CNG, RNG, and Hydrogen Tanks Market Report Scope & Overview:

Get More Information on CNG, RNG, and Hydrogen Tanks Market - Request Sample Report

The CNG, RNG, and Hydrogen Tanks Market Size was valued at USD 2.6 billion in 2023 & is expected to reach USD 6.6 billion by 2032 & grow at a CAGR of 10.6% by 2024-2032.

Growing need for a range of alternatives to traditional fuels such as CNG (Correct Natural Gas), RNG (Renewable Natural Gas), and hydrogen due to local climate change reactions and restrictive ability to emit greenhouse gases. Because carbon emissions from transportation are one of the largest contributors to climate change, both governmental organizations and private companies are turning toward cleaner energy that can fuel vehicles with less environmental harm. CNG and RNG provide even greater emissions reductions over conventional gasoline or diesel immediately while RNG also has a renewable aspect since it is derived from waste materials before being processed into fuel. On the other hand, hydrogen can transform the sector as a zero-emission fuel when produced from renewable feedstocks. An increasing infrastructure around alternative fuel refueling stations and storage, etc. reinforces this trend. Consequently, the automotive and transportation industries are enjoying an increasing penetration of CNG, RNG, and hydrogen vehicles driven by inducements and mandates encouraging sustainable energy choices and reduced carbon footprints worldwide. Together, these developments point to a healthy market outlook for alternative fuel storage and infrastructure in furtherance of global decarbonization goals.

European Union alone planning to install approximately 1,000 hydrogen refueling stations by 2030. This combination of regulations and funding has spurred the adoption of alternative fuel vehicles across the automotive and transportation sectors, accelerating the demand for CNG, RNG, and hydrogen tanks to support this growing shift toward sustainable transportation.

With the evolution of the hydrogen economy, hydrogen has gradually emerged as an increasingly important part of the context of future highlights of clean energy systems across the world. With many countries bringing decarbonization and net-zero targets to the forefront, hydrogen's versatility and zero-emission profile particularly appeal to applications with few viable alternatives to electricity including heavy industry and long-haul transport. As a result, this transition is fueling great investment in hydrogen infrastructure, in particular innovative hydrogen storage solutions, with a focus on appropriate high-pressure tanks that can accommodate the unique characteristics of hydrogen. To help meet this projected increase in hydrogen demand governments and private industry are quickly building production and storage capacity, including networks of hydrogen refueling stations and large-scale industrial storage capacity. Case in point: the EU hydrogen strategy is targeting 40 gigawatts of electrolyzer capacity by 2030 as well as high-pressure tanks and other built-out storage to ensure seamless delivery. Hydrogen infrastructure investments are also high in Japan, South Korea, and the United States reinforcing the case that the industry is serious about making hydrogen a real, ubiquitous fuel. The increased storage capacity not only carbon-sequestration enables a hydrogen-based economy to accommodate a larger-scale role for hydrogen but also paves the way for multiple consumer and industrial applications leading to large-scale adoption, including in transport, energy storage, and more.

the European Union’s Hydrogen Strategy aims to install 40 gigawatts of renewable hydrogen electrolyzers by 2030, with additional investments in hydrogen refueling stations, which the EU expects to reach 1,000 by the same year. The U.S. Department of Energy has allocated USD 9.5 billion under the Bipartisan Infrastructure Law to develop hydrogen production, storage, and distribution infrastructure, setting ambitious targets to reduce hydrogen costs by 80% by 2030.

CNG, RNG, And Hydrogen Tanks Market Dynamics:

Drivers:

-

Government support, subsidies, and mandates for cleaner transportation drive the market growth.

Alternative fuels like CNG, RNG, and hydrogen tanks are undergoing significant momentum largely due to growing government support, the help of subsidies, and mandates for clean transportation (Source: Market demand from a commercial, industrial, and residential point of view). In line with larger environmental and climate objectives, governments across the globe are rolling out policies and financial incentives to speed up the transition to low- and zero-emission transport solutions. Such policies consist of consumer incentives to buy alternative fuel vehicles, tax credits for fuel infrastructure investments, and emissions mandates for particular industries. The U.S. has tax credits and grants to promote clean fuels and infrastructure, and the European Union has the "Fit for 55" to require emissions be cut by 55% in 2030, accelerating investment in green transportation. Meanwhile, China also put subsidies on HTFC-V and also has a goal of one million hydrogen vehicles on the road by 2035. These supportive policies are bringing alternative fuels within the financial reach of companies and consumers leading to growing demand for storage and refueling solutions. This strong governmental push toward sustainable transportation is delivering substantial growth within the market for CNG, RNG and hydrogen tanks, as transportation and energy stakeholders adjust to facilitate compliance and public desire for a cleaner path forward.

Restraints:

-

High Raw Material Costs Limit Economies of Scale in Composites

-

Limited infrastructure discourages and vehicles discourage infrastructure investment.

