Edge Data Center Market Size & Overview:

To Get More Information on Edge Data Center Market - Request Sample Report

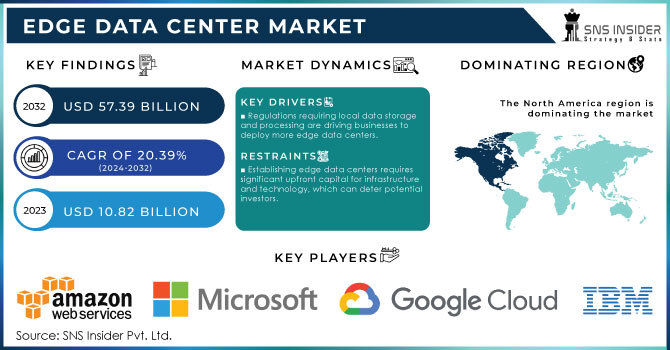

Edge Data Center Market was valued at USD 10.82 billion in 2023 and is expected to reach USD 57.39 billion by 2032, growing at a CAGR of 20.39% from 2024-2032.

The Edge Data Center market is being driven by rapidly growing low-latency data processing requirements and the development of IoT, 5G, and cloud technologies. Localized low-capacity edge data centers can process and transmit data with minimal time lags, which provides a solution to the latency issues experienced by large centralized data centers regarding the volume of processed data and data transmission speed. This, in turn, contributes to the increasing interest of businesses in edge data centers to ensure their more advantageous business operation and ensure round-the-clock real-time data processing with minimal time lags. Firstly, the market is developing due to the rapid growth in the number of IoT devices. According to the reports, by 2030, the number of connected IoT devices will exceed 50 billion. In such conditions, edge data centers will be an instrumental tool for efficient data processing, which is especially important for the seamless performance of autonomous vehicles, smart cities, and telemedicine. Secondly, the development of 5G networks is increasing the demand for edge data centers. The new generation 5G provides for higher speeds and device connectivity. In such circumstances, the use of local data centers is essential for the optimal routing of data flows, and this is especially relevant for real-time data processing when combined with AR and VR applications.

The cloud-to-edge architecture is one of the substantial industry growth drivers. Due to the potential of industries such as Amazon Web Services and Microsoft Azure to invest heavily in their infrastructure, these two companies are at the forefront of the in-depth study of edge solutions. For example, AWS has already developed AWS Local Zones, which enable the provision of computing, storage, and database services available for users in different cities. The market is being driven by new data sovereignty requirements. As relevant data processing must now be done with the necessity of data storage, and processing is up to data owners, the requirement for computing and processing data locally is placed. The industry prospects look optimistic given that by 2025, more than 90% of industrial companies will have adopted edge computing.

Edge Data Center Market Dynamics

Drivers

-

Regulations requiring local data storage and processing are driving businesses to deploy more edge data centers.

-

Edge data centers reduce latency, improving performance for applications like autonomous vehicles, AR/VR, and smart cities.

-

The rollout of 5G networks is increasing demand for edge infrastructure to handle faster speeds and real-time data traffic.

The deployment of 5G networks increases the demand for edge infrastructure significantly, driven by the necessity for real-time data processing and faster data speeds. The majority of data sources demand a lower response time.

5G technology is associated with lower latency and higher bandwidth compared to 4G. Thus, it offers the capacity to connect a larger number of devices. However, traditional central data centers are not usually designed for these technologies. Meanwhile, the lower edge data center allows real-time processing. As a result, the connection to augmented and virtual reality becomes more feasible as even the smallest delays can make AR or VR applications work poorly. It can apply to a range of technological applications such as autonomous vehicles and remote medicine facilities.

Edge processing enables data centers to handle data not in distant cloud facilities but at the "edge" of the network, where the data centers are situated. As a result, the data communicate with the cloud servers occasionally and the time for data to travel is obviously reduced by a big margin. The necessity for local data appears together with the global 5G connections that are expected to reach the number of 1.9 billion in 2025. It is evident that the demand for edge computing is rising as it is predicted to surpass $250 billion in 2025. It was primarily stimulated by the application expansion of 5G technologies. Some telecommunication and cloud service companies such as Verizon and AT&T make considerable investments into the infrastructure.

| Factors | Centralized Data Centers | Edge Data Centers |

|

Latency |

Higher latency |

Ultra-low latency |

|

Data Processing |

Centralized and slower |

Local and real-time |

|

Bandwidth Efficiency |

Lower efficiency |

Higher efficiency |

|

Use Cases |

General applications |

5G, IoT, AR, VR, etc. |

Restraints

-

Establishing edge data centers requires significant upfront capital for infrastructure and technology, which can deter potential investors.

-

Managing numerous smaller data centers can lead to operational complexities and increased maintenance costs.

-

The distributed nature of edge computing raises potential security vulnerabilities, making data protection more challenging.

