Converted Flexible Packaging Market Key Insights:

Get More Information on Converted Flexible Packaging market - Request Sample Report

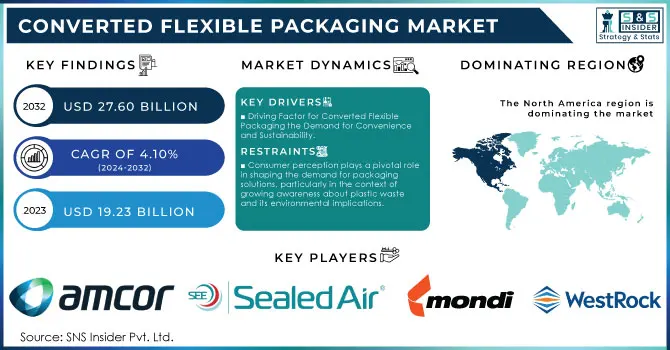

The Converted Flexible Packaging market size was valued at USD 19.23 Billion in 2023 and is expected to reach a market size of USD 27.60 billion by the end of 2032 at CAGR about 4.10% during the forecast period of 2024-2032.

The converted flexible packaging market is experiencing robust growth, driven by technological advancements, sustainability trends, and the increasing demand for convenience packaging. According to the Flexible Packaging Association (FPA), flexible packaging currently holds a 21% share of the packaging market in the U.S. This sector is poised for further expansion as manufacturers invest in innovations in printing, laminating, and sealing technologies, enabling higher quality and customizable packaging solutions that enhance product appeal and shelf life. Sustainability has become a focal point within the industry, exemplified by initiatives such as the collaboration between SABIC, Lamb Weston, and OPACKGROUP. Their packaging for frozen potato products incorporates at least 60% polymer made from bio-feedstock derived from used cooking oil (UCO), reducing the carbon footprint of the previous design by 30%. The process begins with the collection of UCO from Lamb Weston’s production, which is then converted into bio-feedstock to produce certified bio-renewable SABIC HDPE (high-density polyethylene) and Supeer mLLDPE (metallocene linear low-density polyethylene) polymers. Oerlemans Plastics, part of OPACKGROUP, then transforms these polymers into a multilayer PE film for the packaging.

At PACK EXPO International 2024, Constantia Flexibles, the world’s third-largest producer of flexible packaging, will highlight its latest sustainable innovations, with 91% of its products designed for recycling or featuring recyclable alternatives. This aligns with the growing emphasis on sustainability across industries, as brands adopt eco-friendly materials and practices to meet consumer demands. The surge in e-commerce has also amplified the need for versatile and durable packaging solutions that can withstand shipping challenges while appealing to consumers. By 2032, the market is expected to continue its upward trajectory, propelled by ongoing advancements in packaging technology, increasing consumer preferences for sustainable options, and the significant growth of the food and beverage sector.

Market Dynamics

Drivers

-

Driving Factor for Converted Flexible Packaging the Demand for Convenience and Sustainability.

The growing demand for convenience-oriented processed food products is significantly driving the transformation of flexible packaging, which typically employs high-barrier, high-grade materials to ensure longer shelf life. There is also a noticeable shift toward environmentally friendly packaging formats, with innovations like auto-venting films enabling frozen and other foods to steam inside their packages, representing a major technological advancement. The expansion of the e-commerce market further boosts the demand for cardboard and corrugated products, particularly among transportation and logistics companies. Moreover, the eco-friendliness of packaging materials has gained popularity, contributing to market growth. Aluminum foil, widely recognized for its ability to preserve product integrity, is a favored material in converted flexible packaging. According to the European Aluminum Foil Association, deliveries from European foil rollers reached 245,000 tonnes in the first quarter of 2021, a 2.3% increase compared to 2020, driven largely by strong overseas market performance, which saw over 10% growth. The transformed flexible packaging industry is also witnessing an increasing trend toward innovative products, such as controlled and modified atmosphere packaging (CAP/MAP), which extends the shelf life of perishables like produce and meat. As consumer preferences continue to evolve toward convenience and sustainability, the flexible packaging market is poised for significant growth, catering to the dynamic needs of modern consumers while prioritizing environmental considerations.

Restraints

-

Consumer perception plays a pivotal role in shaping the demand for packaging solutions, particularly in the context of growing awareness about plastic waste and its environmental implications.

As consumers become increasingly conscious of their ecological footprint, many are shifting towards alternative packaging options, such as biodegradable or compostable materials. Reports indicate that consumers are not only seeking functionality but also aligning their purchasing decisions with brands that demonstrate environmental responsibility. Consequently, this growing preference can limit the market potential for traditional flexible packaging solutions, as consumers may actively avoid products packaged in non-sustainable materials. Moreover, the call for transparency in packaging practices adds another layer of complexity. Consumers are now scrutinizing the lifecycle of packaging materials and demanding clear information about recyclability and sustainability. Brands that fail to adapt to these expectations risk losing market share to competitors that prioritize eco-friendly practices. This shift in consumer behavior is driving the need for innovation in sustainable packaging solutions, compelling manufacturers in the converted flexible packaging market to rethink their strategies. Embracing eco-friendly alternatives is not just a trend; it has become a crucial factor in maintaining competitiveness. Ultimately, addressing consumer perceptions regarding environmental impact is essential for the long-term viability of the converted flexible packaging market, making sustainability a vital consideration in product development and marketing strategies.

