Satellite Broadband Market Size & Growth:

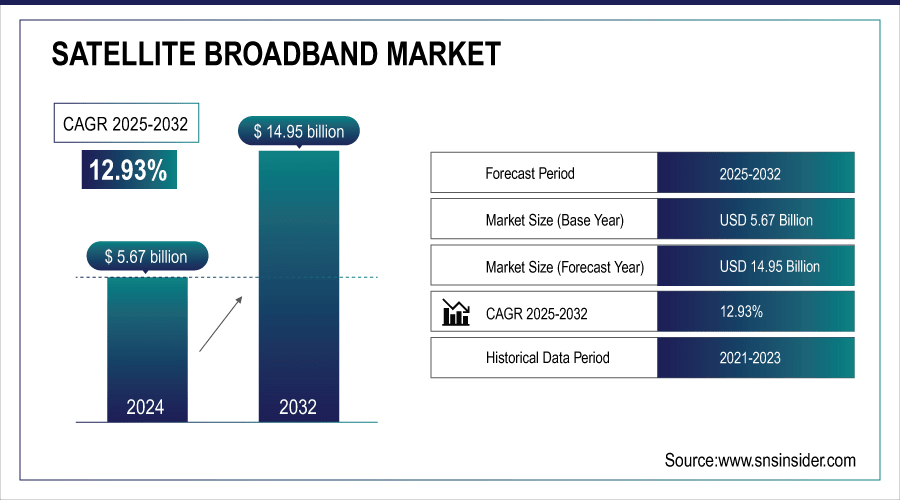

The Satellite Broadband Market size was valued at USD 5.67 billion in 2024 and is expected to reach USD 14.95 billion by 2032 and grow at a CAGR of 12.93% over the forecast period of 2025-2032.

The global market report covers Satellite Broadband Market trends, technological innovations, performance across different countries, players and regions, competitive landscape, share of different segments, and future growth prospects. Factors such as the increasing requirement for broadband internet access in remote regions across a variety of industries, a fast-growing deployment of LEO satellite constellations, and governments initiatives on a digital connectivity can be attributed to its growing expansion. Satellite broadband is becoming a critical driver of global digital inclusion, enabling the filling of connectivity gaps and supporting economic and social development in underserved and remote areas globally.

For instance, over 5,500 active satellites are currently in orbit, with more than 60% supporting communication services.

To Get more information on Satellite Broadband Market - Request Free Sample Report

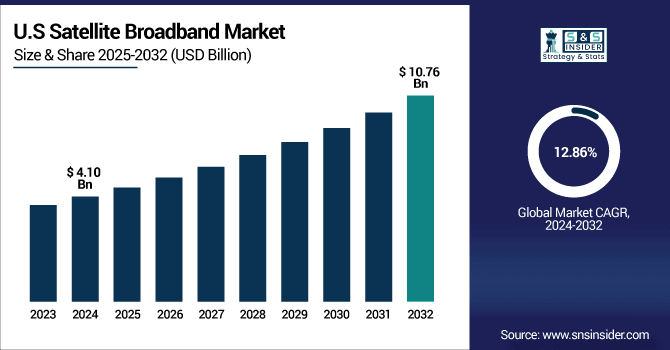

The U.S. Satellite Broadband Market size was USD 4.10 billion in 2024 and is expected to reach USD 10.76 billion by 2032, growing at a CAGR of 12.86% over the forecast period of 2025–2032.

The U.S. growth is propelled by large number of satellite service providers, the rapid advancements in the technology, and by governments rural broadband plans. Increasing need for enterprise-grade and defense communication networks and adoption of low-latency LEO constellations are expected to further spur growth. Within North America, the U.S. is expected to retain its leading position in the satellite broadband market, bolstered by supportive U.S. policies to improve connectivity in un-served and underserved areas.

For instance, current satellite broadband networks cover over 99% of U.S. households, including remote rural communities and islands.

Satellite Broadband Market Dynamics:

Key Drivers:

-

Rapid Deployment of Low Earth Orbit (LEO) Satellite Constellations Enhancing Service Quality and Coverage

Mega constellations such as SpaceX's Starlink, OneWeb, and Amazon's Project Kuiper are being deployed at an unprecedented pace, changing the face of satellite broadband. Compared to traditional GEO satellites, LEO networks offer much lower latency, significantly greater throughput, and far broader global reach. These technological improvements have rendered satellite broadband service more competitive with that of terrestrial services, appealing to both a consumer and enterprise market. At the same time, lower equipment costs and an easier installation process are making it more accessible. Not to be outmatched by any single technology, some governments have been actively accelerating deployments in partnership with the private sector to make sure even polar and oceanic regions get their high-speed internet access.

For instance, over $10 billion globally has been earmarked for satellite broadband partnerships with private operators.

Restraints:

-

Spectrum Licensing and Regulatory Challenges Hindering Market Expansion

The regulatory environments have long been complex for satellite internet, with scale disparities among nations when it comes to spectrum allocation, licensing fees and compliance burdens. Such challenges result in prolonged service launches, higher operating expenses, and restricted regions of operation. This involves participation from several national and international organizations, which often prolongs the approval period. The problem is compounded by competition for spectrum with terrestrial telecom operators. The absence of harmonized regulations globally gives rise to fragmentation and obliges providers to adjust their strategies according to regions preventing the market from scaling quickly enough.

