Robotic Warfare Market Report Scope & Overview:

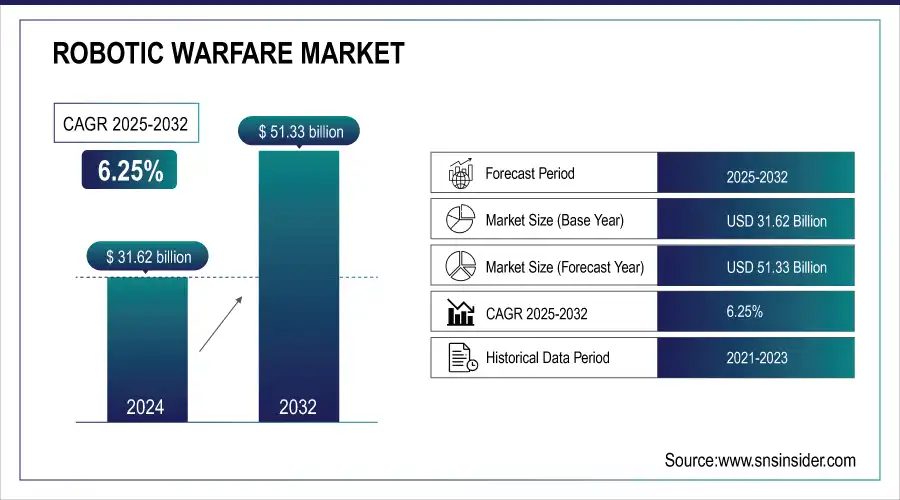

The Robotic Warfare Market size was valued at USD 31.62 Billion in 2024 and is projected to reach USD 51.33 Billion by 2032, growing at a CAGR of 6.25% during 2025-2032. The robotic warfare market is experiencing robust growth driven by increasing demand for autonomous combat systems, electronic warfare capabilities, and enhanced battlefield efficiency. Including advanced sensors, AI-enabled decision-making and multi-domain operability these platforms are able to execute vital missions such as reconnaissance, targeting, logistics support, and electronic signal disruption. Higher defense budgets and armed aggression in some countries, coupled with the trend for minimal human intervention from a safety viewpoint (force protection), are propelling adoption within land, air and maritime sectors. Next-gen robotic platforms are increasingly featuring a focus on lightweight materials, extended operational autonomy and SWaP-optimized architectures. It is also integrated into real-time data networks and cyber-hardened communication systems to provide high resilience even in contested environments. With countries upgrading defense infrastructure, the market is anticipated to continue growing.

To Get more information on Robotic Warfare Market - Request Free Sample Report

Kvertus has rolled out the mass production of AD BERSERK robotic EW platform with a range of up to 20 km, and up to 12 hours autonomy. It will jam drone communication on all frequencies and back front-line demining evacuation, as well as logistics protection

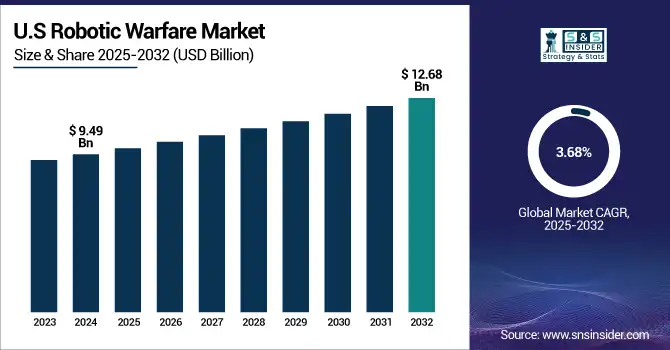

The U.S Robotic Warfare Market size was valued at USD 9.49 Billion in 2024 and is projected to reach USD 12.68 Billion by 2032, growing at a CAGR of 3.68% during 2025-2032. This Robotic Warfare Market growth is driven by rising investments in autonomous military systems, the need for advanced electronic warfare solutions and strategic push to reduce human intervention in war zones. These ongoing developments combined with novel AI process capabilities, real-time data turnaround and multi-domain intelligence interchange could potentially slosh even more robots into service as burgeoning robotic ecosystems become key elements in new warfare modernization policy initiatives.

The Robotic Warfare Market trends is driven by rapid advancements in AI, autonomous navigation, and electronic warfare integration. The trend towards a more multi-mission robotic system that takes care of everything from reconnaissance and close combat support to logistics and EW tasks with just enough human oversight has already started. Defence forces are progressively aiming at the modular, upgradable systems with open architecture that can adapt to ever-evolving threats posed by CBRN incident. Enhanced operational efficiency by leveraging lightweight, long-life battery and SWaP optimization Real time data fusion and increased interoperability with command networks are also emerging as critical capabilities defining the future of battlefield robotics.

