Customer Experience Business Process Outsourcing Market Report Scope & Overview:

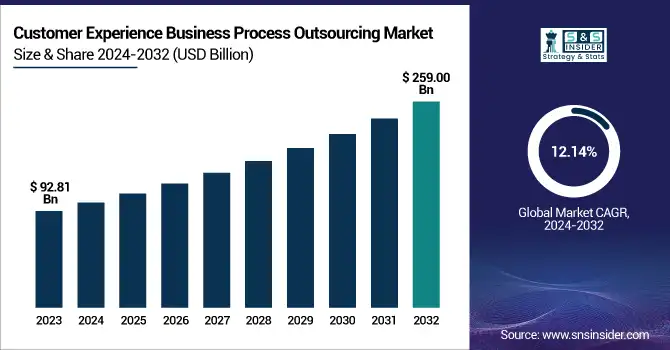

The Customer Experience Business Process Outsourcing Market was valued at USD 92.81 billion in 2023 and is expected to reach USD 259.00 billion by 2032, growing at a CAGR of 12.14% from 2024-2032.

To Get more information on Customer Experience Business Process Outsourcing Market - Request Free Sample Report

This report includes insights into cost savings and efficiency gains, the impact of AI and automation on employment, customer churn rates, outsourcing contract durations, and data security & compliance trends.

The CX BPO market is experiencing rapid expansion, driven by businesses seeking cost efficiencies and improved customer service. AI and automation are reshaping employment structures, optimizing processes while altering workforce dynamics. Managing customer churn remains a priority, influencing outsourcing strategies. Contract durations are evolving, reflecting the need for flexibility and long-term partnerships. Additionally, data security and compliance are becoming critical as companies navigate stringent regulations. This evolving landscape positions CX BPO as a key enabler of customer-centric growth.

U.S. Customer Experience Business Process Outsourcing Market was valued at USD 25.48 billion in 2023 and is expected to reach USD 70.04 billion by 2032, growing at a CAGR of 11.89% from 2024-2032. The growth of the U.S. Customer Experience Business Process Outsourcing (CX BPO) Market is driven by increasing demand for cost efficiency, advanced AI-driven automation, and the need for enhanced customer engagement. Businesses are leveraging CX BPO services to optimize operations while focusing on core competencies. The integration of AI and analytics is improving service quality and reducing operational costs. Additionally, the rise of omnichannel customer support and personalized experiences is pushing companies to outsource to specialized providers. Stricter data security regulations are also driving investments in compliant outsourcing solutions, further fueling market expansion across various industries.

Customer Experience Business Process Outsourcing Market Dynamics

Drivers

-

AI-Driven Automation is Transforming CX BPO by Enhancing Efficiency, Reducing Costs, Improving Response Times, and Enabling Seamless Customer Interactions.

Businesses are under constant pressure to optimize costs while delivering exceptional customer experiences. AI-powered chatbots, virtual assistants, and automation tools are transforming the Customer Experience Business Process Outsourcing (CX BPO) Market by streamlining operations and reducing reliance on human agents. These technologies enable faster response times, 24/7 availability, and personalized interactions, significantly improving customer satisfaction. Automation lowers operational expenses by taking care of repetitive questions, allowing human agents to deal with intricate issues that demand empathy and analytical thinking. AI-powered analytics also offer actionable insights, enabling companies to improve their customer interaction strategies. As businesses focus on efficiency and scalability, outsourcing providers that use AI-powered automation are becoming unavoidable, facilitating smooth customer interactions through various channels while being cost-effective. This change is fueling the large-scale deployment of intelligent automation in CX BPO services.

Restraints

-

Cybersecurity Risks and Regulatory Compliance Challenges Are Increasing Concerns Over Data Security in the Customer Experience BPO Market.

With more businesses outsourcing customer interactions, managing sensitive personal information becomes an important issue. With strict regulation like GDPR, CCPA, and other data protection regulations, companies need to ensure compliance and avoid cybersecurity threats. Unauthorized access, data breaches, and cyber attacks present major threats, resulting in financial sanctions and reputational loss. Strong security controls, such as encryption, multi-factor authentication, and periodic audits, must be put in place by organizations to ensure customer confidence. Stricter compliance across jurisdictions raises complexity and expense for outsourcing operations. Clients are growing increasingly wary of having sensitive customer information shared with third-party service providers, leading them to rethink their approach to outsourcing. These mounting concerns are dictating the business decision-making process in favor of CX BPO solutions.

Opportunities

-

Cloud-Based CX Solutions Are Enabling Scalability, Remote Workforce Management, and Cost Efficiency in the Customer Experience BPO Market.

