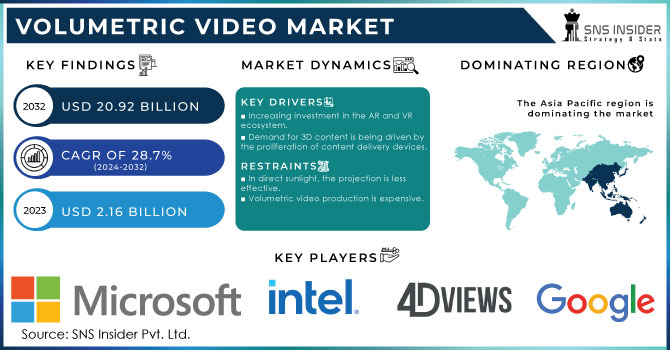

Volumetric Video Market Size & Trends:

The Volumetric Video Market Size was valued at USD 2.6 billion in 2023 and is expected to reach USD 24.23 billion by 2032, growing at a CAGR of 28.15% over the forecast period 2024-2032. Some significant factors propelling the growth of the market are the rising demand for immersive experiences across entertainment, education, and healthcare sectors; and further advancements in capture technology like 3D cameras and AI-enabled video processing.

Get more information on Volumetric Video Market - Request Sample Report

Regulatory and ethical issues are also still evolving, particularly around privacy, data capture, and the sharing of immersive content. Potential regulatory impacts may have an effect on production as well as usage, enabling industry standards and policies to govern video content across sectors. Moreover, strategic collaborations and technological advancements are further fueling market growth and propelling use cases in diverse industries.

Volumetric Video Market Dynamics:

Drivers:

-

Rising Demand for Immersive Experiences Drives the Need for Volumetric Video in AR/VR Technologies.

The growing demand for immersive experiences across industries like entertainment, gaming, and education is a major driver for the volumetric video market. With the widespread adoption of augmented reality (AR) and virtual reality (VR) technologies, there is an increasing need to create more lifelike, interactive environments. Volumetric video allows users to experience 3D content in real-time, offering a level of realism that traditional 2D video cannot provide. In sectors like gaming, users can engage with environments and characters more deeply, while in education and training, this technology helps in creating interactive simulations. As the desire for more engaging and personalized experiences increases, volumetric video plays a key role in shaping the future of AR/VR applications.

Restraints:

-

Overcoming Infrastructure Challenges in the Volumetric Video Market for Enhanced Adoption.

volumetric video requires a high level of infrastructure from the cutting-edge hardware and specialized software to the colossal computational power needed to capture, process, and render volumetric content. Creating and rendering volumetric content usually requires a lot of cameras, sensors, and processing units, which makes the whole process expensive. Moreover, the real-time processing and rendering of 3D content require high-performance computing resources, thus driving the need for high-performance computing solutions in this domain. Acquiring and maintaining this is a complex piece of infrastructure and can be a significant barrier to entry for many businesses (especially small and medium-sized businesses). This high initial investment and ongoing out-laying further slow the adoption and scalability of such volumetric video technology.

Opportunity:

-

Advancements in 5G technology are driving the growth of the volumetric video market by enabling faster streaming and real-time immersive experiences.

The expansion of volumetric video market is tremendously attributed to the rollout of 5G technology. 5G’s high-bandwidth capabilities and ultra-low latency also mean that high-resolution, data-heavy volumetric video content can be streamed more rapidly than ever. With this network enhancement, Live provides collision-free, real-time interaction most in-demand by augmented and virtual reality (AR/VR), gaming, and live events applications. Drive Enhanced Experiences: The continuation of the 5G networks will allow businesses to deliver audiences immersive and interactive experiences. Moreover, this opens up so many avenues for volumetric video technologies to find applications across various industry verticals.

Challenges:

-

Overcoming Complex Data Processing Challenges in the Volumetric Video Market

Volumetric video technology generates vast amounts of data from 3D captures, requiring significant computational power to process, store, and render high-quality video. This demand for high-performance processing units and storage infrastructure can lead to increased costs and latency issues. Challenges that can slow down real-time rendering and interactive capability include complexity with the evolving technology and content, ultimately impeding the scalability of volumetric video applications. The requirement for specific hardware and software raises the entry barrier for many companies; demanding a considerable investment in infrastructure.

