Ductless Heating and Cooling Systems Market Report Scope & Overview:

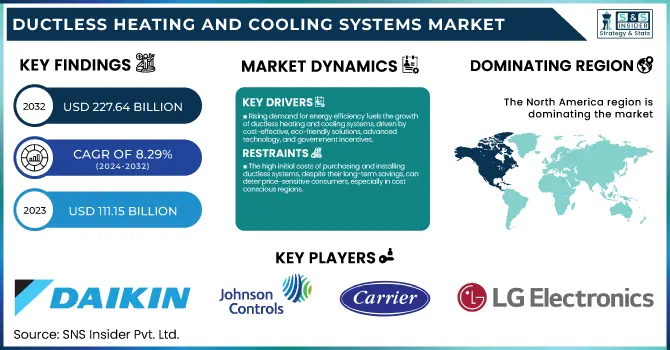

The Ductless Heating And Cooling Systems Market Size was esteemed at USD 111.15 billion in 2023 and is supposed to arrive at USD 227.64 billion by 2032 with a growing CAGR of 8.29% over the forecast period 2024-2032. This report offers a unique perspective on the ductless heating and cooling systems market by analyzing trends in installation and adoption rates, along with insights into maintenance costs and system downtime impacting operational efficiency. It explores technological advancements and smart feature integration, highlighting the growing role of AI and automation. A deep dive into export/import trends and trade flows reveals shifting global supply chain patterns. Additionally, the report examines the influence of energy efficiency regulations and decarbonization efforts, positioning ductless systems as a key solution in the transition toward sustainable HVAC technologies.

To get more information on Ductless Heating and cooling Systems Market - Request Free Sample Report

Ductless Heating And Cooling Systems Market Dynamics:

Drivers

-

The increasing demand for energy efficiency drives the ductless heating and cooling systems market as consumers seek cost-effective, eco-friendly solutions with advanced technology and government incentives.

The increasing demand for energy efficiency is a key driver in the ductless heating and cooling systems market, as consumers seek cost-effective and environmentally friendly HVAC solutions. Ductless systems that provide increased efficiency over traditional ducted units have experienced increased adoption with rising energy prices and heightened awareness of sustainability. These units utilize inverter technology to minimize power consumption and to regulate the temperature accurately. In addition, governments across the globe are encouraging people to use energy-saving appliances, through incentives, rebates, and strict regulations of carbon emissions, thereby fueling the market growth. Ductless systems also bring advantages such as controlling multiple indoor units and allowing extensive flexibility in system design. Smart technologies, such as IoT-enabled controls and AI-driven automation, are also a key trend impacting the market, making ductless systems more appealing for homes and businesses.

Restraint

-

The high initial costs of purchasing and installing ductless systems, despite their long-term savings, can deter price-sensitive consumers, especially in cost-conscious regions.

The Ductless Heating and Cooling Systems Market is the high initial costs associated with purchasing and installing ductless systems. This can be a deterrent to price-sensitive consumers, especially in geographical areas where cost concerns dominate purchase decisions as ductless systems require a higher up-front purchase price when compared to traditional HVAC systems. Although there are long-term energy savings and reduced operational costs offered by ductless systems, the initial installation costs for both home and commercial applications can be a considerable barrier to purchasing. Also, for consumers not versed in the technology, there may be a perception that it is complex and expensive to install, which would be another deterrent to adoption. Ductless systems can help offer such features as greater energy efficiency, flexibility, and ease of installation, though they indeed come with an upfront cost that may be prohibitive for certain households and businesses, particularly in price-competitive markets. Financing mechanisms or government incentives that target this challenge will help spur adoption.

Opportunities

-

The expansion of ductless heating and cooling systems in emerging markets is driven by the growing middle class, rising disposable incomes, and the increasing demand for energy-efficient, cost-effective HVAC solutions.

