Barcode Label Printer Market Size & Overview:

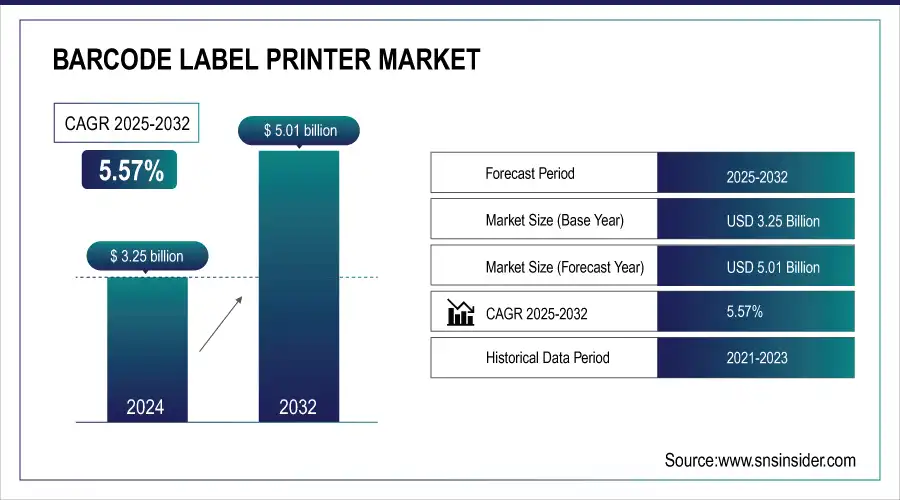

The Barcode Label Printer Market Size was valued at USD 3.25 Billion in 2024 and is expected to grow at a CAGR of 5.57% to reach USD 5.01 Billion by 2032.

The Barcode Label Printer Market has experienced significant growth over the past few years, thanks to the advancements in technology and changes in industry requirements. Recent technological innovations have significantly contributed to the growth of this market. Integration of RFID technology into barcode label printers has significantly improved inventory management and tracking capabilities. Moreover, the development of cloud-based printing solutions and mobile printing options has allowed businesses to produce labels in a more flexible and efficient manner.

Get more information on Barcode Label Printer Market - Request Sample Report

Government regulations regarding proper marking and tracing have promoted the use of barcode label printers even more. For example, the Federal Trade Commission (FTC) reported having received 5.7 million fraud and identity theft reports for the year 2023; identity theft contributed to 1.4 million of these complaints. This justifies the urgent importance of labeling and tracking systems being accurate.

The Barcode Label Printer Market is looking for energy efficiency and sustainability solutions in labeling; it is seen to be in line with global sustainability. The growth in smart factories, Industry 4.0, is also prompting the demand for advanced labeling technology. Opportunities arise in the years ahead in markets like e-commerce, retail, and logistics-areas where labelling efficiency means operational success.

Market Size and Forecast:

-

Market Size in 2024 USD 3.25 Billion

-

Market Size by 2032 USD 5.01 Billion

-

CAGR of 5.57% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

Key Barcode Label Printer Market Trends:

-

Rising automation in retail and logistics is driving the adoption of barcode label printers for efficient goods handling.

-

Increasing use of barcode systems to monitor and track inventory in automated operations.

-

Growing demand for reliable and high-performance barcode printers in logistics and supply chain management.

-

Strict regulatory and compliance requirements in industries like food and pharmaceuticals boost labeling needs.

-

Expansion of traceability and product safety standards is fueling the adoption of barcode printing solutions.

Barcode Label Printer Market Growth Drivers:

-

Rising Need for Automation in Retail and Logistics Industries

The highest growth in automation in retail and logistics sectors drove the demand for barcode label printers. During 2023, nearly 65% of logistics operations worldwide were automated. Increasing automation in these lines triggers a need for barcode systems in order to monitor and handle goods, which stimulates the demand for reliable and effective barcode printers.

-

Harsh Regulatory and Compliance Needs in Industries

The industries need to adhere to labeling and traceability regulations, which increase the demand for barcode printers. For example, the food industry is expected to grow by 8% by 2025, driven by regulatory requirements for detailed labeling, ensuring product traceability and safety standards, fueling the demand for barcode printers.

Barcode Label Printer Market Restraints:

-

High Initial Investment and Maintenance Costs Limiting Market Expansion

High investment and subsequent cost in terms of maintenance plays a critical role in the sectors of retail, logistics, and manufacturing, with respect to their operational efficiency. However, with the cost involved in the procurement of quality equipment and regular maintenance and probable repairs, it would act as a high barrier for entry, especially among small enterprises. Government sources state that over 40% of small and medium enterprises (SMEs) find that the cost of high technology prevents them from implementing automated solutions.

