Mid Wave Infrared (MWIR) Sensors Market Size

Get E-PDF Sample Report on Mid Wave Infrared MWIR Sensors Market - Request Sample Report

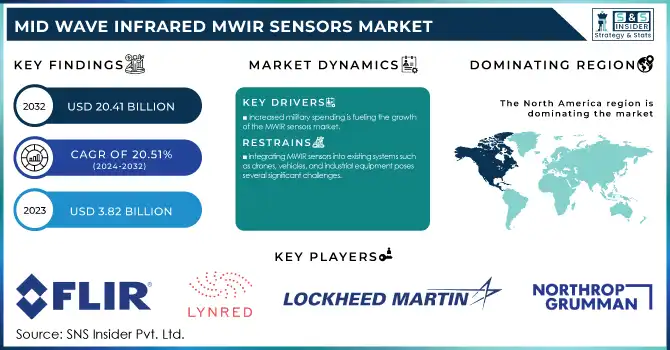

The Mid Wave Infrared (MWIR) Sensors Market Size was valued at USD 3.82 billion in 2023 and is expected to grow to USD 20.41 billion by 2032 and grow at a CAGR of 20.51% over the forecast period of 2024-2032.

The Mid-Wave Infrared (MWIR) sensors market is experiencing significant growth, driven by the rising demand for advanced thermal imaging technologies across defense, surveillance, and industrial sectors. MWIR sensors, which operate in the "third infrared window" (3-5 microns), provide exceptional imaging performance for night vision, target acquisition, and border security, enabling clear thermal imaging in low-light conditions and at extended ranges. In industrial applications, MWIR technology enhances predictive maintenance and process monitoring by detecting potential failures early, improving operational efficiency. Recent advancements, such as uncooled MWIR sensors, are revolutionizing the market with more compact designs, better sensitivity, and cost reductions. MWIR sensors are also being integrated into drones and autonomous vehicles, expanding their use in both military and commercial sectors. These sensors capture thermal radiation emitted by objects, unlike SWIR sensors, which detect reflected light, making them ideal for gas leak detection, long-range surveillance, and security monitoring. MWIR sensors are particularly advantageous in challenging environments, such as fog, dust, and smoke, and are effective even in high humidity conditions. Their relatively smaller size compared to other infrared technologies like LWIR makes them the preferred choice for applications with strict size, weight, and power (SWaP) requirements. The broader infrared spectrum also highlights the distinctions between SWIR, MWIR, and LWIR. SWIR, spanning 1,000 nm to 3,000 nm, is used for material identification, moisture detection, and medical imaging, while MWIR (3,000 nm to 8,000 nm) is essential for thermal imaging in military and industrial settings. LWIR, covering 8,000 nm to 15,000 nm, is best for thermal imaging and temperature measurement. Each region relies on different detector technologies, with SWIR using InGaAs, MWIR using HgCdTe or InSb, and LWIR using micro bolometers.

Mid Wave Infrared Sensors Market Dynamics

Drivers

-

Increased military spending is fueling the growth of the MWIR sensors market.

The rising demand for superior surveillance, target acquisition, and night vision capabilities is driving the adoption of MWIR sensors, especially in applications like drones, guided missiles, and advanced surveillance systems. These sensors, operating in the "third infrared window" (3-5 microns), offer exceptional imaging in low-light conditions and are effective even under challenging circumstances like fog, smoke, and dust. The growing use of MWIR sensors in small UAVs (unmanned aerial vehicles) and electro-optical sensors enhances military operational efficiency, with applications expanding in missile detection and battlefield tracking. The integration of uncooled MWIR sensors is further revolutionizing the market by enabling more compact designs, better sensitivity, and reduced costs. This development is making MWIR sensors more accessible for a variety of defense applications. In addition to military applications, MWIR sensors are increasingly being used in military test range systems for high-speed tracking and thermal imaging, further boosting demand. This growth in military spending, coupled with the broader expansion of defense technologies, correlates directly with the rising MWIR sensor market, which is expected to experience significant growth, particularly in the defense, aerospace, and industrial sectors. The advancements in MWIR technology align with the overall market trend toward enhanced detection capabilities, providing clear thermal imaging for various military, commercial, and industrial operations. This intersection of technological innovation and defense sector investment underscores the continued expansion of the MWIR sensors market.

Restraints

-

Integrating MWIR sensors into existing systems such as drones, vehicles, and industrial equipment poses several significant challenges.