The composites market, and the industries it supplies, are known for fierce competition where cost reigns supreme. Businesses prioritize two key factors: operating expenses (OPEX) and capital expenditures (CAPEX). achieving economies of scale is challenging due to the high cost of raw materials and manufacturing processes. This creates a significant demand for cost-effective design and production technologies in the composites market. The high barrier to entry discourages new players. Carbon fiber and glass fiber, crucial materials for Type 3 and Type 4 CNG composite tanks, require substantial upfront investment. These expensive raw materials directly inflate the overall manufacturing cost of these tanks. Consequently, developing cost-efficient methods for producing carbon and glass fiber composites is a critical challenge for global manufacture

Opportunities:

-

Growing demand for lightweight transportation tanks in electric vehicles.

-

Expansion of Refueling Infrastructure over Hydrogen vehicle market

The hydrogen-powered and electric vehicles use electric tanks for propulsion, and their energy storage methods differ significantly. Hydrogen cars utilize hydrogen gas stored in tanks, which is then converted into electricity via a fuel cell. Electric vehicles rely on traditional battery packs. A major hurdle hindering the widespread adoption of hydrogen cars is the high cost of their storage tanks. These tanks, typically for a 5kg capacity, range from USD 4,000 to 4,500, significantly inflating the overall vehicle price. Research efforts are currently focused on developing lightweight Class 4-cylinder carbon fiber tanks to address this challenge. These tanks aim to reduce costs by lowering the required gas storage pressure.

CNG, RNG, and Hydrogen Tanks Market Segmentation Overview

By Gas Type

Compressed Natural Gas held the largest market share around 54% in 2023. This dominance stems from several factors For many automotive manufacturers worldwide, CNG tanks offer a long-term economic advantage compared to traditional fuel tanks. CNG vehicles equipped with these tanks contribute to a cleaner environment by emitting fewer greenhouse gases than gasoline or diesel alternatives. Many countries already have well-established CNG refueling infrastructure, making CNG a more readily available and convenient option. Government initiatives promoting the use of alternative fuels further propel the CNG tank market by incentivizing CNG adoption.

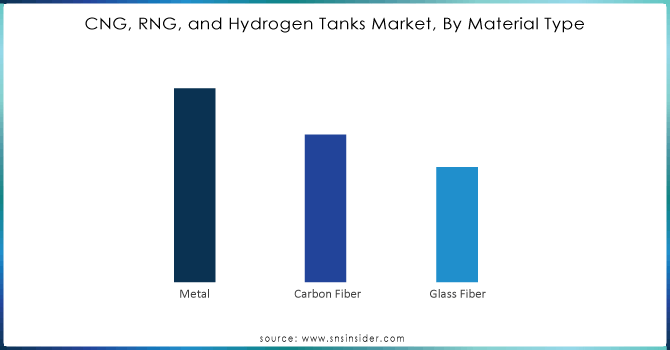

By Material Type

The metal segment held the largest market share around 55% in 2023. This is due to the strength and durability of the metal and its ability to withstand high pressures. Steel or aluminum make the ideal solutions because they are notably durable, suitable to securely contain compressed gases, including CNG, RNG, and hydrogen, which must be retained at high pressures. For heavy-duty applications like buses, trucks, and industrial storage, steel, and aluminum tanks, which are utilized as long as dependability and safety are important, are perfect. In addition, because of the price advantage over composite alternatives, metal tanks are a common choice in parts of the world or applications where achieving the lowest price is a priority in addition to good performance. Coupled with this, metal tanks have a long history of use to store fuel, which has created an industry trust that has led to imaging to standardize their manufacturing processes for this application, which provides further support for the ascendancy of metal tanks in the marketplace. Composite materials are gradually making headway as their lower weight gives advantages; however, metal tanks retain a significant market share where weight is less critical because of their well-known infrastructure and reliability.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Tank Type

Type 1 sub-segment by tank type, constructed entirely of metal, currently dominates the global CNG, RNG, and hydrogen tank market, capturing 43.2% of the market share in 2023. Their popularity stems from their widespread use in light-duty vehicles. Type 1 tanks offer robust performance, they are the most expensive option due to their all-metal construction. This also translates to significant weight, impacting vehicle fuel efficiency. players like Everest Kanto Cylinders Ltd. (India), Praxair Technologies Inc. (U.S.), and Faber Industries S.P.A. (Italy), are major participants in the Type 1 tank market. However, with the rise of composite materials offering lighter weight and potentially lower costs, the future of Type 1 tanks remains to be seen.

