Video Multiplexer Market Size & Trends:

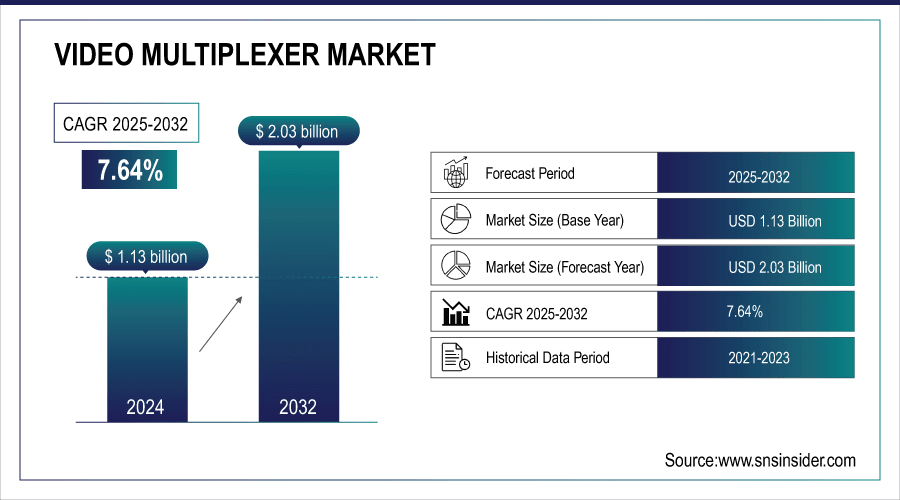

The Video Multiplexer Market size was valued at USD 1.13 billion in 2024 and is expected to reach USD 2.03 billion by 2032 and grow at a CAGR of 7.64% over the forecast period of 2025-2032.

The global market includes comprehensive video multiplexer market analysis, market drivers and restraints, opportunities and challenges, regional, type, application, and end-user insights. The increase is supported by increasing demand in surveillance, broadcasting, transportation and industrial applications. Growing high demand for video transmission, video compression, and real-time streaming has accelerated the adoption rate whereas advancements in IP and cloud-based solutions add might to the existing infrastructure for catering to the clients in various industries with scalable video management systems.

For instance, more than 65,000 smart city and transportation projects use video multiplexers for real-time monitoring globally as of 2025.

To Get more information on Video Multiplexer Market - Request Free Sample Report

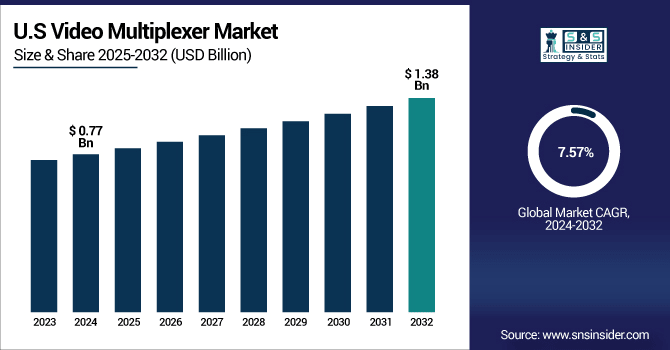

The U.S. Video Multiplexer Market size was USD 0.77 billion in 2024 and is expected to reach USD 1.38 billion by 2032, growing at a CAGR of 7.57% over the forecast period of 2025–2032.

The U.S. market is experiencing rapid growth fueled by the widespread use of surveillance solutions in government buildings, businesses, and smart city initiatives. broadcasters and OTT streaming are making larger investments, further pushing the demand for sophisticated video multiplexers. This is driving adoption as the security requirements continue to rise and the need for real-time monitoring becomes more abundant. Furthermore, ongoing technological advancements including IP-based video systems and integration with cloud-based platforms are anticipated to further propel the video multiplexer market growth in the country, owing to significant advancements in terms of improving efficiency.

For instance, more than 60% of broadcasters and OTT platforms in the U.S. now deploy multiplexers to handle multiple HD feeds simultaneously.