These sensors have specialized requirements that make them difficult to incorporate into standard systems without extensive modifications. One of the primary hurdles is the need for precise calibration. MWIR sensors must be carefully calibrated to ensure they accurately detect thermal radiation and provide clear imaging under a variety of environmental conditions, such as low light, fog, or smoke. This calibration process can be time-consuming and complex, requiring specialized knowledge and equipment. Additionally, the integration of MWIR sensors into platforms like drones and vehicles involves aligning them with the system’s hardware, software, and power management modules. This can necessitate the development of custom solutions to ensure full compatibility, especially in complex environments where multiple technologies must work together seamlessly. In drones, for instance, MWIR sensors must be mounted in a way that ensures stability and optimal performance without adding excessive weight or size, while also maintaining integration with other critical systems such as communication, navigation, and GPS. In vehicles, the integration process becomes even more complicated as the MWIR sensors must function in real-time with advanced driver-assistance systems (ADAS), syncing with other sensors to provide accurate data for autonomous or semi-autonomous operations. Moreover, MWIR sensors often require cooling systems to function effectively, adding to their size, weight, and power consumption. This not only increases the complexity of integration but also impacts the overall system’s design, making it more difficult to meet size, weight, and power (SWaP) constraints. These factors, including the need for high-performance integration and calibration, contribute to the complexity and cost of adopting MWIR technology in various applications.

MWIR Sensors Market Segment Overview

By Device

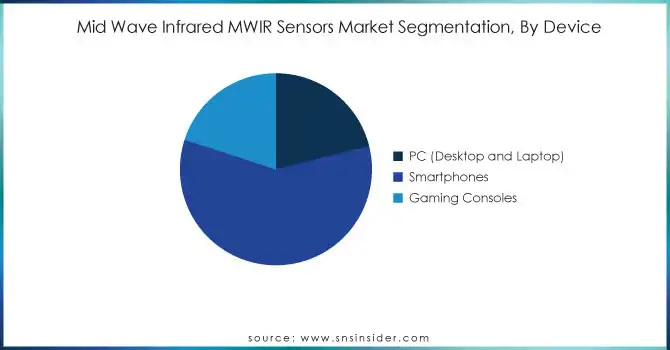

The smartphone segment is leading the Mid-Wave Infrared (MWIR) sensors market, accounting for approximately 59% of the market share in 2023. This dominance can be attributed to the increasing adoption of infrared sensors in smartphones for enhanced functionalities such as facial recognition, thermal imaging, and advanced security features. MWIR sensors in smartphones offer the ability to detect heat signatures, enabling features like accurate face unlocking, temperature measurement, and thermal vision applications, which are gaining traction among consumers. As smartphones continue to evolve with advanced technologies, the demand for more sophisticated sensors, including MWIR, is expected to grow. Additionally, the rise of mobile-based applications in fields like medical diagnostics, augmented reality (AR), and security further drives the integration of MWIR sensors into smartphones, solidifying their leading role in the market.

By Distribution Channel

The online segment is dominating the Mid-Wave Infrared (MWIR) sensors market, accounting for around 67% of the market share in 2023. This growth is primarily driven by the increasing shift towards e-commerce platforms for purchasing high-tech products, including MWIR sensors, due to their convenience and global reach. Online channels provide customers with easy access to a wide range of MWIR sensor products, often with detailed specifications and comparison options, helping businesses and individuals make informed purchasing decisions. Additionally, the growing trend of digitalization and online marketing by sensor manufacturers has enhanced the visibility and accessibility of MWIR sensors across various industries, including defense, automotive, and industrial sectors. As online shopping continues to rise, this distribution channel is expected to maintain its dominance in the MWIR sensors market.

Mid Wave Infrared (MWIR) Sensors Market Regional Analysis

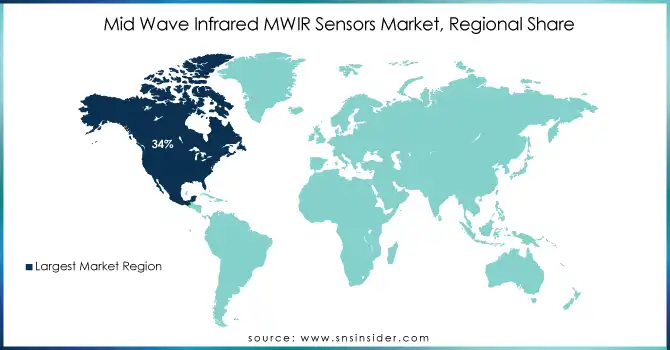

North America is leading the Mid-Wave Infrared (MWIR) sensors market, holding around 34% of the market share in 2023. This dominance can be attributed to the region's strong defense and aerospace sectors, where MWIR sensors are extensively used in military surveillance, target acquisition, and night vision technologies. The increasing demand for high-performance sensors in industrial applications, such as predictive maintenance and process monitoring, further supports this market leadership. Additionally, North America benefits from a robust technological ecosystem, with key manufacturers and innovators in the sensor industry based in the U.S. and Canada. The presence of advanced research and development initiatives, coupled with substantial government investments in defense and security, ensures continued growth and dominance in the MWIR sensors market within the region.

