Metal Injection Molding Market Report Scope & Overview:

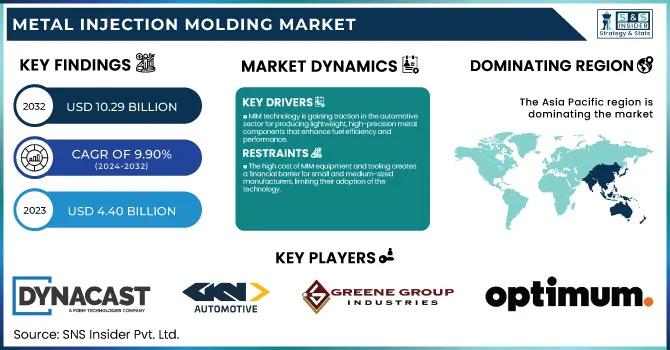

The Metal Injection Molding Market Size was estimated at USD 4.40 billion in 2023 and is expected to arrive at USD 10.29 billion by 2032 with a growing CAGR of 9.90% over the forecast period 2024-2032. The Metal Injection Molding (MIM) market has seen a steady increase in production output, with Asia-Pacific emerging as a key contributor. Capacity utilization rates in North America and Europe have strengthened, driven by growing demand in automotive and medical applications. Material consumption trends indicate a rising preference for stainless steel in precision components. Technological advancements, including AI-driven process optimization, are gaining traction across major manufacturing hubs. Meanwhile, export/import trends highlight China's expanding role as a global MIM supplier.

To Get more information on Metal Injection Molding Market - Request Free Sample Report

Metal Injection Molding Market Dynamics

Drivers

-

MIM technology is gaining traction in the automotive sector for producing lightweight, high-precision metal components that enhance fuel efficiency and performance.

The Metal Injection Molding (MIM) market is experiencing significant growth, driven by the rising demand from the automotive sector. MIM technology is gaining popularity for manufacturing light, high-strength, and 3D metal parts to improve fuel efficiency and vehicle performance. MIM’s capacity to create highly complex geometries with tight tolerances makes it particularly suited for engine components, transmission systems, and safety mechanisms. Moreover, the transition to electric vehicles (EVs) is driving the adoption of MIM as EV manufacturers require lightweight materials to maximize battery range. Additionally, growing trends, including the amalgamation of MIM with additive manufacturing and the utilization of advanced alloys, are also stimulating market growth. It is experiencing rapid growth in the Asia-Pacific region owing to the flourishing automotive sector in China and India. MIM technology is a key player in the future of automotive manufacturing as automakers continue to emphasize efficiency and miniaturization.

Restraint

-

The high cost of MIM equipment and tooling creates a financial barrier for small and medium-sized manufacturers, limiting their adoption of the technology.

The high initial capital investment required for Metal Injection Molding (MIM) is a significant barrier, particularly for small and medium-sized manufacturers. The establishment of an MIM facility requires significant investment in specialized equipment (for example, injection molding machines, debinding systems, and sintering furnaces). The additional cost of developing custom tooling and molds compounds the problem and makes it hard for companies with lower budgets to invest in the technology. MIM is unique among all traditional metalworking processes in that it demands great consistency of material composition, processing conditions, and post-processing treatments, all of which increase operational costs. MIM may reduce operating costs in the long run due to efficient mass production and material savings, while the high investment for MIM process setup may have limited the entry of new players or restrained the growth of existing players. In facing this challenge, companies often look for partnerships, outsourcing opportunities, and government advantages. But, it can be hard to compete with the likes of larger players in the industry that have the financial means to fund advanced MIM capabilities.

Opportunities

-

Metal Injection Molding (MIM) is a sustainable manufacturing solution that minimizes material waste, conserves energy, and supports eco-friendly production across industries.

