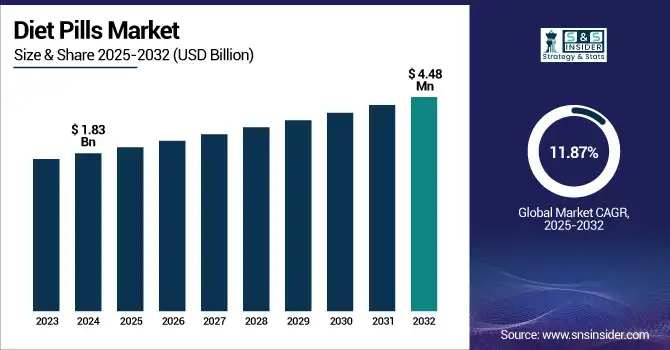

Diet Pills Market Size Analysis

The Diet Pills Market size was valued at USD 1.83 billion in 2024 and is expected to reach USD 4.48 billion by 2032, growing at a CAGR of 11.87% over the forecast period of 2025-2032.

Get more information on Diet Pills Market - Request Sample Report

The diet pills market is growing at a fast pace with an increasing number of obese and overweight population, currently 42.5% of the U.S. population and 18.5% of children are obese. Globally, more than 1 billion people, 650 million adults, 340 million adolescents, and 39 million children are now considered obese. These disturbing figures have precipitated increased consumer interest and psychological need for effective weight control treatments. Prescription diet pills, especially GLP-1 receptor agonists like semaglutide, liraglutide, and tirzepatide, have demonstrated that people can lose on average 10 to 20% of their body weight, and new oral options like orforglipron are in advanced stages of testing. The landscape of diet pills continues to burgeon, and several new drugs across various stages of testing that concentrate on new mechanisms of action, such as amylin analogs, GIP co-agonists, MC4R agonists, and gut-brain axis modulation.

A 2023 AJPM Focus study highlighted the integration of digital behavior change platforms with pharmacotherapy, improving long-term adherence and outcomes in weight management.

OTC, on the other hand, has witnessed sales of over USD 50 billion per year with self-medication trends, rising awareness for fitness, and the online channel being especially accessible. Regulatory activities in the U.S. and Europe, for example, are among the highest, with organizations like the FDA and EMA fast-tracking the approvals of high-impact metabolic and anti-obesity drugs. In 2024, more than 55 new therapies were approved in the United States, a testament to regulatory urgency. R&D investment is also increasing with several pharmaceutical behemoths, including Novo Nordisk, Eli Lilly, and Pfizer, pumping billions of dollars into metabolic research, new drug delivery structures, and combination drugs. Public/Private partnerships play a role in data integration, patient registries, and novel clinical trial designs.

For instance, Eli Lilly's orforglipron, an oral non-peptide GLP-1 receptor agonist, is showing positive Phase 3 trial outcomes, potentially becoming the first once-daily oral weight-loss pill rivaling injectable therapies.

Diet Pills Market Dynamics

Drivers:

-

Rapid Innovation, Shifting Consumer Behavior, and Healthcare Integration are Accelerating the Adoption of Pharmaceutical Weight-Loss Solutions

Technology innovation and lifestyle behavior are converging to drive the diet pills market. Post-pandemic health consciousness has dramatically changed consumer priorities in favor of preventive care, driving interest in medical weight-loss solutions. In addition, digital health platforms and telemedicine providers are collaborating with pharmaceutical brands to remotely prescribe diet pills, eliminating the requirement to visit a clinic to obtain the drugs. More than 70% of adults are now interested in using apps or digital consultations for weight management, and technologies are filling gaps between demand and supply. The use of AI and predictive analytics in clinical trials is reducing the drug development pipeline and cost and improving patient response precision.

In September 2024, Novo Nordisk reported that its new oral obesity drug amycretin outperformed its existing blockbuster Wegovy in early clinical trials, showcasing greater weight loss potential.

Investor trends are pointing in a clear direction: biotech VC investment in obesity drugs grew over 40% in 2023, as those new startups look to next-gen compounds such as MC4R agonists and dual-pathway modulators. Big companies are moving into strategic partnerships, think digital health and pharma teaming up to make combo therapies that are more appealing when it comes to compliance. Government-based benefits for obesity treatment as part of corporate wellness and insurance plans have also helped drive utilization. These advancements, along with drug delivery systems and personalized treatment through artificial intelligence (AI), further boost the market of diet pills.

