Quantum Sensors Market Size & Trends:

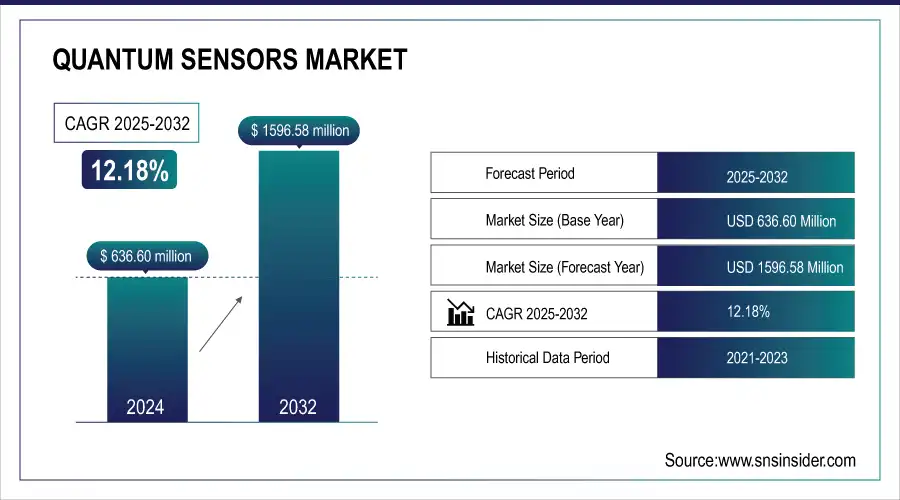

The Quantum Sensors Market Size was valued at USD 636.60 million in 2024 and is expected to reach USD 1596.58 million by 2032, growing at a CAGR of 12.18% over the forecast period 2025-2032. Quantum sensors market is registering fast-paced growth owing to the rapid adoption of premium technology across end-user verticals. As a function of quantum sensor applications in healthcare, defense, and environmental monitoring, adoption and integration metrics indicate a growing count of users. Improvement and innovation in quantum sensor technologies target increased precision, heightened sensitivity, and miniaturization to facilitate new applications. Manufacturing and production metrics focus on the problem of production scaling with a focus on producing more, cheaper, and more reliable. The fusion of AI and quantum computing in sensor applications is also rapidly adapting, which will create systems that are both more intelligent and energy-efficient while having the ability for enhanced data processing and analytics.

Get More Information on Quantum Sensors Market - Request Sample Report

Key Quantum Sensors Market Highlights:

-

Rising demand across key industries including automotive autonomous driving aerospace and defense GPS denied navigation submarine detection and healthcare advanced MRI early diagnostics is fueling market growth

-

Government and private R&D investments with significant funding programs and collaborations are accelerating the commercialization of quantum sensing technologies worldwide

-

Cost and complexity barriers such as high manufacturing costs need for controlled environments and lack of standard protocols are restraining large scale adoption

-

Conventional technology competition as traditional sensing technologies remain entrenched requiring high transition costs and integration efforts to shift toward quantum based solutions

-

Emerging opportunities in environmental monitoring with increasing use in climate change studies precision agriculture and environmental tracking

-

Miniaturization and consumer electronics potential with advances in compact portable quantum sensors enabling integration into wearables smartphones and IoT devices

Quantum Sensors Market Drivers:

-

Driving Forces Behind Quantum Sensors Market Growth in Automotive Aerospace Healthcare Sectors

High demand for high-precision sensing technologies in automotive, aerospace & defense, and healthcare industries is one of the major factors driving the market growth. Quantum sensors have a significant role in the automotive sector, especially when it comes to autonomous driving systems, which require highly accurate positioning and navigation information. Apart from these, in aerospace & defense, these sensors are extensively used in gravitational anomaly detection & submarine detection, and GPS-denied navigation. Increased investment levels by governments and private players in quantum R&D also contribute to the improvement of the increasing commercialization of quantum sensing technology. Another major driver of quantum sensing equipment demand is the growing requirement in the healthcare industry for ultra-sensitive medical imaging and diagnostics since quantum sensors can provide higher-resolution pictures supported by improved MRI technology and early disease detection.

Quantum Sensors Market Restraints:

-

Challenges Hindering Widespread Adoption of Quantum Sensors Despite Market Growth Potential

While the market for quantum sensors is thriving, several drivers may pose a restraint preventing them from achieving widespread adoption. The first and foremost challenge is the high cost and complexity associated with quantum sensor development and manufacturing. A lot of these sensors need very controlled environments, expensive materials, and very precise calibration, which makes them expensive and makes them difficult to commercialize at scale. Also, the teething phase of quantum technologies, with no standard protocols and demonstrations, is a major obstacle to uptake. While conventional sensing technologies remain a staple in many industries, requiring significant investments in research, training, and integration to transition to quantum-based alternatives slows market growth.