Metal Injection Molding (MIM) is gaining traction as a sustainable manufacturing solution due to its ability to minimize material waste and energy consumption. Conventional machining creates a lot of scrap, whereas MIM processes raw material much more efficiently and leaves much less scrap, making MIM a much more resource-efficient method. MIM is near-net-shape, which means that it requires very little post-processing, which saves even more energy and cuts emissions. MIM also facilitates the use of recycled metal powders, aligning manufacturing with circular economy principles. With industrial sectors focusing on green-based production processes, MIM technology has been complementary to these green concepts due to its reduced carbon footprints and reduced material wastage. Its key applications in automotive, healthcare, and other electronics sectors make it an environmentally friendly alternative to traditional manufacturing processes. The growing demand for environmentally friendly processes, however, poses a challenge for many companies, making MIM a possible answer to the quest for improved sustainability without sacrificing precision and cost efficiency. This positions MIM as an exemplary enabler of modern, environmentally responsible industrial production.

Challenges

-

The MIM process requires skilled professionals, and a shortage of trained engineers and technicians can hinder market growth.

The Metal Injection Molding (MIM) process is highly technical, requiring skilled engineers and technicians to manage critical stages such as feedstock preparation, molding, debinding, and sintering. Precision is important to establish the dimensional accuracy, material integrity, and mechanical properties of the final product. However, the shortage of skilled professionals is a major restraint on market growth. As technology, automation, material science, and process optimization improve upon MIM, the demand for new talent focused on metallurgy, powder injection molding, and quality control processes will remain high. A lot of manufacturers have a hard time finding skilled labor, thus causing lengthy production cycles and potential quality fluctuations. To sum up: The technical difficulty of MIM processes and the steep learning curve combined with the specialized knowledge needed for these processes deter new entrants from adopting this technology. In response to this challenge, investments in workforce training, academic partnerships, and skill development programs are crucial for maintaining a pipeline of skilled professionals within the MIM sector.

Metal Injection Molding Market Segmentation Analysis

By End-Use

The Consumer Products segment dominated with a market share of over 42% in 2023, owing to the rising demand for small-sized precision metal components in the electronics, watch, and household goods industries. MIM technology also offers the ability to manufacture complex and durable parts with high strength and accuracy and is a perfect fit for lightweight and miniaturized consumer products. Furthermore, MIM provides cost-effective volume production compared to traditional machining or casting processes whilst minimizing material waste and improving efficiency. Its repeatable ability to produce complex geometries provides added value for its use in the sector. With advances in consumer electronics and wearable devices, the requirement for components produced through MIM is predicted to remain strong, ensuring the domination of this segment across the market.

Metal Injection Molding Market Regional Outlook

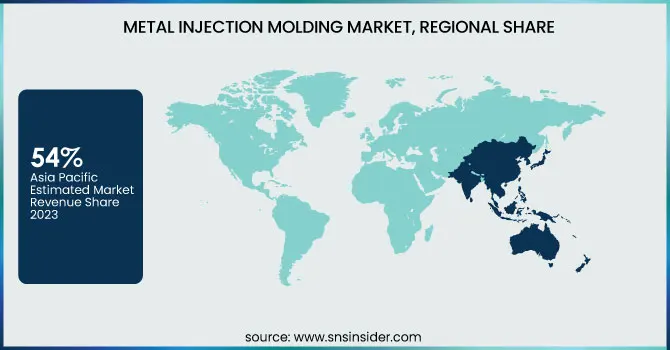

The Asia Pacific region dominated with a market share of over 54% in 2023. Lower labor costs and the country’s well-established supply chain for raw materials are ushering in this growth. High demand for electronic devices, automotive components, and consumer goods is bolstered by the region's robust manufacturing centers, notably China and India. MIM is cost-effective and capable of precise manufacturing, which serves these industries. Rising industrial sectors and the adoption of advanced production technologies are some of the factors driving the market growth of the region. Moreover, Asia Pacific is a key market for MIM, on account of the prominent presence of major players in the region, and beneficial government policies to support manufacturing. The region primarily tops many rankings on industries with continuous innovation.