Restraints:

-

Access Disparity, Public Perception, and Regulatory Complexity Remain Critical Challenges Limiting Widespread Acceptance and Usage

One of the biggest concerns, there’s a deep divide in access by socioeconomic status; people with lower income don’t have nearly as much access to prescriptions for anti-obesity medication. Less than 25% of eligible patients from low-income and underserved communities are prescribed pharmacologic treatment for obesity by their healthcare providers, according to a recent survey on behavioral health. The lingering legacy of snake oil also leaves a bad taste in the mouths of potential buyers who view pharmaceutical weight loss as something of a “short cut” rather than a genuine therapeutic option – again, this inhibits both prescription and OTC uptake. Regulatory regulation. The categorization of diet pills is different from one country to an additional country, problematic and lengthy on the way to commercialize the product globally.

Labels, advertising, and post-market surveillance also impose compliance costs on manufacturers. Moreover, most anti-obesity drugs have a small therapeutic window, which implies that they require accurate dosing; otherwise, patients may experience side effects or treatment may not be effective. Supply chain disruptions, such as a lack of availability of critical actives because of reliance on raw materials imported from the global marketplace, add to the unpredictability of product availability. Finally, uneven reimbursement paradigms in the clinical setting do not create strong incentives for a physician to always prescribe newer, better drugs. These intersecting obstacles, systemic and perceptual, prevent the diet pills market from achieving its full potential even as demand increases.

Diet Pills Market Segmentation Insights

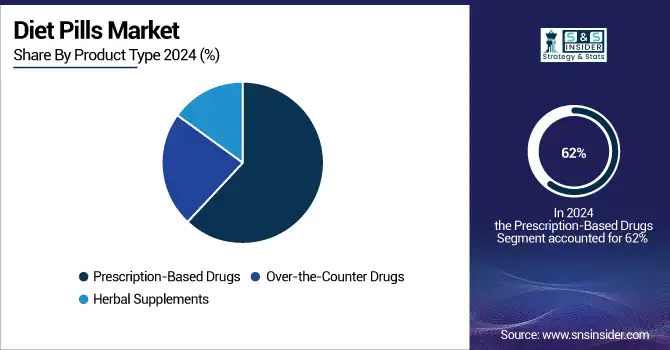

By Product Type

In 2024, the prescription-based drugs led the market with a share of 62%. This leadership is attributed to the increasing uptake of clinically-validated drugs, including GLP-1 receptor agonists and combination products, which are associated with substantial weight loss and are more often prescribed by physicians for obesity co-morbidities, namely type 2 diabetes and metabolic syndrome. The practice of prescribing otherwise highly effective treatments with strong clinical evidence has led to their widespread use among patients and physicians.

Herbal remedies are the fastest-growing category due to the growing consumer preference toward natural and plant-based products. In such a climate of growing apprehension regarding the long-term side effects of synthetic products, as well as the appearance of herbal weight-loss products, it is not surprising that the latter are becoming popular, particularly among younger and health-conscious consumer segments in search of sustainable health options.

By Application

Appetite-controlling pills held about 48% market share in 2024 since they are effective in reducing calorie intake, controlling hunger hormones, including ghrelin, and having better adherence than fat blocking or metabolism boosting counterparts. The consumer group of such products is wide, covering even those who are pursuing modest, no-pain experiences of weight loss.

The application segment, which is growing at the highest rate, is metabolism-raising pills, due to advancements in thermogenic formulations and rising demand for energy-boosting supplements among consumers. These tablets are particularly go-to for gym-goers and those looking for increased fat burn during exercise, making them increasingly popular.

By Distribution channel

Retail pharmacies held a leading share of the market, 53%, in 2024. Its high availability, accessibility, and legitimacy as a disseminator of prescription and OTC diet pills also account for their popularity. Consumers still seek counseling and product access from retail pharmacists, with great variation in suburban and urban locations.

The most rapidly growing distribution channel - hospital pharmacies, mainly driven by the fact that more and more anti-obesity drugs are prescribed during in- and outpatient visits. With the increasing number of anti-obesity drugs as part of the treatment of metabolic and cardiovascular disease, distribution from hospitals continues to expand.

