Digital Dentistry Market Size:

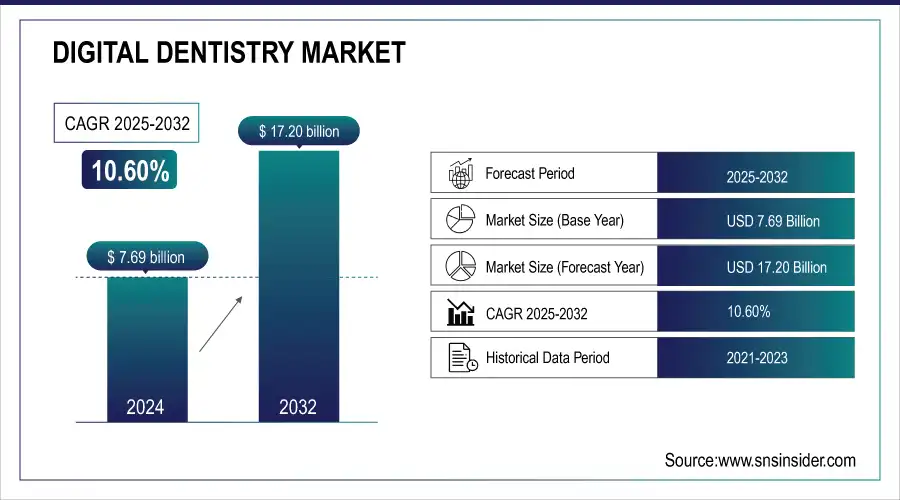

The Digital Dentistry Market size valued at USD 7.69 billion in 2024, expected to reach USD 17.20 billion by 2032, growing at a CAGR of 10.60% from 2025 to 2032.

To get more information on Digital Dentistry Market - Request Free Sample Report

The increasing adoption of advanced dental technologies and rising demand for efficient and precise dental procedures are driving the growth of the digital dentistry market. The changing demand is illustrated by government statistics, with the U.S. Bureau of Labor Statistics predicting employment for dentists will grow 6% from 2021 to 2031, faster than the average for all occupations. Digital technologies in dental practice are partly driving this growth. A significant number of patients are available for digital dental solutions as the Centers for Disease Control and Prevention (CDC) estimates that 91% of adults aged 20 to 64 years had dental caries in permanent teeth from 2011-2016. Additionally, periodontal disease impacts close to 50% of U.S. adults aged 30 and older, according to the National Institute of Dental and Craniofacial Research, necessitating improved diagnostic and treatment modalities. As the COVID-19 pandemic pushed practitioners to adopt digital dentistry, the almost universal availability of dental offices for elective care was reported by mid-August 2020, and many of these practices implemented digital technologies as part of their safety and efficiency protocols.

The market is aided by government efforts to harness digital health technologies to advance the goals of the National Institute of Dental and Craniofacial Research by 2030, such as improving oral health. AI and machine learning are changing the field of diagnosis and treatment planning in dental software, and 3D printing technologies are revolutionizing the production of dental prosthetics and orthodontic devices. In a world where time is money, as more and more dental practices go digital, this market is gearing for great heights with better patient outcomes and digitalized dental procedures.

Key Digital Dentistry Market Trends:

• Integration of AI in diagnostic tools and treatment planning for accurate analysis of dental imaging data.

• Adoption of augmented reality (AR) technology to enhance dental procedures and treatment visualization.

• Expansion of 3D printing for in-house fabrication of crowns, bridges, and aligners, reducing time and costs.

• Use of digital impression systems and intraoral scanners to replace conventional molds, improving patient comfort and workflow.

• Growing demand for minimally invasive, precise, and same-day dental treatments to meet personalized patient care requirements.

Digital Dentistry Market Growth Drivers:

-

Continuous innovations, such as the integration of artificial intelligence (AI) and machine learning (ML) into digital dentistry systems, enhance diagnostics, treatment planning, and prosthetic design, leading to more accurate and efficient dental procedures.

-

Growing patient preferences for minimally invasive treatments, personalized care, and convenient dental solutions drive the adoption of digital dental equipment, offering benefits like shorter treatment times and customized treatment plans.

