Palmitic Acid Market Key Insights:

Get More Information on Palmitic Acid Market - Request Sample Report

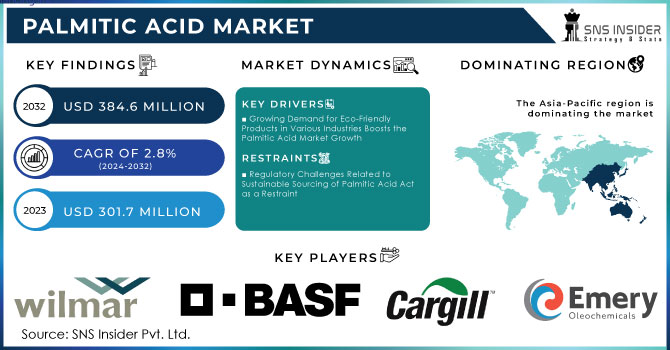

The Palmitic Acid Market Size was valued at USD 301.7 million in 2023, and is expected to reach USD 384.6 million by 2032, and grow at a CAGR of 2.8% over the forecast period 2024-2032.

The Palmitic Acid industry is currently experiencing immense vibrancy associated with multifaceted industrial usage as well as the fluid demands of the consumers. Being a saturated fatty acid, Palmitic Acid acts as a feedstock to the high versatility in various applications in the food and beverages industry, personal care products, and pharmaceuticals, to name a few. In recent years, the consumption of Palmitic Acid has witnessed an upsurge due to its multifaceted applicability as an emulsifying agent possessing proven stability in formulations. This has led to its use in food processing applications to improve texture and shelf-life, as well as cosmetics as an emollient. Furthermore, the pharmaceutical industry utilizes drug delivery systems with the help of Palmitic Acid due to its ability to enhance bioavailability.

Recent market trends of Palmitic Acid proven to mark its importance across time. The leading companies in the market have been focusing actively on strategic endeavors aimed at strengthening their production capabilities and improving product lines. For instance, several major companies have ventured into advanced technologies that help extract and purify better, thus resulting in higher purity levels and higher quality standards. These improvements are useful not just in terms of reducing manufacturing costs but also in assuming better demand for high-quality Palmitic Acid in worldwide markets.

Besides the state of technological advancement, the dynamics of this market are oriented around the changing regulatory landscape and sustainability concerns. With consumers and companies alike showing widespread concern for sustainability, there is a growing demand for sustainable and renewable sources of Palmitic Acid. Various certifications and initiatives on responsible sourcing now capture the attention of companies, and alignment with global goals towards sustainability also boosts their competitive market positions.

The Palmitic Acid market will remain on an upward trajectory with the adoption of forthcoming technological improvements, exigencies of sustainability, and regional market dynamics. The rising base is fueled by innovations that combine investments from some of the sector's key players, awareness among consumers, and increasing regulatory action mounting against the industry. This will alter the phase of the Palmitic Acid market for the next couple of years as both opportunities and challenges come their way for the latter.

Market Dynamics

Drivers:

-

Growing Demand for Eco-Friendly Products in Various Industries Boosts the Palmitic Acid Market Growth

The increasing environmental awareness among consumers is highly responsible for the growing demand for eco-friendly products in every market, boosting the Palmitic Acid market. Environmentally conscious consumers make sure to select products with sustainable sourcing and minimal environmental impact. More and more, manufacturers are sourcing Palmitic Acid from renewable feedstocks - Palmitic Acid and coconut oil - which happen to be more sustainable than some of the other fossil-derived alternatives. This isn't just a response to consumer wishes but also enables companies to deal with regulatory requirements and certifications focused on sustainability. Another reason is that the developing green labeling and green marketing trend allows a company to differentiate its products in the marketplace, thereby improving its competitive advantage. Such industries as cosmetics, personal care, food, and beverages are more heavily affected by this since they add Palmitic Acid increasingly due to its versatility and functional properties while appealing to sustainability. The increasing demand for environment-friendly products puts the Palmitic Acid market in an excellent position to reap the boon, and this might motivate technological changes in Sustainable manufacturing.

-

Expanding Applications in Pharmaceuticals and Personal Care Products Fuel Palmitic Acid Market Demand

The multiple applications of Palmitic Acid in pharmaceutical and personal care industries are the main reasons that have been pushing its demand in the market. In pharmaceuticals, Palmitic Acid is said to increase solubility along with the bioavailability of the active constituents within drug compositions. Therefore, it has been used in numerous medical applications such as topical creams, ointments, and oral drugs. Furthermore, its emulsifying action enables Palmitic Acid to be very effective as a stabilizing agent in multiple formulations to ensure quality and efficacy maintain uniformly. In personal care formulations, Palmitic Acid is becoming one of the favorite emollients and moisturizers that provide hydration to make skin softer and smoother. The product can be used in various forms, like emulsifiers, surfactants, and thickening agents, to cater to divergent consumer needs. As both sectors keep on innovating and expanding their product lines, it will further enhance the demand for Palmitic Acid, elevating the market potential and solidifying the role of the product in multiple applications.