Further, maintaining such large-scale operations may require skilled labor for these printers, thereby raising the labor costs. The issue of affordability becomes increasingly critical with such printers as the industries opt for more advanced automated solutions. For example, recent regulatory change in pharmaceutical, food production etc. requires very advanced barcode system to meet regulatory compliance standards which are very much difficult for smaller business houses, and thus slowing down the penetration in emerging markets. The cost-sensitivity factor could be a cause of slow uptake in emerging markets.

Barcode Label Printer Market Segment Analysis:

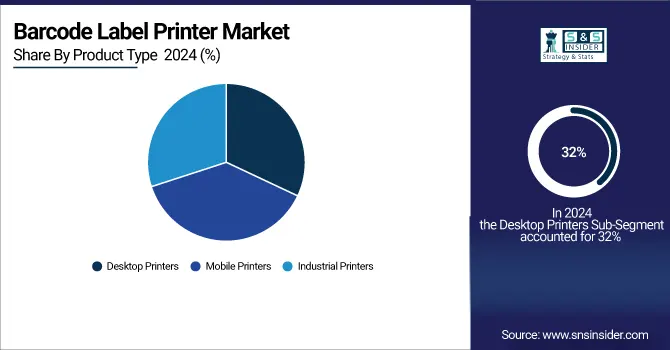

By Product Type

In 2024, Barcode Label Printer Market was dominated by Desktop Printers segment, which possessed a substantial share of 32%. Desktop printers are very common in SMEs because they come at a modest price, small in size, and easy to use. In fact, they come in handy with businesses that require high quality barcode printing for small to moderately sized volumes-which includes most retail stores, healthcare clinics, and warehouses. The rise in small businesses and the trend of e-commerce is expected to drive the demand for desktop printers.

The Desktop Printers segment is expected to grow at the fastest CAGR of 5.91% during the forecast period from 2025-2032. This growth can be attributed to the rapid adoption of e-commerce platforms and the increasing demand for more versatile, compact printing solutions. With companies moving toward cloud-based and mobile solutions, desktop barcode printers are being upgraded to include these technologies in a seamless manner. The low operational costs and the capability to handle various types of labels make desktop printers the favorite among small businesses looking to streamline their operations and reduce waste.

With an increased demand for barcode labeling in health, retail, and logistics industries, the market requires business houses to seek adaptable yet economical solutions. The market leadership and use of desktop printers for this industry has further resulted from its application for streamlining and enhancing efficiency along with compliance in all areas of industries. Adoption of Industry 4.0 standards will further push the envelope and grow this share further in the years ahead.

By Technology

Thermal Transfer segment was the dominated in the Barcode Label Printer Market in 2024, accounting for 44% market share. Thermal transfer printers are the most preferred in such industries where good-quality labels need to be printed for durable purposes for healthcare, pharmaceutical, and logistics companies. The heated ribbon transfers the ink from a master roll, ensuring that it is not easily smudged or ruined. This technology is especially important in applications where labels must survive hostile environments or prolonged exposure to heat, moisture, and chemicals.

The Thermal Transfer segment is expected to grow at the fastest CAGR of 5.83% during the forecast period from 2025-2032, due to the increasing demand for durable and high-quality labels in critical industries such as pharmaceuticals and food packaging. The relentless growth in the fields of logistics and healthcare, where durable and precise labeling is critical, will further support this high growth. Additionally, advancements in ink and ribbon technology have increased the functionality of thermal transfer printers to a degree that they become more efficient and cost-effective tools in industries requiring high-performance labels.

Moreover, these printers have better flexibility in terms of label material compatibility, thus giving businesses more options for printing. As the world is moving toward automation and digitization, thermal transfer technology is well poised to be the future of the barcode label printer market, as it will be able to meet the requirements of reliability and precision in labeling applications.

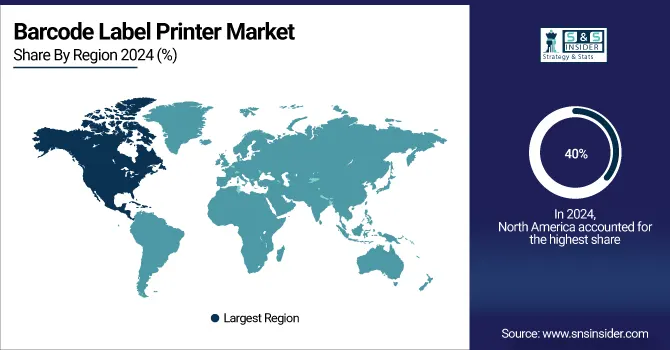

Barcode Label Printer Market Regional Analysis:

North America Barcode Label Printer Market Insights

The North America region dominated the Barcode Label Printers Market in 2024, accounting for 40% of the market share. North America's dominance could be attributed to the well-established logistics, healthcare, and retail industries, which have long been early adopters of advanced technologies. The demand for accurate inventory management, combined with stringent regulatory standards, fuels the demand for barcode labeling systems. Moreover, the constant pressure by the U.S. government toward the optimization of supply chain processes has impelled adoption within almost all sectors.

