Digital Video Advertising Market Key Insights:

The Digital Video Advertising Market Size was valued at USD 184.2 Billion in 2023 and is expected to reach USD 1018.1 Billion by 2032, growing at a CAGR of 20.9% over the forecast period 2024-2032.

The digital video advertising market is witnessing exponential growth. The primary factors responsible for this development include the increasing penetration of digital internet and the government’s efforts. The U.S. Census Bureau’s latest information in 2023 highlights that almost 94% of U.S. households have access to the Internet. In addition, the Federal Communications Commission states that the country’s internet traffic has increased by 30% y-o-y. This increase can be attributed to the people’s changing video consumption patterns. With more individuals engaging in video streaming and socializing, they provide ample opportunities for this market to thrive. Therefore, advertisers are seeking novel and innovative ways to approach the consumers. As a response, emerging digital video advertising relies on modern technology and non-traditional platforms to enhance content creation and delivery.

Digital Video Advertising Market Size and Forecast:

-

Market Size in 2023: USD 184.2 Billion

-

Market Size by 2032: USD 1018.1 Billion

-

CAGR: 20.9% from 2024 to 2032

-

Base Year: 2023

-

Forecast Period: 2024–2032

-

Historical Data: 2021–2022

Get More Information on Digital Video Advertising Market - Request Sample Report

The proliferation of innovative filming techniques, such as vertical filming, moving imaging, and 360° digital videos, have revolutionized digital video advertising across the globe. The incorporation of such techniques has revolutionized advertising and helped convey messages more effectively as well as engaging to target markets. The creation of advanced video formats using artificial intelligence and connected devices in the video presents exciting virtual ways of stimulating brand and product market expansion. Furthermore, the recent technological advancements in video technologies have contributed immensely towards the creation of better digital video quality. For instance, the development of high-definition connected televisions has played an instrumental role in boosting the growth of digital video advertising. Through connected televisions, advertisers have an opportunity to showcase their products as they are, which is high definition and clear to the viewer. Alternatively, ads may be sponsored based on individuals’ friend and group social media search and viewing tendencies. The ads can also be featured on their sites, an ultimate way for their target audience to view the ads. This exhibit boosts brand reputation and nurtures brand loyalty.

The global rise in OTT platform usage, fuelled by widespread access to affordable high-speed internet, has provided advertisers with an effective means to expand their market reach. Platforms like YouTube, Hulu, and Amazon Prime Video allow marketers to leverage pre-roll, mid-roll, and post-roll advertising, maximizing audience engagement. Furthermore, U.S. initiatives such as the Federal Communications Commission’s (FCC) policies supporting enhanced internet access contribute to the growing popularity of OTT platforms. The increasing use of companion ads and in-banner digital video ads ensures seamless viewer experiences while providing advertisers with continuous opportunities to engage audiences, boosting the potential for further growth in the digital video advertising market.

Digital Video Advertising Market Trends

-

Rapid growth in connected TV (CTV), over-the-top (OTT) platforms, and streaming services is significantly increasing digital video ad spending across global markets.

-

Rising mobile video consumption driven by high smartphone penetration and affordable data plans is accelerating in-app and social video advertising demand.

-

Programmatic advertising adoption is enhancing targeting precision, real-time bidding efficiency, and return on ad spend (ROAS) optimization.

-

Integration of artificial intelligence and machine learning is enabling advanced audience segmentation, predictive analytics, and personalized ad delivery.

-

Increasing brand shift from traditional TV advertising to digital channels is driving higher budget allocation toward measurable, performance-based video campaigns.

-

Expansion of short-form video platforms and social commerce is creating new monetization opportunities for advertisers and content creators.

-

Growing emphasis on data privacy regulations and cookie-less tracking solutions is encouraging investment in first-party data strategies and contextual video advertising models.

Digital Video Advertising Market Drivers

-

Increased mobile device penetration is driving higher consumption of digital video content, boosting ad viewership on mobile platforms.

-

Programmatic video advertising allows more targeted ad delivery, enhancing advertiser efficiency and increasing ad spending.

