom AI XPU architecture with integrated Co-Packaged Optics, enabling higher bandwidth, longer reach, and energy-efficient scale-up connections across multiple AI server racks, enhancing performance for next-generation accelerated infrastructure.

Co-Packaged Optics Market Segment Highlights:

-

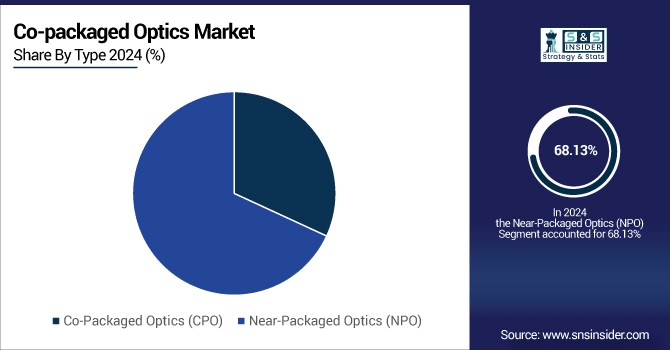

By Type – Dominating: Near-Packaged Optics (NPO) 68.13% in 2024, Fastest: Co-Packaged Optics (CPO) 31.30% CAGR

-

By Data Rate – Dominating: 3.2T 48.13% in 2024, Fastest: Less than 1.6T & 1.6T 34.56% CAGR

-

By Technology – Dominating: 2.5D CPO 58.75% in 2024, Fastest: 3D CPO 29.17% CAGR

-

By Application – Dominating: Data Center & HPC 55.00% in 2024, Fastest: Telecommunications & Networking 28.51% CAGR

By Type, Near-Packaged Optics (NPO) Leads Market While Co-Packaged Optics (CPO) Fastest Growth

Near-Packaged Optics (NPO) leads the Co-Packaged Optics market due to its widespread adoption in data centers and networking, while Co-Packaged Optics (CPO) is witnessing the fastest growth, driven by rising AI workloads, energy-efficient interconnects, and increasing demand for high-density, high-performance computing solutions across commercial and hyperscale applications.

By Technology, 3.2T Dominate Less than 1.6T & 1.6T Shows Rapid Growth

3.2T dominates the Co-Packaged Optics market due to its established use in high-performance computing and data center applications, while Less than 1.6T & 1.6T segments show rapid growth, fueled by increasing demand for energy-efficient, scalable, and cost-effective optical interconnect solutions in emerging AI and cloud infrastructures.

By Application, 2.5D CPO Dominate While 3D CPO Registers Fastest Growth

2.5D CPO dominates the Co-Packaged Optics market due to widespread adoption in conventional data center and high-performance computing setups, while 3D CPO registers the fastest growth, driven by increasing demand for higher bandwidth, compact integration, and enhanced energy efficiency in next-generation AI and cloud infrastructure deployments.

By Industry Vertical, Data Center & HPC Lead While Telecommunications & Networking Grow Fastest

Data Center and High-Performance Computing (HPC) lead the Co-Packaged Optics market due to their extensive adoption of high-speed, energy-efficient interconnects, while Telecommunications and Networking grow fastest, driven by rising demand for faster data transmission, network scalability, and next-generation 5G and cloud infrastructure expansion.

Co-Packaged Optics Market Regional Highlights:

-

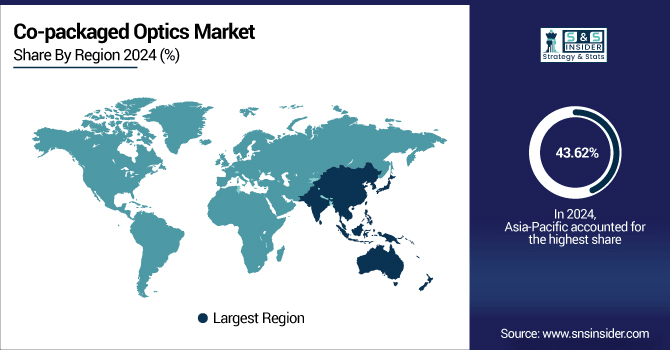

By Region – Dominating: Asia-Pacific (43.62% in 2024), Fastest: North America (25.99% in 2024 to 29.44% in 2032, CAGR 28.51%)

-

Europe: 18.40% → 19.78% (CAGR ≈ 27.68%)

-

South America: 7.20% → 7.89% (CAGR ≈ 27.98%)

-

Middle East & Africa: 4.80% → 4.11% (CAGR ≈ 24.07%, declining)

Asia-Pacific Co-Packaged Optics Market Insights

The Asia-Pacific Co-Packaged Optics market is at the forefront globally, driven by rapid adoption of high-performance computing, expanding data centers, and increasing demand for energy-efficient optical interconnects. Rising investments in advanced AI infrastructure and scalable server solutions are fueling innovation, enhancing performance, and positioning the region as a key hub for next-generation Co-Packaged Optics deployment.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

China Co-Packaged Optics Market Insights

China leads the Asia-Pacific Co-Packaged Optics market, driven by significant investments in AI infrastructure, data centers, and high-performance computing, fostering innovation, scalability, and widespread adoption of advanced optical interconnect solutions.

