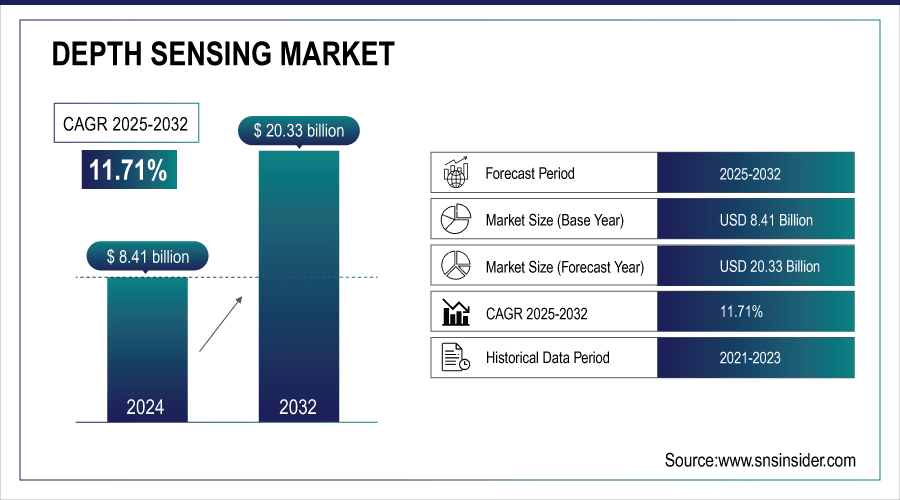

Depth Sensing Market Size & Growth:

The Depth Sensing Market size was valued at USD 8.41 Billion in 2024 and is projected to reach USD 20.33 Billion by 2032, growing at a CAGR of 11.71% during 2025-2032.

The depth sensing market is booming, driven by the increasing demand for 3D imaging technologies such as TOF in smartphones, AR/VR, robotics, and automotive applications. Increased adoption is being driven by the increasing integration of 3D sensors in consumer electronics, and the increasing deployment of these devices in autonomous navigation and industrial automation. Improving speed and accuracy driven by advancements in ToF, structured light, stereo vision, and LiDAR, are fuelling innovations in a range of enterprises. Deeper use cases in health care, manufacturing, and entertainment further buoy market potential in period to come.

Apple confirms LiDAR is built into iPhone 12 Pro and later Pro models and iPad Pro 11-inch (2nd gen+) / 12.9-inch (4th gen+) used by the native Measure app and 3D-scan apps.

To Get More Information On Depth Sensing Market - Request Free Sample Report

Key Depth Sensing Market Trends:

-

Increasing integration of 3D sensing technologies in consumer electronics, including smartphones, AR/VR devices, and gaming consoles.

-

Rapid adoption of advanced driver-assistance systems (ADAS) and autonomous vehicle navigation leveraging depth sensing.

-

Technological advancements in Time-of-Flight, LiDAR, and Structured Light enhancing precision, speed, and real-time processing capabilities.

-

Growing deployment of depth sensing in robotics, warehouse automation, and Industry 4.0 smart manufacturing applications.

-

Expansion of healthcare imaging, surgical navigation, and immersive technologies such as metaverse applications, AR glasses, and mixed-reality devices.

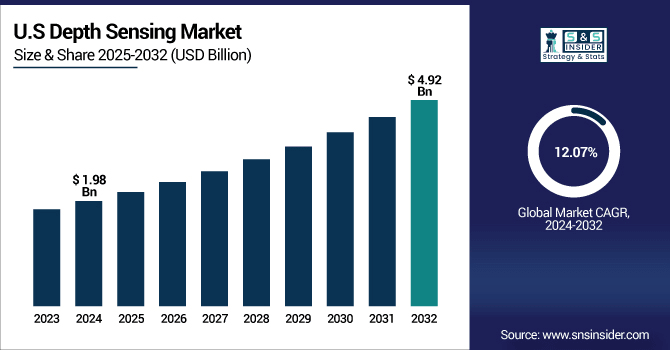

The U.S. Depth Sensing Market size was valued at USD 1.98 Billion in 2024 and is projected to reach USD 4.92 Billion by 2032, growing at a CAGR of 12.07% during 2025-2032. The U.S depth sensing market is expanding owing to increasing adoption of these for imaging and scanning applications across smartphones, AR/VR (Augmented Reality and Virtual Reality), autonomous vehicles, industrial automation and robotics along with strong footprint of R&D, technological advancements in several end-user industries and growing demand for advanced imaging solutions in the domestic market.

