Construction Sealants Market Report Scope & Overview:

Get More Information on Construction Sealants Market - Request Sample Report

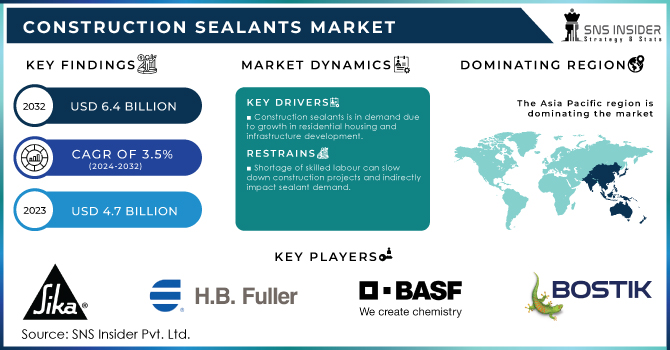

The Construction Sealants Market Size was valued at USD 4.7 billion in 2023, and is expected to reach USD 6.4 billion by 2032, and grow at a CAGR of 3.5% over the forecast period 2024-2032

The construction sealants market has been witnessing a gradual increase in the use of advanced materials and hybrid polymers due to the advancements in material science for separating the numerous demands arising from modern construction projects. Hybrid polymer sealants combine the best characteristics of several sealant chemistries like silicone, polyurethane, and acrylic to create products with improved adhesion, movement, and durability. This versatility in the application of construction materials in domestic residential, commercial, and industrial construction is because these sealants stick well on a variety of surfaces, such as metals, concrete, and plastics.

Hybrid polymer sealants contain few to no VOCs (volatile organic compounds), which fits the trend toward sustainable building materials. Consequently, these tools contribute indirectly to the construction sector initiative for building high-performance green systems, making them a building durability and integrity trend.

In 2023, Henkel launched its latest line of hybrid polymer-based sealants under the Loctite brand, designed to provide high durability and flexibility in harsh environmental conditions. These sealants are engineered with low VOC content, aligning with the market’s demand for sustainable, eco-friendly materials. This launch underscores Henkel’s commitment to sustainable construction solutions.

Moreover, rapid urbanization led opening of infrastructure spaces, which has paved the way for construction activities around the globe, particularly in new economies. Huge infrastructure investments specifically, transportation networks, commercial buildings, and residential housing are being directed into government initiatives from China’s Belt and Road Initiative to India’s Smart Cities Mission. These construction projects need to be built with quality construction sealants for durability, and structural integrity, and be resistant to environmental factors. The extensive usage of high-performance sealants due to expansive development towards the durability of infrastructure encompassing buildings, bridges, and many other infrastructure types that improve the lifecycle and safety of the cities caters to the high demand for these products, backing growth for the defined market.

According to the Global Infrastructure Hub, emerging economies face an estimated USD 15 trillion infrastructure investment gap by 2040, driven largely by urbanization. This significant gap has spurred governments to increase spending on durable, long-lasting infrastructure, raising demand for advanced construction sealants essential for structural integrity.

Construction Sealants Market Dynamics

Drivers

-

Rising demand for durability and offer long-lasting performance

-

Construction sealants are in demand due to growth in residential housing and infrastructure development.

Construction sealants are primarily driven by an increase in residential housing and growth in overall infrastructure development. With rapid urbanization across the globe, the demand for both new housing unit construction and repairs continues to grow as populations become more densely packed. This phenomenon is especially evident in developing countries with rapid urban growth and housing programs sponsored by the government. Construction sealants are important in providing long-lasting use and energy savings in a residential building. By providing watertight seals around windows, doors, and other joints, sealants keep buildings whole, prevent energy waste, and serve as an important means of indoor air quality control the last being a focus for eco-friendly customers.

Beyond housing, infrastructure development, including bridges, smart highways, and public buildings is also driving demand for strong construction sealants. High-performance materials are needed for large-scale projects, usually funded by governmental programs to endure different environmental stresses, from temperature extremes to moisture exposure. Pars Sealants are ideal for infrastructure projects with long service lives where superior adhesion and flexibility to endure structural movement and environmental degradation over time are required. Thus, the growing focus on resilient infrastructure and energy-efficient buildings is making construction sealants a major element in modern construction practice, thereby contributing to global market growth.