Key Segmentation Analysis

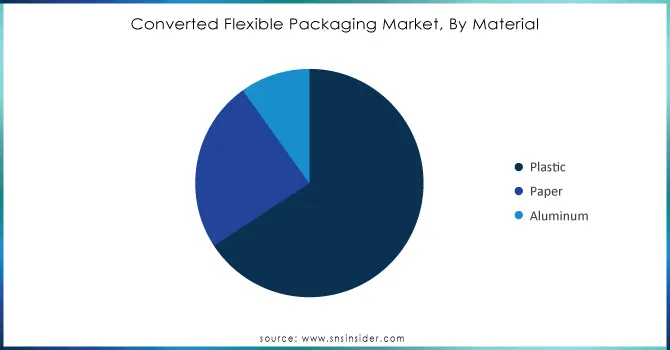

By Material

In the Converted Flexible Packaging market, plastic has established itself as the leading material, capturing around 66% of the revenue share in 2023. This dominance can be attributed to several factors that underscore the advantages of plastic compared to other materials. Plastic packaging is favored for a variety of applications, including food, beverages, personal care items, and pharmaceuticals, due to its lightweight and versatile nature. It is suitable for multiple formats, such as pouches, films, and bags. Additionally, plastics exhibit excellent barrier properties that help maintain the freshness and shelf life of products. High-barrier films made from polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC) protect contents from moisture, oxygen, and light, ensuring product integrity. Moreover, the customization and flexibility offered by plastic packaging are significant advantages, allowing brands to easily print designs and create various shapes and sizes. This capability enhances product visibility on store shelves. Companies like Amcor are leading the way with innovations such as their AmLite Ultra Recyclable packaging, made from mono-material plastics that combine high barrier properties with recyclability, and Berry Global’s Beverage Pack line, which employs advanced barrier technologies to ensure product freshness while minimizing material use and environmental impact.

Need Any Customization Research On Converted Flexible Packaging Market - Inquiry Now

By Type

In the Converted Flexible Packaging market, bags and pouches have emerged as the leading type, capturing a substantial 46% of the revenue in 2023. Their dominance is driven by several key advantages, including versatility across sectors such as food and beverages, personal care, and pharmaceuticals, allowing for a wide range of applications from snacks and frozen foods to liquids and dry products. The lightweight and portable nature of bags and pouches makes them ideal for on-the-go consumption, often featuring convenient closures like zip locks and spouts. Many of these packaging solutions incorporate advanced barrier technologies that protect products from moisture, oxygen, and light, effectively extending shelf life—an essential factor in the food industry. Additionally, bags and pouches are typically more cost-effective to produce compared to rigid packaging options, attracting manufacturers focused on reducing expenses while maintaining quality. As consumer demand for environmentally friendly packaging continues to rise, manufacturers are increasingly developing recyclable and compostable options, further driving growth in this segment.

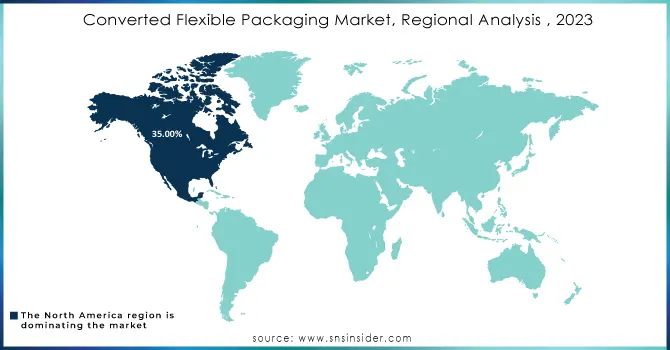

Regional Analysis

North America has emerged as the leading region in the Converted Flexible Packaging market, accounting for approximately 35% of total revenue in 2023. This dominance is driven by the growing demand for convenient packaging solutions across sectors like food and beverages, personal care, and pharmaceuticals. The fast-paced lifestyles of consumers have heightened the preference for on-the-go products, increasing the popularity of flexible packaging formats such as bags, pouches, and films. Additionally, North America is home to several leading packaging companies that focus on research and development, resulting in advanced technologies that enhance product preservation and sustainability. Companies like Amcor and Berry Global have introduced innovative solutions, including AmLite Ultra Recyclable packaging and the Beverage Pack line, which aim to improve recyclability and reduce environmental impact.

