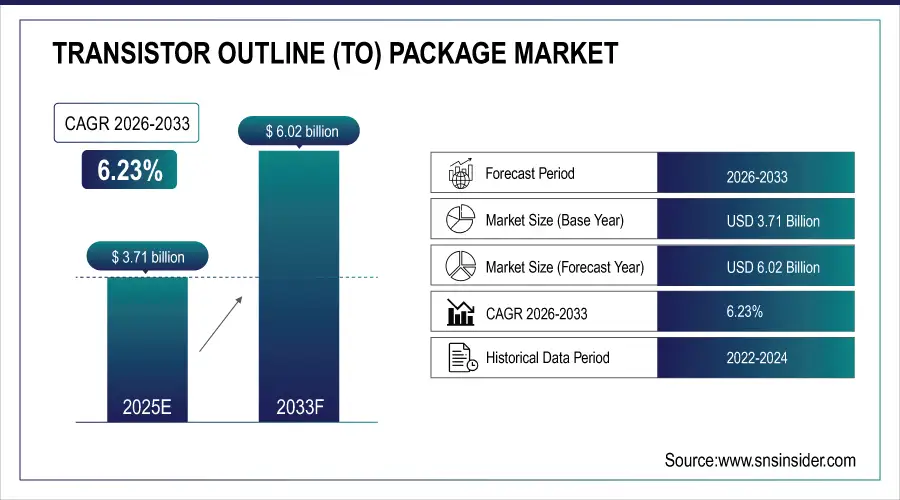

Transistor Outline (TO) Package Market Size & Growth:

The Transistor Outline (TO) Package Market size was valued at USD 3.71 Billion in 2025E and is projected to reach USD 6.02 Billion by 2033, growing at a CAGR of 6.23% during 2026–2033.

The Transistor Outline (TO) Package Market is experiencing consistent growth driven by the rising need for high-performance, reliable, and thermally efficient semiconductor packaging. Widely used for power transistors, diodes, and sensors, TO packages such as TO-220, TO-247, and TO-92 offer excellent heat dissipation and mechanical stability. Ongoing advancements in materials like metal, ceramic, and plastic-molded packages are enhancing durability, miniaturization, and power efficiency. The market is further supported by increasing adoption in automotive electronics, consumer devices, and industrial automation, as well as by emerging semiconductor innovations such as 2D transistors and advanced gate stack technologies that demand precision packaging solutions.

October 14, 2025 – Seoul, South Korea: Researchers at Seoul National University published a roadmap in Nature Electronics outlining next-generation 2D semiconductor gate stack technology, detailing five integration approaches to overcome dielectric and interface limitations for future angstrom-scale transistor commercialization beyond silicon CMOS technology.

Transistor Outline (TO) Package Market Size and Forecast:

-

Market Size in 2025: USD 3.71 Billion

-

Market Size by 2033: USD 6.02 Billion

-

CAGR: 6.23% (from 2026 to 2033)

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Transistor Outline (TO) Package Market - Request Free Sample Report

Transistor Outline (TO) Package Market Highlights:

-

GaN and SiC innovations are driving next-generation growth, boosting power density, efficiency, and thermal performance in EVs, renewable energy, and automation systems.

-

Navitas Semiconductor’s 650V bidirectional GaNFast ICs launched in April 2025 mark a leap in EV charger and motor drive performance.

-

Thermal management challenges and material cost constraints limit scalability and raise production costs in high-power TO packaging.

-

Miniaturization and reliability trade-offs persist due to insulation and mechanical strength requirements, slowing next-gen adoption.

-

AI, HPC, and datacenter expansion are fueling demand for efficient TO-based power packaging solutions.

-

Texas Instruments’ 48V GaN-based eFuse (March 2025) exemplifies emerging opportunities in compact, thermally efficient, and high-performance TO designs.

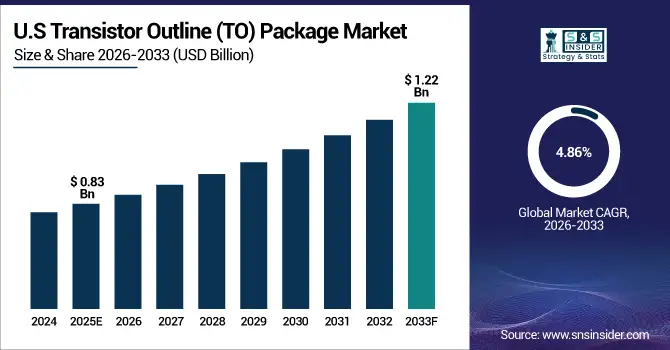

The U.S. Transistor Outline (TO) Package Market size was valued at USD 0.83 Billion in 2025E and is projected to reach USD 1.22 Billion by 2033, growing at a CAGR of 4.86% during 2026–2033. driven by the increasing demand for high-power and thermally efficient semiconductor components in automotive, industrial, and consumer electronics applications. Expanding adoption of electric vehicles, renewable energy systems, and IoT-enabled devices is accelerating the need for robust TO packages that offer superior heat dissipation, reliability, and compactness to support high-performance electronic systems.

