Digital Scent Technology Market Size & Trends:

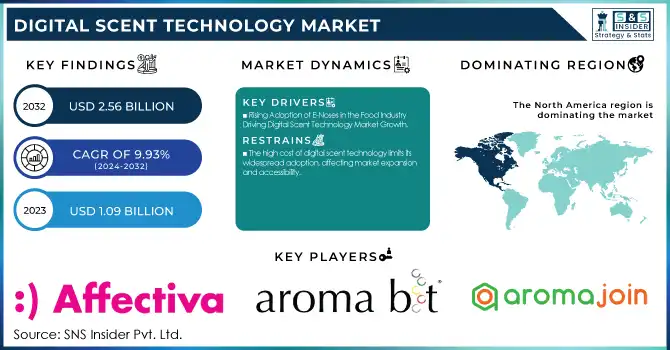

The Digital Scent Technology Market size was valued at USD 1.09 Billion in 2023 and expected to reach USD 2.56 Billion by 2032, growing at a CAGR of 9.93% during 2024-2032. This growth is driven by increasing adoption across industries such Gaming, healthcare, retail, and virtual reality sectors, where scent integration enhances the user experience, are helping the industry grow. The increasing application of AI-assisted olfaction, custom scent marketing, and electronic nose (E-Nose) technology for diagnostics and security is, in turn, driving the market growth.

To get more information on Digital Scent Technology Market - Request Free Sample Report

Adoption rates across technologies, for example, are tracking differently, with electronic noses, scent diffusion systems, and olfactory sensors paving the way. He cites operational costs as an important factor, which affect market penetration and pricing. This is led to the importance of regulatory compliance particularly in the healthcare, food safety, and other consumer electronics which play a pivotal role in determining product approval and market entry barriers. According to consumer surveys, there is an increasing demand for incredibly immersive and multi-sensory experiences and that is resulting in strong demand for digital scent solutions. As industries prioritize realism and engagement, digital scent technology continues to evolve, driving widespread adoption and technological advancements.

Digital Scent Technology Market Dynamics:

Drivers:

-

Rising Adoption of E-Noses in the Food Industry Driving Digital Scent Technology Market Growth

The increasing use of electronic noses (e-noses) in the food industry is a major driver of the digital scent technology market, as they enable rapid, objective, and non-destructive analysis of volatile compounds for process monitoring, freshness evaluation, and authenticity assessment. Research has demonstrated their effectiveness in applications such as monitoring aroma compounds during wine fermentation, detecting spoilage markers like ammonia and sulfur compounds in meat with over 90% accuracy, and differentiating pure extra virgin olive oils from adulterated ones with an accuracy exceeding 95%. Additionally, e-noses are proving valuable in detecting foodborne pathogens and spoilage bacteria, significantly enhancing food safety measures. As food manufacturers increasingly emphasize quality assurance and regulatory compliance, the demand for digital scent technology is expected to surge, fueling market expansion over the coming years.

Restraints:

-

The high cost of digital scent technology limits its widespread adoption, affecting market expansion and accessibility.

The high cost of production stems from considerable research and development costs associated with developing and producing electronic noses (e-noses) and scent synthesizers, as well as the need for specialized materials and components. As a result, the price of these technologies tends to be somewhat high, making it difficult for small and medium-sized enterprises to adopt them. This financial challenge restricts the adoption of digital aroma solutions, especially in price-sensitive areas. As the market continues to evolve, efforts to reduce production costs and enhance affordability will be crucial in promoting broader adoption of digital scent technologies.

Opportunities:

-

Advancements in Explosive Detection Present Opportunities for Digital Scent Technology in Airport Security

Recent technological advancements in explosive trace detection (ETD) are enhancing airport security and efficiency. The Transportation Security Administration (TSA) has implemented computed tomography (CT) checkpoint scanners that provide 3D imaging, enabling automatic detection of explosives, including liquids, and reducing the need for manual bag checks. These CT systems produce detailed images, enabling identification of potential threats with a high level of accuracy. Moreover, micro-sensor-based ETDs capable of detecting explosives, including RDX and ammonium nitrate, at the nanogram level have also been developed, allowing for fast and accurate threat identification. AI-based ETDs can identify different explosive materials, which strengthen the security measures. These advancements highlight significant opportunities for digital scent technology to contribute to more effective and efficient security solutions in the aviation sector.

Challenges:

-

The Absence of Standardization Limits Interoperability and Growth in Digital Scent Technology.

The lack of universal standards in digital scent technology creates significant challenges in interoperability, data consistency, and cross-platform compatibility. The proprietary nature of the algorithms and sensor designs makes it difficult to integrate systems across different industries including healthcare, security, and food safety. In the absence of standardized protocols, the accuracy of scent recognition varies, thereby affecting the reliability and global acceptance of the technology. Defining standard protocols and methodologies for odor detection, classification, and data processing is crucial for interworking, building trust in the users, and speeding up market penetration. Industry collaboration and regulatory frameworks are crucial to overcoming this barrier.

