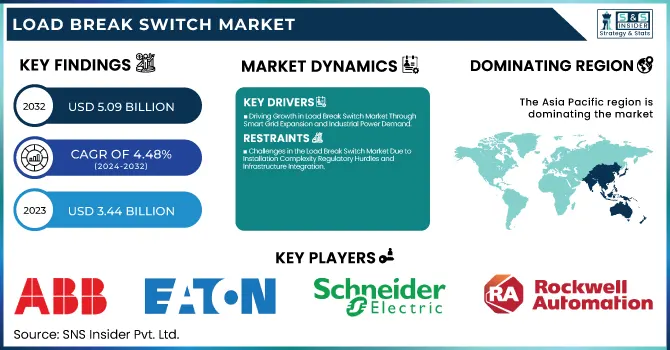

Load Break Switch Market Size & Growth:

The Load Break Switch Market Size was valued at USD 3.44 billion in 2023 and is expected to reach USD 5.09 billion by 2032, growing at a CAGR of 4.48% over the forecast period 2024-2032. Increasing demand for reliable power distribution drives growth in the Load break switch market, which includes Gas-insulated, vacuum, and air-insulated switches among others. From the adoption of utilities, and industrial facilities to the renewable energy sectors where high-efficiency fault isolation and grid stability are needed its adoption rates are ramping up. Trends in end-user adoption indicate increasing utilization in smart grids, commercial, and industrial applications. With advancements in technology, switch reliability, lower maintenance requirements, and service support improve customer satisfaction. The market also focuses on enhancing service metrics, including quick response times and effective post-sales service.

To Get more information on Load Break Switch Market - Request Free Sample Report

Load Break Switch Market Dynamics

Key Drivers:

-

Driving Growth in Load Break Switch Market Through Smart Grid Expansion and Industrial Power Demand

The increasing need for reliable, effective, and efficient power distribution systems, especially in industrial, commercial, and utility sector applications, is expected to fuel the load break switch market over the forecast period. The smart grid infrastructure's expansion and the integration of renewable energy are the key drivers of the market growth. Utility companies globally are emphasizing grid modernization projects which will indirectly help to scale the deployment of advanced switchgear solutions to enhance reliability and reduce downtime. Moreover, the demand for load break switches for smooth power distribution is propelled by factors such as increasing industrial and commercial sectors, especially in developing economies.

Restrain:

-

Challenges in the Load Break Switch Market Due to Installation Complexity Regulatory Hurdles and Infrastructure Integration

The complicated installation and maintenance of load break switches, particularly gas-insulated and vacuum-insulated switches, is one of the vital factors impeding the growth of the load break switch market. The systems need an established workforce for proper installation and periodic servicing, which is going to be a challenge for regions lacking trained manpower. Moreover, stringent regulatory standards and safety compliance can delay product approvals and adoption within the market. Even with international standards, it is not easy for manufacturers to expand with the help of seamless global inclusiveness, as the load break switches still need to adhere to diverse standards. Additionally, the incorporation of contemporary load break switches into aging grid infrastructure can be a complex task, as many existing systems were never designed to accommodate more modern, advanced switchgear technologies.

Opportunity:

-

Opportunities in the Load Break Switch Market Driven by Technology Advancements EV Infrastructure and Smart Grids

Market growth is attributed to technology, focusing on the development of remote monitoring and automation-enabled load break switches for greater operation and reduced maintenance costs. The advancement of switches will lead to a vast opportunity as more people switch to using gas-insulated switchgear and vacuum-insulated switchgear over other types, where they provide significantly higher performance, safety, and reliability than their air-insulated counterparts. Apart from that, the growing setting up of electric-powered vehicle (EV) charging infrastructure and greater urban electrification initiatives provide profitable opportunities for market growth. Asia-Pacific and the Middle East (EME) are projected to enjoy strong growth driven by increasing electricity requirements and investments in smart power infrastructure.

Challenges:

-

Technical and Logistical Challenges Impacting Load Break Switch Market Performance and Production Timelines

Load break switches, particularly the air-insulated types, might experience performance problems because of the high humidity, extreme temperatures, or heavily polluted areas where they are installed and might fail to perform properly. For industrial and utility applications, this level of environmental variability is to be expected, and making sure that the performance is reliable in such situations is critical. Moreover, supply chain failures and lack of materials particularly for insulating mediums, electrical contacts, etc. create risks for manufacturers and incrementally extend the timelines for production. Dealing with these technical and logistical challenges is critical for the growth of the market on a sustained basis.