Transistor Outline (TO) Package Market Drivers:

-

GaN-Based Advancements Power Next-Generation Growth in the Transistor Outline (TO) Package Market

The Transistor Outline (TO) Package Market is driven by the growing demand for compact, high-efficiency power semiconductor devices in electric vehicles, renewable energy systems, and industrial automation. The introduction of advanced packaging solutions, such as bidirectional GaNFast ICs, enhances power density, efficiency, and thermal performance, accelerating the shift toward smaller, high-performance systems. Additionally, increased adoption of GaN and SiC technologies in automotive and power management applications supports continuous innovation in TO packaging, enabling manufacturers to meet evolving performance, cost, and sustainability requirements.

April 7, 2025 — Navitas Semiconductor launched 650 V bidirectional GaNFast ICs and IsoFast drivers for single-stage bidirectional switch (BDS) converters, enhancing efficiency, power density, and performance in EV chargers and motor drives.

Transistor Outline (TO) Package Market Restraints:

-

Thermal Management and Material Limitations Challenge TO Package Market Growth

The Transistor Outline (TO) Package Market faces key restraints driven by thermal management complexities, material constraints, and cost pressures. High power density in advanced semiconductor devices leads to significant heat dissipation issues, limiting performance reliability. Additionally, challenges in achieving miniaturization while maintaining electrical insulation and mechanical strength hinder scalability. The dependence on costly materials like ceramics and specialized metals further increases production costs. Supply chain disruptions, particularly in rare material sourcing, and the slow adoption of next-generation packaging technologies also restrict market expansion despite rising semiconductor demand.

Transistor Outline (TO) Package Market Opportunities:

-

Rising Demand for Efficient Power Packaging in AI-Driven Systems

The growing adoption of artificial intelligence, high-performance computing, and cloud infrastructure is fueling strong demand for advanced power-management solutions such as TI’s 48V integrated hot-swap eFuse technology. This innovation highlights a major market opportunity in the Transistor Outline (TO) Package segment, as manufacturers pursue compact, thermally efficient, and reliable designs. With data centers and AI servers requiring higher power density and reduced system size, TO-based GaN devices are well-positioned to capture emerging opportunities, offering enhanced efficiency, protection, and scalability for next-generation computing and energy-efficient electronic architectures.

March 20, 2025 — Texas Instruments (TI) introduced the industry’s first 48V integrated hot-swap eFuse with power-path protection, enhancing datacenter and AI server efficiency. The new GaN-based power-management chips deliver >98% efficiency, compact design, and advanced fault protection for high-performance computing and power-dense applications.

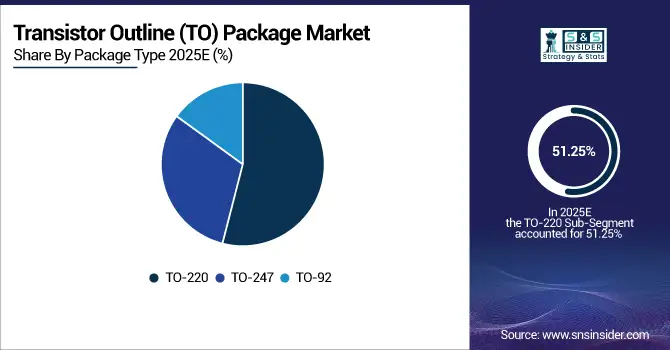

Transistor Outline (TO) Package Market Segment Highlights:

-

By Package Type: Dominant – TO-220 (51.25% in 2025E → 46.75% in 2033); Fastest-Growing – TO-247 (CAGR 9.26%)

-

By End-Use Industry: Dominant – Consumer Electronics (43.25% in 2025E → 38.75% in 2033); Fastest-Growing – Automotive Applications (CAGR 8.93%)

-

By Material: Dominant – Metal Can (55.50% in 2025E → 52.50% in 2033); Fastest-Growing – Plastic Molded (CAGR 8.16%)

-

By Transistor Type: Dominant – MOSFET (44.88% in 2025E → 47.13% in 2033); Fastest-Growing – IGBT (CAGR 7.73%)

By Package Type, TO-220 is Dominating and TO-247 is Fastest-Growing

TO-220 leads the Transistor Outline (TO) Package Market with the highest market share, reflecting its extensive use in power electronics, industrial control systems, and automotive applications due to its cost efficiency and robust thermal performance. Meanwhile, TO-247 is the fastest-growing package type, driven by increasing adoption in high-power and high-efficiency systems such as EVs, data centers, and renewable energy inverters, showcasing a shift toward more advanced packaging technologies.