Opportunities:

-

Expanding Role of Satellite Broadband in Government and Defense Communication Systems

Satellite broadband providers stand to gain greatly from increasing defence and government dependence on secure, high-bandwidth communications channels. In remote or conflict zones military operations, disaster management, border monitoring and urgent response teams more commonly rely upon robust, satellite-based networks. It is a strategic asset for the secured, encrypted, and real-time ground and project data transmission. Governments globally are partnering with satellite operators to improve national security communications, establishing long-term contracts that deliver steady revenue to service providers while supporting additional investments in modern systems.

For instance, more than 70% of humanitarian disaster-response communications in remote zones now depend on satellite broadband.

Challenges:

-

Addressing Space Debris and Orbital Traffic Management Concerns

The boom in LEO satellites has also raised space debris and collision concerns that could threaten the viability of satellite broadband. The industry is facing heightened scrutiny to adopt responsible orbital management practices, such as satellite deorbiting and collision-avoidance systems, among others. Neglect in these challenges could result in a regulatory clampdown, insurance cost escalations, and even service disruptions. In order to maintain safe operations, which is essential in enabling the scale-up of satellite broadband infrastructure — collaborative global frameworks for space traffic management are needed.

Satellite Broadband Market Segmentation Outlook:

By Type

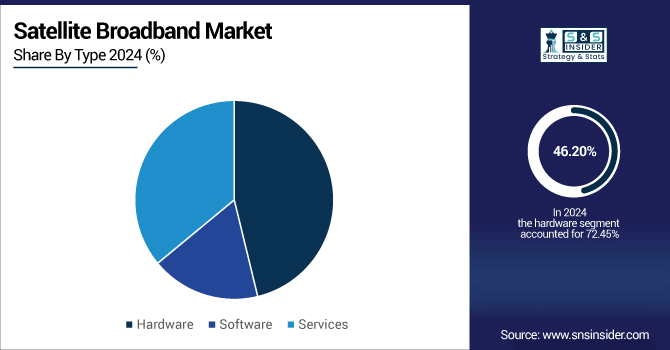

In 2024, Hardware segment held dominant revenue share of the Satellite Broadband Market at about 46.20% in 2024, having record demand for user terminals, antennas & modems which are required to be installed for activation of such services. To address those various connectivity requirements, providers such as Hughes Network Systems have been broadening high-performance ground equipment portfolios. Rapid deployment of LEO & MEO satellites has created demand for new hardware to provide guaranteed service performance in developed and developing markets.

The fastest growing segment is the Services segment, which will capture nearly 14% share of the global revenue by 2032 due to increasing demand for subscription-based broadband plans, managed network solutions, and enterprise-grade connectivity (CAGR of around 13.31% from 2024–2032). Viasat managed services growth, particularly for maritime and aviation use cases The growing adoption in government programs and remote industries, which supports growth, combined with value-added features such as cybersecurity, intensification customer loyalty.

By Application

Residential sector accounted for the largest revenue share of approximately 42.10% in 2024 of the Satellite Broadband Market, where it continues to be the most viable method of connecting rural homes without terrestrial infrastructure to high-speed internet. Starlink, via SpaceX, made some strides on this front—both consumer packages are cheap, and the terminals are designed to be installed with consumer tools. In many underserved areas globally, government subsidies and digital inclusion projects have further sped up uptake.

Government & Defense segment is projected to witness the fastest CAGR of approximately 14.29% during 2024–2032 due to the rising demand for secure communication with high bandwidth to ensure national security and disaster recovery. Over the decades, Inmarsat has remained a trusted partner delivering secure, mission-critical connectivity for defense agencies. Governments are working in partnership and are adding real-time coverage in areas that are critical for driving market expansion in a sustainable manner.

By Frequency Band

In 2024, the Ku Band segment was the largest revenue contributor to the Satellite Broadband Market, accounting for about 38.10% of the overall market share, due to its combination of wide footprint with high-volume data throughput with satellite communication, especially, for maritime, enterprise and rural applications. SES S.A. still taps into Ku Band capacity to ensure dependable connectivity solutions across the globe. The interoperability with GEO and LEO systems and installed infrastructure secures its widespread adoption in various industries.

The Ka Band segment is projected to have fastest CAGR of approximately 14.29% from 2024–2032 owing to its provision of higher capacity and high transmission speeds needed for high demand applications such as in-flight connectivity. To enhance coverage and improve performance, Eutelsat Communications has been busy adding Ka Band payloads. The Ke Band satellites are increasingly deployed to attract enterprise and government customers who want strong broadband service capabilities.

By End-User

The Satellite Broadband Market was led by the Telecommunications segment which accounted for approximately 40.50% in terms of revenue share for the year 2024 as it extends the coverage of the network, which is beneficial to serve rural and remote areas. Satellites have also been an important partner for more and more telecom operators in the last two decades, however Intelsat being a prominent partner for the satellite back haul of 5G and rural network. The dominance of this segment continues to be driven by the integration of satellite with terrestrial networks.