-

The surge in Over-the-Top (OTT) streaming services creates new opportunities for video ad placements, expanding the market.

-

Improved data analytics enable advertisers to create personalized video ads, resulting in better engagement and conversion rates.

In the Digital Video Advertising Market, one of the major drivers is the increasing usage of mobile. Owing to the increased penetration of smartphones and tablets, subscribers rely more on these platforms, thus making mobile the most popular medium for digital advertisers. The consumption of mobile videos has been increasing rapidly, and it has been estimated that in 2023, over 75% of total online videos were viewed through mobile. This growth is attributed to the unlimited internet bandwidth and faster speeds, which are compounded by the emergence of low-cost smartphones in all markets.

Moreover, 5G networks are enhancing the quality of video streaming, given that the platforms are becoming more integrated, thus ensuring that accessing the internet is no longer a hassle. For instance, YouTube, one of the leading video consumption platforms, discloses that over 70% of its watch time takes place through mobile. In addition, the rise of new apps like TikTok that are entirely mobile. As a result, millions of subscribers are leveraging the app’s massive viewership and short video content to advertise. Notably, the ultimate reaction to this trend is to ensure that all video ads are short and tailored to be used on mobile platforms. Notably, in a bid to entertain users and ensure the advertisements are engaging, they cannot exceed 15 seconds. Besides, Snapchat improves the effectiveness of mobile video ads by ensuring that they are vertical to make them suit mobile screens optimally. The convenience of mobile devices, coupled with the ever-growing consumption of videos on platforms like Instagram, Facebook, and TikTok, is triggering a sense of urgency, thus making mobile video consumption a vital investment.

Digital Video Advertising Market Restraints

-

The growing use of ad-blocking software reduces ad visibility, leading to decreased revenue for video advertising campaigns.

-

The crowded digital space makes it challenging for brands to capture user attention, reducing the effectiveness of video ads.

-

Stringent data privacy laws like GDPR limit access to user data, hindering the ability to deliver highly targeted video ads.

Digital video advertising faces a notable constraint in the rising usage of ad blockers. Consumers are increasingly aware of their online activity and, as a result, more people choose to block automated ads to avoid interruptions caused by unwanted promotions. As a rule, this fact diminishes the efficacy and exposure of advertisements for viewers. Investigations suggest that over 20% of internet users use ad-blocking tools, with their usage peaking on mobile devices, which are the most likely to incorporate video ads. On the one hand, it limits the effectiveness of digital video advertising. On the other hand, it limits the revenue sources for content creators, publishers, and online platforms that may rely on such promotions to support their work. It is anticipated that, with time, advertisers will have to develop new strategies, for example, native advertising, or influencer marketing, to deploy their efforts effectively without provoking a reaction from these blocking tools.

Digital Video Advertising Market Segmentation Analysis

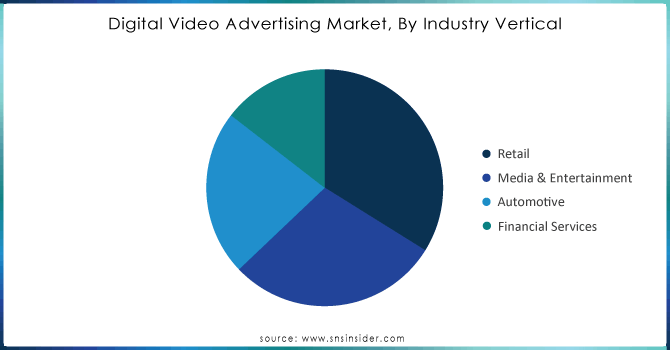

By Industry Vertical

The retail segment dominated the digital video advertising market in 2023 and had a generating revenue share of about 21%. This trend is associated with the fact that retailers have been using digital video advertisements to create an immersive shopping experience for consumers. Presently, the concept of video content is being used to display products, show discounts offered, and increase customer rapport with the brand. eCommerce has experienced tremendous growth in popularity, and this is one of the factors that has pushed the demand for video advertising. Data from the U.S. Department of Commerce shows that in 2023, e-commerce sales accounted for 18.1% of total retail sales, yet in 2020 they were 14%. Furthermore, retailers are using video content to conduct advertisements even in their physical stores by making shopping interactive. In-store video advertisements may include QR codes that consumers can scan to receive promotions, while others direct a customer to examples of the product in use and videos that show how to make a product. These interactive experiences between the retailer and the consumer increase engagement, as well as the penetration of adverts. Hence, many retailers have experienced increased sales since they rolled out video adverts.