The expansion of ductless heating and cooling systems in emerging markets is primarily driven by the rapid growth of the middle class and increasing disposable incomes. With the increasing number of people transitioning into the middle-income consumer segment, they have more affordability and demand for energy-efficient and cost-effective HVAC solutions for their homes and businesses. With urbanization in place and changing economic dynamics, we witness a growing demand for modern, flexible, and quick-to-install ductless systems. There are even significant construction booms in the residential and commercial markets in emerging markets like Asia-Pacific, Latin America, and parts of Africa, thus augmenting market penetration even further. Additionally, driven by the growing consciousness regarding the environment, the consumers in these regions are focusing more on energy-efficient systems in line with sustainability objectives. This raises plenty of potential for manufacturers to diversify their presence in these booming marketplaces by providing to the high stands of these regions at competitive prices innovative ductless machines to fulfill the specific needs of their focus place.

Challenges

-

Traditional HVAC systems remain preferred in large-scale commercial and industrial settings due to their capacity to handle larger spaces and offer cost-effective, uniform temperature control.

Competition from Traditional HVAC Systems remains a significant challenge for the Ductless Heating and Cooling Systems Market, especially in large-scale commercial and industrial settings. There is inherent trust in these systems because they have existed for many years within various industries and commercial sectors, therefore they are more familiar to building managers and facility operators. They also enjoy economies of scale, frequently supplying cheaper per-unit costs for larger installations. Moreover, centralized systems have a longer history of performance and reliability for large-scale heating and cooling requirements. Although ductless systems have proven to be remarkably versatile and energy-efficient in both residential and smaller commercial applications, the larger capacity and pre-existing infrastructure of traditional HVAC systems maintain their status as the predominant HVAC technology of choice for large commercial and industrial buildings.

Ductless Heating And Cooling Systems Market Segmentation Analysis:

By Type

The Split System segment dominated with a market share of over 62% in 2023, owing to advantages over traditional systems. This technology provides high energy efficiency, leading to lower overall power consumption and operating costs, which makes it suitable for residential and commercial use. The system is composed of an indoor and outdoor condenser which makes both installation simpler, and the system flexible in terms of placement than traditional ducted systems. Other value-added benefits include zoned heating and cooling that lets the user set the temperature in individual rooms or areas. Along with its lower sound levels and modern design, this has led to widespread adoption and continued growth in the market.

By Application

The residential buildings segment dominated with a market share of over 52% in 2023, owing to the rising need for energy-efficient and cost-effective HVAC solutions for homes. Applications have to necessarily drop units for homes without ductwork a known but great option for mini-split ductless systems. They are also highly versatile, allowing homeowners to install them in specific locations in the home to achieve individualized control of temperature and zoning capabilities. Many homeowners are increasingly adopting ductless systems due to their energy efficiency and savings on utility bills, as energy costs rise and environmental awareness increases. The growing popularity of ductless heating and cooling systems also stems from the fact that they are easy to install, require lower maintenance expenses, and operate quietly.

Ductless Heating And Cooling Systems Market Regional Outlook:

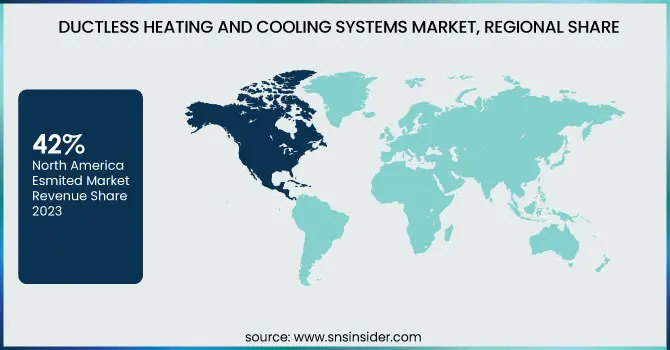

North America region dominated with a market share of over 42% in 2023, owing to a variety of conditions. Its leadership in the market is complemented by the need for energy-efficient solutions owing to the other rising sectors in the region and advancement in technologies in HVAC systems. Moreover, supportive government policies encouraging green technologies and environmentally sustainable solutions have boosted ductless systems' adoption. In North America, commercial and residential sectors have adopted significant uptake of energy features as consumers are increasingly focused on energy-saving options. With a mature infrastructure, as well as established market players, these factors solidify North America's dominance in the industry. Further, continuous innovations and strong market awareness keep fuelling the ductless heating and cooling systems market in the region.

