Commercial Satellite Broadband Market Size & Growth:

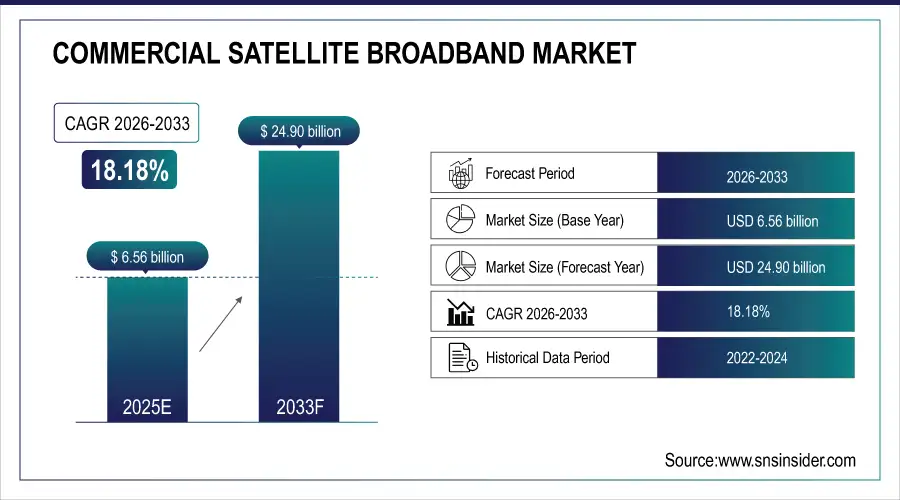

The Commercial Satellite Broadband Market Size is valued at USD 6.56 Billion in 2025E and is projected to reach USD 24.90 Billion by 2033, growing at a CAGR of 18.18% during the forecast period 2026–2033.

Commercial Satellite Broadband Market analysis report provides an in-depth overview of industry dynamics, emphasizing advancements in satellite connectivity, network infrastructure and service offerings. Rising demand for high-speed internet in remote areas and growing enterprise adoption are expected to drive significant market expansion during the forecast period.

Commercial satellite broadband subscriptions reached 18 million in 2025, driven by rural connectivity initiatives and growing adoption of high-throughput satellites (HTS).

Commercial Satellite Broadband Market Size and Forecast:

-

Market Size in 2025: USD 6.56 Billion

-

Market Size by 2033: USD 24.90 Billion

-

CAGR: 18.18% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Commercial Satellite Broadband Market - Request Free Sample Report

Commercial Satellite Broadband Market Trends:

-

Growing deployment of high-throughput and low-Earth orbit (LEO) satellites is enhancing bandwidth capacity and any coverage.

-

Rising demand for high-speed broadband in rural and remote regions is accelerating satellite-based internet adoption.

-

Increasing integration of AI-driven network optimization and beam management is improving service quality and reliability.

-

Expanding use of satellite broadband in maritime, aviation, and defense sectors is fueling commercial adoption.

-

Surge in public-private partnerships and government digital inclusion programs is strengthening infrastructure investment and market penetration.

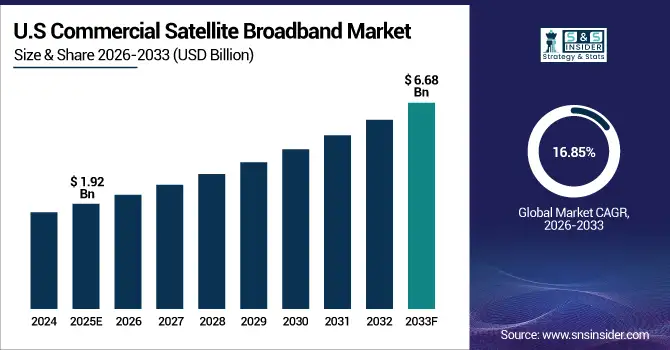

U.S. Commercial Satellite Broadband Market Insights:

The U.S. Commercial Satellite Broadband Market is projected to grow from USD 1.92 Billion in 2025E to USD 6.68 Billion by 2033, at a CAGR of 16.85%. Growth is driven by large-scale LEO satellite deployments, strong rural broadband initiatives, and rising enterprise adoption of high-speed, low-latency satellite connectivity solutions nationwide.

Commercial Satellite Broadband Market Growth Drivers:

-

Rapid expansion of low-Earth orbit (LEO) constellations, enabling faster, more reliable, and globally accessible satellite broadband connectivity.