The distributed nature of edge computing creates several security vulnerabilities that complicate data protection in the Edge Data Center market. Unlike centralized data centers, which operate under a single control point with cohesive security management, edge data centers are dispersed across various locations, each encountering its own unique security challenges. This distribution expands the potential attack surface, making it easier for cybercriminals to exploit multiple entry points.

As edge data centers process sensitive data closer to end users, they face an increased risk of data breaches, unauthorized access, and attacks such as Distributed Denial of Service (DDoS). Furthermore, managing security across numerous edge sites can stretch resources thin and impede the establishment of consistent security protocols. A recent study indicated that nearly 60% of organizations utilizing edge computing encountered security incidents over the past year. To address these challenges, organizations must adopt robust security strategies, including advanced encryption, real-time monitoring, and comprehensive access controls. Additionally, investing in cybersecurity training for personnel is crucial for ensuring the effective management of edge devices and safeguarding sensitive data.

| Challenge | Description | Impact |

|

Increased Attack Surface |

Multiple entry points can be targeted by cybercriminals. |

Higher risk of data breaches. |

|

Inconsistent Security Protocols |

Varied security measures across locations. |

Difficulty in maintaining data protection. |

|

Resource Constraints |

Limited personnel and budget for security management. |

Compromised security measures. |

|

Real-Time Monitoring |

Need for continuous monitoring and quick response. |

Potential delays in threat detection. |

While edge computing offers numerous advantages, its distributed nature presents unique security challenges that organizations must proactively address to protect sensitive data effectively.

Edge Data Center Market Segmentation Analysis

By Component

In 2023, the solutions segment dominated the market and held the largest revenue share, accounting for 86.9%. This segment is expected to sustain its dominant position throughout the forecast period and comprises a range of hardware and software solutions, including networking equipment, IT racks and enclosures, DCIM software, and data center analytics tools. Several factors are fueling the demand for edge data center solutions, such as the emergence of next-generation DCIM offerings and a heightened focus on energy efficiency in data centers. Hardware solutions are generally installed on-site or within third-party data centers and are tailored to meet specific organizational needs. Meanwhile, software solutions manage processing and data storage in edge data centers, incorporating software-defined networking systems, data analytics tools, and applications that enable real-time data processing.

The services segment is projected to achieve the highest CAGR of 19.3% during the forecast period. This segment is further categorized into professional services and managed services. Professional services enhance service delivery, streamline IT operations, and support cloud initiatives, including integration, implementation, and consulting services. Both managed and professional services improve the efficiency of edge data centers by monitoring system performance, identifying bottlenecks, and applying best practices.

By Facility Size

The large facility segment dominated the market and represented the largest revenue share of 78.9% in 2023. This segment comprises 12-49 racks or more facilities and a power draw ranging from 12 to 14 kW per rack or cabinet. Large facility data centers are ideal for businesses with multiple branch offices, offering scalability and enhanced data center capabilities. They also help optimize space, facilitate quick deployment, and provide cost-saving advantages. Although edge data centers are generally smaller and more localized than conventional data centers, the rising demand for faster and more efficient data processing and storage, coupled with the trend toward distributed computing, is anticipated to propel the growth of edge data centers in the coming years.

The small and medium facility segment is expected to achieve the highest growth rate of 20.4% during the forecast period. Small and medium-sized enterprises (SMEs) are anticipated to quickly adopt edge data center solutions as they undergo digitization and expand their online services, both of which require substantial data processing capabilities. As a result, demand for small and medium-edge data centers is projected to increase during this time frame. These facilities tend to be more cost-effective than traditional data centers due to their smaller size and localized design.

By End-Use

In 2023, the IT & telecom segment dominated the market and represented over 39.6% of total revenue share, And is projected to maintain this lead throughout the forecast period. This sector is adapting to meet the rising demands for large-scale data processing and low latency, driven by advancements in technologies such as IoT, 5G, augmented and virtual reality, and AI/ML. As a result, IT & telecom data centers are evolving to fulfill these needs, significantly increasing the demand for edge data centers.

The manufacturing & automotive sector is anticipated to see the highest growth rate of 18.4% during the forecast period. The growing adoption of technologies like 5G and edge computing in the automotive industry, which offer high bandwidth, low latency, and reliable mobile applications, is a major factor contributing to this segment's expansion. Edge data centers improve automation in the manufacturing and automotive sectors by enabling real-time analysis and control of connected devices and systems. This capability helps to minimize human error, enhance operational efficiency, and improve safety.

