Anatomic Pathology Track and Trace Solutions Market Report Scope & Overview:

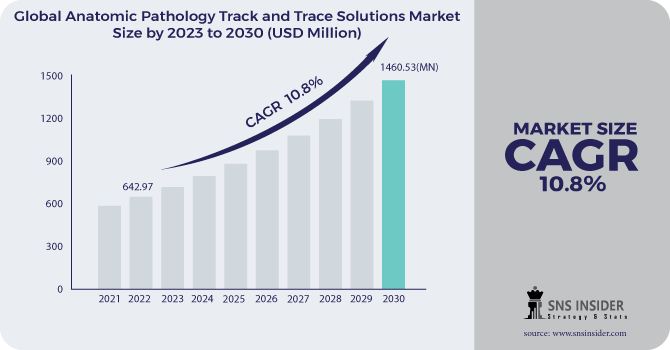

The Anatomic Pathology Track and Trace Solutions Market Size was valued at USD 642.97 million in 2022, and is expected to reach USD 1460.53 million by 2030 and grow at a CAGR of 10.8% over the forecast period 2023-2030.

Since a while ago, tracking options that make use of bar-codes have also been used in the anatomic pathology laboratories. Anatomic pathology specimens, slides tracking, and blocks all contribute to increased laboratory productivity, improved patient care, and increased patient safety. The tracking of anatomic pathology specimens also benefits research laboratories that use extra clinical data stored in biorepositories.

Get more information on Anatomic Pathology Track And Trace Solutions Market - Request Sample Report

The process of tracking implementation is difficult. Before implementing tracking, a workflow analysis in the laboratory is necessary to ensure that the system satisfies their needs. Before the launch and implementation of the tracking system, which aids in exposing the practices, analysis needs certain adjustments. The workflow must alter significantly and the laboratory culture must also adapt for tracking on the programmes. The success of the process depends on planning, buy-in, training, and accountability from each individual.

MARKET DYNAMICS

KEY DRIVERS

-

More Diagnostic Tests Are Being Run in Anatomic Pathology Laboratories

-

A Growing number of Legal Cases Concerning Cancer Misdiagnosis

-

Anatomic Pathology Laboratories Are Consolidating More and More

-

Increasing the Use of Automated Systems to Increase Laboratory Productivity

RESTRAINTS

-

Implementing Track and Trace Solutions in Anatomic Pathology Laboratories Comes at a High Cost

OPPORTUNITIES

-

Growing Quickly in APAC and Latin American Emerging Markets

-

Integrating Track and Trace Pathology Systems with Laboratory Information Systems

CHALLENGES

-

Inadequate Common Standards for Specimen Labeling in Anatomic Pathology Laboratories

IMPACT OF COVID-19

Governments from all across the world are collaborating with pharmaceutical and biotech companies to address the COVID-19 epidemic, from assisting in the creation of vaccinations to preparing for problems with the supply chain for pharmaceuticals Currently, there are 117 vaccine candidates and roughly 156 chemicals in the R&D pipeline. Additionally, there has been a substantial rise in demand for common drugs like hydroxychloroquine, which is used to treat COVID-19. Due to the dearth of these treatments in many industrialized countries, there is a huge market opportunity for manufacturers of COVID-19 management therapies. The pharmaceutical and biotechnology sector is anticipated to have significant expansion in the next years because to the need for COVID-19 vaccines and treatment medications. Due to these considerations, COVID 19 is anticipated to significantly affect the market for Anatomic Pathology Track and Trace Solutions.

By Product

The market is divided into three categories: consumables, hardware, and software. The market sector predicted to hold the biggest proportion is software. This is primarily caused by the growing demand for automation of the sample labelling process to reduce manual errors, the growing emphasis on enhancing the effectiveness of anatomic laboratories, the expanding use of cloud-based LIMS, and the growing workload in anatomic pathology laboratories.

By Technology

Barcode and RFID are the segments used to group the anatomic pathology track and trace solutions market. Due in large part to end users' increased use of barcode systems as a result of their more affordable price, the barcode segment is anticipated to have a larger share of the market (as compared to RFID).

By Application

Slide tracking, tracking of tissue cassettes and blocks, and tracking of specimens are the three segments of the anatomic pathology track and trace solutions market. Slide tracking is anticipated to experience the greatest CAGR throughout the projected period, primarily as a result of the adoption of tracking systems in anatomic pathology laboratories to decrease specimen identification errors and boost workflow efficiency.

By End User

Hospital laboratories, private and reference laboratories, and other end users make track anatomic pathology and market tracking solutions (contract research organizations, government-sponsored medical laboratories, and research institutes). The section combining independent laboratories and references is expected to have the largest CAGR in the forecast period. The expansion of this market is due to the increase in the number of independent cancer screening tests and the expansion of the world's largest laboratories.

KEY MARKET SEGMENTS:

By Product

-

Software

-

Hardware

-

Printers and Labeling Systems

-

Barcode Scanners and RFID Readers

-

Mobile Computing Systems

-

-

Consumables

-

Barcode Labels and RFID Tags

-

Slides

-

Specimen Containers, Tissue Cassettes, and Blocks

-

Transport Bags

By Technology

-

Barcode

-

RFID

By Application

-

Slides Tracking

-

Tissue Cassettes & Blocks Tracking

-

Specimen Tracking

By End User

-

Hospital Laboratories

-

Independent and Reference Laboratories

.png)

Need any customization research on Anatomic Pathology Track and Trace Solutions Market - Enquiry Now

REGIONAL ANALYSIS

According to estimates, the North American market will rise fastest. The increased number of diagnostic tests conducted in anatomic pathology labs, the prevalence of chronic diseases (which is driving up demand for high-quality diagnostic services), and the presence of major market competitors in the area can all be attributable to this. Additionally, the demand for automated labelling systems is being driven in many anatomic pathology laboratories across North America by the need to eliminate specimen identification errors.

REGIONAL COVERAGE

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS:

Some of the major key players are Agilent Technologies, Cerebrum Corporation, AP Easy Software Solutions, General Data Healthcare, Leica Biosystems, Primera Technology, Thermo Fisher Scientific, Sunquest Information Systems, Ventana Medical Systems and Zebra Technologies and other players.

AP Easy Software Solutions-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 642.97 Million |

| Market Size by 2030 | US$ 1460.53 Million |

| CAGR | CAGR of 10.8% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Software, Hardware (Printers and Labeling Systems, Barcode Scanners and RFID Readers, Mobile Computing Systems), Consumables (Barcode Labels and RFID Tags, Slides, Specimen Containers, Tissue Cassettes, and Blocks, Transport Bags) • By Technology (Barcode, RFID) • By Application (Slides Tracking, Tissue Cassettes & Blocks Tracking, Specimen Tracking) • By End User (Hospital Laboratories, Independent and Reference Laboratories) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Agilent Technologies, Cerebrum Corporation, AP Easy Software Solutions, General Data Healthcare, Leica Biosystems, Primera Technology, Thermo Fisher Scientific, Sunquest Information Systems, Ventana Medical Systems and Zebra Technologies. |

| Key Drivers | • More Diagnostic Tests Are Being Run in Anatomic Pathology Laboratories • A Growing number of Legal Cases Concerning Cancer Misdiagnosis • Anatomic Pathology Laboratories Are Consolidating More and More |

| Restraints | • Implementing Track and Trace Solutions in Anatomic Pathology Laboratories Comes at a High Cost |