The Depth Sensing market trends include increasing smartphones and AR/VR devices penetration, higher adoption for Autonomous vehicles, advancing ToF and LiDAR technologies, expanding applications for robotics, and wide applications for Depth Sensing in the field of healthcare, owing to industrial automation, and Entertainment.

Depth Sensing Market Growth Drivers:

-

Rising 3D Sensing Adoption in Consumer Electronics and Automotive Fuels Global Depth Sensing Market Growth

Increasing use of 3D sensing in consumer electronics including smartphones, AR/VR devices, and gaming consoles is the primary factor driving the global depth sensing market. Increased adoption of advanced driver-assistance systems (ADAS) and navigation in autonomous vehicles is, in fact, another significant driver of the increase in demand. Time-of-Flight, LiDAR, and Structured light is evolving quickly, such that they supply greater precision, and speed, for applications in robotics, industrial automation, and healthcare imaging. Moreover, increasing investment in smart devices and connected ecosystem is driving the demand of the market.

The International Federation of Robotics recorded ~4 million industrial robots in operation globally in 2023, with 276,288 new units installed that year, heavily reliant on vision and depth cameras.

Depth Sensing Market Restraints:

-

Challenges in Accuracy Standards and Compliance Restrict Seamless Adoption of Depth Sensing Technologies

The depth sensing technology is limited to accuracy and performance it will provide responses to depth perception during different environmental conditions such as low light, reflective surfaces, outdoor units, which will restrain the adoption of the market. Moreover, the lack of data privacy and security regarding 3D imaging also hinders the widespread implementation of 3D imaging technology in consumer and healthcare applications. Moreover, the other few factors, such as absence of set standards for different sensor technologies creates interoperability issues, and also the integration problems with existing systems, make it harder to deploy seamlessly. The existing regulatory compliance challenges in Automotive and Healthcare makes it more complex and delays large scale commercialization and wider market penetration.

Depth Sensing Market Opportunities:

-

Rising Demand for Hybrid Imaging Devices Creates Growth Opportunities in the Depth Sensing Market

Strong opportunities can be seen from rising depth sensing demand such as growing use in robotics and warehouse automation, along with Industry 4.0 smart manufacturing applications. Additional lucrative opportunities open up by expanding healthcare applications, such as surgical navigation and diagnostic imaging. In addition, the growing demand for immersive technologies, such as metaverse applications, AR glasses, and mixed-reality devices, also presents a long-term growth opportunity for depth sensing solutions.

Amazon confirmed operating over 750,000 robots in its fulfillment centers by 2024, showcasing large-scale use of depth cameras and LiDAR in warehouse automation.

Key Depth Sensing Market Segmentation Analysis:

-

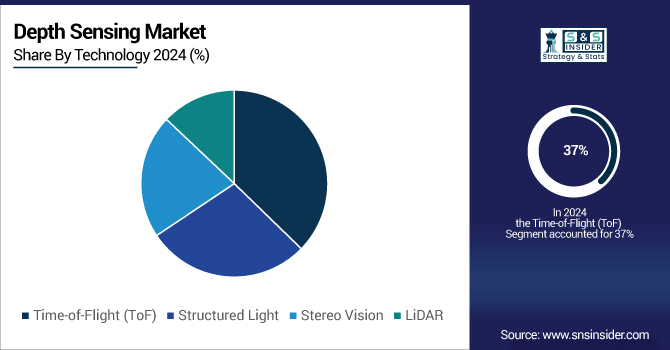

By Technology, Time-of-Flight led with ~ 37% share in 2024; Structured Light fastest growing (CAGR 12.33%).

-

By Application, Consumer Electronics dominated ~39% in 2024; Automotive fastest growing (CAGR 12.37%).

-

By Component, Sensors led ~34% in 2024; Software & Algorithms fastest growing (CAGR 12.39%).

-

By Depth Sensing Market, Consumer Electronics held ~40% in 2024; Integrated Systems fastest growing (CAGR 12.15%).