North America Co-Packaged Optics Market Insights

North America is the fastest-growing Co-Packaged Optics market, fueled by rising AI workloads, high-performance computing demand, and investments in cloud data centers. Adoption of energy-efficient optical interconnects and advanced wafer-scale integration is accelerating innovation, enhancing server performance, reducing latency, and driving market expansion across commercial, hyper scale, and defense sectors

-

U.S. Co-Packaged Optics Market Insights

The U.S. Co-Packaged Optics market is experiencing rapid growth, driven by increasing AI and high-performance computing demands, expanding data center infrastructure, and adoption of energy-efficient optical interconnects. Advanced wafer-scale integration and high-density server deployment are enhancing performance, reducing latency, and fueling innovation, positioning the U.S. as a key hub for next-generation Co-Packaged Optics solutions.

Europe Co-Packaged Optics Market Insights

The Europe Co-Packaged Optics market is witnessing steady growth, fueled by rising adoption of high-performance computing, expanding data centers, and increasing demand for energy-efficient optical interconnect solutions. Strong industrial infrastructure, AI technology integration, and investments in advanced server architectures across key countries are further accelerating market development.

-

Germany Co-Packaged Optics Market Insights

Germany dominates the Co-Packaged Optics market, driven by robust investments in high-performance computing, advanced data center infrastructure, and cutting-edge AI technologies. Strong industrial adoption, focus on energy-efficient optical interconnects, and government support for digital transformation initiatives are accelerating innovation, deployment, and overall market growth across the country.

Latin America Co-Packaged Optics Market Insights

The Latin America Co-Packaged Optics market is expanding steadily, fueled by increasing data center deployments, expanding telecommunications infrastructure, and rising demand for high-speed, energy-efficient optical interconnects, driving technological adoption and regional market development.

-

Brazil Co-Packaged Optics Market Insights

Brazil leads the Latin America Co-Packaged Optics market, driven by growing investments in data centers, high-speed networking infrastructure, and adoption of advanced optical interconnect technologies, supporting regional market growth and innovation.

Middle East & Africa Co-Packaged Optics Market Insights

The Middle East & Africa Co-Packaged Optics market is growing steadily, fueled by expanding data center infrastructure, increasing demand for high-speed networking, and rising adoption of energy-efficient optical technologies across key regional industries.

-

Saudi Arabia Co-Packaged Optics Market Insights

Saudi Arabia dominates the MEA Co-Packaged Optics market, driving regional adoption through investments in high-speed networking, data centers, and energy-efficient optical technologies.

Competitive Landscape for Intelligent Electronic Devices Market:

Ranovus, founded in 2010 in Canada, specializes in high-performance optical interconnect solutions, including Co-Packaged Optics (CPO) and Near-Packaged Optics (NPO). The company develops advanced silicon photonics engines and optical I/O technologies for data centers, AI, and HPC applications, enabling energy-efficient, high-bandwidth, and scalable computing infrastructure globally.

-

In March 2025, Ranovus is advancing Co-Packaged Optics with its ODIN® CPO 3.0, delivering 800Gbps and 6.4Tbps solutions for AI/ML and high-performance computing. The company collaborates with Cerebras and Jabil for wafer-scale AI platforms and mass production of optical engines.

Furukawa Electric Co., Ltd., established in 1884, is a Japanese multinational specializing in optical communications, electronics, and industrial products. The company focuses on innovative solutions including optical fibers, connectors, and Co-Packaged Optics technologies, serving data centers, AI applications, and telecommunication sectors globally.

-

In March 2025, Furukawa Electric launched a compact 12-fiber optical connector designed for Co-Packaged Optics, enabling high-speed, low-power data transmission in AI and data center applications. The connector supports easy assembly, high repeatability, and performance in dusty environments, advancing next-generation photonics-electronics convergence.

Co-packaged Optics Companies are:

-

Molex

-

Marvell

-

Ranovus

-

Ragile Networks Inc.

-

Quanta Computer Inc.

-

Furukawa Electric Co., Ltd.

-

Cisco Systems

-

Intel Corporation

-

Nvidia Corporation

-

Applied Micro Circuits Corporation (AMCC)

-

Finisar Corporation

-

Lumentum Holdings

-

II-VI Incorporated

-

Oclaro, Inc.

-

Ciena Corporation

-

NeoPhotonics Corporation

-

Avago Technologies

-

Sumitomo Electric Industries

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 18.9 Million |

| Market Size by 2032 | USD 124.15 Million |

| CAGR | CAGR of 26.53% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(Co-Packaged Optics (CPO) and Near-Packaged Optics (NPO)) • By Data Rate(Less than 1.6 T & 1.6 T, 3.2 T and 6.4 T), By Technology(2.5D CPO and 3D CPO) • By Application(Data Center and High-Performance Computing, Telecommunications and Networking and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Broadcom, Molex, Marvell, Ranovus, Ragile Networks Inc., SENKO, Quanta Computer Inc., Furukawa Electric Co., Ltd., Cisco Systems, Intel Corporation, Nvidia Corporation, Applied Micro Circuits Corporation (AMCC), Finisar Corporation, Lumentum Holdings, II-VI Incorporated, Oclaro, Inc., Ciena Corporation, NeoPhotonics Corporation, Avago Technologies, Sumitomo Electric Industries |