Digital Printing Market Report Scope & Overview:

Digital Printing Market was worth USD 33.07 billion in 2023 and is predicted to be worth USD 70.48 billion by 2032, growing at a CAGR of 8.79% between 2024 and 2032. Companies in every sector are looking towards green technologies, fuelled by growing worries regarding climate change and initiatives like Red Alert. Furthermore, the green printing initiatives that have been growing in importance within the printing industry are anticipated to boost demand for digital printers given their reduction of waste and streamlining of logistics which ultimately lessens environmental impact. Similarly, higher use of water-based inks and bio-based solvents are expected to drive down emissions for organic compounds. The acquisition of Aleph SrL by Durst Group, a manufacturer of digital printing technology that completed in September 2023 was one such move to promote ecofriendly forms -specifically water-based printing. Digital Printing provides new and eco-friendly production methods with fewer human assistance to avoid printed errors. New market opportunities as companies are investing in creating new products and improvements. In Sep 2023, Fiery, LLC Iron and Esko partner to match digital print innovation efforts

Get More Information on Digital Printing Market - Request Sample Report

Changing customer buying behaviour poses as a challenge for label printing sector, where customers now expect personalization in labels. Digital printing systems provide better print delivery time frames and tools needed by main players to cater changing industry trends. The digital revolution is meanwhile also creating an increase in end-users of labelling and packaging investing in digital technologies. In September 2023, Nilpeter USA Inc. collaborated with SCREEN to land an integrated digital printer press; Moreover, market players are developing solutions and expanding operations through partnerships & collaborations to gain a competitive edge in the global threat intelligence security solutions market. April 2022 Canon USA, Inc. Launched PRISM Acolor Manager a digital cloud-based solution to help users assess and track print quality so that they can monitor results over time with pre-submitted reference work pieces as well provide selling customizable objectives receiving step by step recommendations on recommended variable targets orders. during a 2023 survey by the Printing Industries of America it became clear that about 35% of U.S. printers had signed up to digital printing in some form showing traction on this front but still illustrating bottlenecks preventing more widespread implementation due to the initial investment.

Drivers

-

Increased need for cost-effective, high-quality, short-run production in packaging and marketing is boosting digital printing adoption.

-

Innovations like faster speeds, better ink quality, and versatile substrate options make digital printing more competitive.

-

Digital printing's reduced waste and chemical use align with the industry's shift towards eco-friendly practices.

-

The growth of e-commerce drives demand for customized packaging solutions, fuelling digital printing growth.

Developed digital printing technology has played a important role in boosting the market with improvements, such as higher efficiency, quality and flexibility of print processes. One of the biggest upgrades is in speed. Modern digital printers can now achieve speeds up to 100 meters per minute, a substantial increase compared to earlier models. This increase in speed also brings faster production times, and the long make-readies which have been part of digital printing mean it is more competitive with traditional methods for high-volume jobs. In addition, improvements in ink technology has increased the number of new applications for digital print For instance, the appearance of UV-curable inks has allowed printing on non-porous substrates and a sufficiently reusable extension into an extensive stretch of commercial businesses. In 2023, UV inkjet printing accounted for over 40% of all digital printing applications in the industrial sector, reflecting its growing importance.

The improvements in technology have also led to efficiencies in cost. This includes a reduction in ink consumption of up to 30% due to advancements in printhead technology, which has opened the way for more cost-effective digital printing. On-demand printing became more cost-efficient, dispensing with the necessity of pre-press processes and lowering operational costs across packaging to textiles or commercial print.

Restraints

-

The significant upfront investment in digital printing technology can be prohibitive, particularly for SMEs.

-

Some materials used in traditional printing may not be compatible or cost-effective for digital printing, limiting its application.

-

Inconsistent print quality across different printers, inks, and substrates can be a drawback in industries demanding uniform results.

Digital printing technology has been expensive to begin this cost barrier, especially for Small Medium Enterprise (SMEs) profits. Digital printing equipment, such as advanced inkjet or laser printers, can range from tens of thousands to over a million dollars, depending on the complexity and capabilities of the machine. For examples, industrial-grade digital textile printers can go for $250,000 and higher into the millions. But that cost adds up when specialized inks are 30-50% more expensive than traditional printing, adds to the financial burden. Almost 40 percent of small print businesses view high prices for the equipment as a major difficulty in acquiring digital printing technology. The need for regular maintenance and potential upgrades further escalates the financial strain. This type of upfront financial investment can be a barrier for smaller businesses looking to move into digital printing, preventing them from effectively competing in markets that now require short-run and variable print jobs with high quality.

Segment Analysis

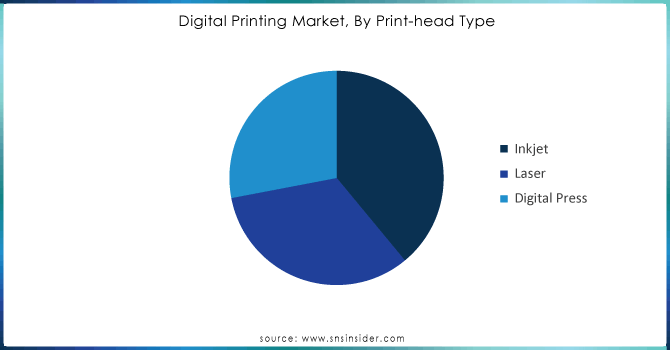

By Print Head Type

Inkjet segment led the market with more than 39% share, faster output capabilities in case of the inkjet printers, increasing requirement for on-demand printing from various industries are offering significant opportunities to the growth during forecast period. Moreover, a rise in the implementation of green technologies will also boost in demand as these printers are eco-friendly. The digital press segment is expected to be the fastest growing sector during the forecast period. The growth will be supported by an increase in the adoption of digital technologies across publishers. Digital presses offer relative affordability, especially for less print volumes are made combined with an ability to do customizing during high-volume printing which will result in expansion of the segment.