Technology is changing the face of digital dentistry, and further rapid advances can be expected in making dentistry more precise, efficient, and effective. One significant advancement has been the involvement of artificial intelligence (AI) in diagnostic tools as well as treatment planning. Artists are interested in using AR technology, and meanwhile, AI algorithms allow the dentist to gain more accurate analysis of the imaging data, diagnosing cavities, periodontal issues, or future areas of concern. For instance, platforms like "Second Opinion" by Pearl powered by AI have shown 96% accuracy in identifying dental pathologies with X-rays. Also, 3D printing is another revolutionary technology. Dental professionals now use this innovation to fabricate crowns, bridges, and aligners in-house, significantly reducing production time and costs. Recent research conducted in 2024 discovered that 3D printing in dentistry has been 98% in producing accurately, guaranteeing to provide patients with comfortably fitted solutions in less than hours.

In addition, digital impression systems take the place of conventional molds. The intraoral scanning (iTero Element 5D) creates high-resolution images of the patient for taking impressions thus avoiding the discomfort associated with the conventional method of impressions. In developed countries, more than three-fourths of dental practices have utilized intraoral scanners, according to a 2023 survey relating to user satisfaction in terms of improving patient experience and improving workflow. These advancements are making room for minimally invasive, accurate, quick, and same-day flowing dental treatments to keep up with the rising need for customized treatments and advanced practicing classes of dentistry across the globe.

Digital Dentistry Market Restraints:

-

The significant upfront expenses associated with purchasing and implementing digital dental equipment, including costs for equipment, software licenses, and staff training, can be prohibitive for small and medium-sized dental practices.

-

In many regions, dental prostheses are considered cosmetic, resulting in minimal or no insurance reimbursements. This lack of financial support can deter patients from opting for digital dental procedures.

High initial investment costs have long posed challenges to the adoption of digital dentistry. The capital investment required to purchase high-tech equipment, such as CAD/CAM systems, 3D printers, and intraoral scanners is a monetary burden for many smaller practices. Moreover, employing such technologies requires proprietary software, frequent upgrades, and expert minders, all of which increase costs.

Training dental professionals to effectively use digital tools is another financial and logistical hurdle, as it often involves additional certification courses or workshops. The ROI might take years, which acts as a deterrent to digital adoption for most practices, primarily in the developing world. Also, because technology is changing so quickly, equipment may become obsolete before it's fully depreciated, resulting in even higher long-run costs for those practices. These will hinder accessibility and delay the adoption of digital dentistry worldwide, especially in limited-resource places due to financial constraints.

Digital Dentistry Market Segment Analysis:

By application

In 2024, the Diagnostics segment accounted for the largest market share and it is expected to continue its dominant position. The dominance of the market is driven by the rising adoption of precision diagnostics tools in dental practices and increasing focus on early detection and prevention of dental diseases. According to the Centers for Disease Control and Prevention (CDC), in 2019, 63.2% of adults aged 18 and over had a dental visit in the past year, indicating a significant patient base for diagnostic services. According to the National Institute of Dental and Craniofacial Research, dental caries is the most common chronic disease among children and adults, underlining the continued need for reliable and expeditious diagnosis. For example, intraoral scanners and 3D imaging systems are digital diagnostic technologies that provide better accuracy and efficiency than traditional methods.

The U.S. Food and Drug Administration (FDA) has approved numerous digital diagnostic devices for dental use, which has further enabled their acceptance. For example, the FDA Approves New AI-Driven Diagnostic Software for Detecting Signs of Possible Dental Caries Instead of using traditional diagnostic methods based on visual examination and radiographic assessment, the FDA recently approved this AI-powered diagnostic software to detect signs of possible dental caries.