Asia-Pacific is the fastest-growing region in the Mid-Wave Infrared (MWIR) sensors market in 2023, driven by rapid industrialization, technological advancements, and increasing defense spending. Countries like China, India, and Japan are expanding their defense capabilities, where MWIR sensors are critical for surveillance, border security, and advanced military applications such as missile detection and night vision. The growing demand for MWIR sensors in industrial sectors, including manufacturing, energy, and oil & gas, is also propelling market growth in the region. Additionally, the region is witnessing increased adoption of drones and autonomous vehicles, further expanding the potential applications of MWIR sensors. With ongoing investments in research and development, coupled with the adoption of advanced technologies, Asia-Pacific is expected to maintain strong growth in the MWIR sensor market in the coming years.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

KEY PLAYERS

Some of the major players in Mid-Wave Infrared (MWIR) sensors market:

-

FLIR Systems (Thermal Cameras, MWIR Sensors)

-

Lynred (MWIR and LWIR Sensors, Focal Plane Arrays)

-

Lockheed Martin (Thermal Imaging Systems, MWIR Sensors for Defense)

-

Raytheon Technologies (MWIR Detectors, Thermal Cameras)

-

Thales Group (MWIR Sensors, Night Vision Systems)

-

Sensors, Inc. (Third Infrared Window Sensors, MWIR Detectors)

-

Xenics (MWIR Sensors, Thermal Cameras)

-

Leonardo DRS (MWIR and LWIR Thermal Imaging Cameras)

-

Northrop Grumman (MWIR Sensors, Thermal Imaging Systems)

-

Harris Corporation (Thermal Sensors, MWIR Detection Systems)

-

Vigo System (MWIR Photodetectors)

-

Emcore (MWIR and LWIR Sensors, Focal Plane Arrays)

-

Bosch Security Systems (Thermal Cameras, MWIR Sensors for Surveillance)

-

Jenoptik (MWIR Cameras, Optical Systems)

-

SCD (Semiconductor Devices) (MWIR Detectors, Thermal Imaging Solutions)

-

Teledyne DALSA (MWIR Imaging Sensors, Cameras)

-

Bae Systems (Thermal Cameras, MWIR Sensors for Military Applications)

-

AeroVironment (MWIR Sensors for UAVs, Surveillance Systems)

-

Intevac (MWIR Sensors, Infrared Detectors)

-

Raptor Photonics (MWIR Cameras, Photodetectors)

List of key suppliers of raw materials and components for the Mid-Wave Infrared (MWIR) sensor market:

-

II-VI Incorporated

-

Lynred

-

Teledyne DALSA

-

Emcore Corporation

-

Sensors, Inc.

-

Vigo System

-

Xenics

-

Jenoptik

-

Bae Systems

-

Flir Systems

-

Raytheon Technologies

-

Northrop Grumman

-

Thales Group

-

Lockheed Martin

-

Raptor Photonics

-

Intevac

-

Luxmux

-

Opto Engineering

-

STMicroelectronics

-

Hamamatsu Photonics

RECENT DEVELOPMENT

-

December 10, 2024, Teledyne FLIR and VSI Labs' testing of a fused-thermal imaging PAEB system showed it outperformed existing AEB systems during FMVSS No. 127 tests, which will be mandated in 2029. The new system successfully passed all tests, while three 2024 vehicles failed multiple nighttime scenarios, highlighting challenges for current AEB systems in low-visibility conditions.

-

December 1, 2024, Thales is upgrading the TALIOS targeting pod with AI enhancements, set to equip the French Air and Space Force's Rafales starting in 2026. The integration of deep learning technologies will enhance the Rafale's combat capabilities in complex environments.

-

December 17, 2024, L3Harris successfully demonstrated the integration of AI/ML with its WESCAM MX™-15 and MX™-10 EO/IR systems, alongside Overwatch Imaging's Automated Sensor Operator (ASO) software. This collaboration enhances object detection, situational awareness, and operational efficiency for defense and commercial applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.82 Billion |

| Market Size by 2032 | USD 20.41 Billion |

| CAGR | CAGR of 20.51% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sensors Product (Gamepads) Joysticks/ Controllers, Gaming Keyboards, Gaming Mouse, Headsets, Surfaces, Virtual Reality (VR) Devices, Cooling Fans, Web Camera, Others) • By Device Type (PC (Desktop and Laptop), Smartphones, Gaming Consoles), By Distribution Channel (Online, Offline) • By End-user (Casual Gaming, Professional Gaming) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | FLIR Systems, Lynred, Lockheed Martin, Raytheon Technologies, Thales Group, Sensors, Inc., Xenics, Leonardo DRS, Northrop Grumman, Harris Corporation, Vigo System, Emcore, Bosch Security Systems, Jenoptik, SCD, Teledyne DALSA, Bae Systems, AeroVironment, Intevac, and Raptor Photonics specialize in MWIR and LWIR sensors, thermal cameras, and imaging systems. |

| Key Drivers | • Increased military spending is fueling the growth of the MWIR sensors market. |

| Restraints | • Integrating MWIR sensors into existing systems such as drones, vehicles, and industrial equipment poses several significant challenges. |