Video Conferencing Market Report Scope & Overview:

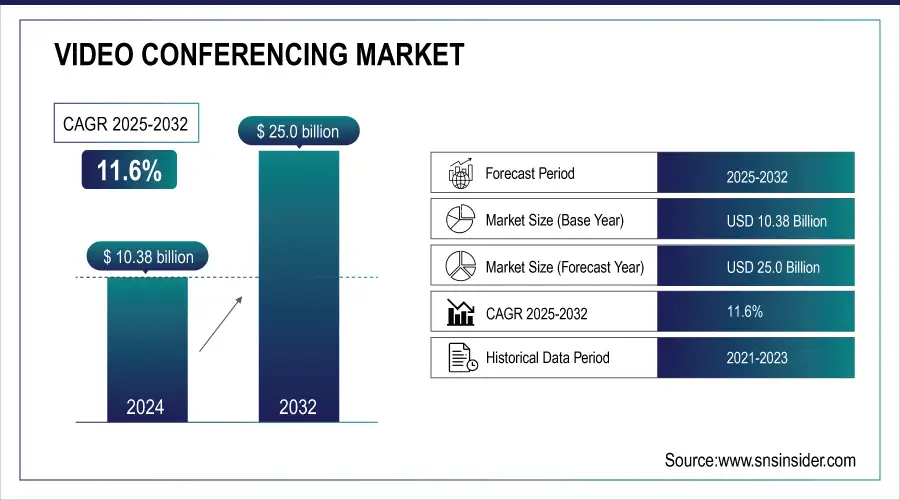

The Video Conferencing Market was valued at USD 10.38 billion in 2024 and is expected to reach USD 25.0 billion by 2032, growing at a CAGR of 11.6% from 2025-2032.

The video conferencing market is growing due to rising demand for virtual communication across industries, driven by remote and hybrid work models. Healthcare, education, and government sectors increasingly use it for consultations, learning, and secure communication. Growth is fueled by cloud-based solutions for scalable, cost-effective services, AI and ML features like real-time transcription and noise suppression, and 5G adoption, which enhances video quality and reduces latency, even in areas with limited internet infrastructure.

Get more information on Video Conferencing Market - Request Free Sample Report

Furthermore, the increasing focus on digital transformation across businesses, coupled with the need for improved team collaboration tools, has spurred the adoption of video conferencing software. Leading platforms like Zoom, Microsoft Teams, and Google Meet have rapidly expanded their feature sets to meet growing enterprise needs, such as security enhancements, better integration with business workflows, and virtual collaboration tools like whiteboarding and breakout rooms.

However, the market faces challenges such as data privacy concerns and the need for better cybersecurity measures due to the sensitive nature of video communications. Despite these challenges, the growing importance of global business operations, remote workforce management, and digital learning environments will continue to drive the video conferencing market forward.

Video Conferencing Market Drivers:

-

Demand for improved cybersecurity and data privacy measures to protect sensitive video communications.

-

Improved video performance with lower latency and higher quality, particularly in regions with limited internet infrastructure.

-

Enhanced user experience through real-time transcription, noise suppression, and video quality improvements.

In the video conferencing market, enhanced user experience through technologies like real-time transcription, noise suppression, and video quality improvements is becoming a key differentiator. These features, driven by advancements in artificial intelligence (AI) and machine learning (ML), improve the accessibility, clarity, and overall effectiveness of virtual meetings. For instance, real-time transcription allows users to follow conversations more easily, particularly in multinational or hearing-impaired settings, while AI-powered noise suppression ensures that background sounds are minimized, leading to clearer communication. As 5G networks expand, video quality will further improve, offering high-definition streaming with reduced latency, especially in areas with previously limited internet capabilities. This will enable smoother, more immersive communication, encouraging wider adoption of video conferencing across industries like healthcare, education, and global business operations.

Future growth will also be driven by the increasing integration of AI for more advanced capabilities, such as smart camera adjustments, sentiment analysis, and real-time language translation, making virtual meetings even more seamless and inclusive. Additionally, as more businesses transition to remote or hybrid models, the demand for high-quality, reliable, and secure video conferencing solutions will increase.

Video Conferencing Market Restraints:

-

Reliable, high-quality video calls demand significant internet bandwidth, limiting accessibility in areas with poor infrastructure.

-

Prolonged virtual meetings contribute to "Zoom fatigue," potentially reducing the frequency of usage over time.

-

Rising cyberattacks and vulnerabilities in video conferencing platforms require stronger protection measures.

The rise in cyberattacks and vulnerabilities in video conferencing platforms is a growing concern in the market. As virtual meetings have become essential for businesses, schools, and government institutions, cybercriminals are increasingly targeting these platforms to exploit sensitive information. Common threats include unauthorized access, data breaches, and "zoom bombing" (where uninvited users disrupt meetings). These incidents highlight the need for stronger cybersecurity measures to protect users and sensitive data shared during video calls. Leading video conferencing providers like Zoom, Microsoft Teams, and Google Meet have been ramping up their efforts by introducing end-to-end encryption, multi-factor authentication, and other advanced security features to mitigate these risks. However, as cyber threats evolve, the demand for even more robust security solutions will intensify.