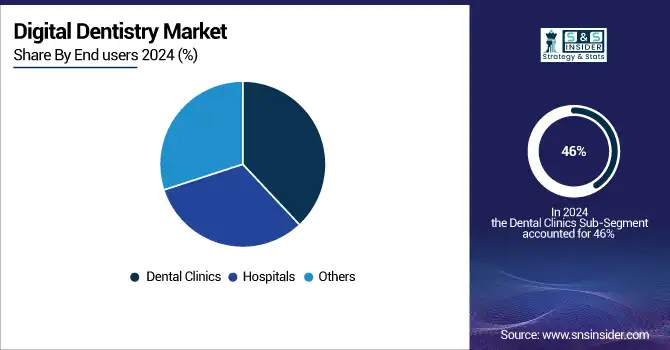

By End-user

In 2024, the digital dentistry market was dominated by the dental clinics segment with a 46% revenue share due to the direct interaction with patients, as well as the increasing use of digital technologies to improve patient care and provide efficient operational practices in dental clinics. According to the U.S. Bureau of Labor Statistics, in May 2020, there were 132,210 general dentists in offices of dentists, which gives a considerable base for introducing digital dentistry. The proportion of dental clinics in the entire health care delivery is also massive, as the dental services spending was $142.4 billion in 2020, according to CMS data. According to the National Center for Health Statistics, the percentage of adults aged 18–64 with a dental visit within the past year in 2019 was 64.9%, which shows that dental clinics have a high influx of patients. Additionally, in 2021, the Health Resources and Services Administration (HRSA) identified 6,896 dental health professional shortage areas [DHPSAs], highlighting the urgent need for effective digital solutions to deliver as much care as possible to patients at existing clinics.

By Product

The software segment held the largest market share, owing to the ease of integration with other digital dental technologies and the contribution of software for efficient workflows in dental practice. Over 90% of dental practices in the US use practice management software, as reported by the American Dental Association (ADA) in 2021, reinforcing the volume of practices equipped with digital solutions. According to a report from the U.S. Department of Health and Human Services, by 2019, 73% of office-based physicians had adopted certified electronic health record (EHR) systems, a trend that has expanded into dental offices, increasing the demand for focused dental software. The National Institute of Standards and Technology (NIST) has established guidelines for dental CAD software, thus ensuring that CAD software used to design digitally has a certain reliability and accuracy within a design process. In addition, a rise in quality and safety through the regulation of dental software by the FDA as medical devices has helped the adoption of dental software. Digital dental technologies are expected to be used more often as the U.S. Bureau of Labor Statistics has predicted that from 2020 through 2030, the employment of dental laboratory technicians, who often use CAD software, is projected to grow by 9%, faster than the average for all occupations. NIH-funded research in dental informatics has helped drive innovations in dental software development to both sophisticated and useable systems for dentists.

Digital Dentistry Market Regional Analysis:

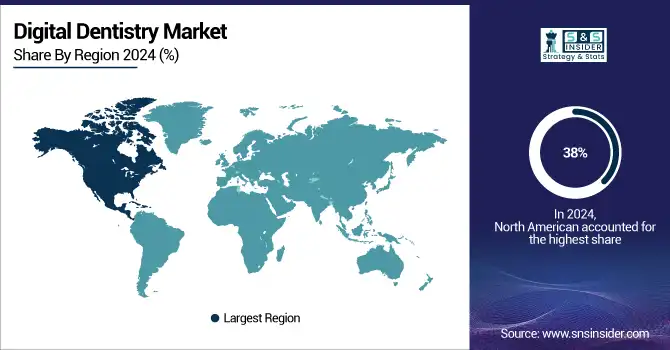

North America Digital Dentistry Market Insights

In 2024, North America accounted for the largest share of the digital dentistry market at 38% Contributing factors to this dominance include a developed healthcare infrastructure, new technologies commonly adopted, and significant investments in dental research and development. The number of dentists practicing in the U.S. was around 201,117 in 2021, according to the American Dental Association, creating a significant ground for digital dentistry adoption. According to the U.S. Bureau of Labor Statistics, the employment of dentists is projected to grow 6 percent from 2021 to 2031, revealing a sustaining demand for digital dental solutions. As per the data reports of National Institute of Dental and Craniofacial Research, in the year 2020, it was estimated that the dental care expenditure in the U.S.A. was about a huge 142.4 billion U.S. dollars as this clearly states how much dental health investment is needed.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Digital Dentistry Market Insights

The Asia-Pacific region is projected to achieve the highest CAGR throughout the forecast period. Increasing healthcare spending, surging awareness regarding oral wellbeing, and initiatives taken by the government to provide accessibility to dental services are major factors driving this market at an astounding rate. For example, integrated, comprehensive oral health care by the National Oral Health Program of the Indian government may promote the use of digital dentistry technologies. China National Health Commission reported that the number of dental hospitals increased from 458 in 2010 to 807 in 2020, showing improved infrastructure for advanced dental care in China. Increasing digital technology application in healthcare is one of the segments of the "Japan Healthcare 2035" strategy released by the Japanese government, which is likely to push the digital dentistry CDNIs growth in the region.