Restraint:

-

Regulatory Challenges Related to Sustainable Sourcing of Palmitic Acid Act as a Restraint

Despite high applications and growing market demand, the Palmitic Acid market still has significant restraints based on the regulatory challenges of sustainable sourcing. Due to the more comprehensive global regulations regarding issues of environmental impact and sustainability, firms are compelled to ensure sustainability in their sourcing practices. This will be observance of standards that promote the use of eco-friendly agriculture, especially when it comes to Palmitic Acid production in an industry frequently under fire for the relationship between deforestation and habitat destruction. Failure to comply may lead to severe penalties, reputational damage, and other factors which come at a cost in terms of time and resources incurred for a manufacturer to guarantee a supplier's compliance. This complexity in navigating such regulations may deter smaller players in the market because they cannot afford the luxuries of painstaking compliance, which could potentially reduce competition and innovation. Debates on the environmental impacts of sourcing Palmitic Acid further create uncertainty in the market space about long-term planning and investment. All these regulatory challenges pose a significant restraint in the growth of the Palmitic Acid market.

Opportunity:

-

Emerging Trends in Bio-Based Alternatives Present Opportunities for Palmitic Acid Market Expansion

Bio-based alternatives are emerging in trends for market expansion in the Palmitic Acid market. Industries look towards moving to more sustainable practices, and these bio-based alternatives are at the forefront when it comes to developing safer alternatives to petrochemical products. Given its renewable sources, the trend is such that it is offered well with the Palmitic Acid that will provide a viable option for companies looking to be on the side of sustainability. In such scenarios, research and development efforts are directed to optimize methods of extraction and processing of Palmitic Acid to make this chemical more available and affordable. Innovation in product formulation through bio-based Palmitic Acid may, therefore, be the important key to unlocking new opportunities in markets like cosmetics, foods, and drugs where consumers are not just looking for greener alternatives but also commitments to sustainability. Further, where industry players can cooperate and help consumers understand the justification behind the development of bio-based Palmitic Acid would drive market awareness and acceptance. Increased demand to produce friendly solutions from the environment shall propel the Palmitic Acid market to make significant gains resulting from these new trends and opportunities for companies looking to innovate and expand their product portfolios.

Challenge:

-

Volatility in Raw Material Prices Poses a Challenge for the Palmitic Acid Market

Raw material volatility has been the most dominant challenge to the Palmitic Acid market - the overall cost of production and profit margins to the firms. The main sources of raw materials include Palmitic Acid and coconut oil, whose market prices keep on fluctuating because of various causes such as climate change, politics, geoeconomic tensions, and even new agriculture practices. For instance, adverse climatic factors lead to crop failures, reducing supply and subsequently raising prices. More to that, trade policies and tariffs can even make sourcing somewhat convoluted and uncertain to the manufacturers dependent on imports. Thus, this makes it challenging for companies to maintain stable prices for their end products, making the budgeting of production costs and plans for investments over periods more challenging. Rather, the business will be held by bigger companies due to greater resources since they will maximize the instability for survival. Hence, the challenge requires better risk management practices as well as alternative sourcing in which companies may lessen the impacts of raw material price volatility on their operations.

Market Segmentation Analysis

By Grade

In 2023, the Industrial Grade type dominated the Palmitic Acid market with a share of 55%. This is because has now become universal. There are many different sorts of lubricants, surfactants, and emulsifiers in a wide range of different industries now. It can be used for emulsion stabilization and the improvement of the flow and lubricity of creams and lotions in the cosmetic and toiletry industries, for instance. It is generally used in the production of detergents and cleaning agents as a raw material since it is also a surfactant. A huge demand for versatile ingredients in the manufacturing process is driving this segment, hence this market is the leading category in Palmitic Acid.

By Source

The Plant-Based segment dominated the Palmitic Acid market in 2023 with an estimated 70% market share. This is particularly because of the shift in consumers’ taste toward environmentally friendly products since plant sources are better helpful for the environment in comparison to the animal-based ones. Therefore, it is observed in the Food and cosmetic and personal care industry that most of the palmitic acid manufacturers prefer using plant sources such as Palmitic Acid, which is used in the production of palmitic acid from coconut oil; however, the functions of palmitic acid are as followed in its applications in the food and the cosmetic and personal care industry. For example, in the food industry, it is used as an emulsifier or stabilizer in the preparation of baked products and in the preparation of margarine, it is used for texture and shelf life. In the cosmetics industry, plant-based ingredients are taking the natural route in the formulation. Consumers find synthetic additives unappealing in their products. This transformation towards plant-based sources does not only cater to the market demand but also sustainability initiatives, making the Plant-Based segment lead the Palmitic Acid market.

By Application

The Personal Care and Cosmetics segment dominated and accounted for a significant share of around 40% of the Palmitic Acid market in 2023. This may be because of the extensive use of Palmitic Acid in formulating various cosmetic and personal care products, such as acting as an emulsifier, thickener, and moisturizing agent. For instance, in emollients and moisturizing creams, Palmitic Acid adds smoothness to the texture and stability of the formula along with added protection in the prevention of loss of moisture that ensures its entry into the skin. As a hair care ingredient, it also gives smoothness and easier manageability to conditioners and shampoos, a characteristic that makes manufacturers want it in their formula for high quality products. Consumer awareness and a need for effective beauty treatments are expected to add on to the booming importance of personal care and cosmetics products for dominance in the market for palmitic acid.