The financial service segment is anticipated to record a remarkable CAGR between 2024 and 2032. The demand for video advertising in this segment can be attributed to the need to acquire and retain customers in an already competitive marketplace. Digital video advertisements assist in explaining complicated financial services such as different types of mortgages or investment opportunities. Moreover, the trend, which has seen an increased need for financial institutions to provide personalized financial advice, has led to targeted marketing. Notably, various government statistics reported a notable increase in digital transactions. Government statistics indicate that digital payments in the U.S. crossed $7.6 trillion in 2023, reflecting a sharp increase in digital transactions. Additionally, consumer behaviour has shifted towards digital financial services, with 83% of banking transactions now conducted online, according to the Federal Reserve. This trend of increased use of digital technology has led financial service institutions to adopt digital video advertising to inform consumers of new products and services.

Need Any Customization Research On Digital Video Advertising Market - Inquiry Now

By Type

The largest revenue share in 2023 was held by the desktop segment, which can be attributed to the higher engagement with video content. Moreover, the likelihood of individuals spending more time on websites or social media while using desktops is higher. As such, the time required for video content can also be extended since advertisers have more time to deliver this content. Moreover, the U.S. Department of Labor Statistics shows that the amount of remote work has receded but remained high with one-quarter of the workforce working at home in 2023. Furthermore, desktops and laptops are the preferred method of consuming visual media. For instance, ads can be displayed on larger screens, which can increase the extent of the impact on people. This type of video advertisement may call on individuals to enact specific behaviors, including but not limited to purchasing a product or signing up for a specific service.

The mobile segment is expected to grow with the highest CAGR in the approaching period, and this trend can be explained by the proliferation of affordable smartphones. Moreover, the population is more inclined to consume content at its convenience. For instance, mobile games are one manner to engage individuals, and they award game credits or coins if one chooses to watch a digital video ad while waiting for the next play. Additionally, mobile service vendors are willing to share location data with video advertisers. As such, companies can adjust their digital video ad delivery approach based on demographic developments within a specific area.

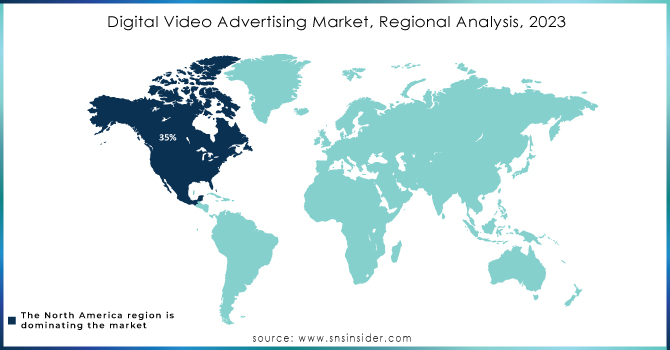

Digital Video Advertising Market Regional Analysis

In 2023, North America led the digital video advertising market with a market share of 35%. The leading position of this region is determined by the high rate of internet penetration and the perfectly developed digital base needed for the delivery of digital video ads without glitches. In addition, the US government’s ongoing efforts to advance broadband access support the relevance of this sector as illustrated by the launch of the National Broadband Plan. This project is focused on bringing high-speed internet to 99% of American households by 2025 and therefore also bolsters the demand and relevance of digital video marketing.