By End-Use Industry, Consumer Electronics is Dominating and Automotive Applications are Fastest-Growing

Consumer Electronics holds the largest share in the Transistor Outline (TO) Package Market, driven by massive integration of semiconductor components in smartphones, wearables, and home appliances. However, Automotive Applications are expanding rapidly, fueled by rising adoption of power semiconductors in electric vehicles (EVs), ADAS, and charging infrastructure, highlighting strong future growth potential.

By Material, Metal Can is Dominating and Plastic Molded is Fastest-Growing

Metal Can packages dominate the market owing to their superior durability, thermal stability, and reliability in industrial and high-power applications. Meanwhile, Plastic Molded packages are the fastest-growing, supported by trends toward miniaturization, cost efficiency, and their increasing suitability for high-volume consumer and automotive electronics manufacturing.

By Transistor Type, MOSFET is Dominating and IGBT is Fastest-Growing

MOSFETs lead the market due to their extensive deployment in low-to-medium voltage applications, offering efficiency and fast switching in electronic and automotive systems. In contrast, IGBTs are witnessing the fastest growth, propelled by expanding use in EVs, renewable power systems, and heavy industrial drives where high voltage and current handling are critical.

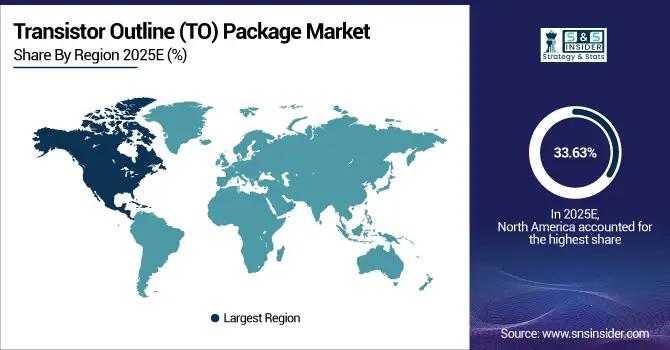

Transistor Outline (TO) Package Market Regional Highlights:

-

North America: 33.63% → 31.38%, Dominant region in 2025, driven by strong industrial automation, EV adoption, and robust R&D infrastructure (CAGR ~5.31%)

-

Asia-Pacific: 30.88% → 36.13%, Fastest-growing region, fueled by rapid industrialization, semiconductor expansion, and increasing power electronics demand (CAGR ~8.32%)

-

Europe: 21.88% → 21.13%, Stable region, supported by sustainability initiatives and steady adoption of advanced power modules (CAGR ~5.77%)

-

Latin America: 7.88% → 7.13%, Emerging region, witnessing gradual industrial growth and increasing electrification (CAGR ~4.90%)

-

Middle East & Africa: 5.75% → 4.25%, Smallest market, limited by slow industrial uptake but showing long-term development potential (CAGR ~2.22%)

North America Transistor Outline (TO) Package Market Insights:

North America leads the Transistor Outline (TO) Package market, driven by advanced semiconductor manufacturing, strong presence of key OEMs, and rising demand for high-performance power devices across automotive and industrial sectors. Continuous R&D investments and adoption of efficient thermal management solutions further strengthen the region’s market dominance.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S Transistor Outline (TO) Package Market Insights:

The U.S. leads the Transistor Outline (TO) Package market, driven by robust semiconductor innovation, strong presence of global chip manufacturers, and growing demand for high-power electronics. Advanced R&D capabilities, government support for domestic chip production, and rapid adoption across automotive and defense sectors reinforce its market leadership.

Asia-Pacific Transistor Outline (TO) Package Market Insights:

Asia-Pacific is the fastest-growing region in the Transistor Outline (TO) Package market, fueled by rapid industrialization, expanding electronics manufacturing hubs, and increasing semiconductor production in China, Japan, South Korea, and Taiwan. Strong demand from automotive, consumer electronics, and renewable energy sectors further accelerates regional market growth.

China Transistor Outline (TO) Package Market Insights:

China leads the Asia-Pacific Transistor Outline (TO) Package market, driven by strong supply chain integration, cost-effective manufacturing, and growing demand for power electronics and semiconductor components across major industries.

Europe Transistor Outline (TO) Package Market Insights:

The Europe Transistor Outline (TO) Package market is witnessing emerging trends driven by advancements in electric mobility, renewable energy systems, and industrial automation, alongside increasing adoption of energy-efficient power semiconductors and robust R&D initiatives across Germany, France, and the U.K. supporting innovation in packaging technologies.