The rapid expansion of low-Earth orbit (LEO) constellations is a major growth driver for the Commercial Satellite Broadband Market growth. As leading providers deploy thousands of small satellites, broadband coverage becomes faster, more stable, and accessible even in remote regions. This innovation enables seamless connectivity for enterprises, aviation, maritime, and defense applications, reducing latency, improving network capacity, and redefining performance standards for next-generation satellite communication services.

LEO satellite deployments increased by 42% in 2025, driven by expanding broadband constellations from major operators and rising connectivity demand.

Commercial Satellite Broadband Market Restraints:

-

High infrastructure costs, bandwidth limitations and signal latency issues are constraining widespread adoption of commercial satellite broadband services.

High infrastructure costs, bandwidth limitations, and signal latency issues are major restraints for the Commercial Satellite Broadband Market. Establishing and maintaining satellite networks, especially LEO constellations, requires extensive capital investment in manufacturing, launch, and ground infrastructure. Bandwidth sharing among multiple users can reduce speed and reliability, while latency challenges persist compared to terrestrial broadband. These technical and financial barriers limit scalability and affordability, particularly in developing regions, constraining overall market penetration and profitability.

Commercial Satellite Broadband Market Opportunities:

-

Growing demand for broadband in remote and underserved regions presents major opportunities for satellite service expansion and innovation.

Growing demand for broadband in remote and underserved regions presents a major opportunity for the Commercial Satellite Broadband Market. As governments and telecom operators push digital inclusion, satellite networks offer viable solutions where terrestrial infrastructure is limited. Investments in low-Earth orbit constellations and high-throughput satellites are expanding affordable, high-speed access. This shift not only bridges the digital divide but also opens new revenue streams across enterprise, education, and public service sectors.

Rural and remote broadband projects accounted for 28% of new satellite service deployments in 2025, driven by digital inclusion initiatives and LEO network expansion.

Commercial Satellite Broadband Market Segmentation Analysis:

-

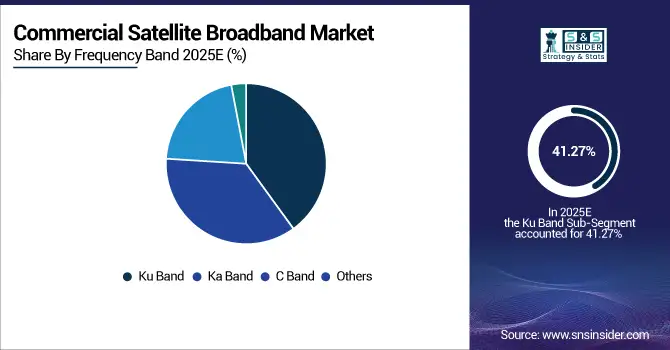

By Frequency Band, Ku Band held the largest market share of 41.27% in 2025, while Ka Band is projected to grow at the fastest CAGR of 20.63% during 2026–2033.

-

By Component, Services accounted for the highest market share of 48.92% in 2025, while Satellite Capacity is anticipated to expand at the fastest CAGR of 19.44% through 2026–2033.

-

By Application, Remote Communication dominated with a 34.75% share in 2025, while Backhaul Connectivity is expected to grow at the fastest CAGR of 21.58% during the forecast period.

-

By End-User, Enterprise held the largest share of 39.81% in 2025, while Aviation is forecasted to grow at the fastest CAGR of 22.36% during 2026–2033.

By Frequency Band, Ku Band Dominates While Ka Band Expands Rapidly:

The Ku Band segment dominated the market due to its established infrastructure, widespread adoption in maritime and enterprise connectivity, and balanced coverage-cost efficiency. It remains the most widely used frequency for commercial broadband links and VSAT applications, particularly across shipping and remote industrial operations. The Ka Band is the fastest-growing segment, driven by higher data throughput and integration with LEO constellations. In 2025, Ka Band-enabled systems supported over 35% of new satellite broadband launches, marking a shift toward high-capacity transmission.

By Component, Services Dominate While Satellite Capacity Expands Rapidly:

The Services segment dominated the market, reflecting the growing preference for managed connectivity, subscription models, and customer-focused broadband packages. Enterprises, maritime operators and aviation players increasingly rely on service providers for seamless data delivery and network management. The Satellite Capacity is the fastest growing segment as satellite operators invest in high-throughput satellites and LEO constellations. In 2025, leased satellite capacity contracts grew by 31%, underscoring strong demand from telecom and government sectors.