Get Customized Report as per your Business Requirement - Request For Customized Report

Asia Pacific Barcode Label Printer Market Insights

The Asia-Pacific region is expected to develop at the fastest pace with a CAGR of 6.51% during the forecast period from 2025-2032. The rapid industrialization and the boom of e-commerce in countries like China, India, and Japan are strong demand drivers for barcode printers. Industries such as retail, logistics, and manufacturing in these countries are expanding with increased opportunities for advanced labeling solutions. In addition, the shift toward automated systems and digital transformation across these industries will further raise the demand for barcode printers in the region.

Another factor driving the demand for barcode labeling technologies in Asia-Pacific is the increasing focus on supply chain transparency and traceability, especially in food safety, healthcare, and consumer goods. As businesses in the region continue to modernize and expand, the need for reliable, high-performance barcode label printers will continue to rise, contributing to the rapid market growth in the Asia-Pacific region.

Europe Barcode Label Printer Market Insights

Europe’s barcode label printer market is driven by increasing automation in retail, logistics, and manufacturing. Regulatory compliance, traceability requirements, and the adoption of advanced printing technologies are boosting demand. Growth is further supported by e-commerce expansion, modern warehouse operations, and the need for efficient inventory and supply chain management.

Latin America (LATAM) and Middle East & Africa (MEA) Barcode Label Printer Market Insights

The LATAM and MEA markets are growing due to rising logistics and retail automation, expanding e-commerce, and increasing regulatory standards for product labeling and traceability. Investments in modern warehouse infrastructure and adoption of advanced barcode printing solutions are creating opportunities for market expansion across multiple industrial and commercial sectors.

Barcode Label Printer Market Key Players:

Some of the Barcode Label Printer Market Companies are

-

Zebra Technologies (Zebra ZT410, Zebra ZD620)

-

Honeywell International (Honeywell PM42, Honeywell PX940)

-

Epson (Epson TM-C7500, Epson ColorWorks C7500)

-

Brother Industries (Brother QL-820NWB, Brother TD-4550DNWB)

-

SATO Holdings Corporation (SATO CL4NX, SATO WS4)

-

Toshiba Tec Corporation (Toshiba B-EX4T1, Toshiba B-EP4DL)

-

GoDEX International (GoDEX G500, GoDEX G300)

-

Printronix (Printronix T8000, Printronix T6000e)

-

Bixolon Co., Ltd. (Bixolon SLP-DX420, Bixolon SLP-TX420)

-

Intermec Technologies Corporation (Intermec PM43, Intermec PX6i)

-

TSC Auto ID Technology Co., Ltd. (TSC TTP-2410MT, TSC TTP-384MT)

-

Citizen Systems Japan Co., Ltd. (Citizen CL-S621, Citizen CL-S631)

-

Argox Information Co., Ltd. (Argox X-1000L, Argox X-2000L)

-

Datamax-O'Neil (Datamax I-Class Mark II, Datamax M-Class Mark II)

-

Sick AG (Sick CLV620, Sick CLV630)

-

TSC Auto ID Technology Co., Ltd. (TSC TTP-2410MT, TSC TTP-384MT)

-

Zebra Technologies (Zebra ZT410, Zebra ZD620)

-

Honeywell International (Honeywell PM42, Honeywell PX940)

-

Epson (Epson TM-C7500, Epson ColorWorks C7500)

-

Brother Industries (Brother QL-820NWB, Brother TD-4550DNWB)

Competitive Landscape for Barcode Label Printer Market:

SATO Corporation is a leading provider of barcode and labeling solutions, offering advanced printers and automated systems for retail, logistics, and manufacturing. The company focuses on high-quality, reliable, and efficient barcode label printers that enhance inventory management, ensure regulatory compliance, and improve operational efficiency across global supply chains.

-

May 2024: EM Microelectronic and SATO Corporation, a prominent global manufacturer of printing and labeling solutions, declared that SATO's series of RAIN RFID and HF printers — the CL4NX and CL6NX Plus industrial along with CT4-LX desktop printers — tailored for retail, healthcare, and smart industrial uses can now inherently print and encode em|echo-V RAINFC labels.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.25 Billion |

| Market Size by 2032 | USD 5.01 Billion |

| CAGR | CAGR of 5.57% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Desktop Printers, Mobile Printers, Industrial Printers) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

|

Company Profiles |

Zebra Technologies, Honeywell International, Epson, Brother Industries, SATO Holdings Corporation, Toshiba Tec Corporation, GoDEX International, Printronix, Bixolon Co., Ltd., Intermec Technologies Corporation, TSC Auto ID Technology Co., Ltd., Citizen Systems Japan Co., Ltd., Argox Information Co., Ltd., Datamax-O'Neil, Sick AG. |