Condensing Unit Market Report Scope & Overview:

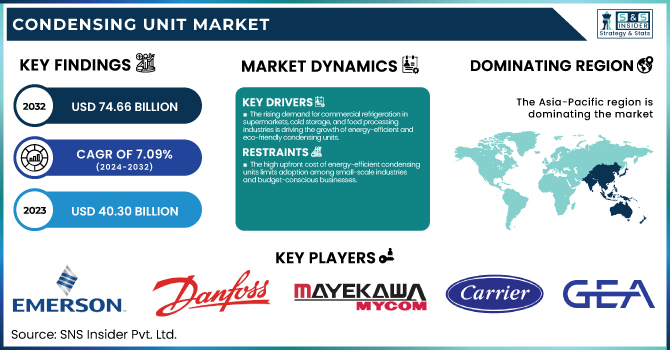

The Condensing Unit Market Size was estimated at USD 40.30 billion in 2023 and is expected to arrive at USD 74.66 billion by 2032 with a growing CAGR of 7.09% over the forecast period 2024-2032.

To Get more information on Condensing Unit Market - Request Free Sample Report

This report uniquely analyzes production output trends and capacity utilization rates across key regions, highlighting efficiency benchmarks and supply chain resilience in the condensing unit market. It offers exclusive insights into maintenance and downtime metrics, shedding light on operational bottlenecks and cost-saving strategies. A deep dive into technological adoption rates by region showcases the shift toward IoT-enabled, energy-efficient condensing units. Additionally, export/import data provides a trade flow analysis, identifying dominant exporters and emerging markets. To enhance value, the report also covers regulatory impact on refrigerants and competitive R&D investments, offering a forward-looking perspective on industry transformation.

The U.S. condensing unit market is projected to grow from USD 6.74 billion in 2023 to USD 12.89 billion by 2032, registering a CAGR of 7.48%. This growth is driven by increasing demand for energy-efficient refrigeration and HVAC systems across commercial and industrial sectors. Rising adoption of sustainable cooling solutions and technological advancements further fuel market expansion.

Condensing Unit Market Dynamics

Drivers

-

The rising demand for commercial refrigeration in supermarkets, cold storage, and food processing industries is driving the growth of energy-efficient and eco-friendly condensing units.

The growing demand for commercial refrigeration is a key driver of the condensing unit market, fueled by the expansion of supermarkets, hypermarkets, cold storage facilities, and food processing industries. As consumers increasingly turn to frozen and processed foods, businesses are adopting energy-efficient refrigeration solutions to maintain product quality and abide by regulatory standards. The worldwide cold chain business is turning into extra invaluable, because of the rise of e-commerce grocery deliveries and storage necessities for pharmaceuticals. Moreover, the rising adoption of advanced technologies, including Internet of Things (IoT)-based monitoring systems and natural refrigerants, are other trends steering the industry towards sustainability and operational efficiency. Market growth is also driven by rapid urbanisation and industrialisation in developing economies of Asia-Pacific and Latin America. Globally, Governments are imposing stringent energy efficacy standards, leaving no choice with manufacturers but to fabricate environmentally sound condensing units. This bodes well for the market, where we can expect further steady growth with an emphasis on efficiency, sustainability and innovation.

Restraint

-

The high upfront cost of energy-efficient condensing units limits adoption among small-scale industries and budget-conscious businesses.

The high initial investment cost of advanced condensing units is a significant restraint in the market. They are built with energy-saving technologies, eco-friendly refrigerants, and smart controls, which means that these are pricier in comparison to conventional models. Although they provide long-term benefits of reduced energy consumption and operational efficiency, the initial investment is often too high, especially for small-scale industries, startups, and businesses that operate within narrow profit margins. This makes small businesses wary of the upfront cost and puts off upgrades to more efficient systems. A new or retrofitted heating system would also be more expensive to install, and servicing the equipment requires specialist skills. While government incentives and financing options help, accessibility continues to be limited across many regions. This forces price-sensitive consumers to purchase lower-cost units, which may slow condensing unit acceptance rates even further, only postponing its larger energy, cost, and emissions reductions in the long term.

Opportunities

-

The expanding cold chain industry, driven by e-commerce and food safety regulations, is increasing demand for advanced refrigeration and condensing units.