Video Multiplexer Market Dynamics:

Key Drivers:

-

Expansion of Broadcasting and Streaming Industries Enhances the Need for Efficient Video Multiplexing Solutions

Technological developments in broadcasting and streaming globally are providing lucrative opportunities for video multiplexer adoption. As consumers are demanding more HD and UHD content, broadcasters need high density technologies to process multiple video streams at once. Multiplexers optimize the compression, transmission, and control of high-bandwidth video data in very low latency packets. In addition, the rapid growth of OTT platforms and live streaming on-the-go is quickly pushing towards the operational need of multiplexers for content delivery and distribution networks. This unprecedented proliferation of media and entertainment will certainly spark market growth.

For instance, over 50% of smart city surveillance networks in major metropolitan areas integrate video multiplexers for real-time monitoring.

Restraints:

-

High Initial Deployment Costs and Infrastructure Limitations Hamper Wider Adoption of Video Multiplexer Systems

High initial cost of video multiplexer systems, especially for large scale installation is one of the major restraints affecting the market. Such systems are expensive for small and medium enterprises and residential users. Infrastructure requirements — storage solutions, servers, and high-speed connectivity — contribute to the cost pressure too. The hurdles are even higher for developing economies where budgets are leaner, curbing swift uptake. Currently, the increasing demand for video multiplexer systems across various industries is indirectly hampered due to this financial barrier, which brings a slowdown for mass penetration of this particular system.

Opportunities:

-

Rising Smart City Projects and Government Surveillance Programs Create Strong Growth Potential for Video Multiplexer Adoption

Investment in development of smart city is encouraging strong growth tempo for video multiplexer market across the globe. Advanced surveillance systems are being employed by governments to ensure urban safety, traffic monitoring, and public security across regions. The infrastructure requires video multiplexers capable of handling massive streams of video data from numerous cameras placed across cities. Their relevance is further amplified with integration with IoT, AI-driven analytics and cloud platforms. Increasing deployment of smart city projects, especially locally in Asia Pacific and Middle East would spur the demand for effective video multiplexing as per the request.

For instance, more than 60% of advanced traffic monitoring systems in smart cities use multiplexers to enable real-time video processing.

Challenges:

-

Rapid Technological Advancements and Constant Need for Upgrades Pose Operational and Financial Burdens

Video multiplexer market is changing very fast, with innovation for compression, streaming and also for IP based technology happening every day. Though undertakes exponents development, it exposes end-user to problem of obtaining a new replacement subsystem with regards production to remain compatible whenever made with periodically to seem efficient. Regular broadcasting standards updates, AI-integration, and 4K/8K content delivery only add to the financial burden. Keeping pace with these advancements is a challenge for limits, both businesses and government agencies. This induces reluctance in investing, especially in small-medium scale applications.

Video Multiplexer Market Segmentation Analysis:

By Type

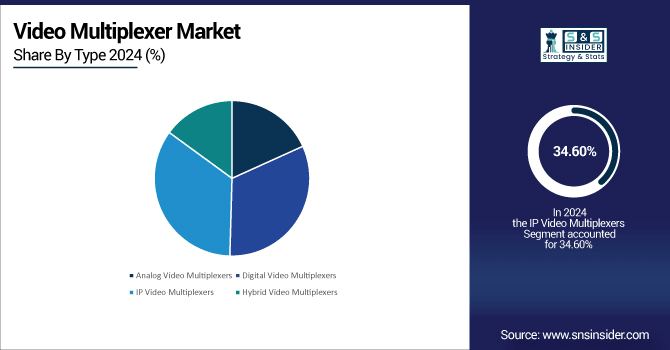

The IP Video Multiplexers segment held the largest revenue share in 2024, of approximately 34.60%. Compatibility with cloud platforms and advancements in analytics and set up scalable networks of digital security cameras are driving extensive adoption of these cameras globally and also in IP surveillance and broadcast systems. These multiplexers provide efficient integration with modern infrastructure and allow up to 32 high-quality video feeds to be easily processed in a solid-state form. They become the first choice of enterprises, government projects, and large-scale surveillance networks due to their dependability and Internet of Things (IOT) systems connectivity.

Digital Video Multiplexers segment is estimated to grow rapidly with the fastest CAGR of approximately 8.58% during the forecast period 2024–2032. Growth is driven by growing demand in broadcasting, enterprise, and industrial automation applications. Firms such as Hikvision are diversifying their digital video solutions, providing better compression, uninterrupted tracking and pocket-friendly systems. Due to their flexibility and the amount of performance they provide for the price, digital multiplexers are quickly phasing out analog systems. Increasing adoption of this segment in media distribution, smart facilities, and enterprise security is further driving the rapid growth of the segment.

