Predictive Genetic Testing & Consumer/Wellness Genomics Market Report Scope & Overview:

Get more information on Predictive Genetic Testing & Consumer/Wellness Genomics Market - Request Sample Report

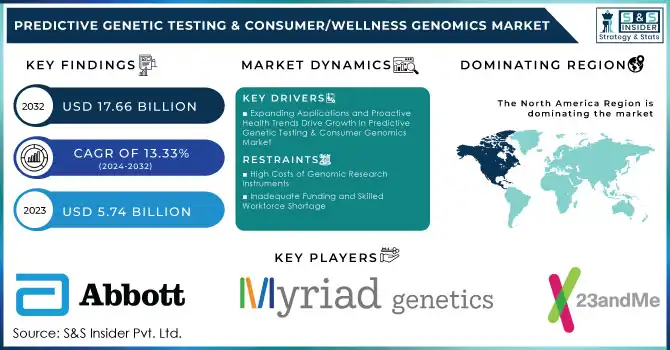

The Predictive Genetic Testing & Consumer/Wellness Genomics Market Size was valued at USD 5.74 billion in 2023 and is expected to reach USD 17.66 billion by 2032 and grow at a CAGR of 13.33% over the forecast period 2024-2032.

The Predictive Genetic Testing & Consumer/Wellness Genomics market is witnessing significant growth driven by expanding applications in personalized medicine and the rising demand for proactive health solutions. Predictive genetic testing provides individuals with valuable insights into their genetic predispositions, allowing for early detection of potential health risks. It enables personalized healthcare by guiding lifestyle changes, such as diet and exercise, tailored to an individual’s genetic profile. Consumer/wellness genomics empowers people to optimize their well-being by making informed decisions based on genetic insights, promoting proactive health management and preventative care. This market is further boosted by the growing consumer interest in wellness genomics, including areas such as nutrigenomics, skin, and metabolism genetics, which are linked to personalized dietary plans and lifestyle adjustments.

The growing awareness of predictive genetic testing for cancer, cardiovascular diseases, and neurodegenerative conditions is driving the expansion of the genetic testing and wellness genomics market. As consumers seek proactive, personalized healthcare solutions, the demand for early detection and preventive measures increases. This trend toward personalized medicine, where treatments are tailored to genetic profiles, is fueling market growth, with individuals leveraging genetic insights to manage health risks and improve overall wellness. According to the American Heart Association, by 2050, over 60% of U.S. adults are anticipated to suffer from heart disease or stroke, a sector being developed with high risks of hypertension, diabetes, and obesity. Hypertension will go up from 51.2% in 2023 to 61% by 2050, while the prevalence of diabetes might rise from 16.3% in 2023 to 26.8% by 2050, doubling stroke rates. This increasing healthcare burden emphasizes the importance of predictive genetic testing that can evaluate the risk factors for an individual. According to World Health Organization statistics, more than 500 million adults suffer from diabetes worldwide, and this figure is expected to be over 700 million by 2045 according to International Diabetes Federation estimations. In addition, as per the Alzheimer's Association, the number of Alzheimer’s patients is already more than 6 million in the U.S. and is poised to nearly triple by 2060. So, it is urgent healthcare issues like these that are, in turn, increasing demand for early-stage detection and prevention solutions, thereby opening enormous growth potential in the markets for predictive genetic testing and wellness genomics.

One of the main growth factors is the increasing use of genetic tests in preventative healthcare, which helps identify genetic susceptibilities early, potentially reducing the burden of chronic conditions through lifestyle interventions or early treatment. Additionally, the rise in direct-to-consumer (DTC) testing has made genetic tests more accessible, expanding the market’s reach beyond healthcare settings. The integration of predictive diagnostics in population screening programs is also expected to drive the market, making genetic testing more mainstream.

The market’s growth is supported by advancements in genetic sequencing technologies, which are becoming more affordable and accessible, making predictive testing and consumer genomics more attractive to both healthcare providers and consumers. Despite these advancements, challenges like the high cost of genetic research instruments, the complexity of genetic testing procedures, and the shortage of skilled professionals in the field remain significant hurdles.

Overall, the predictive genetic testing & consumer wellness genomics market is poised for robust growth over the next decade, as demand for personalized and preventative healthcare solutions continues to rise.

Market Dynamics

Drivers

- Expanding Applications and Proactive Health Trends Drive Growth in Predictive Genetic Testing & Consumer Genomics Market

The wide range of applications of predictive genetic testing across different domains is the key driver in the growth of the market for predictive genetic testing and consumer/wellness genomics. Some applications of this kind of testing are diagnostic testing, presymptomatic and predictive testing, prenatal and newborn screening, genetic carrier testing, pharmacogenetics, and recommendations regarding cancer treatment. Genetic testing is also used in tissue typing, a process that is adopted in different transplantation procedures. Such applications are examples of the benefits of predictive genetic testing in terms of the achievement of early health insights and better patient outcomes and, most importantly, tailoring treatment plans to the needs of the patient.