According to the United Nations (2022), the global urban population is expected to grow from 4.4 billion in 2020 to 6.7 billion by 2050, representing a sharp increase in demand for residential housing.

Restraint

-

Shortage of skilled labour can slow down construction projects and indirectly impact sealant demand.

One of the most critical restraints of the construction sealants market is the lack of skilled labor availability, which can delay construction to some extent while also affecting demand for construction sealants. Reasonable use of sealants requires skilled individuals who have expertise in proper application techniques; that is to say, the skill set needed to ensure that the sealants are installed properly and function adequately. However, without sufficient labor, project timelines could be pushed back causing a ripple effect on demand for construction materials such as sealants. In addition, improper application due to untrained professionals will result in poor performance of the sealant, even causing leakage, energy loss, and structural damage. This has an even more deleterious effect on construction quality, leading to more maintenance costs, which would make it an undesirable investment in sealants. The construction industry is witnessing a decline in the number and quality of construction workers due to several factors such as demographic shifts, poor training, migration, etc. This is anticipated to restrict the growth of the construction sealants market, which can hamper the long-term prospects of the market.

Opportunities

-

A growing popularity for eco-friendly, low-VOC construction sealants.

The construction industry is experiencing a significant shift towards eco-conscious practices. This is driving a surge in demand for low-VOC and green construction sealants. focus on sustainability is leading architects and builders to prioritize eco-friendly materials. This translates to a higher demand for green sealants. Regulatory bodies like the US EPA, Europe's REACH program, and LEED are implementing stricter rules on VOC emissions. This is pushing manufacturers to develop and offer low-VOC sealants that comply with these regulations. The shift towards greener construction presents a significant growth opportunity for manufacturers who can develop innovative and sustainable sealant solutions.

Construction Sealants Market Segmentation Overview

By Resin Type

The silicone held the largest market share around 52% in 2023. the properties offered by silicone-based construction sealants make the product suitable for a wide range of applications. These are suitable for interior and exterior sealing work in construction, offering superior flexibility, durability, and extreme temperature resistance. They offer durable weather-resistant seals while displaying superior resistance against UV rays, moisture, and adverse external environment disintegration. It is this movement, which is adjusted for by thermal contraction and expansion that makes silicone sealants so useful as a seal in windows, doors, and other joints in buildings. Moreover, silicone sealants offer excellent long-term performance, thereby minimizing maintenance and replacement, thereby supporting the adoption. With a rising emphasis on building energy-efficient structures and sustainable construction practices, the need for silicone sealants increases to ensure increased insulation and minimal energy loss, which further establishes the segment as a key market player.

By Application

The glazing segment held the largest market share around 44.6% in 2023. It is driven by the increasing focus on energy-efficient and visually appealing buildings. High-performance sealants that provide high adhesion, flexibility, and durability are needed for glazing, and the sealing of windows, doors, and glass panels. The glazing application where sealants form an airtight and watertight seal (which prevents heat loss, air leakage, and moisture ingress) hence directly contributes to a building’s energy efficiency and comfort. This demand is further propelled by the growing trend of large glass facades, energy-efficient windows; and the growing popularity of curtain walls in residential and commercial construction. Furthermore, they also promote UV, weather, and chemical resistance while keeping the glass intact. The demand for buildings with modern and sustainable designs from architects and builders is also contributing to the growing market share of the glazing segment, as it is vital for ensuring insulation, safety, and aesthetics of buildings.

By End-Use

The Residential segment held the largest market share around 42% in 2023. It is due to the increasing demand for new housing as well as the renovation of homes in the world, the residential segment thus dominates the construction sealants, in terms of high market share. The rise in demand for residential buildings is high, especially in emerging economies as urbanization grows and populations continue to grow. Construction sealants are used during the process of building a house, for example, to seal windows, doors, the roof, and joints, important functions that provide residents with energy efficiency, weather resistance, and soundproofing. The increasing interest among consumers in energy-efficient homes that help reduce utility bills, in addition to government regulations mandating sustainability across all segments, has further enhanced the need for sealants.