By Technology, Time of Flight Leads Depth Sensing Market While Structured Light Emerges as the Fastest Growing Technology

In 2024, Time-of-Flight (ToF) technology led the depth sensing market, due to high accuracy, ability to capture data very quickly, and operations in varying light conditions. The extensive use of this technology for face recognition on smartphones, AR applications and automotive ADAS systems made the top position even stronger. In the coming years, Structured Light is anticipated to register the fastest CAGR over 2025-2032 owing to its accuracy in close-range applications such as 3D scanning, gaming, and healthcare imaging. The growing utilization in consumer electronics and medical diagnostics, along with the development of improvements in terms of reliability and cost benefit, will accelerate its adoption during the forecasted period.

By Application, Consumer Electronics Lead Depth Sensing Today While Automotive Applications Accelerate as the Fastest Growth Driver Ahead

Consumer Electronics was the largest segment of the depth sensing market. Its dominance is bolstered by the surging need for facial recognition, immersive gaming & the development of additional camera features. But during 2025-2032, Automotive will boast the fastest growth at a CAGR, driven by the rapid development of advanced driver-assistance systems (ADAS), autonomous driving technologies, and in-cabin monitoring solutions. Technologies for depth sensing, such as LiDAR and ToF have been irreplaceable for navigation and detection of obstacles, and improvement of safety, which make automotive applications to drive the trend of market growth in the near future.

By Component, Sensors Dominate Depth Sensing Today While Software and Algorithms Unlock the Fastest Growth Through 2032

In 2024, Sensors held the largest revenue share for depth sensing as it is the primary hardware component in supporting the capabilities for accurate three-dimensional data collection across consumer electronics, automotive, robotics, and healthcare devices. This positions them well to maintain strong market leadership thanks to the importance of these features for facial recognition, navigation and object detection. Over 2025-2032, Software & Algorithms is expected to be the fastest-growing technology category, due to the growing demand for the ability to process and interpret complex 3D data in real-time. The innovations in AI, machine learning, and computer vision are making depth sensing applications more accurate and efficient, paving the way for more exciting applications in AR/VR, smart manufacturing, healthcare imaging, and autonomous systems.

By End-Use Industry, Consumer Electronics Lead Depth Sensing Today While Automotive Emerges as the Fastest Growth Driver Ahead

The depth sensing market was led by consumer electronics in 2024 due to the proliferation of 3D sensing technologies in smartphones, AR/VR headsets, gaming consoles, and tablets. Due to features such as facial recognition, gesture control and immersive imaging, consumer electronics was the top driving segment and saw robust adoption. These include depth sensing in the automotive industry, which is expected to grow at the fastest CAGR over 2025-2032, attributed to the growth of depth sensing applications in advanced driver-assistance systems (ADAS), autonomous driving, and in-cabin monitoring applications. Demand for precise navigation, real-time obstacle detection, and improved passenger safety are boosting rapid adaptation, making automotive applications an important driver for medium- to long-term market growth.

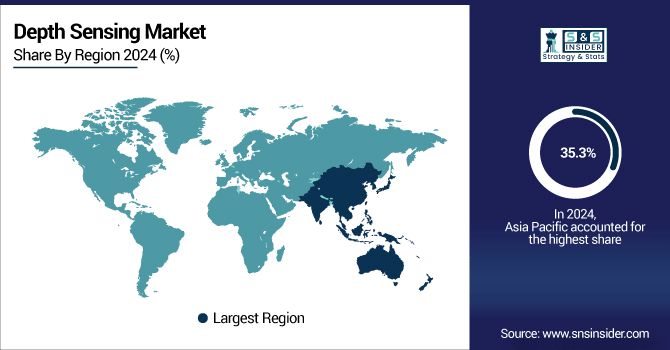

Asia-pacific Depth Sensing Market Insights:

Asia Pacific held the highest revenue of 35.3% in the depth sensing market share in 2024 due to vast consumer electronics manufacturing hubs, high penetration of smartphones, and high consumer spending associated with AR/VR technologies. The growth of the market in the Asia Pacific region is further supported by increasing investments in automotive innovation, industrial automation, and healthcare imaging across various countries in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Depth Sensing Market Insights:

North America Region is expected to have the fastest CAGR growth during the period of 2025-2032 due to the fast-developing technologies in autonomous vehicles, strong adoption of AR/VR technologies and huge investments in robotics and industrial automation. Besides, the demand for advanced healthcare imaging and the presence of leading technology companies makes the region a highly lucrative market for depth sensing solutions.

