Electric Vehicle Traction Motors Market Size Analysis:

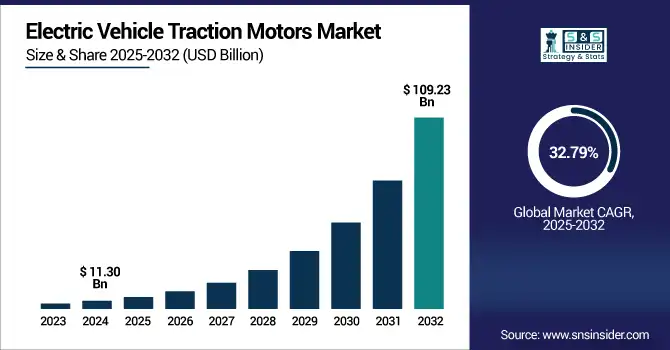

The Electric Vehicle Traction Motors Market size was valued at USD 11.30 Billion in 2024 and is projected to reach USD 109.23 Billion by 2032, growing at a CAGR of 32.79% during 2025-2032.

To Get more information on Electric Vehicle Traction Motors Market- Request Free Sample Report

The Electric Vehicle (EV) Traction Motors market is experiencing strong growth, due to the rapid development of electric mobility, strict emission regulations, and growing demand for high performance and energy-efficient drivetrain. Traction motors are a key technology that directly impacts the power, range, and efficiency of EVs, and have thus become a focus for automakers and suppliers. With motor technologies like permanent magnet synchronous motors (PMSMs) and induction motors, the performance of vehicles is being upgraded, power loss and operation cost are being downsized. With increased procurement of electric vehicles worldwide as automakers concentrate on regionalizing their supply chain, and implementing more motors, the demand for traction motors across passenger and commercial vehicle categories will likely grow.

Toyota Breaks Ground for Its First Independent Lexus EV Factory in China Toyota started to build its first its independently owned Lexus NEV plant in Shanghai, to produce 100,000 NEVs annually by 2027 on a major expansion into the world’s largest NEV market.

The U.S Electric Vehicle Traction Motors Market size was valued at USD 11.30 Billion in 2024 and is projected to reach USD 109.23 Billion by 2032, growing at a CAGR of 32.79% during 2025-2032, on the account of increasing electric vehicle penetration, favorable federal regulation policies and advancement in the motor efficiency and design. The move towards electrified vehicles, as well as growing investment in domestic EV production and infrastructure, is driving demand for high-performance traction motors in both passenger and commercial vehicle applications.

Electric Vehicle (EV) Traction Motors Market Dynamics:

Drivers:

-

Rising Demand for Plug-In Hybrids Accelerates Growth of EV Traction Motors Market

The surging consumer preference for plug‑in hybrid vehicles (PHEVs) is a critical driver of growth in the Electric Vehicle Traction Motors market. increasing demand of the Electric Vehicle Traction Motors market. With automakers broadening their PHEV offering to comply with tightening emission regulations and accommodate changing customer preferences for adaptability, the growing dependence on high‑efficiency traction motors is more pronounced. Such engines must exhibit high torque density and a smooth power delivery in the electric and combustion modes and be small enough to fit inside a HEV powertrain. Furthermore it is critical in thermal management and material science research for the reduction of the energy loss and this can result in an efficient performance for its driving under different operating environment. In turn, manufacture of new‑generation electric traction motor has led to research and development (R&D) focus for the next-generation electric traction motor technology advancing the market proliferation and the inflow of innovative products in the automotive market.

As the UAE accelerates its shift toward greener mobility, plug-in hybrid vehicles (PHEVs) are gaining popularity as a practical solution for fuel-efficient and eco-friendly driving. Models like the 2025 Volvo XC90 PHEV combine petrol and electric power, offering luxury, performance, and reduced emissions. Equipped with advanced features and electric propulsion systems, these vehicles appeal to consumers seeking environmental responsibility without sacrificing comfort or range.