Regional Analysis

North America led the edge data center market in 2023, accounting for a 35.1% share, and is expected to stay in the leading position in the estimated period. The high utilization rate of edge data center solutions and services in the region is the major growth driver. The fact that North America is the home of numerous leading service providers of edge data center solutions and services makes it a prominent region in the marketplace. However, the Asia Pacific region is likely to demonstrate the highest CAGR of 17.1% in the estimated period. The key reasons behind such high growth are the substantial investments in the IT industry, growth of various end-user industries, and a significant number of edge computing providers, such as Huawei Technologies Co., Ltd., and Fujitsu. The large population of the region and the rapid development of urban areas are the factors that positively affect the expansion of edge data centers in Asia Pacific.

Do You Need any Customization Research on Edge Data Center Market - Enquire Now

Key Players

The major key players are

List 1: Manufacturers

Amazon Web Services (AWS) –( Dell Technologies, Cisco Systems)

Microsoft Azure – (Hewlett Packard Enterprise (HPE), Lenovo)

Google Cloud – (NVIDIA, Cisco Systems)

IBM – (NetApp, Lenovo)

Cisco Systems – (Arista Networks, Dell Technologies)

EdgeConneX – (Schneider Electric, Vertiv)

Equinix – (Nokia, Corning)

Digital Realty – (Fujitsu, Siemens)

Alibaba Cloud – (Huawei Technologies, Inspur)

Hewlett Packard Enterprise (HPE) – (Arista Networks, Dell Technologies)

Vertiv – (Schneider Electric, Eaton)

Fujitsu – (NEC Corporation, Hitachi)

Huawei Technologies – (ZTE Corporation, Inspur)

NTT Communications – (Cisco Systems, Juniper Networks)

Oracle – (Dell Technologies, NetApp)

Vantage Data Centers – (Vertiv, Schneider Electric)

CyrusOne – ((Cisco Systems, Dell Technologies)

Glesys – (DigitalOcean, Linode)

Iron Mountain – (Vertiv, Schneider Electric)

StackPath – (Akamai Technologies, CenturyLink)

List 2: Suppliers

Amazon Web Services (AWS) – (Cisco Systems, Dell Technologies)

Microsoft Azure – (Lenovo, Hewlett Packard Enterprise (HPE))

Google Cloud – (Cisco Systems, NVIDIA)

IBM – (Lenovo, NetApp)

Cisco Systems – (Dell Technologies, Arista Networks)

EdgeConneX – (Vertiv, Schneider Electric)

Equinix – (Corning, Nokia)

Digital Realty – (Siemens, Fujitsu)

Alibaba Cloud – (Inspur, Huawei Technologies)

Hewlett Packard Enterprise (HPE) – (Dell Technologies, Arista Networks)

Vertiv – (Eaton, Schneider Electric)

Fujitsu – (Hitachi, NEC Corporation)

Huawei Technologies – (Inspur, ZTE Corporation)

NTT Communications – (Juniper Networks, Cisco Systems)

Oracle – (NetApp, Dell Technologies)

Vantage Data Centers – (Schneider Electric, Vertiv)

CyrusOne – (Dell Technologies, Cisco Systems)

Glesys – (Linode, DigitalOcean)

Iron Mountain – (Schneider Electric, Vertiv)

StackPath – (CenturyLink, Akamai Technologies)

Recent Developments

In July 2023, Dell unveiled a partnership with Airspan to develop a pre-integrated solution for wireless edge deployments. This alliance combines Dell's modular data center with Airspan's advanced wireless networking technology, providing a streamlined and effective solution for wireless edge implementations.

In Sep 2023, A South Korean technology solutions provider, SOLIS-IDC, planned to invest over USD 2 billion in India with the aim of developing an edge data center. To navigate through the intricacies of entering the Indian market for this project, the company has selected the services of the Global Forum for Policy and Strategy (GFPS) Advisory.

| Report Attributes | Details |

| Market Size in 2023 | USD 10.82 billion |

| Market Size by 2032 | USD 57.39 billion |

| CAGR | CAGR of 20.39 % From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, services) • By Facility Size (Small & Medium Facility, Large Facility) • By End-user Industries (IT & Telecom, BFSI, Healthcare & Lifesciences, Manufacturing, Government, Automotive, Gaming & Entertainment, Retail & E-commerce, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Amazon Web Services (AWS),Microsoft Azure, Google Cloud, IBM, Cisco Systems, EdgeConneX, Equinix, Digital Realty, Alibaba Cloud, Hewlett Packard Enterprise (HPE) |

| Key Drivers | •Regulations requiring local data storage and processing are driving businesses to deploy more edge data centers. •Edge data centers reduce latency, improving performance for applications like autonomous vehicles, AR/VR, and smart cities. •The rollout of 5G networks is increasing demand for edge infrastructure to handle faster speeds and real-time data traffic. |

| Market Restraints | •Establishing edge data centers requires significant upfront capital for infrastructure and technology, which can deter potential investors. •Managing numerous smaller data centers can lead to operational complexities and increased maintenance costs. •The distributed nature of edge computing raises potential security vulnerabilities, making data protection more challenging. |