Volumetric Video Market Segment Analysis:

By Volumetric Capture

The hardware segment dominated the volumetric video market in 2023, capturing around 40% of the revenue share. The market is generally dominated by volumetric video capture system, as there are an increasing number of high-quality capture hardware such as camera, sensors, and computing equipment for volumetric video production. These devices create a real-time rendering of high-resolution images that meets the immersive experience demanded by sectors such as entertainment, gaming, and education. The evolution of technology continues to drive such hardware innovations, which in turn is expanding the range of capabilities offered by versatile volumetric video systems, ultimately helping boost market growth.

The service segment is the fastest growing in the volumetric video market over the forecast period from 2024 to 2032. The need for specialized burnt services such as video production, post-production, cloud storage, and real-time streaming are what are driving this growth, as they are needed to enable all the various workflows necessary to create volumetric video content. The demand for volumetric video production, integration and distribution will grow as more industries embrace immersive technologies for entertainment, education and training, and are looking for end to end solutions and service providers with expertise.

By Delivery Platforms

The AR/VR HMDs (Head-Mounted Displays) segment dominated the volumetric video market with the largest share of around 41% in 2023. The increasing adoption across diverse industries (gaming, entertainment, healthcare, education, etc.) for AR/VR devices is driving this dominance. Such immersive experiences require HMD to enable users to interact with volumetric content as the volumetric content needs to be presented in three dimensional interactive and realistic manner. With the demand for high quality, immersive experiences showing no signs of slowing down, AR/VR HMDs will make up a huge percentage of the market and will aid in future growth.

The smartphones segment is poised for the fastest growth in the volumetric video market over the forecast period from 2024 to 2032. As smartphone, technology continues to advance, with improved camera capabilities, processing power, and display technology, the demand for immersive experiences is rising. Volumetric video can be seamlessly integrated into smartphones, offering consumers real-time, interactive experiences across various applications, such as entertainment, gaming, and education. This trend is expected to drive adoption, making smartphones a key platform for delivering volumetric video content to a broader audience.

By Application

The sports, events, and entertainment segment dominated the volumetric video market in 2023, accounting for around 41% of the revenue share. This growth is driven by the increasing demand for immersive and interactive experiences in live sports broadcasts, entertainment events, and other media content. Volumetric video enables viewers to experience events from multiple angles, enhancing engagement and realism. As the adoption of AR/VR technologies expands, especially in entertainment and sports, volumetric video is poised to revolutionize how audiences interact with live events, fueling the segment's dominance in the market.

The signage and advertisement segment is expected to be the fastest growing in the volumetric video market from 2024 to 2032. This growth is fueled by the increasing demand for more dynamic, interactive, and immersive advertising experiences. Volumetric video allows advertisers to create 3D, interactive content that can be displayed across various platforms, enhancing consumer engagement. This technology is gaining traction as it enables brands to deliver more personalized and memorable advertisements, providing an edge in highly competitive markets. As businesses strive for innovative marketing strategies, the adoption of volumetric video in advertising is expected to accelerate significantly.

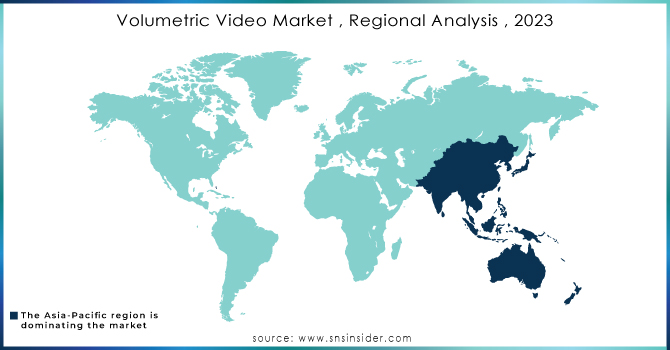

Volumetric Video Market Regional Landscape:

North America dominates the volumetric video market, holding a 34% share in 2023. This is due to the region’s leadership in technological advancements, substantial investment in research and development, and a thriving entertainment industry. The demand for immersive content in sectors such as gaming, healthcare, and education further fuels growth. Additionally, the presence of major players, alongside the rapid adoption of AR/VR technologies and the rollout of 5G networks, provides a strong foundation for market expansion. North America's well-established infrastructure and innovation ecosystem continue to support the region's leadership in volumetric video.