Future growth in the market will be closely linked to how well these platforms can address cybersecurity challenges. Businesses, especially those handling sensitive data in sectors like healthcare, finance, and government, will prioritize security when choosing video conferencing solutions. This is already leading to increased investments in AI-powered threat detection systems, encrypted data storage, and secure cloud infrastructure.

Video Conferencing Market Segment Analysis:

-

By Deployment

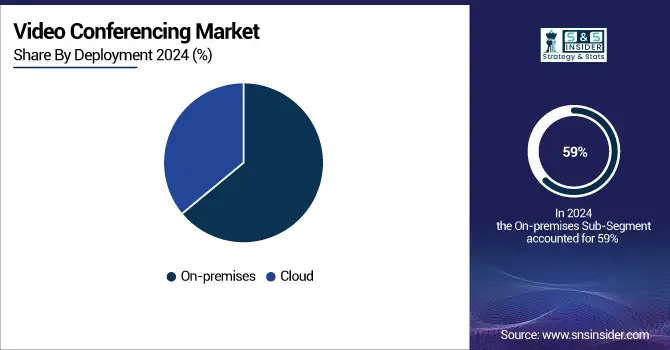

In 2023, the on-premise segment dominated the market and captured the largest revenue share, around 59%, fueled by industries with stringent data security requirements, existing IT infrastructure investments, and challenges related to internet reliability, latency, and bandwidth. Additionally, the segment's growth is driven by the rising demand for flexible, scalable remote work solutions, lower upfront costs, reduced maintenance, and advancements in cloud technology that improve security and interoperability.

The cloud segment is projected to experience the highest CAGR of over 12.3% during the forecast period. This growth is driven by the increasing adoption of cloud-based video conferencing solutions in businesses, which provide flexible work environments and enhance overall productivity.

-

By Component

In 2023, the hardware segment dominated the market. It accounted for the largest revenue share of 42.6%, driven by the growing adoption of endpoints such as laptops, smartphones, and desktops equipped with high-resolution cameras, speakers, and microphones. The shift toward remote and hybrid work culture, especially following the pandemic, has accelerated the use of video conferencing solutions for team collaboration.

Moreover, the software segment will experience the highest CAGR rate during the forecast period. This growth is fueled by rising demand for software solutions that offer real-time communication, screen sharing, virtual backgrounds, and enhanced collaboration and productivity. Additionally, the expansion of high-speed internet and the widespread use of smartphones are further boosting the demand for video conferencing software.

-

By Application

In 2023, the enterprise segment dominated the market and captured the largest market share of around 53.3%, driven by the increased demand for room-based conference video endpoints that are deployed and configured in meeting rooms. In the enterprise segment, the large enterprises held the highest market share of around 54.5%, driven by the significant adoption of video conferencing solutions for business communications across various geographies. Consequently, leading market players are concentrating on developing offerings that meet the specific needs of multinational enterprises. The SME segment is anticipated to grow at the highest CAGR during the forecast period, fueled by the growing awareness of the significance of conferencing and collaboration. Various market players are creating cost-effective solutions tailored to the needs of SMEs. For example, Cisco Systems Inc. provides collaboration solutions like the Cisco Business Edition 7000 specifically for small and mid-sized businesses. This focus on developing suitable offerings is significantly contributing to the segment's growth in the coming years.

The consumer segment is anticipated to register the highest CAGR of around 12.6% during the forecast period, driven by the increasing demand for consumer-grade solutions. The surge in online learning has further fueled the need for these solutions to facilitate virtual classes, lectures, and workshops. Additionally, the growing demand for remote medical consultations and follow-ups has led to a higher adoption of video conferencing solutions.

-

By End-Use

In 2023, the corporate segment dominated the market and represented over 36.3% market share, driven by increasing consumer interest in cloud-based communication and collaboration solutions. The rise in geographically dispersed teams has further enhanced the use of cloud-based platforms for seamless data sharing, collaboration, and communication.

The healthcare segment is expected to experience a significant CAGR during the forecast period. The increasing trend of telemedicine, which enables medical practitioners to use video conferencing solutions for providing medical advice, monitoring patients, and discussing treatment plans virtually, is expected to drive this growth. Moreover, healthcare institutions are working together across regions and specialties, with video conferencing enabling multidisciplinary discussions, case reviews, and knowledge sharing among medical professionals. This collaborative approach is further propelling the segment's growth in the coming years.