By Application

Security and Surveillance segment accounted for the highest revenue share of about 44.50% in 2024 for the Video Multiplexer Market. High demand for real-time monitoring in public infrastructure, enterprises, and residential areas is another factor contributing to adoption. Advanced surveillance for law enforcement and smart city projects is funded by the government. Multiplexers assist in merging multiple camera inputs into a single system, thereby providing an effective solution to alleviate crime and provide security. Such increasing emphasis on dependability and scalability of security solutions, consolidates the hold on this segment.

The Traffic Monitoring segment will be attributed to the fastest growing CAGR of approximately 10.09% during the forecast period of 2024–2032. Introduction of AI based traffic management systems within a short span of time further driving the adoption. To ease scaling from this point on, companies such as Axis Communications are innovating for traffic monitoring multiplexers beasts with embedded analytics. Multiplexers play an essential role in real-time monitoring, which in turn is essential for traffic data analysis and automated control. This segment is gaining traction in smart city mobility initiatives, resulting in rapid market growth in urban areas globally.

By Technology

Compression Technology segment is the largest segment holding about 30.20% of revenue market share. In large-scale deployments, its ability to optimize video quality while reducing bandwidth and storage needs is crucial. Surveillance, broadcasting, compression can saved cost and no compromise in performance. The increasing adoption of HD and UHD video content makes compression all the more important. Due to this high demand, it has become the most widely adopted technology for video multiplexer solutions globally.

The Streaming Technology segment is anticipated to exhibit the highest CAGR of 8.42% during 2024 to 2032. Part of this growth is propelled by the expansion of OTT platforms, augmented with cloud-based video services. Advanced technologies for streaming multiplexers optimized for real-time video distribution reflect a new approach from companies such as Harmonic Inc. that have previously enabled launches with minimal time delay. They are designed to provide entertainment, broadcasting, and surveillance solutions. Thanks to the increasing adoption of live streaming, interactive services, and video-on-demand platforms is driving demand, thereby making streaming technology the fastest-growing category of the market.

By End-User

In 2024, the government segment for video multiplexer market share was the largest, at 34.50%. So, its leadership is driven by large-time adoption at defense use cases, law enforcement and smart city projects. The need for public safety and national security has led governments to closely monitor urban settings, thereby using multiplexers for surveillance and traffic control purposes upto a great extent. Demand is reinforced by robust budget allocations and regulatory mandates, along with integration with AI-based monitoring technologies, rendering government applications the most prominent end-user segment.

Transportation segment is estimated to grow with the fastest growth rate of 9.21% CAGR during 2024–2032. Demand is being driven by growing adoption of intelligent transport systems, aviation monitoring, and rail transport surveillance. Bosch Security Systems has already introduced such integrated multiplexer-based traffic and transport solutions, which will facilitate real-time video monitoring. These technologies are designed with passenger safety in mind and helping to reduce roadway congestion and improving operational efficiency. Governments are investing in smart mobility initiatives, which is driving the transportation segment, as it is the most evolving end-user segment for the market.

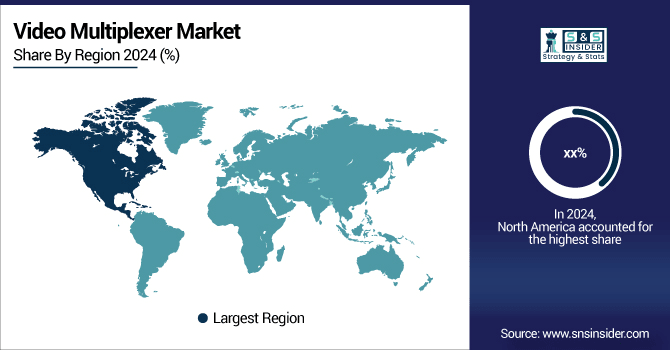

Video Multiplexer Market Regional Analysis:

North America is a significant region in the video multiplexer market. The U.S. is the largest market due to the high adoption of the technology in surveillance, broadcasting, and enterprise applications. The demand of the region is further driven by growing investments in smart city projects and OTT platforms. Meanwhile, Canada and Mexico continue to grow steadily with public safety, transportation monitoring, and digital infrastructure expansion garnering more attention.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

The U.S. dominates the North America Video Multiplexer Market due to extensive investments in surveillance, government security projects, and enterprise monitoring systems. Strong demand from broadcasting and OTT platforms further strengthens its leadership position, supported by advanced IP-based video infrastructure.

