Parcel Sortation Systems Market Size & Trends:

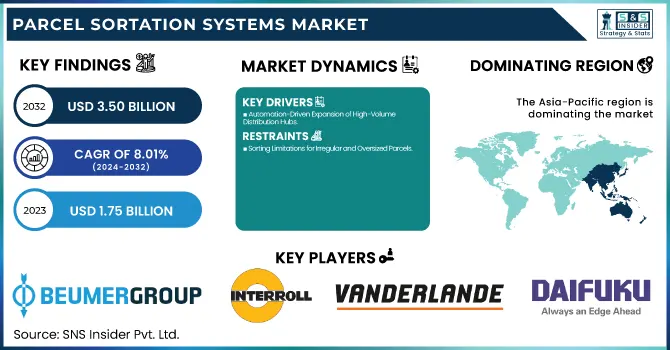

The Parcel Sortation Systems Market size was valued at USD 1.75 Billion in 2023, and expected to reach USD 3.50 Billion by 2032, growing at a CAGR of 8.01 % during 2024-2032. The market is primarily driven by the continuous growth of e-commerce, which has increased the need for fast automated parcel-sorting solutions to accommodate high volumes of shipments. As a response, logistics companies are investing heavily in automations, such as AI-based sortation systems, robotics, and machine learning algorithms, to reduce processing time, minimize manual errors, and improve throughput capacity.

To Get more information on Parcel Sortation Systems Market - Request Free Sample Report

Over the past few years, the boom in same-day and express delivery services, along with heightened consumer expectations for rapid shipping, have only accelerated adoption of advanced and sophisticated sorting technologies. Key market factors are the growing implementation of IoT driven smart logistics, developments of AI based vision systems & implementation of predictive analytics for streamlining parcel flow while decreasing operational bottlenecks. Many parcel sortation solutions are now modular and scalable due to an increasing focus on efficiency, labor savings, and sustainability in logistics operations. Furthermore, last-mile delivery challenges have intensified the need for automated hubs, as retailers and logistics firms strive to enhance delivery accuracy, optimize routing, and reduce turnaround times.

Parcel Sortation Systems Market Dynamics:

Drivers:

-

Automation-Driven Expansion of High-Volume Distribution Hubs

The rapid expansion of automated distribution hubs is transforming global logistics, as companies increasingly invest in advanced parcel sortation systems to handle growing e-commerce volumes and improve supply chain efficiency. These high-volume fulfillment centers integrate cutting-edge technologies such as AI-driven sorting, machine vision, and robotics to streamline parcel movement, reduce processing time, and minimize errors. Automated systems enhance operational scalability, allowing logistics firms to handle peak-season surges while maintaining efficiency. The adoption of high-speed sortation equipment also optimizes last-mile delivery, ensuring faster dispatch and reducing bottlenecks in supply chains. Companies like Amazon, FedEx, and DHL are investing heavily in AI-powered sortation solutions to meet consumer expectations for rapid and accurate deliveries. Additionally, sustainability initiatives drive the deployment of energy-efficient sorting technologies, reducing operational costs and environmental impact. As automated hubs become the backbone of modern logistics networks, investments in parcel sortation systems will continue to accelerate worldwide.

Restraints:

-

Sorting Limitations for Irregular and Oversized Parcels

Parcel sortation systems are designed to handle high volumes of packages efficiently, but their effectiveness is often limited when dealing with irregularly shaped, oversized, or fragile parcels. Many automated sortation solutions are optimized for standard package dimensions, making it difficult to process non-uniform shipments without causing delays or errors. The rigid design of conveyor-based and robotic sorting systems can struggle with items that are bulky, asymmetrical, or require delicate handling, increasing the risk of damage. Logistics companies must invest in specialized equipment, such as advanced machine vision technology and adaptive grippers, to improve sorting accuracy for diverse parcel sizes. However, these enhancements come at a higher cost, limiting widespread adoption. As e-commerce continues to grow, the demand for flexible sorting solutions will rise, pushing manufacturers to innovate more adaptable parcel sortation systems capable of handling a wider range of package types with greater efficiency.