The Asia-Pacific region is expected to be the fastest-growing segment in the volumetric video market during the forecast period from 2024 to 2032. The growth is attributed to the rising investment in AR/VR technologies and the growing demand for immersive content across sectors such as entertainment, gaming, and education, along with the rapid rollout of 5G infrastructure. Moreover, key drivers facilitating the deployment of the volumetric video technologies include the region's growing consumer base, especially in countries such as China, Japan, and India. Strong government initiatives and technological advancements also back the growth of the Asia-Pacific market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players:

Some of the Major players in Volumetric Video Market along with their product:

-

Microsoft Corporation (USA) [Azure Cloud, Mixed Reality solutions, volumetric video rendering]

-

Intel Corporation (USA) [Processors, 3D camera solutions, AI for volumetric capture]

-

Google LLC (USA) [AR/VR solutions, software tools for volumetric video]

-

Meta Platforms (USA) [Oculus VR, volumetric capture technology for immersive experiences]

-

8i Co. (New Zealand) [Volumetric video production tools and platforms]

-

Sony Corporation (Japan) [Cameras, 360-degree video capture, VR solutions]

-

Unity Technologies (USA) [Real-time 3D rendering and development platform for volumetric video]

-

4Dviews (France) [Volumetric capture systems for 3D video production]

-

8i (New Zealand) [Volumetric video content creation and distribution platform]

-

Alphabet (USA) [Google AR/VR tools, volumetric video encoding, and playback]

-

Canon (Japan) [Cameras and imaging technology for 3D volumetric capture]

-

Capturing Reality (Slovakia) [Photogrammetry software for creating 3D models from volumetric video]

-

Coretec Group (USA) [Technologies for advanced volumetric video display and capture]

-

Dimension (UK) [Volumetric video and holographic content creation]

-

Evercoast (USA) [Volumetric video production and software for immersive media experiences]

-

IO Industries (Canada) [Cameras and systems for high-resolution volumetric video capture]

-

Mark Roberts Motion Control (UK) [Camera motion control systems for volumetric video applications]

-

Metastage (USA) [Volumetric capture studio and software services]

-

Mod Tech Labs (USA) [3D scanning, motion capture, and volumetric video solutions]

-

Scatter (USA) [Volumetric video technology for capturing and viewing immersive content]

-

Sony Corporation (Japan) [Cameras for volumetric video production]

-

Stereolabs (USA) [3D cameras and sensors for immersive volumetric video experiences]

-

Unity Technologies (USA) [Volumetric video development and real-time rendering platform]

-

Verizon Communications (USA) [5G infrastructure to support volumetric video streaming]

-

Vividq (UK) [Holographic and volumetric video solutions for AR and VR]

List of Suppliers that provide raw materials and components for the volumetric video market:

-

Intel Corporation

-

NVIDIA Corporation

-

Qualcomm

-

Sony Corporation

-

Canon

-

Microsoft Corporation

-

Panasonic Corporation

-

Vicon Motion Systems

-

GoPro

-

Red Digital Cinema

-

Himax Technologies

-

Lytro

-

Oculus (Meta Platforms)

-

ARHT Media

-

Vuzix Corporation

Recent Development

-

On May 22, 2024, Microsoft introduced 'Volumetric Apps' at the Microsoft Build 2024 event, to connect Windows and Meta Quest for advanced functionality like positioning windows in a 3D space and touching. To enable experiences like Apple Vision Pro, this is the intention of the feature.

-

On August 9, 2024, , Intel broadcast technology lead Courtney Willock spoke about how Intel is backing Olympic Broadcasting Services (OBS) for the Olympics this summer, specifically AI-generated clipping, production virtualization and volumetric capture and AR tech.

| Report Attributes | Details |

| Market Size in 2023 | USD 2.6 Billion |

| Market Size by 2032 | USD 24.23 Billion |

| CAGR | CAGR of 28.15 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Volumetric Capture (Hardware, Software, Service) • By Delivery Platforms (Projectors, AR/VR HMDs, Smartphones, Volumetric Displays) • By Application (Sports, events, & entertainment, Medical, Education & training, Signage & advertisement, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Microsoft, Intel, Google, Meta, 8i, Sony, Unity Technologies, 4Dviews, Alphabet, Canon, Capturing Reality, Coretec Group, Dimension, Evercoast, IO Industries, Mark Roberts Motion Control, Metastage, Mod Tech Labs, Scatter, Stereolabs, Verizon Communications, and Vividq. |