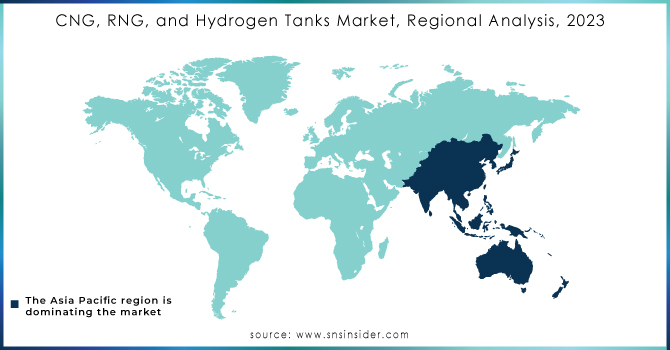

CNG, RNG, and Hydrogen Tanks Market Regional Analysis

Asia Pacific held the largest market share around 48% in 2023. The CNG, RNG, and hydrogen tanks market in the Asia Pacific accounts for the largest market share due to the increasing emphasis on emission reduction, rising usage of alternative fuels, and favorable government policies in the region. Initiatives promoting clean energy and moving away from conventional fossil fuels are led by China, Japan, South Korea, India, and others. China, as one example, is promoting natural gas and hydrogen-powered vehicles, bolstered by subsidies for green tech and infrastructure. Japan has introduced measures to scale up its hydrogen economy, with plans to build a 'hydrogen society' that features hydrogen cars and facilities — such as enormous hydrogen refueling stations [source]. Likewise, in India, CNG and, more recently, RNG have been implementing its public transportation networks to curb air quality in cities, providing all necessary incentives and establishing refueling stations throughout major metropolitan areas. A strong manufacturing base in the Asia Pacific region has further saved overheads and yielded fuel storage tanks for sale at scale – making them cost-effective and easily accessible. Together with the region's fast-expanding automotive sector, increasing number of automobiles, and progress towards urbanization, these factors are supporting the high demand for clean fuel options in the Asia Pacific, rendering the region a leading player in the CNG, RNG, and hydrogen tanks market.

Key Players in CNG, RNG, and Hydrogen Tanks Market

-

Worthington Industries, Inc. (CNG Composite Cylinders, Hydrogen Storage Tanks)

-

Faber Industrie SpA (CNG Cylinders, Hydrogen Storage Systems)

-

Luxfer Group (CNG Cylinders, Hydrogen Pressure Vessels)

-

Hexagon Composites ASA (CNG Storage Tanks, Hydrogen Vessels)

-

Everest Kanto Cylinders Ltd. (CNG Cylinders, Hydrogen Storage Tanks)

-

Quantum Fuel Systems LLC. (CNG Tanks, Hydrogen Storage Systems)

-

Praxair Technologies Inc. (Hydrogen Storage Vessels, CNG Cylinders)

-

Avanco Group (CNG Pressure Vessels, Hydrogen Cylinders)

-

Xinyi Beijing Tianhai Industry Co. Ltd. (CNG Storage Tanks, Hydrogen Vessels)

-

Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd. (CNG Cylinders, Hydrogen Composite Tanks)

-

Nantong Yongsheng Gas Cylinder Co. Ltd. (CNG Cylinders, Hydrogen Tanks)

-

Inox India Ltd. (CNG Cylinders, Hydrogen Vessels)

-

Rexarc International, Inc. (Hydrogen Storage Tanks, CNG Pressure Vessels)

-

Cylinders Holding Group (CNG Storage Tanks, Hydrogen Storage Systems)

-

Foster Wheeler Energy Ltd. (Hydrogen Vessels, CNG Tanks)

-

Tianjin Energy Development Group Co. Ltd. (Hydrogen Tanks, CNG Cylinders)

-

Steelhead Composites (CNG Cylinders, Hydrogen Vessels)

-

Messer Group GmbH (Hydrogen Storage Tanks, CNG Cylinders)

-

Shaanxi Hengtong Gas Equipment Co. Ltd. (CNG Tanks, Hydrogen Cylinders)

-

Cryogenic Solutions, Inc. (Hydrogen Pressure Tanks, CNG Storage Systems)

Recent Development:

-

In May 2023, Luxfer Group debuted a groundbreaking Type 4 cylinder, the G-Stor Go H2. This advanced design boasts a reliable boss-to-liner interface, minimizing gas leakage. As a certified and cost-competitive hydrogen storage solution, the G-Stor Go H2 is perfectly suited for a variety of applications, including fuel-cell-powered buses, heavy-duty trucks, vans, bulk gas transport, boats, and even trains.

-

IN January 2023, Hexagon Purus marked a significant milestone in January 2023 with the opening of a brand-new hydrogen cylinder manufacturing facility in Westminster, Maryland, USA. This state-of-the-art plant boasts the capacity to produce up to 10,000 cylinders annually, specifically designed for heavy-duty vehicle applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.65 Billion |

| Market Size by 2032 | US$ 6.56 Billion |

| CAGR | CAGR of 10.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Gas Type (Compressed Natural Gas (CNG), Hydrogen, Renewable Natural Gas (RNG)) • By Material Type (Metal, Carbon Fiber, Glass Fiber) • By Tank Type (Type 1, Type 2, Type 3, Type 4) • By Application (Fuel Tank, Transportation Tank) |

| Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America |

| Company Profiles | Hexagon Composites ASA, Everest Kanto Cylinders Ltd.., Worthington Industries, Inc., Luxfer Group, Faber Industrie SpA, and other players. |

| DRIVERS | • Providing more tax breaks for CNG cars and infrastructure |

| Restraints | • High cost of tanks made of composite materials and government approvals |