Video Conferencing Market Regional Analysis:

North America Video Conferencing Market Insights

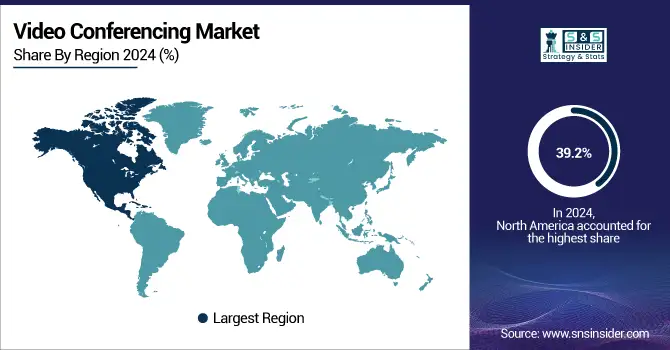

The North American video conferencing market accounted for approximately 39.2% of revenue in 2024, driven by a higher number of adoptions across the region. Market growth is expected to be driven by the growing demand for high-quality internet and visual meeting services. Moreover, market growth is further driven by the strong presence of various major players in this region and a growing trend towards Bring Your Own Device solutions that lead to an increase in demand for webcams and headphones.

With the adoption of new working styles in regional enterprises, the Asia Pacific video conferencing market is expected to grow at a compound annual growth rate of more than 13.2% during the forecast period. In addition, market growth will be further accelerated by the evolution of mobile broadband technologies like WiMAX and HSDPA networks in Japan and other countries. The Japan video conferencing market is expected to grow at a CAGR of approximately 12.1% during the forecast period, driven by the rising trend of remote and hybrid working models in organizations that require dependable video conferencing platforms.

Get Customized Report as per Your Business Requirement - Enquiry Now

Video Conferencing Market Key Players:

-

Zoom Video Communications - (Zoom Meetings, Zoom Phone, Zoom Rooms)

-

Microsoft - (Microsoft Teams, Skype, Microsoft 365)

-

Cisco Systems - (Cisco Webex, Cisco Jabber, Cisco TelePresence)

-

Google - (Google Meet, Google Chat)

-

GoTo - (GoTo Meeting, GoToWebinar, GoToConnect)

-

RingCentral - (RingCentral Video Meetings, RingCentral Office)

-

BlueJeans Network - (BlueJeans Meetings, BlueJeans Events)

-

Lifesize - (Lifesize Go, Lifesize Cloud)

-

Pexip - (Pexip Infinity, Pexip Meetings)

-

Logitech - (Logitech MeetUp, Logitech Rally)

-

Polycom - (Polycom RealPresence, Polycom Trio)

-

Avaya - (Avaya Spaces, Avaya Equinox)

-

Adobe- (Adobe Connect)

-

Huawei - (Huawei WeLink)

-

Jitsi - (Jitsi Meet, Jitsi Videobridge)

-

8x8 - (8x8 Video Meetings, 8x8 Contact Center)

-

ZoomInfo - (ZoomInfo Meetings)

-

GoToWebinar - (GoToWebinar)

-

Join.me - (Join.me)

-

VSee - (VSee Telehealth)

Recent Developments:

-

Adobe Inc.

Adobe Inc. is a global leader in digital media and digital experience solutions, headquartered in San Jose, California. Founded in 1982, the company is best known for its industry-defining software, including Photoshop, Illustrator, Acrobat, and Adobe Creative Cloud, which empower individuals and enterprises to create, manage, and deliver compelling digital content. Beyond creative tools, Adobe has expanded into digital experience and marketing solutions through Adobe Experience Cloud, enabling businesses to optimize customer engagement, analytics, and personalization. With its strong emphasis on innovation, subscription-based SaaS model, and cloud-first strategy, Adobe continues to play a pivotal role in shaping the digital economy.

-

In April 2024, Adobe Inc. introduced the latest version of Frame.io, V4, a flexible, fast, and intuitive creative collaboration platform designed to streamline and simplify workflows in content creation and production.

-

Zoom Video Communications, Inc.

Zoom Video Communications, Inc. is a leading provider of cloud-based communication and collaboration solutions, headquartered in San Jose, California. Founded in 2011, Zoom revolutionized virtual communication with its user-friendly video conferencing platform, enabling seamless meetings, webinars, and hybrid collaboration across industries. The company gained global recognition during the COVID-19 pandemic, becoming a vital tool for remote work, online learning, and telehealth. Beyond video conferencing, Zoom has expanded its portfolio to include Zoom Phone, Zoom Rooms, and Zoom Contact Center, supporting unified communications. With its scalability, reliability, and innovation, Zoom continues to shape the future of digital interaction and enterprise collaboration.

-

In April 2024, Zoom Video Communications, Inc. announced the general availability of Zoom Workplace, an AI-powered collaboration platform featuring new tools to enhance teamwork, foster connections, and boost productivity.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 10.38 Billion |

| Market Size by 2032 | USD 25.0 Billion |

| CAGR | CAGR 11.6% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software and Service) • By Deployment (On-premise and Cloud) • By Application (Consumer, Enterprise • By End-Use (Corporate, Education, Healthcare, Government & Defense, BFSI, Media & Entertainment and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Zoom Video Communications, Microsoft, Cisco Systems, Google, GoTo, RingCentral, BlueJeans Network, Lifesize, Pexip, Logitech |