The expanding cold chain industry is a key driver for the condensing unit market, fueled by the rapid rise of e-commerce, online grocery delivery, and food distribution networks. As consumer needs increasingly shift to perishable goods such as fresh produce, dairy, meat, and frozen foods, retailers and logistics providers are making significant investments in cold storage facilities and temperature-controlled transportation. This growth is also reinforced by the pharmaceutical sector, where vaccines, biologics, and temperature-sensitive drugs have stringent refrigeration requirements. Besides, governments all over the world have been introducing strict regulations on food safety and storage, which also contributes to the increasing need for efficient and reliable refrigeration systems. Along with the growing demand for energy-efficient and eco-friendly refrigerants in cold storage, it is expected to lend a range of opportunities for the players involved in the manufacturing of advanced condensing units. Rising global trade and urbanisation will support cold chain infrastructure and market growth, with condensing units being an essential contributor to temperature-controlled chain logistics functions.

Challenges

-

Supply chain disruptions in the condensing unit market stem from geopolitical tensions, trade restrictions, and material shortages, impacting production timelines and costs.

Supply chain disruptions pose a significant challenge to the condensing unit market, affecting production timelines and component availability. Geopolitical tensions, including trade wars and sanctions, can prevent access to key materials like copper, aluminum, and refrigerants, increasing price volatility and supply shortages. Procurement still becomes more challenging due to trade restrictions / import-export regulations, leading manufacturers to diversify suppliers or move production plants. Advanced, electronically controlled, condensing units have also been impacted by semiconductor shortages. On top of that, increased freight costs and port congestion compound the pain and cut into profitability. To minimize such risks, companies are diversifying their supplier networks, investing in regional manufacturing, and adopting digital supply chain management solutions.

Condensing Unit Market Segmentation Analysis

By Type

The Air-cooled segment dominated with a market share of over 65% in 2023, due to its affordability, ease of installation, and minimal maintenance requirements. Air-cooled condensing units are not reliant on a continuous water supply like water-cooled units, reducing operating costs and making this type of unit well-suited for places with limited access to water. Things are widely used in commercial refrigeration, cold storage, supermarkets, & industrial cooling applications. Their wide usage also stems from their compactness and low environmental effects. It is highly popular among businesses due to its reliable and easily serviceable nature, designed to suit varying climatic conditions. This also means that as energy efficiency regulations become stricter, new air-cooled technology creates added incentive for its use, further cementing air-cooled for market dominance.

By End-Use

The Air Conditioning segment dominated with a market share of over 48% in 2023, due to its extensive application in residential, commercial, and industrial sectors. The prevailing trend of growing urbanization, increased population, and disposable incomes has drastically improved the demand for air conditioning systems, especially in developing economies. Moreover, the growth of commercial infrastructure, such as office buildings, shopping malls, and hotels, has contributed to the demand for effective cooling systems. Market growth is also aided by technological advancements, such as energy-efficient and inverter-based condensing units. Additionally, increased adoption rates are driven by the impact of climate change and rising global temperatures. The growing government regulations to promote energy-efficient and eco-friendly refrigerants are also boosting the strength of the air conditioning segment in the condensing unit market.

By Application

The Commercial segment dominated with a market share of over 53% in 2023, driven by the increasing demand for refrigeration in supermarkets, restaurants, convenience stores, and cold storage facilities. Increasing urbanization and changing consumer preferences have led to a rapid expansion of food retailing, which in turn has significantly increased the demand for effective refrigeration systems. Moreover, strict regulations for food safety that require the appropriate storage conditions are projected to drive the market growth. The dominance of the segment is other supported by developments in energy-efficient and environment-friendly refrigeration technologies as well. Manufacturers are targeting innovative product developments that can help businesses get cost-effective and environmentally friendly cooling solutions. The increasing demand for fresh and frozen food products, along with growing retail infrastructure, strong Commercial segment's position.

By Compressor Type

The Reciprocating Compressor segment dominated with a market share of over 72% in 2023, primarily due to its extensive application across commercial refrigeration, industrial processes, and air conditioning systems. These compressors are generally preferred due to their performance as well as price over longer life spans, and they have been useful for many different cooling applications. Their performance across a wide range of loading speeds also makes them even more reliable in sectors such as food & beverage, pharmaceuticals, and cold storage. Moreover, reciprocating compressors also possess ease of maintenance and repair, further enhancing their cost benefits over the long run. Due to the increasing demand for refrigeration units, ice cream display cabinets, and industrial cooling applications in supermarkets and convenience stores, the growing demand for this type of refrigerating solution continues to outpace other compressor types and ensure its dominance in the current market environment.