Germany Transistor Outline (TO) Package Market Insights:

Germany dominates the Europe Transistor Outline (TO) Package market, driven by its strong semiconductor manufacturing base, advanced automotive electronics demand, and continuous innovation in power device efficiency and packaging technologies.

Latin America Transistor Outline (TO) Package Market Insights:

The Latin America Transistor Outline (TO) Package market is steadily expanding, driven by the growing electronics manufacturing sector, increased adoption of industrial automation, and rising investments in automotive and energy industries. Countries like Brazil and Mexico are emerging as key hubs for semiconductor packaging and assembly due to supportive government initiatives and cost advantages.

Brazil Transistor Outline (TO) Package Market Insights:

Brazil is the dominant country in the Transistor Outline (TO) Package market, driven by its robust electronics manufacturing ecosystem, increasing adoption of power semiconductors in automotive applications, and government initiatives supporting local semiconductor production and innovation.

Middle East & Africa Transistor Outline (TO) Package Market Insights:

The Middle East and Africa Transistor Outline (TO) Package market is witnessing moderate growth, supported by rising investments in industrial automation, renewable energy projects, and data center expansion. Increasing adoption of power-efficient semiconductor components in automotive and communication sectors is further contributing to the gradual yet steady market expansion across the region.

United Arab Emirates (UAE) Transistor Outline (TO) Package Market Insights:

The United Arab Emirates (UAE) is the dominant country, driven by its strong electronics manufacturing base, rapid data center development, and increasing government initiatives supporting semiconductor and power management technologies.

Transistor Outline (TO) Package Market Competitive Landscape:

SCHOTT AG, established in 1884, is a Germany-based global leader in specialty glass, materials, and advanced packaging solutions. The company serves industries including semiconductors, electronics, healthcare, and optics, leveraging over 140 years of expertise in precision-engineered glass innovations for high-performance and reliability-driven applications worldwide.

-

In September 2025 –SCHOTT AG unveiled its cutting-edge specialty glass solutions for advanced semiconductor packaging at SEMICON Taiwan 2025, showcasing high-precision glass carrier wafers and panels designed to meet the demands of AI and HPC applications through reduced total thickness variation (TTV) and expanded global production capabilities.

Texas Instruments Incorporated (TI), established in 1930 and headquartered in Dallas, Texas, is a global leader in semiconductor design and manufacturing. The company specializes in analog and embedded processing chips, powering innovations across industrial, automotive, aerospace, and consumer electronics sectors through high-performance and reliable semiconductor packaging technologies.

-

April 2024, Texas Instruments highlighted advancements in electronic component packaging for space applications, emphasizing SWaP+C benefits of plastic packages, continued support for QMLV-RHA ceramic packaging, and its role in standardizing QMLP to enhance reliability and design efficiency in space-grade semiconductors.

Transistor Outline (TO) Package Companies are:

-

TFC Ltd.

-

AMETEK Inc.

-

ROHM Co., Ltd.

-

Texas Instruments Incorporated

-

Spectrum Semiconductor Materials, Inc.

-

Xuzhou Xuhai Opto-Electronic Technologies Co., Ltd.

-

Infineon Technologies AG

-

ON Semiconductor Corporation (onsemi)

-

STMicroelectronics N.V.

-

Nexperia B.V.

-

Vishay Intertechnology, Inc.

-

Toshiba Electronic Devices & Storage Corporation

-

Diodes Incorporated

-

Renesas Electronics Corporation

-

Panasonic Industry Co., Ltd.

-

Fuji Electric Co., Ltd.

-

IXYS Corporation (Littelfuse, Inc.)

-

Microchip Technology Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 3.71 Billion |

| Market Size by 2033 | USD 6.02 Billion |

| CAGR | CAGR of 6.23% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Package Type: TO-220, TO-247, and TO-92 • By End-Use Industry: Consumer Electronics, Automotive Applications, and Industrial Automation • By Material: Metal Can, Plastic Molded, and Ceramic • By Transistor Type: Bipolar Junction Transistor (BJT), MOSFET, and Insulated-Gate Bipolar Transistor (IGBT) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | SCHOTT AG, TFC Ltd., AMETEK Inc., ROHM Co., Ltd., Texas Instruments Incorporated, Evergreen Semiconductor Materials Inc., Spectrum Semiconductor Materials Inc., Xuzhou Xuhai Opto-Electronic Technologies Co., Ltd., Infineon Technologies AG, onsemi, STMicroelectronics N.V., Nexperia B.V., Vishay Intertechnology Inc., Toshiba Electronic Devices & Storage Corporation, Diodes Incorporated, Renesas Electronics Corporation, Panasonic Industry Co., Ltd., Fuji Electric Co., Ltd., IXYS Corporation (Littelfuse, Inc.), and Microchip Technology Inc. |