Load Break Switch Market Segmentation Overview

By Type

Gas-insulated load break switches held the largest market share of 35.3% in 2023 as they offer higher reliability and compact designs with superior insulation features. Such switches are widely deployed in industrial, commercial, and utility applications where it is essential to compromise on both space and operational efficiency. This makes them a compelling option over both traditional air-insulated or oil-immersed rivals - they can operate efficiently even in demanding environmental conditions and at high voltages. Besides that, their adoption has also been boosted by the rising emphasis on grid modernization and renewable energy integration.

The air-insulated segment is projected to be the fastest growing segment concerning CAGR over the forecasted period from 2024 to 2032 due to its low cost and environmentally friendly characteristics. With the growing focus on sustainable solutions in industries, air-insulated switches are becoming more popular than gas-insulated switches since the latter uses SF6 gas a greenhouse gas with a very low environmental impact. Furthermore, their derivative design and lesser need for maintenance make them perfectly suited for medium-voltage power distribution networks and industrial sites. However, the increasing requirement for decentralized energy systems, smart grids, and rural electrification projects is contributing to raising the market of air-insulated load break switches.

By Voltage

The 11-33 kV segment led the market with a share of 39.3% in 2023, on account of the high penetration of this voltage level in power distribution networks, industrial applications, and commercial buildings. In medium-voltage applications, these load-break switches are essential to ensure reliable power supply and network stability, which is why they are increasingly used by utilities and in infrastructure projects. Additionally, a burgeoning necessity for smart grids along with the integration of renewables has driven the demand for 11-33 kV switches, especially in urban and semi-urban areas where control mechanisms in power distribution systems are an essential complexity.

33–60 kV is predicted to experience the highest CAGR from 2024 to 2032 due to rising industrial demand and the utility sector boom for high-voltage transmission solutions. Although this voltage range has essentially been disregarded for a long time, the increasing expansion and enhancement of power grids for handling higher power loads rapidly increases the demand for robust and cost-effective alternative solutions for switchgear in the medium voltage range. Moreover, the growing use of renewable energy sources, high-voltage substations, and smart grid technologies has increased the demand for the device.

By Installation

In 2023, the outdoor segment accounted for the highest share of 57.8% of the overall market, owing to its widespread application in power distribution networks, substations, and renewable energy installations. Outdoor load break switches are essential for grid resilience and reliability, used in a substation, typically at high-voltage transmission lines, or at remote load centers. Trade in Utility and Industry Solutions Their resistance towards extreme environmental conditions extreme temperature, humidity, and/or pollution makes them useful for utility and industrial applications. Their adoption has been further boosted by increasing demand for smart grids as well as rural electrification projects, especially in developing regions with a strong need to expand infrastructure.

The indoor segment is anticipated to witness the fastest growth rate CAGR during 2024-2032, owing to the growing need for limited & space-save types of power distribution & alternative current in commercial, industrial & metropolitan infrastructure. Indoor load break switches find growing applications in factories, data centers, and other commercial buildings where safe and efficient power control is needed. Growing demand for sustainable building designs and smart energy management systems is further fuelling growth. Besides, the growing emphasis on renewable energy integration and microgrid development is anticipated to drive the demand for indoor load break switches, especially for smart cities and industrial automation projects.

By End Use

In 2023, the utility segment dominated the market share with 49.8%, due to the growing demand for grid revival, efficient power transmission, and renewable energy balancing, Load break switches are widely used in power transmission and distribution networks to disconnect a power line and isolate a fault. Smart grid infrastructure investments are being made while electricity networks expand in developing regions, but load break switch demand is still dominated by utilities. Moreover, initiatives taken by the governments for power cuts reduction, and improvement of energy efficiency are also contributing to growth in this market.

The industrial segment is anticipated to be the fastest-growing segment in the forecast period from 2024 to 2032 for reasons of rapid industrialization, high demand for energy consumption, and the need for the efficient management of power. For example, industries require high-performance electrical switchgear to keep operations running without interruptions; think manufacturing, oil & gas, mining, data centers, etc. In industrial facilities, the increasing use of automation, IIoT, and integration with renewable energy will create even more demand for load break switches.