Opportunities:

-

Accelerating E-Commerce Growth and the Demand for Same-Day Delivery

The rapid expansion of e-commerce and rising consumer expectations for instant deliveries are driving significant investments in high-speed, automated parcel sortation systems. With online shopping volumes surging, logistics providers are under pressure to process, sort, and dispatch parcels faster than ever. Automated sorting solutions powered by AI, robotics, and machine vision technologies enable efficient handling of high parcel volumes while reducing errors and delivery delays. Same-day and next-day delivery services are becoming the norm, prompting major retailers and logistics companies like Amazon, FedEx, and UPS to enhance their sorting infrastructure. Additionally, urban fulfillment centers and micro-warehouses are incorporating advanced sortation systems to optimize last-mile delivery. As consumer demand for speed and convenience intensifies, the adoption of high-performance parcel sortation systems is set to grow, ensuring streamlined operations and enhanced customer satisfaction in the fast-paced e-commerce landscape.

Challenges:

-

Operational Disruptions Due to Maintenance and Downtime Risks

Automated parcel sortation systems are critical for ensuring smooth operations but also require regular maintenance and may encounter unexpected breakdowns, causing adverse effects on logistics and supply chain efficiency. If sorting hubs go down, deliveries will be delayed, bottlenecks will form in distribution networks and operational costs will rise with emergency repairs and wasted man-hours. Scheduled maintenance is a necessary evil, yet even scheduled downtime can affect throughput, forcing companies to deploy redundancy or backup systems. This has only increased demand for skilled technicians who have the ability to diagnose technical problems and solve them, increasing already-high labor shortages across the industry. Further, unpredictable equipment failures can create a ripple effect across supply chains, causing service disruptions for e-commerce and retail businesses. To mitigate risks, logistics providers are investing in predictive maintenance technologies, AI-driven monitoring, and real-time diagnostics to enhance system reliability and minimize costly downtime.

Parcel Sortation Systems Market Segment Analysis:

By Offering

In 2023, the hardware segment accounted for approximately 70% of the total revenue in the Parcel Sortation Systems Market, due to the growing adoption of advanced sorting machinery and conveyor and scanning technologies. High-speed sorters, cross-belt conveyors, and AGVs (automated guided vehicles) are critical equipment to accommodate increasing parcel volumes resulting from growing e-commerce and same-day delivery services. Leading companies are using durable and high-performance sorting equipment to improve efficiency, lower processing time, and reduce errors during parcel handling. As logistics companies strive to adapt to shifting customer demands, the need for robotics and AI-based hardware solutions is also growing. The importance of hardware in improving the flow of parcels is further accentuated by advancements in sensor technology and real-time tracking systems. With the growth of logistics networks, hardware innovation is also becoming a key element to ensure that sortation processes operate seamlessly and at scale.

The services segment is expected to be the fastest-growing category in Parcel Sortation Systems Market from 2024 to 2032, driven by increasing demand for installation, maintenance, system integration, and consulting services. As logistics companies and e-commerce players invest in advanced automation solutions, the need for expert support in deploying, optimizing, and maintaining sortation systems is rising. Regular servicing and predictive maintenance help prevent unexpected downtimes, ensuring uninterrupted operations and maximizing system efficiency. Additionally, software integration services, including AI-driven analytics and cloud-based tracking solutions, are becoming crucial for enhancing sorting accuracy and operational visibility. The shift toward service-based models, such as Equipment-as-a-Service (EaaS), is further fueling growth, allowing businesses to optimize costs while leveraging the latest sorting technologies. As companies prioritize efficiency and scalability, the services segment will continue to expand, playing a vital role in the evolution of automated parcel sorting.