Europe plays a crucial role in the Metal Injection Molding (MIM) market, driven by its strong automotive and medical device industries. The automotive industry in this region is continuously migrating to lighter materials and precision components to enhance fuel economy and reduce emissions, thereby generating high demand for MIM technology. MIM is also utilized in Europe’s medical sector to manufacture complex, sturdy medical products such as instruments, surgical instruments, and implants. Furthermore, the emphasis on technology and stringent quality standards in the region also bolsters market growth. Europe is still a significant focus for MIM application cases, supported by ongoing innovation in material science and on the manufacturing side to deliver exactly what the industries need in terms of high precision, efficiency, and sustainability of production. Such growing momentum establishes Europe as one of the driving forces in the global adoption of MIM solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major key players in the Metal Injection Molding Market

-

Dynacast (MIM components for automotive, electronics, and healthcare)

-

GKN Automotive Limited (MIM parts for drivetrains, transmissions, and EV components)

-

Greene Group Industries, Inc. (Britt Manufacturing) (Precision MIM parts for medical and industrial applications)

-

Optimim (MIM components for aerospace, defense, and medical industries)

-

Dean Group International (MIM parts for aerospace, medical, and consumer goods)

-

Sintex (MIM solutions for industrial and consumer applications)

-

CMG Technologies (MIM parts for automotive, medical, and electronics industries)

-

INDO-MIM (Precision MIM components for aerospace, medical, and industrial applications)

-

Schunk Mobility (MIM solutions for automotive and industrial sectors)

-

Rockleigh Industries (MIM parts for medical, automotive, and defense applications)

-

ARC Group Worldwide (MIM components for industrial, medical, and automotive industries)

-

Parmaco Metal Injection Molding AG (MIM parts for high-precision applications)

-

Kyeongwon M&T Co., Ltd. (MIM components for electronics and consumer goods)

-

Perry Tool & Research, Inc. (MIM components for aerospace and medical industries)

-

Ecrimesa Group (MIM parts for automotive, industrial, and defense sectors)

-

Smith Metal Products (MIM solutions for firearms, medical, and industrial applications)

-

ATW Companies (FloMet & Parmatech) (MIM components for medical, aerospace, and defense)

-

MPP (Metal Powder Products) (MIM parts for automotive, industrial, and medical sectors)

-

Advanced Forming Technology (AFT) (MIM solutions for firearms, defense, and medical industries)

-

Form Technologies, Inc. (MIM parts for automotive, industrial, and healthcare applications)

Suppliers for (Custom MIM solutions with high precision and durability) in the Metal Injection Molding Market

-

INDO-MIM

-

OptiMIM

-

Meta Build Industries

-

Jiangsu Hetian MIM Technology Co., Ltd. (JH MIM)

-

Orange Koi

-

Pavan Industries

-

Murlidhar Metalline Industries

-

MIM Components

-

CMG Technologies

-

Advanced Forming Technology (AFT)

Recent Development

In April 2024: Greene Group Industries (GGI) acquired the assets of Holo, Inc., including its PureForm Additive Manufacturing technology. This acquisition strengthens GGI's capabilities in rapid prototyping and scaled production of metal parts, supporting faster iterations and high-quality finishes.

In April 2024: MPP partnered with Tactile Engineering to develop a metal injection molded core plate for the groundbreaking Cadence tablet, a dynamic braille reader designed for the visually impaired. This partnership enhances the tablet’s capability to present tactile graphics that shift and adapt beneath the user's fingertips.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.40 Billion |

| Market Size by 2032 | USD 10.29 Billion |

| CAGR | CAGR of 9.90% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By End Use (Automotive, Consumer Product, Medical, Industrial, Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Dynacast, GKN Automotive Limited, Greene Group Industries, Inc. (Britt Manufacturing), Optimim, Dean Group International, Sintex, CMG Technologies, INDO-MIM, Schunk Mobility, Rockleigh Industries, ARC Group Worldwide, Parmaco Metal Injection Molding AG, Kyeongwon M&T Co., Ltd., Perry Tool & Research, Inc., Ecrimesa Group, Smith Metal Products, ATW Companies (FloMet & Parmatech), MPP (Metal Powder Products), Advanced Forming Technology (AFT), Form Technologies, Inc. |