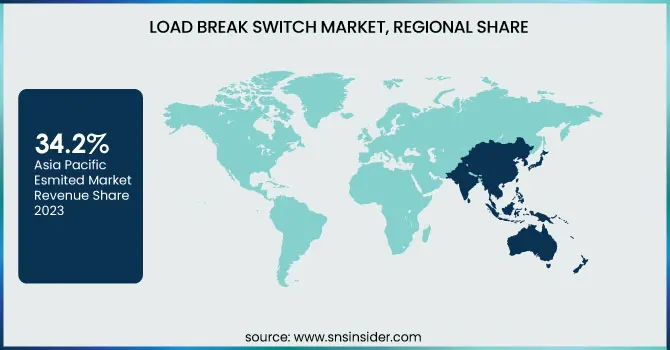

Load Break Switch Market Regional Analysis

In 2023, the market share was led by the Asia-Pacific region accounting for 34.2% due to a rapid pace of urbanization, expansion in industrial activities, and massive investments in power infrastructure. The demand for load break switches is also getting a boost as countries such as China, India, and Japan are investing heavily in renewable energy generation projects and smart grids along with power distribution networks. As an example, China’s State Grid Corporation is developing its ultra-high-voltage (UHV) transmission networks and increasingly needs switchgear technology. On account of the improving distribution infrastructure, the aged power infrastructure modernization in nations like India is anticipated to offer new income avenues for the air-insulated switches as a result of authorities initiatives such as the 'Revamped Distribution Sector Scheme (RDSS)', aiding sooner acceptance of air-insulated switches and vacuum-insulated load break switch.

North America is anticipated to register the highest CAGR from 2024 to 2032, owing to grid modernization, rising renewable energy adoption, and the growing electric vehicle (EV) charging infrastructure. The Load Break Switch market in the North American region is also driven by the U.S. Department of Energy Grid Modernization Initiative which works to improve the reliability and safety of the power grid, thereby generating demand for advanced load break switches in the future. This is partly driven by the USD 10 billion Clean Power Fund, which reflects Canada’s drive to renewable energy, with associated investments in smart grid technologies. Demand for load break switches in North America is further supported by the expansion of companies like Tesla with its Supercharger network, industrial automation, and data centers, amongst others.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Load Break Switch Market are:

-

ABB Ltd. (Gas-Insulated Load Break Switches, Air-Insulated Load Break Switches)

-

Eaton Corporation PLC (Air-Insulated Load Break Switches, Gas-Insulated Load Break Switches)

-

Schneider Electric SE (Gas-Insulated Load Break Switches, Air-Insulated Load Break Switches)

-

Fuji Electric Co., Ltd. (Gas-Insulated Load Break Switches, Air-Insulated Load Break Switches)

-

SOCOMEC (Gas-Insulated Load Break Switches, Air-Insulated Load Break Switches)

-

Rockwell Automation, Inc. (Gas-Insulated Load Break Switches, Air-Insulated Load Break Switches)

-

Ensto Group (Gas-Insulated Load Break Switches, Air-Insulated Load Break Switches)

-

G&W Electric Company (Gas-Insulated Load Break Switches, Air-Insulated Load Break Switches)

-

Legrand SA (Gas-Insulated Load Break Switches, Air-Insulated Load Break Switches)

-

Hitachi Energy (Load-Break Switch Type LBOR III, Oil-Immersed Rotary Switch)

-

Chint Group (Gas-Insulated Load Break Switches, Air-Insulated Load Break Switches)

-

Lucy Electric UK Ltd. (Gas-Insulated Load Break Switches, Air-Insulated Load Break Switches)

-

Kraus & Naimer (Rotary Cam Switch, Control and Load Switch)

-

KATKO Oy (Gas-Insulated Load Break Switches, Air-Insulated Load Break Switches)

-

Larsen & Toubro Limited (Gas-Insulated Load Break Switches, Air-Insulated Load Break Switches)

Recent Trends

-

In April 2024, Schneider Electric launched the EasySet MV switchgear, a compact, modular solution for medium-voltage distribution, designed for efficiency and flexibility.

-

In August 2024, Hitachi Energy showcased its 550 kV SF₆-free Gas Insulated Switchgear (GIS), utilizing EconiQ™ gas to reduce environmental impact.

-

In October 2024, Lucy Electric opened a new manufacturing facility in Dammam, Saudi Arabia, aimed at producing advanced medium-voltage switchgear.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.44 Billion |

| Market Size by 2032 | USD 5.09 Billion |

| CAGR | CAGR of 4.48% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Gas-insulated, Vacuum-insulated, Air-insulated, Oil-immersed) • By Voltage (Below 11 kV, 11-33 kV, 33-60 kV) • By Installation (Outdoor, Indoor) • By End Use (Utilities, Industrial, Commercial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB Ltd., Eaton Corporation PLC, Schneider Electric SE, Fuji Electric Co., Ltd., SOCOMEC, Rockwell Automation, Inc., Ensto Group, G&W Electric Company, Legrand SA, Hitachi Energy, Chint Group, Lucy Electric UK Ltd., Kraus & Naimer, KATKO Oy, Larsen & Toubro Limited. |