Quantum Sensors Market Opportunities:

-

Growth Opportunities in Quantum Sensors for Environmental Monitoring and Consumer Electronics Expansion

Growth opportunities also lie in the growing use of quantum technology for environmental monitoring like climate change studies and precision agriculture. Quantum sensors and technology offer success that corresponds with favorable developments in miniaturization, integration, and the production of small-sized, portable devices that can be easily transferred into consumer electronics and other mobile technology markets, including wearables. In addition, collaborative efforts among research institutions, technology companies, and start-ups pave the way for next-generation quantum sensors, offering enhanced precision and cost-effectiveness. As quantum computing and quantum communication are maturing along parallel paths, their convergence can unlock new use cases in the fields of quantum secure communication and quantum communication systems, which will increase the market size.

Quantum Sensors Market Segment Analysis:

By Product

The quantum sensors market was dominated by Atomic Clocks in 2024 accounting for 39.3% of the market due to their extensive use in precise timekeeping, navigation, and defense applications. Their predominant use within GPS devices, telecommunications, and scientific research has established them as the market leader.

Photosynthetically Active Radiation (PAR) Sensors are expected to grow fastest between 2025 and 2032 and are driven by growing demand for these sensors in agriculture, environmental monitoring, and climate research. Increasing emphasis on sustainable agriculture and improving ambient conditions for plant growth using quantum-enabled light detection technologies is anticipated to lead to considerable demand for PAR sensors shortly.

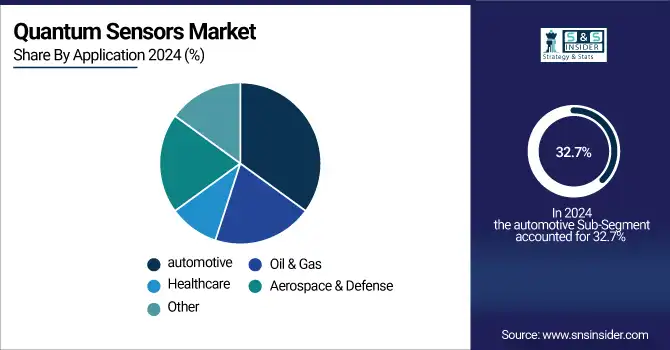

By Application

The automotive application accounted for the largest market share of 32.7% in the quantum sensors market in 2024 due to the increasing integration of quantum sensors in advanced driver-assistance systems (ADAS), autonomous vehicles, and navigation. As the future of mobility relies more heavily on these adoption technologies, Quantum sensors will facilitate vehicle safety, positioning, and performance, making them a vital aspect of next-generation mobility solutions.

The healthcare segment is expected to register the fastest CAGR between 2025 and 2032 owing to rising demand for ultra-sensitive medical imaging, and interdisciplinary medical research for early detection of diseases and diagnostics. High sensitivity detection capabilities due to the quantum sensors lead to advanced technologies such as MRI, brain imaging, and bio-sensing applications.

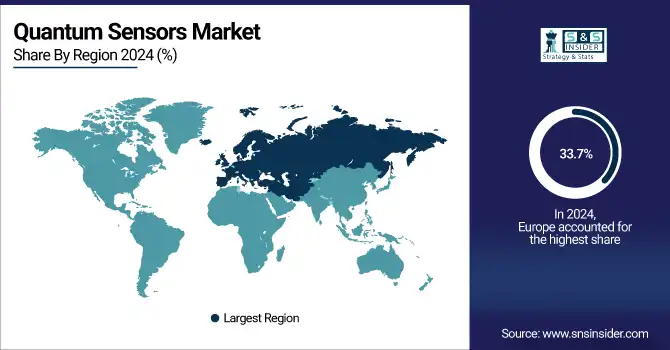

Europe Quantum Sensors Market Trends

Europe led quantum sensors with a 33.7% share of the market in 2023 thanks to government funding, competitive research institutions, and partnerships between industry players. As a pioneer hub for the development of quantum technology, this includes the EURO 1 billion EU Quantum Flagship Program, dedicated to fostering quantum research in the region. European companies Muquans (France) and Qnami (Switzerland) are influence makers in quantum sensing solutions development for aerospace, defense, and medical imaging. Moreover, the UK National Quantum Technologies Programmed has also contributed advances in atomic clocks, and quantum magnetometers, further adding to the strength of Europe's business advantage in this space.

Get Customized Report as per your Business Requirement - Request For Customized Report

Asia-Pacific Quantum Sensors Market Trends

The Asia-Pacific market is expected to grow at the fastest CAGR from 2025-2032, due to Rising Quantum Technology Investments by China, Japan & South Korea Notably, China has made rapid advances like launching the Hefei National Laboratory for Physical Sciences concentrating on quantum precision measurement. Companies such as CASIQLY (China) are developing high-performance quantum sensors for a range of navigational and defense purposes. Meanwhile, Japan's home region of Ibaraki is emerging as the next potential powerhouse of quantum-enhanced healthcare solutions, with the RIKEN Center for Quantum Computing also on the hunt for top-tier quantum sensor commercialization within its borders.