One of the leading nations within the North American region is the United States. The country benefits from a vast customer base. Adequate infrastructure and a high level of development of online platforms are also instrumental in the development of the industry in the country. High-speed internet is present almost everywhere. Meanwhile, the digital revolution started a bit earlier than in other regions, and the advanced digital infrastructure makes it one of the most attractive regions for video advertising. The development of online platforms, such as Google and Facebook, provides fertile ground for the advancement of video advertisement due to the presence of excellent content creators and large audiences willing to consume said content. A National Strategy for Innovation and A Strong Economy plan made internet development its key asset, and this led to formation of a strong advertisement market eager to seize new opportunities.

The Asia Pacific region is likely to exhibit the fastest growth in the CAGR of video advertising. Such a state of affairs may be attributed to the rapid proliferation of smartphones and internet connections in such countries as India, China, and various states in Southeast Asia. Widespread internet usage and high adoption levels of smartphones is a characteristic feature of this region, and currently, prices for high-speed internet are record low. Such companies as Alibaba or JD.com also serve to enhance their clients’ video marketing plans. Urbanization and a new way of life play an important role in developing a new demand for entertainment and digital resources. The demand for digital content in China will be propelled by rising incomes and the prevalence of smartphones.

Recent Developments

-

In April 2024, Innovid launched Harmony, an initiative aimed at improving the connected TV (CTV) advertising ecosystem. The first product under this initiative, Harmony Direct, streamlines the buying and selling of guaranteed, non-auction-based CTV advertising inventory.

-

In April 2023, Viant Technology Inc. partnered with IRIS.TV to provide its clients with deep, cookie-free contextual TV data enabling marketers to target and measure advertising activations more precisely.

-

In March 2023, Google announced the launch of its new video ad format "TrueView for Reach," aimed at helping advertisers maximize their reach while maintaining cost efficiency. This new format allows businesses to deliver skippable video ads, optimizing for reach and frequency, which is expected to drive further adoption of digital video advertising.

Key Players

-

Google (YouTube Ads, Google Ads)

-

Facebook (Facebook Ads, Instagram Ads)

-

Amazon (Amazon Advertising, Amazon DSP)

-

Adobe (Adobe Advertising Cloud, Adobe Experience Manager)

-

Snap Inc. (Snap Ads, Ads Manager)

-

Twitter (Twitter Ads, Amplify)

-

TikTok (TikTok Ads, TikTok For Business)

-

The Trade Desk (Unified ID 2.0, Koa)

-

Verizon Media (Yahoo Ads, Ad Manager)

-

IBM (Watson Advertising, IBM Marketing Cloud)

-

Roku (Roku Advertising, OneView)

-

LinkedIn (LinkedIn Ads, Sponsored Content)

-

Vimeo (Vimeo Ads, Vimeo Livestream)

-

SpotX (SpotX Ad Server, SpotX Exchange)

-

Magnite (Magnite Ad Server, CTV Solutions)

-

Xandr (Xandr Invest, Xandr Monetize)

-

FuboTV (FuboTV Advertising, FuboTV Campaign Manager)

-

PubMatic (PubMatic Ad Server, PubMatic Connect)

-

AdColony (AdColony Mobile Ads, Instant-Play Video)

-

Outbrain (Outbrain Amplify, Outbrain Engage)

and others in final Report.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 184.2 Billion |

| Market Size by 2032 | USD 1018.1 Billion |

| CAGR | CAGR of 20.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Desktop, Mobile) • By Industry Vertical (Retail, Media & Entertainment, Automotive, Telecom, Financial Services, Consumer Goods and Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Google, Facebook, Amazon, Adobe, Snap Inc., Twitter, TikTok, The Trade Desk, Verizon Media, IBM, Roku, LinkedIn, Vimeo, SpotX, Magnite, Xandr, FuboTV, PubMatic, AdColony, Outbrain. |

| Key Drivers | • Increased mobile device penetration is driving higher consumption of digital video content, boosting ad viewership on mobile platforms. • Programmatic video advertising allows more targeted ad delivery, enhancing advertiser efficiency and increasing ad spending. |

| RESTRAINTS | • The growing use of ad-blocking software reduces ad visibility, leading to decreased revenue for video advertising campaigns. • The crowded digital space makes it challenging for brands to capture user attention, reducing the effectiveness of video ads. |