Digital Scent Technology Market Segment Analysis:

By Hardware

E-noses segment is dominated the largest share revenue in Digital Scent Technology Market of around 55% in 2023, driven by the widespread use of e-noses in various sectors, such as food & beverage, healthcare and security. In the food industry, the e-noses are used to enhance quality control by determining spoilage, verifying the authenticity of products, and following the progress of fermentation. In the medical field, they help with the discovery of disease through the analysis of breath biomarkers, which can enhance early diagnosis of diseases including lung cancer and metabolic disorders such as diabetes. Applications are also growing in security, with e-noses deployed in airport screening in a quest to detect explosives. Growing demand for powered olfactory sensors, advancement in miniaturization, and increasing requirement of real-time odor analysis are promoting the growth of this segment. E-noses will likely remain the lead and pioneer of digital scent implementations across different industries with more investments improving sensitivity and response time.

The scent synthesizers segment is projected to be the fastest-growing in the Digital Scent Technology Market from 2024 to 2032. Driven by growing need in entertainment, virtual reality (VR), and immersible experiences, scent synthesis doesn't only heighten human engagement by reproducing all associated smells from the real world; this segment is expected to see strong adoption over the next few years. Adding to the tech-factory experience, gaming, cinema, and retail industries are filtering digital scent systems to create more immersive environments. Moreover, the medical field is also looking into utilizing scent synthesizers for therapeutic purposes, such as relieving stress or stimulating cognitive function. Moreover, the integration of artificial olfactory technology and machine learning will ensure greater accuracy and customization in scent creation. Growing consumer demand for multi-sensory experiences, increased investment in digital olfaction research, and broader applications in advertising and smart home devices are driving growth in the scent synthesizers segment in the forecast period.

By Application

The Medical Diagnostic Products segment accounted for the largest share, around 26%, of the Digital Scent Technology Market in 2023. Due to the increasing utilization of electronic noses (e-noses) for non-invasive disease diagnosis, especially in respiratory and metabolic disorders. Owing to the presence of volatile organic compounds (VOCs) in the breath, advanced olfactory sensors are being used for the early-stage diagnosis of conditions such as lung cancer, diabetes, and bacterial infection. The growing burden of chronic diseases along with the need for faster and accurate diagnostic methods is driving market growth. Moreover, advances in artificial olfaction and machine learning are constantly being developed, aiding the accuracy and efficiency of digital scent-based diagnostics. Additionally, ongoing research and development in artificial olfaction and machine learning have enhanced the accuracy and efficiency of digital scent-based diagnostics. With regulatory support for non-invasive medical technologies and expanding healthcare applications, the segment is expected to maintain its leading position in the forecast period, further driving the adoption of digital scent solutions in the medical field.

The Smartphones segment is projected to experience substantial growth in the Digital Scent Technology Market over the forecast period (2024-2032). The growth is propelled by the rapid research and development of mobile-based olfactory sensors to provide scent-based applications for health monitoring, personalized user experience, and improved digital interaction. Different companies are adding digital scent capabilities to smartphones — for sensing air quality, for checking food freshness or even for analyzing your breath for possible health alerts. Growing consumer need for engaging, multi-sensory experiences in mobile devices is also boosting market growth. In addition, partnerships between technology companies and healthcare organizations are paving the way for mobile-compatible osmatic detection technologies, encouraging their use in diagnostics and well-being.

By End Use

The Medical segment accounted for the largest revenue share in the Digital Scent Technology Market, contributing approximately 34% in 2023. This dominance is attributed to the rising use of e-noses and scent detection systems in medical diagnostics, disease detection, and patient monitoring. The considerable developments made in electronic nose technology have apprehended the attention of medical experts for non-invasive breath analysis of various Instantaneous diseases, such as respiratory diseases, diabetes, lung cancer, and a variety of other pathological conditions. Increasing need for early disease diagnosis and real-time monitoring of health conditions has led to investments in Ai-powered olfactory sensors for various medical applications. In addition, R&D in the field of biomarker based scent detection has further bolstered the segment’s growth. Existing use cases, such as in telemedicine and remote healthcare solutions, also open up new areas of market potential for digital scent technology. As the healthcare industry embraces advanced diagnostic tools, the Medical segment is expected to maintain its leading position, driving continuous innovation and adoption in the coming years.

The Environmental Monitoring segment is projected to be the fastest-growing in the Digital Scent Technology Market during the forecast period 2024-2032. The increasing need for air quality assessment, pollution control, and hazardous gas detection is driving the demand for advanced olfactory sensors. Digital scent technology is being deployed to monitor industrial emissions, detect volatile organic compounds (VOCs), and ensure compliance with environmental regulations. Governments and regulatory bodies worldwide are implementing stricter air quality standards, boosting the adoption of electronic noses (e-noses) for real-time environmental analysis. Additionally, the integration of AI and IoT in scent detection systems enhances their accuracy and efficiency, making them essential for smart city initiatives and sustainable development.