North America Quantum Sensors Market Trends

North America held a significant share of the quantum sensors market in 2023, driven by strong defense investments, advancements in quantum computing infrastructure, and substantial funding initiatives from the U.S. and Canada. The U.S. National Quantum Initiative Act and Department of Defense (DoD) programs have accelerated the development of quantum magnetometers, gyroscopes, and gravimeters for aerospace, navigation, and security applications. Companies like ColdQuanta (U.S.) and AOSense (U.S.) are spearheading innovations in atomic-based quantum sensing solutions, while collaborations with leading universities and research institutes are strengthening the ecosystem.

Latin America Quantum Sensors Market Trends

The Latin American quantum sensors market is in its early stages but is gaining momentum with growing academic collaborations and niche research projects, particularly in Brazil, Chile, and Argentina. Brazil’s National Institute for Quantum Science & Technology (INCT) is supporting projects in quantum metrology and environmental sensing. Emerging startups and partnerships with European and North American research hubs are laying the groundwork for regional growth, focusing on precision agriculture, energy infrastructure monitoring, and climate research applications.

Middle East & Africa Quantum Sensors Market Trends

The Middle East & Africa (MEA) region is witnessing gradual adoption of quantum sensors, fueled by initiatives in the UAE, Saudi Arabia, and South Africa. Government-led programs, such as the UAE’s National Quantum Strategy, aim to develop local expertise in quantum-enhanced navigation and oilfield exploration technologies. Collaborations with European quantum research institutions are fostering knowledge transfer and pilot deployments in energy, defense, and smart city infrastructure.

Key Quantum Sensors Companies are:

-

Andor Technology (Marana 4.2B-11, Balor sCMOS camera)

-

D-Wave Systems (D-Wave 2000Q, D-Wave Advantage)

-

Quantinuum (System Model H1-1, System Model H2)

-

Kistler Group (PiezoStar KI100 sensors, Type 6215 Quartz High-Pressure Sensor)

-

QuantX Labs (Cryoclock, advanced magnetic field sensors)

-

Xanadu Quantum Technologies (Programmable Gaussian Boson Sampler, Photonic Quantum Computer)

-

Uster Technologies (Quantum Expert System, Quantum 3 Yarn Clearer)

-

ID Quantique (ID281 Superconducting Nanowire System, Clavis3 Quantum Key Distribution)

-

Qnami (ProteusQ, Quantilever MX)

-

Muquans (Absolute Quantum Gravimeter, MuClock)

-

ColdQuanta (Quantum Core, Albert)

-

AOSense (Quantum Gravimeter, Atomic Gyroscope)

-

Bosch (MEMS Quantum Sensors, BMA400 Accelerometer)

-

Honeywell Quantum Solutions (H1 Quantum Computer, Trapped-Ion Quantum Sensors)

-

Microsoft Quantum (Quantum Development Kit, Topological Qubits)

-

Campbell Scientific, Inc. (PAR Quantum Sensors, LI-190R Quantum Sensor)

-

LI-COR, Inc. (LI-250A Light Meter, LI-190R Quantum Sensor)

-

M Squared Ltd. (Quantum Accelerometer, Quantum Gravimeter, Quantum Clocks

-

Mulberry Sensors (Chip-Scale Mid-Infrared Molecular Sensors)

-

KWAN-TEK (Diamond NV-Center Quantum Sensors)

Quantum Sensors Market Competitive Landscape:

Andor Technology, established in 1989 in Belfast, Northern Ireland, is a leading provider of high-performance scientific imaging solutions. The company specializes in advanced cameras and detectors, including sCMOS and EMCCD technologies, widely used in quantum sensing, life sciences, and materials research, enabling high-precision measurement and imaging applications globally.

-

In November 2024, Andor Technology launched the ZL41 Cell and ZL41 Wave sCMOS cameras, enhancing sensor technology for life and physical sciences.

D-Wave Systems, founded in 1999 and headquartered in Burnaby, Canada, is a pioneer in quantum computing technology. The company develops quantum annealing systems and software platforms used across various industries, including quantum sensing research, optimization, and AI applications, supporting advancements in aerospace, defense, and high-performance computing solutions.

Carahsoft Technology Corp., established in 2004 in Reston, Virginia, USA, is a leading government IT solutions provider. While not a direct quantum hardware manufacturer, Carahsoft partners with quantum technology firms to deliver quantum sensing, computing, and cybersecurity solutions to federal, state, and education sectors, accelerating market adoption and deployment.

-

In January 2025, D-Wave and Carahsoft partnered to expand quantum computing solutions in the U.S. public sector, providing access via government contract vehicles.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 636.60 Million |

| Market Size by 2032 | USD 1596.58 Million |

| CAGR | CAGR of 12.18 % From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Atomic Clocks, Gravitational Sensors, Photosynthetically Active Radiation (PAR), Quantum Magnetic Sensors, Others) • By Application (Aerospace & Defense, Automotive, Oil & Gas, Healthcare, Other) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles |

Andor Technology, D-Wave Systems, Quantinuum, Kistler Group, QuantX Labs, Xanadu Quantum Technologies, Uster Technologies, ID Quantique, Qnami, Muquans, ColdQuanta, AOSense, Bosch, Honeywell Quantum Solutions, Microsoft Quantum, Campbell Scientific, Inc., LI-COR, Inc., M Squared Ltd., Mulberry Sensors, KWAN-TEK. |