By Type

The linear Parcel Sortation System segment held the largest revenue share of approximately 58% in the Parcel Sortation Systems Market in 2023, driven by its high efficiency, scalability, and suitability for handling large parcel volumes. These systems, which include cross-belt and tilt-tray sorters, are widely used in high-throughput logistics hubs and e-commerce fulfillment centers to streamline sorting operations. Their ability to process parcels in a continuous, linear flow enhances speed and reduces bottlenecks, making them ideal for large-scale distribution networks. Additionally, advancements in automation, AI-based tracking, and IoT-enabled monitoring have further improved sorting accuracy and operational reliability. Major logistics players such as Amazon, FedEx, and UPS continue to invest in linear sortation systems to optimize delivery speeds and minimize handling errors. As e-commerce and express parcel services expand globally, the demand for high-speed, space-efficient sorting solutions is expected to sustain market growth.

The loop (circular) parcel sortation system segment is projected to be the fastest-growing in the Parcel Sortation Systems Market from 2024 to 2032, owing to its high throughput efficiency, flexibility to multiple facility layouts, and capacity to accommodate mixed-size parcels. Unlike linear systems in which items can only go forward, the loop sortation systems — tilt-tray and cross-belt sorters — run on a continuous and circular track and enable parcels to be dynamically recirculated until reaching the right destination. This design improves operational flexibility, minimizes mis-sorts, and maximizes space in high-density sorting hubs. The surge in e-commerce and same-day delivery services has increased the requirement for speedier and improvised parcel transfer (sorting), thereby driving the demand for loop sortation segment.

By Industry Vertical

The logistics segment held the largest share of around 45% in the Parcel Sortation Systems Market in 2023, based on the rapid rise of e-commerce, increasing global trade, and the need for efficient last-mile delivery solutions. It is pushing logistics service providers to invest heavily in automated sorting systems to improve operational efficiency, cut transit times and cope with high parcel volumes. AI-driven sortation is also optimized for large-scale distribution hubs, with machine vision and robotics integrated into the process, maximizing sortation accuracy and throughput. Another area is sustainability, with energy-efficient sorting machines becoming more common to both lower operational cost and decrease global impact. With customer demand for ever faster and more reliable parcel processing continuing to rise, the logistics and supply chain sector will remain a significant contributor to investment in next generation sortation systems.

The e-commerce segment is the fastest growing in the Parcel Sortation Systems Market Over the forecast period 2024-2032, due to rising demand for online shopping and express deliveries. As consumers become more demanding about shipping speed, retailers and third-party logistics providers are turning to automated, high-speed sortation systems to streamline efforts and limit delays. Parcel handling will become more accurate and high-throughput as technologies like AI-driven sorting systems, robotics, and machine vision are applied to improve last-mile delivery operations. Moreover, the growth of omnichannel retailing and same-day delivery services is also propelling demand for automated sortation solutions. Global demand for e-commerce will remain a primary growth factor in the market, as large logistics and e-commerce companies are replacing existing fulfillment centers with automation with advanced sorting infrastructure to meet increasing parcel volumes.

Parcel Sortation Systems Market Regional Overview:

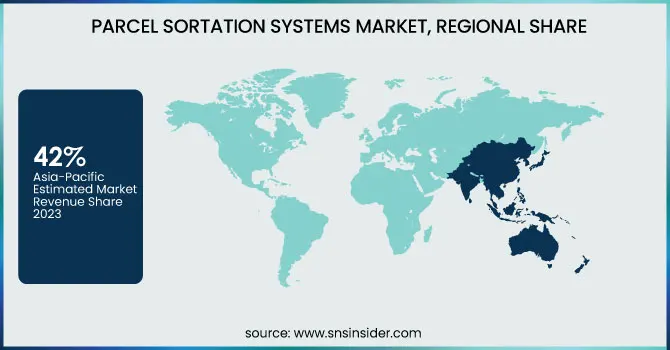

In 2023, the Asia-Pacific region held the largest revenue share of approximately 42% in the parcel sortation systems market, driven by rapid e-commerce expansion, urbanization, and increasing investments in logistics automation. Countries like China, Japan, India, and South Korea are witnessing a surge in online shopping, prompting major logistics providers to adopt high-speed sortation systems to handle rising parcel volumes efficiently. Government initiatives supporting smart logistics infrastructure and the presence of leading e-commerce giants such as Alibaba and JD.com further fuel market growth. Additionally, advancements in AI-powered sorting, robotics, and warehouse automation are enhancing operational efficiency across distribution hubs. With ongoing digital transformation and rising consumer demand for fast deliveries, the Asia-Pacific region is expected to sustain its leadership in parcel sortation system adoption.