By Application, Remote Communication Dominates While Backhaul Connectivity Expands Rapidly:

Remote Communication segment dominated the market as satellite broadband provides critical connectivity for offshore operations, defense outposts, and isolated enterprises. Its reliability under challenging terrain and weather conditions makes it essential for business continuity. Backhaul Connectivity is the fastest-growing segment, as telecom operators increasingly integrate satellites to extend rural 4G and 5G networks. In 2025, satellite backhaul links supported over 40,000 new cell sites globally, showcasing their expanding role in network densification.

By End-User, Enterprise Dominates While Aviation Expands Rapidly:

The Enterprise segment dominated the market due to rising satellite broadband demand across mining, oil & gas, logistics, and remote industrial facilities. Enterprises favor satellite networks for dependable data communication, cloud access, and IoT integration. The Aviation is the fastest growing segment, propelled by surging passenger demand for in-flight Wi-Fi and digital services. In 2025, over 68% of new commercial aircraft deliveries were equipped with satellite broadband systems, illustrating the sector’s fast-paced adoption.

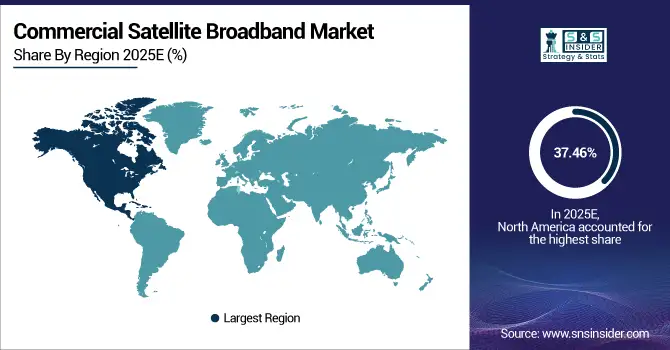

North America Commercial Satellite Broadband Market Insights:

North America dominated the Commercial Satellite Broadband Market with a 37.46% share in 2025, supported by extensive satellite infrastructure and leading providers such as SpaceX, Hughes, and Viasat. The region’s robust demand for high-speed connectivity across residential, enterprise, and defense sectors drives continuous investment in LEO constellations and high-throughput satellites. Strong digital transformation initiatives, coupled with early adoption of satellite-based broadband, further reinforce North America’s leadership and technological edge in the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Commercial Satellite Broadband Market Insights:

U.S. Commercial Satellite Broadband Market growth is driven by expanding LEO satellite networks, growing rural connectivity programs, and rising enterprise broadband demand. Increasing adoption across aviation, maritime and defense sectors is enhancing nationwide coverage. Continuous innovation in high-throughput satellites and ground infrastructure is elevating service quality, speed, and accessibility across the country.

Asia-Pacific Commercial Satellite Broadband Market Insights:

The Asia-Pacific Commercial Satellite Broadband Market is the fastest-growing region, projected to expand at a CAGR of 20.62% during 2026–2033. Growth is driven by accelerating digital inclusion programs, expanding LEO satellite deployments, and strong government support for rural broadband. Increasing enterprise connectivity demand, telecom collaborations, and rapid internet adoption across China, India, and Southeast Asia are positioning Asia-Pacific as the most dynamic and transformative region in the satellite broadband industry.

China Commercial Satellite Broadband Market Insights:

China Commercial Satellite Broadband Market is driven by rapid expansion of LEO satellite networks, strong government-backed space programs, and rising broadband demand in rural and industrial regions. Growing investment in high-throughput satellite technology and enterprise connectivity solutions positions China as a key growth engine within the Asia-Pacific satellite broadband landscape.

Europe Commercial Satellite Broadband Market Insights:

The Europe Commercial Satellite Broadband Market is witnessing steady growth driven by increasing adoption of high-speed satellite internet across residential, enterprise, and government sectors. Rising investments in next-generation programs such as IRIS² and expanding LEO satellite deployments are boosting regional capacity. Major contributors include Germany, the UK, France, and Italy, where digital inclusion goals, sustainable connectivity initiatives, and growing demand for reliable broadband access are strengthening Europe’s position in the satellite broadband market.

Germany Commercial Satellite Broadband Market Insights:

Germany is one of the key markets for Commercial Satellite Broadband, supported by strong aerospace, defense and telecommunication sectors. Growth is driven by expanding high-speed connectivity demand, adoption of LEO satellite services, and government-backed digital infrastructure programs. Innovation and technology integration reinforce Germany’s leadership in Europe’s satellite broadband expansion.