Europe Depth Sensing Market Insights:

Depth sensing Market in Europe is propelled by high adoption in the automotive, industrial automation and healthcare markets alongside the regional dominance in advanced driver-assistance systems (ADAS) and Industry 4.0. Increasing adoption of 3D imaging across medical diagnostics, which will witness a robust integration across the consumer electronics, AR/VR landscapes will continue imparting contribution to propelling Europe as a strong market.

Latin America (LATAM) and Middle East & Africa (MEA) Depth Sensing Market Insights:

Gradual adoption of depth sensing in consumer electronics, automotive, and healthcare applications drives demand for depth sensing in within markets, such as Latin America and the Middle East & Africa. Smartphone penetration and increasing adoption of gaming and AR/VR establish the key growth drivers in LATAM. At the same time, demand for MEA is on the rise as the requirement for smart city projects, security and healthcare imaging, along with increasing investments in technology create long-term opportunities for depth sensing solutions.

Competitive Landscape for Depth Sensing Market:

Sony Semiconductor Solutions is the world's largest imaging and sensing company, and a key player in the depth sensing industry. The firm is known for its market-leading Time-of-Flight (ToF) image sensors that have achieved widespread adoption in smartphones, AR/VR devices and IR industrial automation systems. For instance, offerings, such as the IMX556 Depth Sensor and IMX316 ToF Sensor provide high accuracy and speed, which enables better 3D imaging, facial recognition, and gesture control. This was followed by more than fifteen years of commitment by Sony to innovative initiatives geared at further accelerating depth sensing in various industrial applications.

-

In June 2025, Sony unveiled the AS-DT1, the world’s smallest and lightest miniature precision LiDAR depth sensor using Direct Time-of-Flight (dToF) technology with a SPAD image sensor ideal for compact robotics, drones, and mobile applications.

Intel RealSense Intel RealSense is a pioneer in depth sensing solutions, developing advanced 3D vision technologies powering a multitude of applications in robotics, drones, healthcare, industrial automation and AR/VR. The D455 Depth Camera, L515 LiDAR Camera, and D435i Depth Camera are high precision, low-latency 3D sensing solutions ideal for a variety of applications in automotive, robotics, drone, mobile, and other industries. Summary: Intel RealSense technology is all about intelligible object tracking and navigation, scene understanding and is thus considered as a key enabler for smart devices, autonomous systems and immersive experiences, within the global depth sensing market.

-

In July 2025, Intel RealSense aims to expand into AI, robotics, biometrics, and next-gen depth cameras. Its D555 camera featuring Power over Ethernet (PoE) and AI capabilities is already embedded in 60% of autonomous mobile robots and humanoids globally.

Depth Sensing Companies are:

-

Sony

-

Apple

-

Hitachi High-Technologies Corporation

-

Qualcomm

-

Infineon

-

STMicroelectronics

-

Texas Instruments

-

OmniVision

-

Himax.

-

Samsung

-

PMD Technologies

-

Stereolabs

-

Becom Bluetechnix

-

Melexis

-

Lumentum

-

NVIDIA.

-

LG Innotek

-

Ouster

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 8.41 Billion |

| Market Size by 2032 | USD 20.33 Billion |

| CAGR | CAGR of 11.71% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, and Services) • By Compression Technique (Lossy Compression, and Lossless Compression) • By End-Use Industry (Media & Entertainment, Security & Surveillance, Healthcare, Education & E-learning, and Others (Corporate, Government, etc.)) • By Application (Video Streaming, Video Conferencing, Broadcasting, and Others (Digital Storage, Video-on-Demand, etc.)) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Sony, Intel RealSense, Apple, Qualcomm, Infineon, STMicroelectronics, ams OSRAM, Texas Instruments, OmniVision, Himax, Samsung, PMD Technologies, Stereolabs, Becom Bluetechnix, Melexis, Lumentum, NVIDIA, LG Innotek, Ouster, and Aeva Technologies. |