North America is projected to be the fastest-growing region in the parcel sortation systems market from 2024 to 2032, to the increasing need for automated logistics solutions and the flourishing of e-commerce activities. A lot of companies and major players such as Amazon, Fed Ex, UPS and DHL are pouring money into fast, AI-enhanced sorting technologies to increase operational capacity and also meet rising consumer demands for same-day, and next-day deliveries. Market growth is further driven due to the increasing focus on warehouse automation, robotics, and machine learning-based sorting solutions in the region. The continuous labor shortages and high labor costs are also driving companies involved in logistics to re-evaluate their operation models in adopting automated systems, in order to work more efficiently and cut costs. The rapid adoption of parcel sortation systems in North America is also due to government initiatives supporting smart supply chain infrastructure and the expansion of micro-fulfillment centers.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Some of the Major Players in Parcel Sortation Systems Market along with their product:

-

Beumer Group (Germany) – Cross-belt sorters, high-speed conveyor sortation systems

-

Interroll Group (Switzerland) – Roller conveyor sorters, modular automated sorting systems

-

Vanderlande Industries B.V. (Netherlands) – Loop sorters, sliding shoe sorters, automated parcel sorting solutions

-

Daifuku Co., Ltd. (Japan) – Tilt-tray sorters, linear parcel sortation systems

-

Kion Group AG (Germany) – Automated warehouse sortation systems, shoe sorters

-

Bastian Solutions, LLC (USA) – Robotic parcel sorting systems, pop-up sorters

-

Körber AG (Germany) – AI-powered parcel sortation, high-speed sorting conveyors

-

Okura Yusoki Co., Ltd. (Japan) – Tilt-tray sorters, parcel diverters

-

Dematic (USA) – Cross-belt sorters, robotic parcel sorting solutions

-

Honeywell International, Inc. (USA) – Smart parcel sorting systems, IoT-enabled automated sorters

-

Murata Machinery, Ltd. (Japan) – High-speed parcel sorting conveyors, loop sortation systems

-

SSI Schaefer (Germany) – Linear sortation conveyors, automated sorting hubs

-

TGW Logistics Group (Austria) – Shuttle-based parcel sorting, dynamic conveyor sorting systems

-

Equinox (Netherlands) – Parcel sorting solutions, robotic sorting arms

List of Suppliers who provide Raw Material and component in Parcel Sortation Systems Market:

-

Interroll Group (Switzerland)

-

SSI Schaefer (Germany)

-

Fives Group (France)

-

SEW-Eurodrive (Germany)

-

SICK AG (Germany)

-

Pepperl+Fuchs (Germany)

-

Rockwell Automation (USA)

-

Mitsubishi Electric (Japan)

-

Bonfiglioli (Italy)

-

Lenze (Germany)

Recent Development:

-

Oct 11, 2024: Körber Opens Supply Chain Innovation Center Near DFW Airport Körber launched a state-of-the-art Innovation Center in Irving, Texas, showcasing advanced parcel and postal sortation solutions, reinforcing its role in global supply chain efficiency.

-

Feb 2, 2024: Honeywell Partners with Hai Robotics to Boost DC Efficiency Honeywell integrates Hai Robotics' autonomous case-handling robots with its Momentum software, enhancing warehouse automation and real-time operational insights.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.75 Billion |

| Market Size by 2032 | USD 3.50 Billion |

| CAGR | CAGR of 8.01% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Offering (Hardware, Software, Service) • By Type (Linear Parcel Sortation System, Loop (Circular) Parcel Sortation System) • By Industry Vertical (Logistics, E-commerce, Airports, Pharmaceuticals, Food & Beverages, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Beumer Group, Interroll Group, Vanderlande Industries, Daifuku Co., Kion Group, Bastian Solutions, Körber AG, Okura Yusoki, Dematic, Honeywell International, Murata Machinery, SSI Schaefer, TGW Logistics Group, and Equinox. |