Robotic Warfare Market Dynamics:

Drivers:

-

Rising Adoption of Modular Unmanned Combat Systems in Naval Warfare

The growing emphasis on modular, missile-equipped unmanned systems is significantly driving the robotic warfare market. Types of defense forces are also going for wily operational systems which include multi-mission roles like surveillance, strike, electronic warfare and logistics support. Across the board, this move is driven by the need for increased force multipliers and minimization of human risks in more dangerous regions, to operate at a heightened level with maximal efficiency across contested spaces. A modular architecture provides fast payload integration and quick mission reconfigurations, which is combined with off-the-shelf commercial components that ensures quicker deployment to field and cost-effective manner. As navies and military worldwide update their fleets with autonomous systems, a growing need for AI-powered robotic warfare solutions will change the way combat is conducted.

The U.S. The MASC program was created by the Navy to field missile-armed unmanned warships that can carry out modular, multi-mission roles. For the U.S. Navy, this signals a significant move down the path to autonomous naval warfare strengthening fleet resilience and distributed lethality.

Restraints:

-

Operational Complexity and Cybersecurity Risks Limiting Deployment

The adoption of robotic warfare systems faces key restraints due to substantial operational complexity and a rise in cybersecurity concerns. Implementing AI-based autonomy, real-time processing of data and multi-platform coordination require a lot of backend infrastructure and trained personnel that many defense agencies do not have. These systems also suffer from a glut of networking, communications and software-derived functions -- those in turn can be hacked, jammed or electronically interfered with. Thus, it leads to potential mission failures and data breaches in high-risk environments. It further slows widespread adoption by adding the costs of secure system development, testing, and maintenance. Thus, while technologically capable, many countries do feel inhibited to utilize the full extent of their robo-warfare platforms in key military operations.

Opportunities:

-

Modular and Cost-Effective UGVs Enabling Scalable Battlefield Integration

The growing demand for affordable, modular, and AI-enabled unmanned ground vehicles (UGVs) presents a significant opportunity in the robotic warfare market. Modular UGVs provide unmatched operational flexibility to militaries that require rapidly deployable solutions for a range of combat scenarios from payload transport to mine detection and casualty evacuation. Hence, the personnel could be rapidly built on field with off-the-shelf components without logistic overheads and increasing mission readiness as well. This change represents a broader move to low-cost robotics systems, which will ultimately allow startups and defense innovators to modernize ground warfare in response to the emerging threat landscape.

NATO has invested €9 million in ARX Robotics to develop modular, AI-driven unmanned ground systems for modern combat. These autonomous robots support missions like payload transport, mine-sweeping, and casualty evacuation with rapid battlefield adaptability.

Challenges:

-

Regulatory, Ethical, and Tactical Barriers Hindering Full-Scale Robotic Warfare Adoption

The robotic warfare market faces critical challenges stemming from regulatory uncertainty, ethical concerns, and tactical limitations. The use of autonomous systems quickly cascades into difficult legal and ethical questions about responsibility, levels-of-autonomy, rules of engagement, compliance with international humanitarian laws etc. Also, standardizing a protocol for interoperability among allied forces is absent which makes the integration real-time communication in joint operations difficult. Operational reliability, which in this case is also limited since tactical constraints are involved such as vulnerability to electronic warfare, terrain adaptability and real-time decision making under combat pressure. Those factors give defense agencies pause, delaying procurement cycles and the large-scale deployment of weapon systems. Thus, in practice, the governance aspect of these systems keep holding back the full impact of robotic warfare capability even if it is otherwise technologically possible.

Robotic Warfare Market Segmentation Analysis:

By Mode of Operation

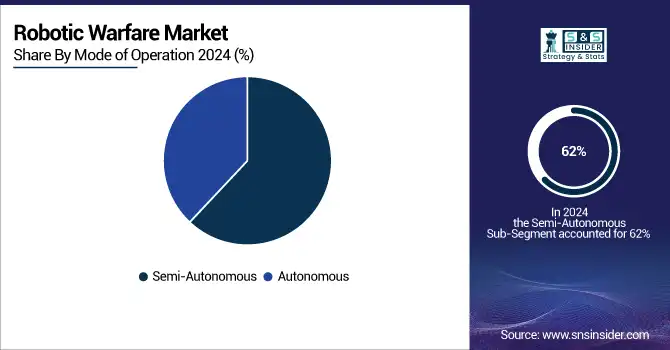

In 2024, the Semi-Autonomous segment accounted for approximately 62% of the Robotic Warfare market share, highlighting its dominant role in current defense operations. This strong market presence is driven by the balance it offers between human control and machine efficiency, allowing remote operation with advanced decision-support systems. Semi-autonomous platforms are widely adopted due to their reliability, lower regulatory barriers compared to fully autonomous systems, and proven performance in tasks like reconnaissance, targeting, and logistics. As trust in autonomy grows gradually, the segment is expected to remain a preferred choice for militaries transitioning toward fully autonomous capabilities.