Public awareness concerning the benefits of genetic testing is also advancing, and an increasingly healthier lifestyle is another factor driving market demand forward. Thus, people are increasingly approaching predictive testing as preventive rather than reactive, to detect potential health risks early so that interventions could occur before conditions worsen. This develops trends broadly toward preventive care solutions that give people a glimpse into their health and well-being.

In addition, increased investments in R&D for a therapeutic paradigm will further accelerate this market growth. Such efforts focus on leveraging genetic discoveries to design treatments against disease. They are making progressive strides in the context of precision medicine. Increased and efficient R&D will further help expand the scope of predictive genetic testing while enhancing its accuracy and efficacy in the context of preventive healthcare. The inclusion of such factors is augmenting the predictive genetic testing and consumer/wellness genomics market to rise further. Moreover, this is primarily because of ongoing improvements in personalized health solutions and the growth in health-conscious behaviors.

Restraints

-

High Costs of Genomic Research Instruments

-

Inadequate Funding and Skilled Workforce Shortage

-

Complexity in Genetic Testing Procedures

Key Segmentation

By Test:

Predictive testing was the dominant segment in 2023 within the predictive genetic testing & consumer/wellness genomics market, owing to its wide application in identifying individuals at higher risk of inherited diseases, particularly genetic disorders and cancers. It held a substantial share, dominating around 40.0% of the market. The popularity of predictive testing can be attributed to its pivotal role in proactive healthcare, enabling early diagnosis, targeted prevention strategies, and personalized treatment plans. This segment is particularly influential in genetic testing for conditions like breast and ovarian cancers, cardiovascular diseases, and neurological disorders, driving its continued dominance.

Consumer Genomics is expected to be the fastest-growing segment during the forecast period 2024-2032. The increase in consumer awareness, access to direct-to-consumer genetic testing, and a rising interest in personal health insights have contributed to its rapid expansion. This segment saw a growth rate of over 15% year-over-year, driven by advancements in mobile technology, improved affordability, and the widespread adoption of wellness genomics testing.

By Application:

Breast and ovarian cancer screening, specifically through genetic tests such as BRCA1 and BRCA2 mutations, dominated the predictive genetic testing & consumer/wellness genomics market in 2023. This segment accounted for nearly 30.0% of the market share in 2023 due to the growing focus on personalized oncology. Early genetic screening for hereditary cancer syndromes plays a crucial role in identifying high-risk individuals and informing decision-making around preventive measures, including surgery or enhanced surveillance. Public awareness campaigns and increased genetic testing accessibility have contributed to the growing prevalence of this segment.

Cardiovascular Screening is anticipated to be the fastest-growing application over the forecast period, largely fueled by the rising incidence of cardiovascular diseases worldwide. Genetic tests that predict the risk of heart disease, stroke, and other cardiovascular conditions are increasingly in demand as they provide individuals with actionable insights into their cardiovascular health. The segment's growth is attributed to advancements in genomic research, the integration of genomic testing into routine cardiovascular care, and a growing focus on preventive health strategies.

Regional Analysis

North America remained the dominant region for predictive genetic testing and consumer/wellness genomics market, holding a significant market share due to advanced healthcare infrastructure, high consumer awareness, and robust healthcare spending. The U.S. leads the way with its well-established market for direct-to-consumer genetic tests such as 23andMe and AncestryDNA, fueling the rapid growth of wellness genomics. The regulatory environment, including the FDA’s guidelines for genetic tests, and the increasing acceptance of personalized healthcare also contribute to the region’s dominance.

Europe is the second largest region for predictive genetic testing and consumer/wellness genomics market, driven by the growing adoption of predictive genetic testing in clinical settings, especially for conditions like breast cancer and cardiovascular diseases. Countries like the UK and Germany have integrated genomic testing into national health services, making predictive genetic tests accessible and affordable. The region’s strong emphasis on preventive healthcare and its healthcare policies supporting genetic research has contributed to the steady growth of this market.

Asia-Pacific is the fastest-growing region, particularly in countries like China and India, where there is rising interest in wellness genomics. The growing middle class, increased awareness about health risks, and expanding access to genetic testing services are driving the market’s growth. In China, the government’s investment in genetic research and healthcare innovation has bolstered the popularity of predictive and wellness genomics testing. The region’s vast population and evolving healthcare systems offer considerable growth opportunities, with an expected CAGR of over 20% in the coming years.