The growing trend towards cloud-based customer experience solutions is revolutionizing outsourcing strategies, helping businesses gain increased scalability and flexibility. Cloud technology enables CX BPO companies to manage remote workforces cost-effectively, facilitating uninterrupted delivery of services from anywhere. Through access to real-time data, integrated system operations, and AI-powered automation, cloud platforms improve business efficiency at a lower cost of infrastructure. Organizations gain improved data protection, disaster recovery capabilities, and the option to rapidly expand customer support groups to meet varying demands. Cloud contact centers also enable omnichannel engagement to deliver a unified and consistent customer experience. As companies look for efficient and flexible customer support options, the need for cloud-based CX BPO services is increasing, making it a key driver of industry growth.

Challenges

-

Ensuring Consistent, High-Quality Service Across Multiple Channels Is a Major Challenge for Customer Experience BPO Providers.

As businesses strive to meet customer expectations, delivering seamless and consistent service across various platforms—such as phone, chat, email, and social media presents significant obstacles. Managing interactions across these diverse channels requires advanced integration of tools, data, and technologies to ensure a unified customer experience. The complexity of aligning team processes, maintaining real-time communication, and tracking customer queries across multiple touchpoints demands significant resources and coordination. Inconsistent experiences or delayed responses on any given platform can lead to dissatisfaction and erode brand loyalty. Moreover, with varying levels of expertise required for different communication channels, ensuring each customer touchpoint is handled by well-trained professionals is a challenge that CX BPO providers must overcome to maintain service quality.

Customer Experience Business Process Outsourcing Market Segment Analysis

By Service Type

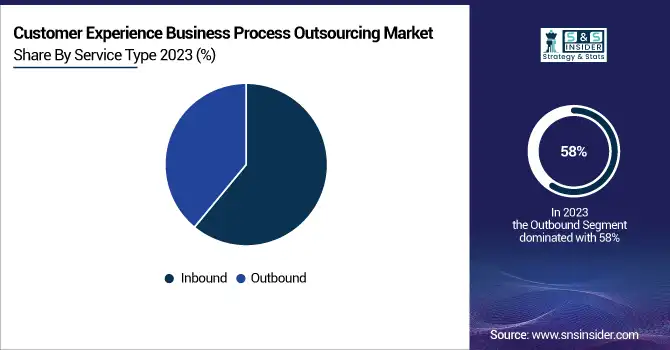

Outbound segment led the Customer Experience Business Process Outsourcing Market with the maximum revenue share of nearly 58% in 2023. The lead position of the outbound segment is being fueled by growing demand for active customer interactions, including outbound calls, surveys, sales calls, and follow-ups. Several organizations are prioritizing customer retention and lead generation using outbound services, looking to develop customer relationships, boost conversions, and grow revenues, which reaffirms the dominant position of the segment.

Inbound segment is expected grow at the fastest CAGR of approximately 13.24% during 2024-2032. The high growth of the inbound segment is fueled by the increased demand for customer support, inquiries, technical support, and service requests. With an increased number of businesses adopting customer-centric models, there is an escalating need to offer quality inbound services that provide customer satisfaction, loyalty, and long-term relationships. This growing dependency on inbound services is driving the growth of the segment.

By Support Channel

Voice segment led the Customer Experience Business Process Outsourcing Market with the largest revenue share of approximately 60% in 2023. Voice segment dominance is primarily due to the age-old preference for human interaction, which is perceived as more personal and effective in resolving intricate issues. Most customers opt for voice channels for instant help, particularly in cases that need elaborate descriptions or empathy, hence the default channel of customer support and service in most industries.

Segments of non-voice are anticipated to grow at the fastest CAGR of approximately 13.41% during 2024-2032. The high rate of growth of the non-voice segment is due to the rising adoption of digital channels including email, chat, social networks, and messaging applications. With customers demanding greater convenience and flexibility, companies are increasingly investing in non-voice solutions to cater to these demands. Non-voice channels are also more economical, offer 24/7 support, and serve a global customer base, driving their adoption at a faster rate.

By End-use

IT & Telecommunications segment led the Customer Experience Business Process Outsourcing Market with the largest revenue share of nearly 26% in 2023. The reason behind its dominance is the increasing need for IT support services, technical issue troubleshooting, and telecommunication services, which are critical for enterprises in all industries. The demand for customer care in intricate IT and telecom industries, such as network problems, device installation, and technical support, keeps fueling the strong demand for expert BPO services in this segment.

Retail & E-commerce segment is expected grow at the fastest CAGR of around 14.58% during the period of 2024-2032. The retail and e-commerce sector growth in the CX BPO market is fueled by the rapid growth in online shopping businesses. While online businesses strive to provide superior customer service, ranging from post-sale support, return management, to real-time question-answering, growing demand for BPO providers able to process large volumes of transactions efficiently is fueled by the digital growth of the sector and consumers' heightened expectations.