The Autonomous segment is expected to experience the fastest growth in Robotic Warfare market over 2025-2032 with a CAGR of 6.76%, This growth is driven by rapid advancements in artificial intelligence, sensor fusion, and machine learning, enabling robotic systems to operate independently in dynamic and hostile environments. Defense agencies are increasingly investing in fully autonomous platforms for applications such as surveillance, targeting, logistics, and combat operations. The reduced need for human intervention enhances operational efficiency and safety, particularly in high-risk missions. As battlefield complexity increases, autonomous systems are becoming critical for achieving strategic superiority and real-time responsiveness.

By Capability

In 2024, the Unmanned platforms & systems segment accounted for approximately 36% of the Robotic Warfare market share, owing to a significant demand from defense operations persisting autonomous ground and aerial systems across mostgeographies. This supremacy comes down to the fact that drones can execute dangerous reconnaissance, logistic and electronic warfare missions without any threats to human personnel. The growing investment in various technologies such as AI, sensor integration, and modular payload systems have led to increasing their adoption. The segment is anticipated to continue to hold a large market share as militaries modernize in part due the type's adaptability, cost-effectiveness and mission versatility.

The Target acquisition systems segment is expected to experience the fastest growth in Robotic Warfare market over 2025-2032 with a CAGR of 13.37%, This surge is driven by increasing integration of AI-powered vision systems, advanced sensors, and real-time data processing to enhance precision in identifying, tracking, and engaging enemy targets. As modern warfare shifts toward automation and speed, demand for highly accurate and responsive targeting solutions is rising. These systems are becoming essential across unmanned aerial, ground, and naval platforms, reinforcing their critical role in next-generation combat scenarios.

By Application

In 2024, the Intelligence, Surveillance & Reconnaissance (ISR) segment accounted for approximately 28% of the Robotic Warfare market share, reflecting its crucial role in enhancing situational awareness and mission planning. This dominance is driven by the growing use of autonomous drones, ground robots, and sensor-fusion systems that collect and relay real-time battlefield intelligence. With rising demand for data-driven decision-making, ISR capabilities are being integrated across various unmanned platforms. The segment's importance is expected to grow further as defense forces prioritize precision, stealth, and early threat detection in increasingly complex combat environments.

The Combat & Operations segment is expected to experience the fastest growth in Robotic Warfare market over 2025-2032 with a CAGR of 9.32%, This growth is fueled by the increasing deployment of autonomous systems for frontline combat roles, including direct engagement, fire support, and tactical maneuvers. Advancements in AI, weapon integration, and real-time coordination are enhancing the operational effectiveness of robotic platforms in high-threat environments. As militaries seek to reduce human exposure while maintaining combat superiority, the demand for robotic systems capable of executing offensive and defensive missions is rapidly accelerating.

By Domain

In 2024, the Land segment accounted for approximately 41% of the Robotic Warfare market share, highlighting its dominant role in current defense operations. This leadership is driven by the widespread use of unmanned ground vehicles (UGVs) for reconnaissance, logistics support, combat assistance, and explosive ordnance disposal. Increasing border security needs, counter-insurgency missions, and urban warfare challenges have accelerated the deployment of robotic platforms on land. The adaptability, mobility, and modularity of ground-based systems make them vital assets across a wide range of military scenarios, reinforcing their continued market dominance.

The Airborne segment is expected to experience the fastest growth in Robotic Warfare market over 2025-2032 with a CAGR of 9.10%, driven by rising demand for UAVs in ISR, precision strike, and EW missions. Increased investments in drone swarming, AI flight autonomy, and beyond-visual-line-of-sight (BVLOS) operations are fueling rapid adoption across defense forces globally.