Condensing Unit Market Regional Outlook

Asia-Pacific region dominated with a market share of over 45% in 2023, due to rapid industrialization, increasing demand for refrigeration in food processing, and a growing commercial sector. In countries such as China, India, and Japan, cold storage, supermarkets, and industrial refrigeration are seeing massive growth, which in turn prospers the market. The growing food & beverage sector in the region, with increasing disposable income, is driving the demand for effective cooling solutions. Moreover, initiatives taken by the government to promote energy-efficient refrigeration systems are also driving the market. These demands are also driven by the expanding pharmaceutical and healthcare industries, which need precise temperature control for storage as well. Asia-Pacific remains the largest market for condensing units, owing to a large manufacturing base and consistent technological developments in the region, leading to top players and investments.

North America is the fastest-growing region in the Condensing Unit Market, driven by the increasing adoption of energy-efficient refrigeration systems. High-GWP refrigerants are being phased out due to strict environmental regulations, which means that businesses are being pushed to invest in advanced condensing units that meet sustainability standards. The booming retail and foodservice industries, such as supermarkets, cold storage facilities, and restaurants, are increasing the need for reliable and efficient refrigeration solutions. Increasing consumer inclination towards frozen and packaged food products fuels the market growth as well. Further, with technological advancements such as smart monitoring and IoT-enabled refrigeration systems boosting efficiency and reducing operational costs, North America is emerging as a primary growth market for the condensing unit industry.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players in the Condensing Unit Market

-

Emerson Electric Co. (Copeland Scroll Condensing Units)

-

Frigogas (Refrigeration Condensing Units)

-

Danfoss (Optyma Condensing Units)

-

Mayekawa Mfg. Co. (Mycom Condensing Units)

-

Carrier Global Corporation (AquaForce and AquaSnap Condensing Units)

-

Mitsubishi Heavy Industries (Commercial Refrigeration Condensing Units)

-

Baltimore Aircoil Company (Evaporative Condensing Units)

-

Trane Technologies Plc (Trane Split Condensing Units)

-

BITZER SE (Ecoline and Ecostar Condensing Units)

-

GEA Group Aktiengesellschaft (GEA Bock Condensing Units)

-

EVAPCO, Inc. (Evaporative Condensers)

-

SCM Frigo S.p.A. (CO2 Condensing Units)

-

Daikin Applied (ZEAS and Conveni-Pack Condensing Units)

-

Johnson Controls International Plc (YORK Condensing Units)

-

Tecumseh Products Company (AE and AK Series Condensing Units)

-

Heatcraft Worldwide Refrigeration (Quantum and Hypercore Condensing Units)

-

Panasonic Corporation (CO2 and R290 Condensing Units)

-

Lennox International Inc. (L Series Condensing Units)

-

Frascold S.p.A. (P Series and Z Series Condensing Units)

-

Bitzer Kühlmaschinenbau GmbH (Octagon and VARISPEED Condensing Units)

Suppliers for (Energy-efficient refrigeration and HVAC solutions) Condensing Unit Market

-

Danfoss

-

Bitzer

-

Copeland

-

Emerson Electric Co.

-

Carrier Global Corporation

-

Finpower Aircon

-

Abe & Hex India Private Limited

-

Godrej & Boyce Manufacturing Company Limited

-

Panasonic India Private Limited

-

Embraco

Recent Development

In April 2024: Mitsubishi Heavy Industries Thermal Systems launched the KXZ3 Series of multi-split air conditioners, adopting the R32 refrigerant with a GWP of 675, significantly reducing environmental impact. The new series, featuring models ranging from 22.4kW to 33.5kW, will be introduced in Europe this summer, followed by Australia, New Zealand, and Turkey.

In February 2024: Panasonic Europe expanded its CO₂ outdoor condensing unit range by launching a 20HP model in the European market. Designed for supermarkets and industrial process cooling, it supports applications like walk-in cold rooms, freezers, display cases, and blast chillers, enhancing refrigeration efficiency for food retail and processing.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 40.30 Billion |

| Market Size by 2032 | USD 74.66 Billion |

| CAGR | CAGR of 7.09% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Peristaltic Pumps, Diaphragm Pumps, Piston/Plunger Pumps, Others) • By End-use (Pharmaceutical, Water & Wastewater, Food & Beverage, Oil & Gas, Chemical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Emerson Electric Co., Frigogas, Danfoss, Mayekawa Mfg. Co., Carrier Global Corporation, Mitsubishi Heavy Industries, Baltimore Aircoil Company, Trane Technologies Plc, BITZER SE, GEA Group Aktiengesellschaft, EVAPCO, Inc., SCM Frigo S.p.A., Daikin Applied, Johnson Controls International Plc, Tecumseh Products Company, Heatcraft Worldwide Refrigeration, Panasonic Corporation, Lennox International Inc., Frascold S.p.A., Bitzer Kühlmaschinenbau GmbH. |