Asia-Pacific is the fastest-growing region in the ductless heating and cooling systems market, driven by rapid urbanisation and increased disposable incomes, especially in developing economies such as China and India. With the burgeoning populations of the cities, there will always be a demand for energy-friendly and economical solutions for heating and cooling needs. Moreover, Japan and South Korea have also experienced strong demand for advanced HVAC systems due to technological developments and environmental awareness. As the residential and commercial construction industry continues to thrive so does the need for ductless systems. These systems are easy to install and energy efficient, and ODS is ideally suited for the continent’s diverse and growing markets.

Need any customization research on Ductless Heating and cooling Systems Market - Enquiry Now

Some of the major key players in the Ductless Heating and Cooling Systems Market:

-

DAIKIN Industries (Mini Split Systems, Multi Split Systems, VRF Systems)

-

Johnson Controls (YORK Ductless Systems, Variable Refrigerant Flow Systems)

-

Carrier (Infinity Series Ductless Systems, Performance Series)

-

Trane Technologies plc (Ductless Split Systems, Multi-Zone Systems)

-

LG Electronics (Art Cool Ductless Systems, Multi-V Single & Multi Split Systems)

-

Emerson Electric Co. (Copeland Scroll Compressors for Ductless Systems)

-

Honeywell International Inc. (Lyric T5 Wi-Fi Thermostat for Ductless Systems)

-

Mitsubishi Electric Corporation (MSZ-GL Mini Split Systems, City Multi VRF Systems)

-

Nortek Air Management (Mitsubishi, Quietside Ductless Mini Split Systems)

-

Samsung Electronics (Wind-Free Ductless Systems, Multi-Zone Systems)

-

Hitachi Ltd. (Smart Air Ductless Systems, VRF Air Conditioners)

-

Lennox International Inc. (Mini Split Systems, Multi-Zone Systems)

-

Whirlpool Corporation (Ductless Mini Split Systems, Inverter Technology Systems)

-

Fujitsu General Limited (Halcyon Ductless Mini Split Systems)

-

Gree Electric Appliances (Livo+ Mini Split Systems, Multi-Zone VRF Systems)

-

Senville (AURA Mini Split Systems, Multi-Zone VRF Systems)

-

Panasonic Corporation (Ductless Mini Split Systems, Multi Split Systems)

-

Zhongtai Air Conditioning (Multi-Zone VRF Systems)

-

Toshiba Carrier Corporation (Ductless Air Conditioners, VRF Systems)

-

Trane Inc. (Ductless Heating & Cooling Systems, VRF Systems)

Suppliers for ( ) on Ductless Heating and Cooling Systems Market

-

DAIKIN Industries

-

Johnson Controls

-

Carrier

-

Trane Technologies plc

-

LG Electronics

-

Emerson Electric Co.

-

Honeywell International Inc.

-

Mitsubishi Electric Corporation

-

Nortek Air Management

-

Samsung Electronics

Recent Development:

-

On December 17, 2024: Mitsubishi Electric will invest $143.5 million to retrofit its Maysville, Kentucky factory for producing variable-speed compressors, with production set to begin in October 2027. This expansion aims to meet the growing demand for energy-efficient HVAC solutions and is supported by a $50 million grant from the U.S. Department of Energy, strengthening its local supply chain and partnership with Trane Technologies.

-

In November 21, 2024: Panasonic introduced its new R32 heat pumps, the EXTERIOS Z and ClimaPure XZ series, to the Canadian market. These ductless systems, featuring heating capacities ranging from 10,900 Btu/h to 28,800 Btu/h, are designed for energy efficiency and sustainability, using R32 refrigerant.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 111.15 Billion |

|

Market Size by 2032 |

USD 227.64 Billion |

|

CAGR |

CAGR of 8.29% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Split System (Mini Split System, Multi Split System, and VRF System), Window Air Conditioning System) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

DAIKIN Industries, Johnson Controls, Carrier, Trane Technologies plc, LG Electronics, Emerson Electric Co., Honeywell International Inc., Mitsubishi Electric Corporation, Nortek Air Management, Samsung Electronics, Hitachi Ltd., Lennox International Inc., Whirlpool Corporation, Fujitsu General Limited, Gree Electric Appliances, Senville, Panasonic Corporation, Zhongtai Air Conditioning, Toshiba Carrier Corporation, Trane Inc. |