Robotic Warfare Market Regional Analysis:

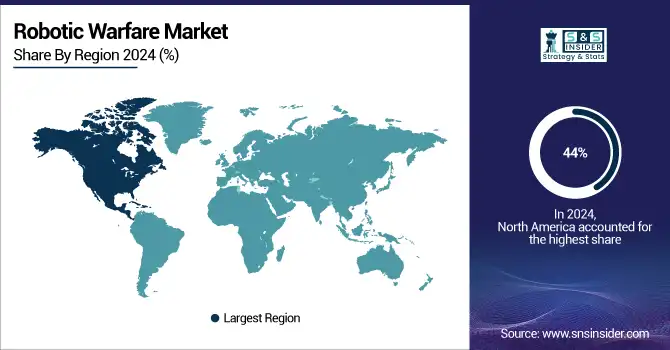

In 2024 North America dominated the Robotic Warfare market and accounted for 44% of revenue share. This leadership is driven by high defense spending, rapid adoption of autonomous technologies, and strong presence of key defense contractors. The region's focus on modernizing military infrastructure, expanding unmanned combat capabilities, and integrating AI across land, air, and naval platforms continues to fuel sustained market growth and innovation.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia-Pacific is expected to witness the fastest growth in the Robotic Warfare Market over 2025-2032, with a projected CAGR of 7.91%. This acceleration is driven by increasing defense budgets, rising geopolitical tensions, and rapid advancements in indigenous unmanned technologies. Countries like China, India, South Korea, and Japan are heavily investing in autonomous systems for surveillance, border security, and combat readiness, propelling regional demand for robotic warfare solutions.

In 2024, Europe emerged as a promising region in the Robotic Warfare Market, supported by rising defense modernization programs and increased investment in unmanned systems. The region is focusing on developing AI-driven autonomous platforms for surveillance, combat support, and logistics operations amid growing security concerns. Collaborative defense initiatives, funding from organizations like NATO, and the presence of innovative defense tech startups are further accelerating adoption. As a result, Europe is positioning itself as a key player in advancing robotic warfare capabilities across land, air, and naval domains.

Latin America (LATAM) and the Middle East & Africa (MEA) regions are witnessing steady growth in the Robotic Warfare market, driven by growing security concerns, border surveillance needs, and modernization of military forces. These regions are gradually adopting unmanned systems for reconnaissance, counterterrorism, and urban combat operations. Government initiatives, rising defense budgets, and collaborations with international defense technology providers are supporting market expansion. While still in early stages compared to developed markets, LATAM and MEA are showing increasing interest in cost-effective, semi-autonomous, and modular robotic platforms to enhance tactical capabilities.

Robotic Warfare Market Companies are:

The Key Players in Robotic Warfare Market are Elbit Systems, Lockheed Martin, Northrop Grumman, Rheinmetall, QinetiQ, BAE Systems, Raytheon Technologies, General Dynamics, Thales, Israel Aerospace Industries, Kongsberg Gruppen, Leonardo, Textron, L3Harris Technologies, SAAB, Hanwha Aerospace, Turkish Aerospace Industries, Milrem Robotics, EDGE Group, Boston Dynamics. and Others.

Recent Developments:

-

In Oct 2024, Elbit Systems unveiled the Sigma 155×52 automated wheeled howitzer at AUSA 2024, aiming to modernize US Army artillery with advanced mobility, automation, and rapid-fire capabilities, while General Dynamics showcased its TRX Defender, Stryker MCOTM, and MUTT XM platforms, emphasizing robotic integration, hybrid-electric drives, and enhanced survivability for next-gen battlefield operations.

-

In June 2025, Northrop Grumman has integrated the U.S. Naval Research Laboratory’s robotic payload onto its Mission Robotic Vehicle (MRV), advancing DARPA’s satellite servicing goals. The MRV will now undergo space-condition testing to enable robotic inspection, repair, and relocation in geosynchronous orbit.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 31.62 Billion |

| Market Size by 2032 | USD 51.33 Billion |

| CAGR | CAGR of 6.25% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Capability(Unmanned platforms & systems, Exoskeleton & wearables, Target acquisition systems and Turret and weapon systems) • By Application(Intelligence, Surveillance & Reconnaissance (ISR), Logistics & Support, Search & Rescue, Tracking & Targeting, Combat & Operations and Others) • By Mode of Operation(Autonomous and Semi-Autonomous) • By Domain(Land, Marine and Airborne) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | The Robotic Warfare Market Companies are Elbit Systems, Lockheed Martin, Northrop Grumman, Rheinmetall, QinetiQ, BAE Systems, Raytheon Technologies, General Dynamics, Thales, Israel Aerospace Industries, Kongsberg Gruppen, Leonardo, Textron, L3Harris Technologies, SAAB, Hanwha Aerospace, Turkish Aerospace Industries, Milrem Robotics, EDGE Group, Boston Dynamics. and Others. |