Digital Scent Technology Market Regional Outlook:

North America dominated the Digital Scent Technology Market in 2023, accounting for approximately 36% of the total revenue. The region's leadership is driven by strong technological advancements, high R&D investments, and the presence of key industry players such as Aryballe Technologies, Sensigent LLC, and Smiths Detection Group. The United States holds the largest market share, with extensive adoption of digital scent technology in medical diagnostics, security, and environmental monitoring. Government initiatives supporting advanced sensory technologies, particularly for homeland security and healthcare applications, further bolster market growth. Canada is also emerging as a key contributor, leveraging AI-driven olfactory systems for air quality monitoring and industrial applications. Additionally, the demand for digital scent solutions in consumer electronics and automotive industries is rising, with companies integrating olfaction sensors into smart devices and luxury vehicles. The region's well-established infrastructure, strong regulatory framework, and increasing adoption of digital scent applications across multiple industries ensure its continued dominance in the forecast period.

Europe is the fastest-growing region in the Digital Scent Technology Market, due to increasing AI-driven olfaction enhancements, growing acceptance of digital scent solutions across the healthcare sector, and support given by the government for research and development. Germany, France, and the UK are among the leading nations that have forwarded their development of e-nose technology for diagnostics in medicine, food safety, and environmental monitoring. These strict quality and safety regulations by the European Union compel the industries to maintain such elevated standards which have been key drivers in the adoption of advanced scent detection solutions in the region, especially in pharmaceuticals and security. Germany is at the fore of industrial applications of this technology, notably in automation and robotics. While France follows innovations in the luxury and fragrance industry thanks to digital scent, the UK is exploring health care use and using electronic noses for early disease detection. Also, increasing collaboration between universities, research institutes and tech companies is speeding up innovation.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Some of the Major Players in Digital Scent Technology Market along with their product:

-

Affectiva (United States) [Emotion AI & Scent Detection]

-

Aroma Bit, Inc. (Japan) [Electronic Olfaction Sensors]

-

Aromajoin Corporation (Japan) [Digital Scent Technology]

-

Fraunhofer IIS (Germany) [Sensory & Electronic Nose Technology]

-

Kiwa Bio-Tech Products Group Corporation (China) [Bio-Tech & Environmental Solutions]

-

Owlstone Inc. (United Kingdom) [Chemical Sensing & Breath Analysis]

-

Scentsy, Inc. (United States) [Fragrance & Home Scent Solutions]

-

Sensigent LLC (United States) [Gas & Odor Detection Systems]

-

Smiths Detection Group Ltd. (United Kingdom) [Security & Threat Detection]

-

The eNose Company (Netherlands) [Artificial Olfaction & Medical Diagnostics]

-

Vapor Communications (United States) [Digital Scent Communication]

-

Aryballe Technologies (United States) [Digital Olfaction & Scent Recognition]

-

Adamant Technologies (United States) [AI-Based Scent & Taste Analysis]

-

ScentAir Technologies LLC (United States) [Scent Marketing & Diffusion Systems]

-

Aromax (Mexico) [Fragrance & Air Care Solutions]

List of Suppliers of Raw Materials & Components for Digital Scent Technology

Scent Detection Sensors & Electronic Noses

-

Figaro Engineering Inc. (Japan)

-

Alpha MOS (France)

-

Sensirion AG (Switzerland)

-

Aroma Bit, Inc. (Japan)

Microfluidic & Scent Diffusion Components

-

Dolomite Microfluidics (United Kingdom)

-

Cellix Ltd. (Ireland)

-

Parker Hannifin Corporation (United States)

Scent Encapsulation & Fragrance Ingredients

-

Firmenich SA (Switzerland)

-

International Flavors & Fragrances Inc. (United States)

-

Symrise AG (Germany)

AI & Software for Scent Recognition

-

Aryballe Technologies (United States)

-

Adamant Technologies (United States)

-

Fraunhofer IIS (Germany)

Recent Development

-

In June 2024 – Aroma Bit have developed e-Nose type odor imaging sensor based on CMOS semiconductors, Among the smallest in the world with highly integrated 1.2mm × 1.2mm sensor element with 100 odor-receptor membranes making it easy to integrate with all types of devices.

-

11 Nov 2024– The e-Nose created by the University of Hertfordshire researchers can sample 60 times a second to imitate a mouse's sense of smell, which allows real-time detection of odor patterns for following the source of scent through swampy environments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.09 Billion |

| Market Size by 2032 | USD 2.56 Billion |

| CAGR | CAGR of 9.93% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Hardware (E-noses, Scent Synthesizers, Others) • By Application(Smart Phones, Smelling Screens, Music and Video Games, Explosive Detectors, Quality Control Products, Medical Diagnostic Products, Others) • By End Use(Food & Beverages, Military & Defence, Medical, Marketing, Environment Monitoring, Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Affectiva (United States), Aroma Bit, Inc. (Japan), Aromajoin Corporation (Japan), Fraunhofer IIS (Germany), Kiwa Bio-Tech Products Group Corporation (China), Owlstone Inc. (United Kingdom), Scentsy, Inc. (United States), Sensigent LLC (United States), Smiths Detection Group Ltd. (United Kingdom), The eNose Company (Netherlands), Vapor Communications (United States), Aryballe Technologies (United States), Adamant Technologies (United States), ScentAir Technologies LLC (United States), Aromax (Mexico). |