The U.S. and Canada are also making significant strides in sustainable practices, with government initiatives aimed at reducing plastic waste and promoting recycling. The rise of e-commerce has further fueled the demand for lightweight and protective packaging solutions, prompting manufacturers to adapt their strategies accordingly.

Asia Pacific is recognized as the fastest-growing region in the Converted Flexible Packaging market in 2023, propelled by a mix of strong economic development, shifting consumer preferences, and innovative packaging solutions. This growth is largely attributed to rapid population increase and urbanization in countries like China and India, where a rising middle class is driving demand for convenience-focused products such as ready-to-eat meals and on-the-go snacks. The popularity of flexible packaging formats, including pouches and bags, is a direct response to these changing consumer needs. Additionally, the region is experiencing significant advancements in packaging technology, with companies investing in research and development to improve product quality and sustainability, such as the introduction of bio-based plastics and recyclable materials. The rise of e-commerce further fuels demand for lightweight, protective, and user-friendly packaging, particularly in markets like Japan and Australia. Country-specific initiatives, like India’s promotion of recyclable materials and China’s stringent regulations on packaging waste, are fostering sustainable practices among manufacturers. Furthermore, companies such as Amcor and Berry Global are launching innovative products tailored for the Asian market, contributing to the region's ongoing growth and development in the flexible packaging sector.

Key Players

Some of the major key players in Converted Flexible Packaging with product:

-

Amcor plc (Flexible packaging solutions for food, beverage, and pharmaceutical industries)

-

Berry Global Inc. (Plastic films, bags, and pouches)

-

Sealed Air Corporation (Bubble wrap and protective packaging solutions)

-

Mondi Group (Kraft paper and flexible films for various applications)

-

Huhtamaki Oyj (Food packaging and foodservice products)

-

Constantia Flexibles Group GmbH (Flexible packaging for the food, pharma, and consumer goods sectors)

-

WestRock Company (Flexible packaging solutions and paper products)

-

Sonoco Products Company (Flexible packaging for snacks, beverages, and personal care)

-

Wipak Group (High-barrier packaging solutions for food and medical applications)

-

Ball Corporation (Aluminum and flexible packaging products)

-

ProAmpac LLC (Pouches, films, and laminates for food and retail)

-

Graham Packaging Company (Custom blow-molded plastic containers)

-

Clondalkin Group (Flexible packaging and labels for the food and pharmaceutical sectors)

-

Packaging Corporation of America (Paper-based packaging solutions)

-

Printpack Inc. (Flexible packaging for snacks, beverages, and healthcare)

-

Innovative Packaging Corporation (Custom flexible packaging solutions)

-

Sappi Lanaken Mills (Specialty papers and flexible packaging)

-

Coveris Holdings S.A. (Flexible packaging and labels for food and consumer goods)

-

Smurfit Kappa Group (Paper-based packaging and flexible products)

-

AptarGroup, Inc. (Dispensing and closure systems for flexible packaging)

List of Potential customers of converted flexible packaging:

-

Procter & Gamble

-

Nestlé S.A.

-

Coca-Cola Company

-

PepsiCo, Inc.

-

Unilever

-

Mondelez International

-

Johnson & Johnson

-

Danone S.A.

-

Kraft Heinz Company

-

General Mills, Inc.

Recent Developments

-

04 June 2024: ePac Flexible Packaging has entered a multiyear strategic agreement to convert its fleet to the HP Indigo 200K, enhancing its digital print capabilities with improved speed, quality, and customization to meet rising customer demands for sustainable packaging.

-

May 2, 2024: A recent development in India highlights the introduction of 20-liter lubricant pails made from 50% post-consumer recycled content, marking a significant milestone as the first pail packaging for lubricants in the country; this initiative has recycled the equivalent of approximately 2.3 million plastic bottles.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 19.23 Billion |

| Market Size by 2032 | USD 27.60 Billion |

| CAGR | CAGR of 4.10% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Plastic, Paper, and Aluminum) • By Type (Bags & Pouches, Sachets & Stick Packs, Films & Labels, Cartons, and Others) • By Application (Food & Beverage, Healthcare, Personal Care & Cosmetics, Retail, Electrical & Electronics, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amcor plc, Berry Global Inc., Sealed Air Corporation, Mondi Group, Huhtamaki Oyj, Constantia Flexibles Group GmbH, WestRock Company, Sonoco Products Company, Wipak Group, Ball Corporation, ProAmpac LLC, Graham Packaging Company, Clondalkin Group, Packaging Corporation of America, Printpack Inc., Innovative Packaging Corporation, Sappi Lanaken Mills, Coveris Holdings S.A., Smurfit Kappa Group, and AptarGroup, Inc. |

| Key Drivers | • Driving Factor for Converted Flexible Packaging the Demand for Convenience and Sustainability. |

| RESTRAINTS | • Consumer perception plays a pivotal role in shaping the demand for packaging solutions, particularly in the context of growing awareness about plastic waste and its environmental implications. |