Regional Analysis

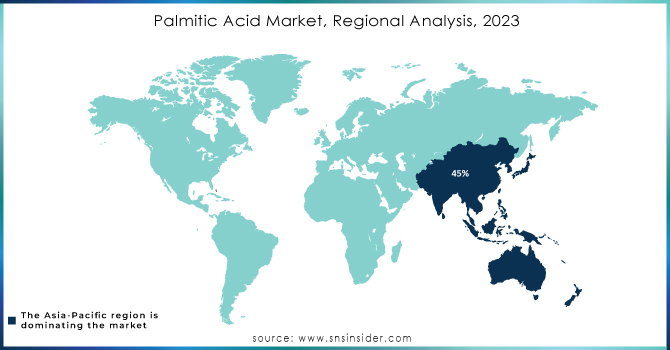

In 2023, the Asia-Pacific region dominated the Palmitic Acid market with a 45% market share, since this region has a strong industrial base, mainly in the cosmetics, food, and personal care sectors; significant consumers of Palmitic Acid. Among the countries, China and India take up a major share in this demand, with reasons of middle-class intensity and subsequent spending on personal care and cosmetic products. The natural and organic cosmetics growth trend in these markets has led to the use of plant-based Palmitic Acid as an essential ingredient for moisturizing creams and lotions. Further, major manufacturers and established supply chains in the Asia-Pacific region contribute significantly to the expansion of this region in the Palmitic Acid market.

The North American region emerged as the fastest growing region and accounted for the highest growth rate in the Palmitic Acid market in 2023. It is expected to increase at a CAGR of 7% throughout the forecast. This is primarily due to increasing consumer awareness about the usage of clean label products in the food and personal care sectors. The food industry has a clear trend towards natural and plant-based ingredients, and, therefore, Palmitic Acid is added for its emulsifying properties in margarine and bakery products. In personal care, formulates where use of synthetic additives is avoided, makes manufacturers opt for the incorporation of renewable source-derived Palmitic Acid into their composition. Sustainability is the prime focus for this region, plus the innovation in product development going on in North America will also see impressive growth in the Palmitic Acid market.

Need Any Customization Research On Palmitic Acid Market - Inquiry Now

Recent Developments

January 2024: Investigators at the University of Toronto discovered that, at times, the liver can synthesize the crucial molecule palmitic acid when dietary intake is not sufficient. But with some infant formula manufacturers looking for ways to save money, questions arise about levels of palmitic acid in baby formula.

Key Players

-

Manufacturers

-

SABIC (Saudi Basic Industries Corporation)

-

IOI Group (IOI Corporation Berhad)

-

BASF SE

-

Cargill, Incorporated

-

Kraton Corporation

-

Musim Mas Group

-

Miwon Commercial Co., Ltd.

-

Erdos Group

-

Raw Material Suppliers

-

Wilmar International Ltd. (Palmitic Acid, Palm Kernel Oil)

-

Cargill, Incorporated (Palmitic Acid, Coconut Oil)

-

Sime Darby Plantation Berhad (Palmitic Acid)

-

Musim Mas Group (Palmitic Acid, Palm Kernel Oil)

-

Olam International (Palmitic Acid, Coconut Oil)

-

IOI Group (IOI Corporation Berhad) (Palmitic Acid, Palm Kernel Oil)

-

Austrian Chemicals (Coconut Oil, Palmitic Acid)

-

BASF SE (Palmitic Acid Derivatives)

-

Mewah International Inc. (Palmitic Acid, Palm Kernel Oil)

-

Kawan Food Berhad (Palmitic Acid, Coconut Oil)

-

-

Palmitic Acid Market Report Scope:

Report Attributes Details Market Size in 2023 US$ 301.7 Million Market Size by 2032 US$ 384.6 Million CAGR CAGR of 2.8% From 2024 to 2032 Base Year 2023 Forecast Period 2024-2032 Historical Data 2020-2022 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments •By Grade (Industrial Grade, Food Grade, Pharmaceutical Grade)

•By Source (Animal-Based, Plant-Based)

•By Application (Food and Beverages, Personal Care and Cosmetics, Pharmaceuticals, Industrial Uses, Detergents and Soaps, Others)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) Company Profiles Wilmar International Ltd., SABIC (Saudi Basic Industries Corporation), IOI Group (IOI Corporation Berhad), BASF SE, Cargill, Incorporated, Emery Oleochemicals, Kraton Corporation, Musim Mas Group, Miwon Commercial Co., Ltd., Erdos Group and other key players Key Drivers • Growing Demand for Eco-Friendly Products in Various Industries Boosts the Palmitic Acid Market Growth

• Expanding Applications in Pharmaceuticals and Personal Care Products Fuel Palmitic Acid Market DemandRESTRAINTS • Regulatory Challenges Related to Sustainable Sourcing of Palmitic Acid Act as a Restraint