Construction Sealants Market Regional Analysis

Asia Pacific held the largest market share around 44% in 2023. The construction sealants market in the Asia-Pacific region accounts for the largest share, led by rapidly accelerating urbanization, industrialization, and massive infrastructure development in major countries such as China, India, Japan, and Southeast Asian countries. Asia-Pacific comprises some of the highest GDP-growing economies and experiences rapid growth in residential and commercial construction activities. Significant investments in infrastructure-related projects are being driven by government initiatives such as the Belt and Road Initiative in China and the Smart Cities Mission in India, which are creating significant demand for construction materials, including sealants. Furthermore, the rapidly growing population of the middle class in the region has escalated the demand for anticipated housing and good-quality buildings which in turn is expected to propel the requirement for sealants during energy-efficient and durable construction. With the existing industrial base in the area and low-cost manufacturing with favorable regulations, domestic sealant manufacturers are able to supply not only regional needs but also national and global supply needs. All these factors together account for Asia-Pacific being the dominating region in the construction sealants market.

the China National Development and Reform Commission (2022) report, which highlights that China alone has invested over USD 1 trillion in infrastructure projects as part of the Belt and Road Initiative (BRI) since its launch. This initiative has led to significant construction activities across Asia and other regions, driving the demand for materials like sealants, which are essential for ensuring the durability and energy efficiency of large-scale infrastructure projects.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players in Construction Sealants Market

-

Bostik (Bostik Seal & Fix, Bostik Window & Door Sealant)

-

Sika (Sikaflex-11 FC, Sikasil-P)

-

H.B. Fuller (FullerBond, Titebond)

-

Henkel (Loctite, Pattex)

-

BASF (MasterSeal, Elastopor)

-

Dow (Dow Corning 791, Dow Corning 995)

-

Wacker Chemie AG (Germany) (Silicone Sealant, Elastosil)

-

Soudal (Soudal Silirub, Soudaflex)

-

Konishi (Super Fix, Konisil)

-

DAP Products (DAP Silicone Sealant, DAP Caulk)

-

Pidilite (Fevicol, M-Seal)

-

Yokohama Rubber (Yokohama Sealant, YS-5700)

-

Selena (Tytan Professional, Selena Sealant)

-

Kömmerling (Kömmerling 2K, KÖDISPACE)

-

PCI (PCI Sealing, PCI Soudal)

-

Hodgson Sealants (Hodgson Silicone Sealant, Hodgson Hybrid Sealant)

-

Pecora (Pecora 895, Pecora 890)

-

Euclid (EucoSeal, EucoFlex)

-

3M (3M Marine Adhesive Sealant, 3M Window Glazing)

-

MAPEI (Mapeflex, Mapei Polyurethane Sealant)

Recent Development:

-

In June 2023, Sika opened a new plant in Kharagpur. This facility will cater to the West Bengal region's massive population (over 100 million) by producing mortar products, concrete admixtures, and shotcrete accelerators.

-

In May 2023, Henkel inaugurated a 70,000-square-foot Technology Center in Bridgewater, New Jersey. This interactive space showcases Henkel's entire technology portfolio – adhesives, sealants, functional coatings, and specialty materials. The center fosters collaboration with partners and customers across over 800 industries to develop cutting-edge solutions.

-

In March 2022, Bostik partnered with DGE to distribute their products across Europe, the Middle East, and Africa. This agreement, effective January 2022, includes Born2Bond engineering adhesives (ideal for "by-the-dot" bonding in electronics, luxury packaging, etc.) and Bostik's Industrial Adhesives & Sealants used in various manufacturing and assembly applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.7 Billion |

| Market Size by 2032 | US$ 6.4 Billion |

| CAGR | CAGR of 3.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Resin Type (Silicone, Polyurethane, Polysulfide, Plastisol, Emulsion, Butyl-Based, Others) • By Application (Glazing, Flooring & Joining, Sanitary & Kitchen, Others) • By End-Use Industry (Residential, Industrial, Commercial) • By Function (Bonding, Protection, Insulation, Soundproofing, Cable Management) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bostik (France), Sika (Switzerland), H.B. Fuller (U.S.), Henkel (Germany), BASF (Germany), Dow (U.S.), Wacker (Germany), General Electric (U.S.),, ITW (U.S.), Soudal (Belgium), Konishi (Japan), DAP Products (U.S.), Pidilite (India), KCC (Korea), Yokohama Rubber (Japan), Franklin (U.S.), Selena (Poland), Kömmerling (Germany), PCI (Germany), Hodgson Sealants (U.K.), Pecora (U.S.), Euclid (U.S.), 3M (U.S.), MAPEI (Italy), Asian Paints (India), Yokohama Rubber (Japan) |