Europe Digital Dentistry Market Insights

Europe’s digital dentistry market is driven by advanced healthcare infrastructure, high adoption of AI, intraoral scanners, and 3D printing technologies. Strong government support, increasing awareness of oral health, and well-established dental practices contribute to growth. Rising demand for minimally invasive and personalized treatments further strengthens market expansion across the region.

Latin America (LATAM) and Middle East & Africa (MEA) Digital Dentistry Market Insights

The LATAM and MEA digital dentistry market is expanding due to growing dental healthcare awareness, investments in modern dental technologies, and rising private dental clinics. Adoption of digital workflows, intraoral scanning, and 3D printing is increasing, driven by demand for efficient, precise, and cost-effective dental treatments in these emerging markets.

Competitive Landscape for Digital Dentistry Market:

Dentsply Sirona is a global leader in digital dentistry, offering comprehensive solutions including intraoral scanners, 3D printers, and cloud-based platforms. Their Primescan 2 intraoral scanner and DS Core cloud platform enable efficient, precise, and personalized dental care. The company actively participates in industry events like DS World and IDS to showcase innovations and foster professional development

-

In 2024, Dentsply Sirona introduced the Primescan 2, a next-generation intraoral scanner that enables cloud-based scanning, enhancing patient care and practice efficiency.

Align Technology is a global leader in digital dentistry, renowned for its Invisalign clear aligners, iTero intraoral scanners, and exocad CAD/CAM software. The company is at the forefront of integrating AI, 3D imaging, and cloud-based platforms to enhance orthodontic and restorative workflows. Align's innovations, such as the Invisalign Smile Architect and the iTero Element 5D scanner, empower dental professionals to deliver personalized, efficient, and minimally invasive treatments. With a strong presence in over 100 countries, Align Technology continues to shape the future of digital dentistry through continuous research, development, and strategic partnerships.

-

In October 2024, Align Technology launched Invisalign Smile Architect, a software that allows orthodontists to visualize and compare multiple treatment plans, enhancing patient education and treatment planning

Digital Dentistry Market Key Players:

Some of the Digital Dentistry Market Companies are

-

Dentsply Sirona (CEREC System, PrimeScan)

-

3Shape (TRIOS Scanner, Dental System)

-

Align Technology (Invisalign, iTero Scanner)

-

Carestream Dental (CS 3600, CS 9600)

-

Straumann Group (Virtuo Vivo, ClearCorrect)

-

Planmeca Oy (Planmeca Emerald, Planmeca Romexis)

-

Envista Holdings Corporation (i-CAT, KaVo OP 3D)

-

Zimmer Biomet (Trabecular Metal Dental Implants, T3 Dental Implant)

-

Ivoclar Vivadent (IPS e.max, PrograMill PM7)

-

Kulzer GmbH (cara Print 4.0, Pala Digital Denture)

-

Vatech Co., Ltd.

-

GC Corporation

-

Nobel Biocare

-

Sirona Dental Systems

-

Roland DG Corporation

-

Shining 3D

-

Dental Wings

-

Acteon Group

-

Hengxi Medical Instruments

-

Osstem Implant Co., Ltd.

| Report Attributes | Details |

| Market Size in 2024 | USD 7.69 Billion |

| Market Size by 2032 | USD 17.20 Billion |

| CAGR | CAGR of 10.60% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Equipment, Software) • By Specialty Areas (Orthodontics, Prosthodontics, Implantology, Other speciality areas) • By Application (Diagnostics, Therapeutics, Other Applications) • By End users (Dental clinics, Hospitals, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Dentsply Sirona, 3Shape, Align Technology, Carestream Dental, Straumann Group, Planmeca Oy, Envista Holdings Corporation, Zimmer Biomet, Ivoclar Vivadent, Kulzer GmbH, Vatech Co., Ltd., GC Corporation, Nobel Biocare, Sirona Dental Systems, Roland DG Corporation, Shining 3D, Dental Wings, Acteon Group, Hengxi Medical Instruments, Osstem Implant Co., Ltd. |