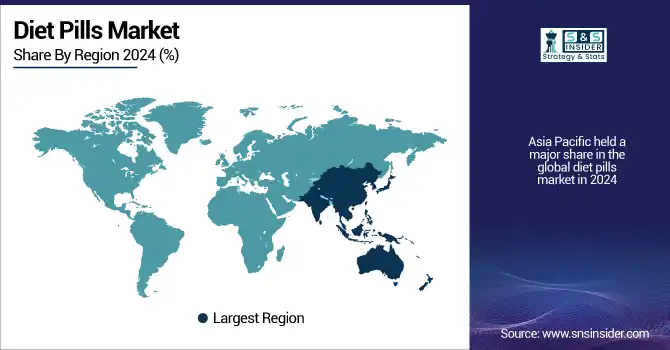

Regional Outlook

Asia Pacific held a major share in the global diet pills market in 2024, as urbanization was on the rise in some of the fast-developing economies such as India, China, and Japan, improvements in discretionary spending, and a shift towards preventive health in the region. Driving all of that is a surging obesity rate, particularly in China, where more than 50% of adults are overweight or obese, as well as an aging Japanese population looking for metabolism-boosting products. Governments' efforts to spread awareness about anti-obesity, coupled with an increasing number of e-commerce platforms, have made these products available. The regional hot spot, with its massive consumer base and growing capability in pharma manufacturing, is still China.

North America Diet Pills Market Trends

North America is projected to be the second-largest growing market in the diet pills market in the coming years, owing to the increasing prevalence of obesity, affecting around 42 percent of adults in the U.S., supported by the excellent healthcare and pharmaceutical sector. The U.S. diet pills market size was valued at USD 0.44 billion in 2024 and is expected to reach USD 1.16 billion by 2032, growing at a CAGR of 12.90% over the forecast period of 2025-2032, buoyed by significant R&D spending from the likes of Eli Lilly and Novo Nordisk, and broad consumer access to prescription meds for weight loss. The approval of advanced obesity treatments by the FDA has also helped in faster market penetration. There is a growing trend in demand for prescription and OTC diet pills in Canada, especially in urban localities where people are becoming much more health-conscious. Additionally, the advent of digital healthcare and telemedicine enhances the availability of anti-obesity drugs to the North American-based patient population and supports the rapid growth of the regional market.

Europe offers a well-established yet steadily increasing market, due to the growing prevalence of health consciousness and government initiatives to prevent obesity. Germany, UK in the lead Germany and the UK are leading the way, due to their strong regulation and high consumer spending on health supplements. Germany is also one of the major markets on account of an aging population and preference for the clinically proven metabolic boosters. Consumer receptivity to appetite-suppressant supplements and the rise in private-label brands are also driving the UK market. With obesity rates breaking 25% in some parts of Western Europe, the demand for pharmaceutical and botanical fat reduction products is booming. The advent of technological innovation in drug delivery and growing online distribution is also expected to support regional growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Diet Pills Market

Leading diet pills companies operating in the market include Iovate Health Sciences Inc., Zoller Laboratories, Cortislim, Nanjing Chang'ao Pharmaceutical Co., Vivus Inc., Orexigen Therapeutics, GlaxoSmithKline Pharmaceuticals Ltd., Gelesis Inc., Herbalife International, and Amway Corp.

Recent Developments in the Diet Pills Industry

In April 2025, Pfizer discontinued the development of its oral weight-loss drug danuglipron following adverse side effects in mid-stage trials, halting its progress in the competitive obesity drug market.

In March 2025, Eli Lilly announced promising trial results for its once-daily oral obesity pill orforglipron, showing strong efficacy in reducing body weight and positioning it as a potential competitor to injectable therapies.

| Report Attributes | Details |

| Market Size in 2024 | USD 1.83 Billion |

| Market Size by 2032 | USD 4.48 Billion |

| CAGR | CAGR of 11.87% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Prescription-Based Drugs, Over-the-Counter Drugs, and Herbal Supplements) • By Application (Metabolism Raising Pills, Fat Blocking Pills, and Appetite Controlling Pills) • By Distribution channel (Hospital Pharmacy, Retail Pharmacy, and Drug Stores) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Iovate Health Sciences Inc., Zoller Laboratories, Cortislim, Nanjing Chang'ao Pharmaceutical Co., Vivus Inc., Orexigen Therapeutics, GlaxoSmithKline Pharmaceuticals Ltd., Gelesis Inc., Herbalife International, and Amway Corp. |