Latin America Commercial Satellite Broadband Market Insights:

The Latin America Commercial Satellite Broadband Market is expanding rapidly with growing demand for rural connectivity and digital inclusion. Countries Such as Brazil, Mexico, and Argentina are driving growth through government-backed broadband programs and partnerships with satellite operators. Rising enterprise adoption and infrastructure modernization are enhancing regional access and connectivity performance.

Middle East and Africa Commercial Satellite Broadband Market Insights:

The Middle East & Africa Commercial Satellite Broadband Market is growing rapidly, driven by expanding connectivity needs across remote regions and energy sectors. Government-led digital transformation programs in Saudi Arabia, the UAE, and South Africa are boosting adoption. Rising investments in LEO satellite networks and telecom partnerships are enhancing broadband accessibility and coverage.

Commercial Satellite Broadband Market Competitive Landscape:

SpaceX, headquartered in the United States, dominates the Commercial Satellite Broadband Market through its Starlink constellation, the world’s largest network of low-Earth orbit (LEO) satellites. With thousands of satellites already in orbit, SpaceX provides high-speed, low-latency broadband access across remote and underserved regions. Its vertically integrated manufacturing, advanced launch capabilities, and rapid deployment strategy enable unmatched scalability and cost efficiency. Continuous innovation in satellite technology and expansion into enterprise and aviation markets solidify SpaceX’s market leadership.

-

In October 2025, SpaceX launched its 10,000th Starlink satellite, further strengthening its dominance in satellite broadband. The milestone, achieved through its 132nd Falcon 9 mission of the year, enhances internet reach and improves service quality for underserved regions.

Hughes Network Systems, based in Maryland, USA, is a leading provider of satellite broadband and managed network services. Leveraging its HughesNet platform and Jupiter™ high-throughput satellites, the company serves millions of residential and business customers across the Americas. Hughes stands out for its hybrid network solutions that integrate terrestrial, GEO, and LEO satellites for seamless connectivity. Its focus on affordability, enterprise-grade reliability, and government partnerships reinforces its dominant role in the satellite broadband ecosystem.

-

In April 2025, Hughes Network Systems launched its HL1100W electronically steerable antenna (ESA), a compact, flat-panel user terminal designed for mobility and remote connectivity applications. The product marks a key expansion in Hughes’ next-generation broadband solutions portfolio.

Viasat Inc., headquartered in California, is a leader in high-capacity satellite broadband communications. Known for its ViaSat-3 constellation and Ka-band technology, the company delivers fast, secure, and reliable internet to residential, enterprise, aviation, and defense users. Its continuous investment in high-throughput satellites, coupled with innovative ground network infrastructure, drives superior data speeds and coverage. Strategic acquisitions and government collaborations have strengthened Viasat’s position as a top-tier provider in the commercial satellite broadband market.

-

In September 2025, Viasat announced the upcoming launch of its ViaSat-3 F2 satellite, designed to more than double bandwidth capacity. The new satellite aims to improve coverage, reliability, and throughput across commercial aviation, defense, and residential broadband markets.

Commercial Satellite Broadband Companies are:

-

SpaceX

-

Viasat Inc.

-

SES S.A.

-

Inmarsat plc

-

Intelsat S.A.

-

OneWeb

-

Iridium Communications Inc.

-

Telesat

-

EchoStar Corporation

-

Globalstar Inc.

-

Gilat Satellite Networks Ltd.

-

Avanti Communications Group plc

-

Thaicom Public Company Limited

-

Speedcast International Limited

-

KVH Industries, Inc.

-

AsiaSat

-

China Satcom

-

ST Engineering iDirect

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 6.56 Billion |

| Market Size by 2033 | USD 24.90 Billion |

| CAGR | CAGR of 18.18% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Frequency Band (C Band, Ku Band, Ka Band, Others) • By Component (Satellite Capacity, Ground Equipment, Services) • By Application (Backhaul Connectivity, Remote Communication, Emergency & Disaster Management, Media & Entertainment, Others) • By End-User (Enterprise, Government & Defense, Maritime, Aviation, Energy, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | SpaceX, Hughes Network Systems, Viasat Inc., SES S.A., Eutelsat Communications, Inmarsat plc, Intelsat S.A., OneWeb, Iridium Communications Inc., Telesat, EchoStar Corporation, Globalstar Inc., Gilat Satellite Networks Ltd., Avanti Communications Group plc, Thaicom Public Company Limited, Speedcast International Limited, KVH Industries Inc., AsiaSat, China Satcom, ST Engineering iDirect. |