Restraints:

-

High Material Costs and Supply Chain Constraints Limit Traction Motor Market Growth

The Electric Vehicle Traction Motors market faces key restraints due to the high costs and limited availability of critical raw materials such as rare earth elements used in permanent magnet motors. The materials are integral to enabling high efficiency and performance, but price volatility and geopolitical supply risk increase production costs and uncertainty for manufacturers. Moreover, global supply chains are often complex and in pieces which may cause lag in sourcing components and assembling motors during high demand or economic downturn. These challenges present scalability barriers, are a deterrent to smaller manufacturers entering the market, and have implications on profitability, which can limit the broad implementation and affordability of electric traction motor solutions.

Opportunities:

-

Expanding EV Adoption and Technological Advancements Unlock New Opportunities for Traction Motor Market

Increase in adoption of electrified transportation would provide the significant opportunity in electric vehicle traction motors market. Demand for electric vehicles is increasing at an ever growing pace, as consumers increasingly prefer clean mobility and regulatory environment is conducive and supportive towards the adoption and growth of electric vehicles in different market segments. As automotive manufacturers scale up EV volume production and expand their model lineup, the demand for more efficient, higher-torque density traction motors has grown. And advances in motor design, materials and manufacturing processes continue to drive down costs and improve performance. This changing frontier provides significant upside to traction motor vendors that are able to innovate, scale with production, and align more closely with developing EV architectures and platforms.

China’s NEV makers report record H1 deliveries on domestic demand surge XPeng, Leapmotor, and Xiaomi Auto all recorded all-time high first-half sales in 2025, bolstered by increasing consumer demand, policy support and accelerating EV penetration across China.

Challenges:

-

Raw Material Dependency and Thermal Management Issues Pose Challenges for EV Traction Motors Market

The Electric Vehicle Traction Motors market faces significant challenges due to its heavy reliance on critical raw materials such as rare earth elements, which are subject to volatile prices and geopolitical supply risks. These materials are the foundation for high-performance motors, and lack of supply can interrupt manufacturing and drive up prices. Further traction motors are required to work under severe thermal and mechanical conditions, which calls for sophisticated cooling systems and robust materials. Heat mismanagement can decrease the life and performance of motors. In addition, the integration issues with the emerging EV architectures and the requirement to achieve compact SWaP had brought complexities into design and manufacturing, thus bottlenecks to scalability and long-term market viability.

EV Traction Motors Market Segmentation Analysis:

By Vehicle Type

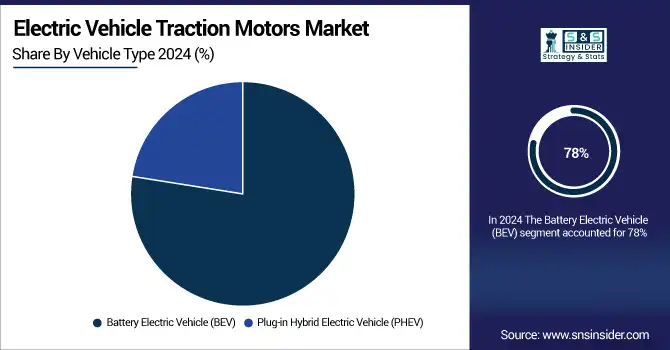

The Battery Electric Vehicle (BEV) segment held a dominant Electric Vehicle Traction Motors Market share of around 78% in 2024, driven by electric power only, the market is in need of traction motors with high power performance. This increase is supported by government subsidies, tightening emissions standards, and battery and motor improvements that extend vehicle range and productivity.

The Plug-in Hybrid Electric Vehicle (PHEV) segment is expected to experience the fastest growth in the Electric Vehicle Traction Motors Market over 2025-2032 with a CAGR of 38.00%, owing to consumers’ preference for dual power alternates along with long range driving. Save and Reduce Costs Electric Vehicles Wheels Electric Vehicles are cost-saving and cheaper to run than internal combustion engines vehicles. Since PHEVs are based on internal combustion and electrical drivetrains, they need more specialized traction machineries to enable effective electric propulsion, increasing their penetration in short/long haul conditions in traffic.

By Type of Motor

The Permanent Magnet Synchronous Motor (PMSM) segment held a dominant Electric Vehicle Traction Motors Market share of around 60% in 2024, owing to its enhanced efficiency, high torque density and compact size. PMSM is the most popular type of motor for EV application because of well smooth torque output, low energy loss, and excellent heat-releasing. Their growing presence in BEVs and PHEVs has been a major factor in the segment’s continued market domination.