Laser segment, on the other hand is expected show steady growth. The segment is registering growth on account of a high-quality print delivery, which remains an essential requirement in the market. These results show that print will eventually recover, as indeed all three segments are on a near-perfect recovery trajectory but each for different reasons and needs within the printing industry.

Need any customization research on Digital Printing Market - Enquiry Now

By end user

The publishing segment is held the significant share more than 29% of market, attributed to rising adoption of virtual technologies by using magazine manufacturers and marketing companies for producing high quality print offerings. As well, the quick production times of digital printing have encouraged book publishers to invest in these technologies.

The packaging and label segment is projected to exhibit one of the highest CAGRs during the forecast period due to increasing demands from retail & e-commerce channels which are in-turn fuelling adoption smart printing technologies. It will also recently be driven by an upward trend of digital labelling solutions utilized across fashion accessories, pharma products and visiting cards amongst others. In the clothing segment, is set to experience growth as per changing fashion trends and demand advanced printing solutions. The expected growth is for each segment to continue its rise as the market matures, with the publishing, packaging & label and apparel sectors significantly influencing digital printing technology adoption.

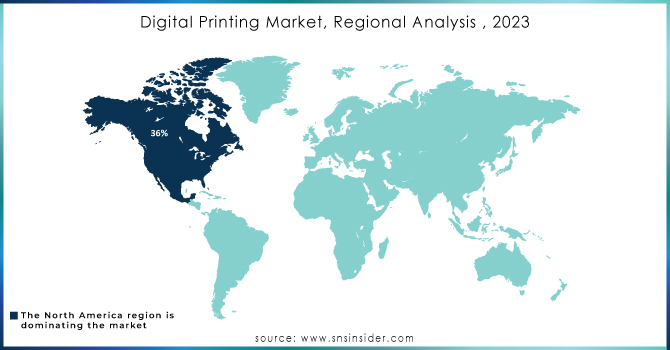

Regional analysis

In 2023, North America dominated the global digital printing market with a share of more than 36%. Growth in the region is propelled by increased utilization of Advanced digital technologies across all sectors. The United States, in particular is set to establish itself as the regional leader with large textile and publishing industries. Joann, a U.S.-based fabric and sewing company, for example only bought WeaveUp in March 2022 as it could see digital textile printing was an exciting project domestically.

There is also expected to be a significant growth in Asia Pacific during the forecast period. Market expansion is attributed to the thriving e-commerce industry in countries such as China, Japan and South Korea. As per industry experts, it is not only the demand for digitalized label printing which is rising in Asia Pacific. In particular companies in the Chinese printing industry are eager to enter new data-driven business models, digital platform solutions and more generally fully digitized value-creation chains. This digital printing penetration has given local designers online access to over 12,000 folding carton designs, highlighting the importance of packaging design in the region's market. Companies are increasingly investing in digital presses due to the efficiency of the printing process, which reduces steps and accelerates product delivery. For instance, in October 2021, China's Tomato Cloud Technology Co., Ltd ordered ten new Fujifilm Jet Press 750S digital inkjet machines, adding to the four already in use. China PRINT 2021, and the company is expected to become one of Fujifilm's most important new Jet Press customers globally before FYE22.

KEY PLAYERS:

The major key players are Canon, Inc, DIC Corporation, Epson Co., Ltd, Hewlett-Packard, Konica Minolta, Ricoh Co., Ltd, Sakata INX Co., Ltd, Toshiba Co. Ltd, Toyo Ink SC Holdings Co., Xerox Corporation & Other Players

Recent development

-

ARC Document Solutions LLC joined forces with Canon Solutions America in the purchase of Arizona printer system designed to advance its digital colour printing capabilities, now scheduled for September 2023-delivery. The joint development is part of the company's initiative to incorporate advanced technologies into its digital colour printing portfolio.

-

Epson Co., Ltd. has been trading since July 2023, entering in to a strategic alliance with the Australian Fashion Council for digital printing and projection into the clothing & textile industry. However, the partnership aims to deliver cutting-edge printing services for fashion industry.

-

By June 2023, Durst Group, the digital printing manufacturer and solution provider acquired Aleph SrL in 2022 to foster environmental-friendly methodologies related to water-based inkjet. The deal is contingent with Durst Group philosophy to develop highly innovative digital products standing out for their quality and sustainability.

| Report Attributes | Details |

| Market Size in 2023 | US$ 33.07 Bn |

| Market Size by 2032 | US$ 70.48 Bn |

| CAGR | CAGR of 8.79% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Print-head Type (Inkjet, Laser, Digital Press • By Application (Paper, Thick Cardstock, Textile, Plastic Film, Glass, Other) • By End-user (Publishing, Clothing, Glass , Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Canon, Inc, DIC Corporation, Epson Co., Ltd, Hewlett-Packard, Konica Minolta, Ricoh Co., Ltd, Sakata INX Co., Ltd, Toshiba Co. Ltd, Toyo Ink SC Holdings Co., Xerox Corporation. |

| Key Drivers | • Demand for environmentally friendly printing is increasing • In the packaging and textile industries, there has been a lot of change |

| Market Opportunities | • Demand from the in-plant market is increasing • Investment is increasing in research and development |