The Aviation segment is projected to grow at the fastest CAGR of approximately 15.23% during the forecast period of 2024–2032 due to increasing demand for in-flight connectivity. Panasonic Avionics Corporation has been developing its satellite-based IFC solutions for airlines around the globe. With LEO-based systems history under their belts improving speed and punching latency has brought satellite broadband a seat in the airliner passenger service row.

Satellite Broadband Market Regional Analysis:

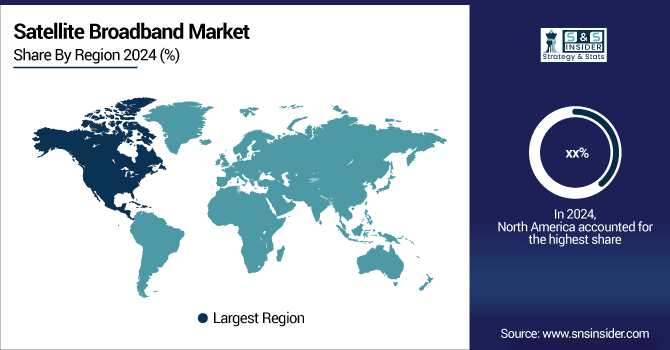

In 2024, North America held over one-third of revenue share in Satellite Broadband Market, thanks to a number of leading satellite operators, high rural connectivity coverage and robust public funding for broadband expansion projects. Regional power dynamics The U.S. establishes its leadership role in the technology and the first large scale LEO deployments.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

The U.S. dominates the North American satellite broadband market due to its advanced satellite infrastructure, strong presence of leading providers such as SpaceX and Viasat, robust government funding, and rapid adoption of LEO constellations for rural and enterprise connectivity solutions.

Asia Pacific is expected to be the fastest with an approximate CAGR of 13.78% during 2024–2032 due to large underserved population, internet expansion policies backed by the government, and adoption of cost-effective satellite-based solutions in wide scale. Both urban and remote areas are seeing service penetration accelerate as a result of the growth of the economy and the inevitable digital (and other sectors) transformation.

-

China leads the Asia Pacific satellite broadband market owing to large-scale government-backed satellite projects, rapid expansion of domestic providers such as China Satcom, growing demand in rural and remote regions, and integration of satellite networks into national digital transformation and connectivity initiatives.

Germany leads the European satellite broadband market with strong telecom infrastructure, government-backed rural connectivity projects, and high LEO adoption. Companies including SES and Deutsche Telekom fuel growth, supported by Industry 4.0 advancements and rising enterprise broadband requirements across the country.

-

Germany leads the European satellite broadband market with strong telecom infrastructure, government-backed rural connectivity projects, and high LEO adoption. Companies such as SES and Deutsche Telekom fuel growth, supported by Industry 4.0 advancements and rising enterprise broadband requirements across the country.

UAE dominates Middle East & Africa satellite broadband market, on the back of developed space programs, highly developed infrastructure, and increased broadband uptake. Brazil is the leader in Latin America, thanks to investments in rural connectivity, government support, and strong demand for satellite internet for rural and underserved communities.

Satellite Broadband Companies are:

Major Key Players in satellite broadband market are SpaceX, Hughes Network Systems, Viasat Inc., Eutelsat Communications, SES S.A., OneWeb, Inmarsat Global Limited, Telesat Canada, Iridium Communications Inc., Thuraya Telecommunications Company, Intelsat S.A., Globalstar Inc., Hispasat S.A., Singtel Satellite, Gilat Satellite Networks Ltd., Skycasters LLC, Yahsat, Kacific Broadband Satellites Group, Speedcast International Limited and Swarm Technologies Inc and others.

Recent Developments:

-

In July 2024, Hughes’ Jupiter 3 satellite (EchoStar XXIV) was launched aboard a SpaceX Falcon Heavy, offering up to 100 Mbps download speeds and enormous 500 Gbps throughput across the Americas.

-

In March 2025, SES partnered with Lynk Global to explore 'direct-to-device' (D2D) satellite services, enabling LEO satellites to connect directly with mobile phones without terrestrial infrastructure.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.67 Billion |

| Market Size by 2032 | USD 14.95 Billion |

| CAGR | CAGR of 12.93% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Hardware, Software and Services) • By Application (Residential, Commercial, Government & Defense and Others) • By Frequency Band (C Band, Ku Band, Ka Band, L Band and Others) • By End-User (Telecommunications, Maritime, Aviation, Energy and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | SpaceX, Hughes Network Systems, Viasat Inc., Eutelsat Communications, SES S.A., OneWeb, Inmarsat Global Limited, Telesat Canada, Iridium Communications Inc., Thuraya Telecommunications Company, Intelsat S.A., Globalstar Inc., Hispasat S.A., Singtel Satellite, Gilat Satellite Networks Ltd., Skycasters LLC, Yahsat, Kacific Broadband Satellites Group, Speedcast International Limited and Swarm Technologies Inc. |