In 2024, Asia Pacific accounted for the largest share of the Video Multiplexer Market in terms of revenue, at around 38.20%, and is likely to grow at the fastest CAGR of 8.48% during the forecast period, 2024 to 2032. Rapid urbanization, wide deployments of smart city programs, and large scale government surveillance projects have shifted the region to a leadership position. China, India, and Japan are among the top countries embracing the technology, with backing from robust infrastructure, broadcasting, and public safety investments. The increasingly larger consumer bases and demand for a wide range of automated security systems ensures that the Asia pacific region is the leading area in this market.

-

China dominates the Asia Pacific Video Multiplexer Market with massive government surveillance initiatives, smart city projects, and rapid urbanization. Its strong manufacturing base and investments in advanced broadcasting and security infrastructure reinforce China’s leadership across regional video multiplexer adoption.

Europe represents a significant share of the Video Multiplexer Market, driven by strong adoption in broadcasting, smart infrastructure, and enterprise security solutions. Countries such as Germany, the U.K., and France are leading demand with investments in public safety and industrial automation. Rising focus on data protection, smart city projects, and advanced streaming platforms further enhances market growth across the region.

-

Germany leads the European Video Multiplexer Market due to advanced industrial automation, widespread surveillance adoption, and strong broadcasting technology. Significant investments in smart city initiatives and security infrastructure further solidify its position as the region’s top contributor.

In the Middle East & Africa, countries such as the UAE, Saudi Arabia, Qatar, and South Africa are driving the Video Multiplexer industry through investments in smart infrastructure and security solutions, with the rest of the region steadily adopting advanced technologies. Similarly, in Latin America, Brazil and Argentina lead market growth, supported by expanding broadcast and surveillance systems, while other countries gradually contribute to regional adoption.

Video Multiplexer Companies are:

Major Key Players in Video Multiplexer Market are Analog Devices, Böning Automationstechnologie GmbH & Co. KG, Moog Components Group, FTA Bvba, Imagine Communications, Harmonic Inc., Telestream, Haivision, Huawei Technologies, Cisco Systems, Nokia Corporation, Ciena Corporation, Fujitsu Limited, NEC Corporation, ZTE Corporation, Mitsubishi Electric Corporation, Evertz Microsystems Ltd., Corning Incorporated, Fiberail and Keysight Technologies and others.

Recent Developments:

-

In April 2025, Synamedia unveiled its latest innovations at the NAB Show in Las Vegas. The company showcased cloud and SaaS-based technologies aimed at transforming video services. These advancements are designed to enhance scalability, improve monetization opportunities, and reduce operational costs for broadcasters and streaming platforms.

-

In April 2025, the Video Multiplexer Market received a significant boost due to increased government funding. This financial support is aimed at enhancing video surveillance systems, particularly in public safety and smart city initiatives. The funding is expected to accelerate the adoption of advanced video multiplexing technologies across various sectors.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.13 Billion |

| Market Size by 2032 | USD 2.03 Billion |

| CAGR | CAGR of 7.64% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Analog Video Multiplexers, Digital Video Multiplexers, IP Video Multiplexers and Hybrid Video Multiplexers) • By Application (Security and Surveillance, Broadcasting, Healthcare, Traffic Monitoring and Industrial Automation) • By Technology (Compression Technology, Transmission Technology, Storage Technology and Streaming Technology) • By End-User (Government, Business and Enterprises, Residential Users, Transportation and Retail) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Analog Devices, Böning Automationstechnologie GmbH & Co. KG, Moog Components Group, FTA Bvba, Imagine Communications, Harmonic Inc., Telestream, Haivision, Huawei Technologies, Cisco Systems, Nokia Corporation, Ciena Corporation, Fujitsu Limited, NEC Corporation, ZTE Corporation, Mitsubishi Electric Corporation, Evertz Microsystems Ltd., Corning Incorporated, Fiberail and Keysight Technologies. |