By Outsourcing Type

Offshore segment dominated the Customer Experience Business Process Outsourcing Market with the highest revenue share of about 51% in 2023. The offshore segment remains dominant due to its cost-effectiveness and access to a large, skilled labor pool in regions such as India, the Philippines, and Latin America. Businesses prefer offshore outsourcing for its ability to provide high-quality services at lower costs, making it a strategic choice for companies seeking to reduce operational expenses while maintaining service standards.

Nearshore segment is expected to grow at the fastest CAGR of about 14.00% from 2024-2032. The nearshore segment is gaining momentum due to its geographic proximity, offering similar advantages as offshore outsourcing while mitigating some of the challenges such as time zone differences, cultural barriers, and language issues. As companies seek faster response times, better customer experience, and reduced logistical challenges, nearshore outsourcing is becoming an increasingly attractive option, particularly for companies in North America and Europe.

Regional Analysis

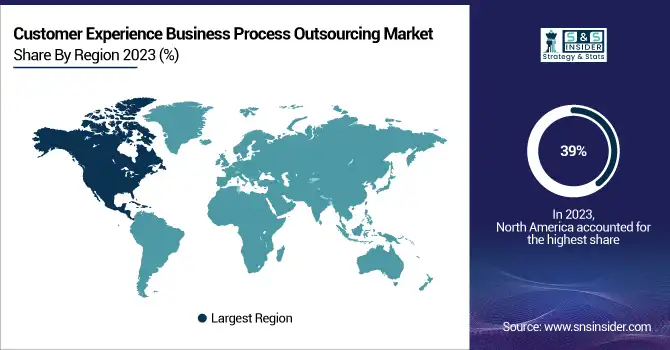

North America dominated the Customer Experience Business Process Outsourcing Market with the highest revenue share of about 39% in 2023. North America's dominance is due to the region's high adoption of advanced technologies, strong customer service infrastructure, and the presence of major BPO providers. The demand for both inbound and outbound services in industries such as finance, healthcare, and technology contributes to its leading position in the global CX BPO market.

Asia Pacific is expected to grow at the fastest CAGR of about 13.87% from 2024-2032. Asia Pacific's rapid growth is driven by the increasing number of digital-first businesses, low labor costs, and a large talent pool. The region's growing middle class, increased internet penetration, and expansion of e-commerce are propelling demand for high-quality customer support services. As global businesses look to expand into emerging markets, Asia Pacific's cost-effective and scalable CX BPO solutions are attracting significant attention.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Accenture Plc [Customer Engagement Solutions, Digital Inside Sales]

-

Automatic Data Processing, Inc. [Comprehensive Payroll Services, Human Capital Management Solutions]

-

Cognizant Technology Solutions Corp [Customer Service Management, Digital Contact Center Solutions]

-

Concentrix Corporation [Omnichannel Customer Support, Customer Journey Mapping]

-

Firstsource Solutions [Customer Lifecycle Management, Collections Management]

-

Fusion BPO Services Group [Multilingual Customer Support, Technical Support Services]

-

Genpact [Customer Care Services, Sales and Commercial Operations]

-

Infosys Limited [Customer Service Outsourcing, Digital Marketing Operations]

-

International Business Machines Corporation [IBM Watson Assistant for Customer Service, Contact Center Transformation]

-

Tata Consultancy Services [Experience Strategy and Design, Personalized Commerce and Content]

-

Teleperformance [Digital CX and AI Solutions, Omnichannel Customer Support]

-

TELUS International [AI-Powered Customer Support, Multilingual Customer Experience Services]

-

Unity Communications [Back Office Teams, E-commerce Support Teams]

-

Wipro Enterprises Private Limited [Omnichannel and AI-Guided Interactions, Unified Agent Desktop]

-

WNS Global [Customer Interaction Services, Analytics-Driven Customer Experience]

Recent Developments:

-

In January 2025, Fusion CX acquired S4 Communications, a company specializing in call center outsourcing and BPO services. This acquisition added over 900 employees in Texas and the Philippines, aiming to enhance Fusion CX's capabilities in the telecom and utilities sectors.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 92.81 Billion |

| Market Size by 2032 | US$ 259.00 Billion |

| CAGR | CAGR of 12.14% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Inbound, Outbound) • By Outsourcing Type (Onshore, Offshore, Nearshore) • By Support Channel (Voice, Non-voice) • By End-use (BFSI, Healthcare, Manufacturing, Media & Entertainment, IT & Telecommunications, Retail & E-commerce, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Accenture Plc, Automatic Data Processing Inc., Cognizant Technology Solutions Corp, Concentrix Corporation, Firstsource Solutions, Fusion BPO Services Group, Genpact, Infosys Limited, International Business Machines Corporation, Tata Consultancy Services, Teleperformance, TELUS International, Unity Communications, Wipro Enterprises Private Limited, WNS Global |