Need any customization research on Predictive Genetic Testing & Consumer/Wellness Genomics Market - Enquiry Now

Key Players

-

23andMe, Inc. - Personal Genome Service

-

Myriad Genetics, Inc. - EndoPredict, Prolaris

-

F. Hoffmann-La Roche Ltd - FoundationOne CDx

-

Abbott - BRCA Analysis

-

Agilent Technologies, Inc. - SureSelect

-

Thermo Fisher Scientific Inc. - GeneMapper, Ion Torrent, NovaSeq, MiSeq

-

BGI - CytoScan

-

Bio-Rad Laboratories, Inc. - GeneSight

-

Illumina, Inc. - TruGenome, AmpliSeq, Veriti Thermal Cycler

-

ARUP Laboratories - Invader Assay

-

Affymetrix, Inc. - GeneChip

-

Applied Biosystems - TaqMan Assays

-

Amgen, Inc. - No specific product listed

-

Cepheid - GeneXpert

-

Color Genomics, Inc. - Color Test

-

Cooper Surgical, Inc. - CooperGenomics

-

Danaher Corporation - Bio-Rad Laboratories, Inc.

-

EasyDNA - DNA Testing Kits

-

Gene by Gene - DNA Testing Services

-

Guardant Health, Inc. - Guardant360

-

Hologic, Inc. (Gen-Probe Incorporated) - Aptima

-

Konica Minolta, Inc. (Ambry Genetics Corporation) - Ambry Genetics Testing Services

-

Laboratory Corporation of America Holdings - LabCorp DNA Testing

-

Mapmygenome - MyMap

-

Orig3n (Interleukin Genetics Inc.) - DNA Tests

-

Pathway Genomics - Pathway Genomics Testing

-

Positive Biosciences, Ltd. - Predictive Testing Kits

-

QIAGEN - QIAamp DNA Kits

-

Quest Diagnostics Incorporated - Hereditary Cancer Testing

-

Siemens healthineers- PathFast

-

Xcode Life - DNA Testing and Reports

Recent Developments

In August 2024, Myriad Genetics finalized the sale of its EndoPredict business unit to Eurobio Scientific, a France-based developer specializing in in-vitro diagnostics and life sciences solutions. EndoPredict is a prognostic testing service that assesses the recurrence risk of breast cancer, enabling some patients to avoid chemotherapy safely. As part of the agreement, Myriad Genetics also granted Eurobio Scientific sales rights for Prolaris in-vitro diagnostic (IVD) kits outside of the U.S.

In July 2024, 23andMe announced a partnership with 20 prominent lung cancer advocacy organizations to initiate an extensive study aimed at advancing lung cancer research. Known as the Lung Cancer Genetics Study, the research focuses on gaining deeper insights into the genetic factors affecting lung cancer patients, with the goals of improving detection, lowering risk, and optimizing patient care.

| Report Attributes | Details |

| Market Size in 2023 | US$ 5.74 Billion |

| Market Size by 2032 | US$ 17.66 Billion |

| CAGR | CAGR of 13.33% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Test [Predictive Testing (Genetic Susceptibility Test, Predictive Diagnostics, Population Screening), Consumer Genomics (Wellness Genomics, Nutria Genetics, Skin & Metabolism Genetics, Others)] •By Application [Breast & Ovarian Cancer, Cardiovascular screening, Diabetic Screening & Monitoring, Colon Cancer, Parkinsonism / Alzheimer’s Disease, Urologic screening/ Prostate cancer screening, Orthopedic & Musculoskeletal, Other cancer screening, Other diseases] •By Setting [DTC, Professional] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 23andMe, Inc., Myriad Genetics, Inc., F. Hoffmann-La Roche Ltd, Abbott, Agilent Technologies, Inc., Thermo Fisher Scientific Inc., BGI, Bio-Rad Laboratories, Inc., Illumina, Inc., ARUP Laboratories, 454 Life Sciences Corporation, Affymetrix, Inc., Applied Biosystems, Amgen, Inc., Cepheid, Color Genomics, Inc., Cooper Surgical, Inc., Danaher Corporation, EasyDNA, Gene by Gene, Guardant Health, Inc., Hologic, Inc. (Gen-Probe Incorporated), Konica Minolta, Inc. (Ambry Genetics Corporation), Laboratory Corporation of America Holdings, Mapmygenome, Orig3n (Interleukin Genetics Inc.), Pathway Genomics, Positive Biosciences, Ltd., QIAGEN, Quest Diagnostics Incorporated, Siemens, Xcode Life. |

| Key Drivers | • Expanding Applications and Proactive Health Trends Drive Growth in Predictive Genetic Testing & Consumer Genomics Market |

| Restraints | • High Costs of Genomic Research Instruments • Inadequate Funding and Skilled Workforce Shortage • Complexity in Genetic Testing Procedures |