The Brushless DC Motor (BLDC) segment is expected to experience the fastest growth in the Electric Vehicle Traction Motors Market over 2025-2032 with a CAGR of 36.12%, due to their efficient, maintenance free, and compact nature. BLDC motors are controlled precisely and work well in constant load on full range of speeds, the former shall be providing better performance charactersticas over the latter, making the BLDC a perfect fit for the modern EV. Their economical price and better performance are making them more and more common among different models of electric vehicles.

Electric Vehicle Traction Motors Market Regional Outlook:

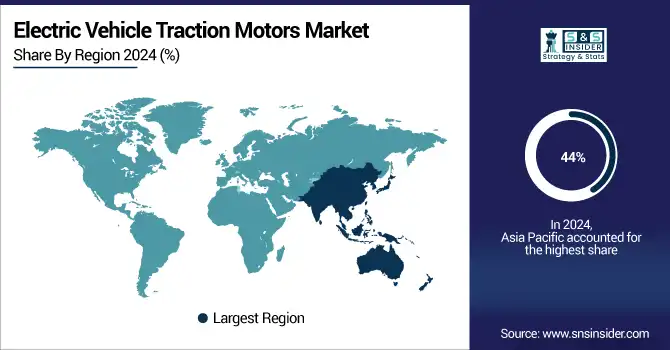

In 2024, Asia-Pacific dominated the Electric Vehicle Traction Motors market and accounted for 44% of revenue share, due to high EV sales, robust production capabilities, and supportive government initiatives in major markets, including China, Japan, and South Korea. Strong supply chain systems, in concert to advanced motor investments, placed the region in a leading position for EV traction motor production and innovation Globally.

North America is expected to witness the fastest growth in the Electric Vehicle Traction Motors Market over 2025-2032, with a projected CAGR of 34.86%, as demand for PHEVs and BEVs escalates, having an expanded charging infrastructure, combined with strong federal support with incentives, and emissions regulations. Rising investments for domestic manufacturing of motor technologies along with the progression of advanced motors will stimulate the regional market growth.

In 2024, Europe emerged as a promising region in the Electric Vehicle Traction Motors Market, driven by stringent emission regulations, rising environmental awareness, and strong government incentives for electric mobility. The region’s focus on sustainability, coupled with growing investments in EV production and advancements in motor technology, is fostering demand for high-efficiency traction motors across both passenger and commercial vehicle segments.

LATAM and MEA is experiencing steady growth in the Electric Vehicle Traction Motors market, due to increasing population and ongoing emerging trend of Electric Vehicles in different countries present in the region. Increasing demand for hybrid and electric mobility and infrastructure development and foreign investments is also driving the growth in the emerging markets.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The Electric Vehicle Traction Motors Companies are ABB, Parker Hannifin Corp, AB SKF, ZF Friedrichshafen AG, Robert Bosch GmbH, Valeo, Continental Engineering Services, Hitachi Ltd., Turntide, YASA Limited, NIDEC Corporation and Others.

Recent Developments:

-

In May 2025, ABB has launched the AMXE250 motor and HES580 inverter package, delivering up to 12% fewer motor losses and improved performance for electric buses.

-

In Jul 2024, Parker Hannifin has extended its GVM310 motor range up to 351 kW to meet growing electrification demands, offering higher power density and efficiency for on- and off-road EVs.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 11.30 Billion |

| Market Size by 2032 | USD 109.23 Billion |

| CAGR | CAGR of 32.79% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type(Battery Electric Vehicle (BEV), Plug-in Hybrid Electric Vehicle (PHEV)) • By Type of Motor(Permanent Magnet Synchronous Motor (PMSM), Induction Motor (IM), Brushless DC Motor (BLDC), Other Motors) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | The Electric Vehicle Traction Motors Companies are ABB, Parker Hannifin Corp, AB SKF, ZF Friedrichshafen AG, Robert Bosch GmbH, Valeo, Continental Engineering Services, Hitachi Ltd., Turntide, YASA Limited, NIDEC Corporation and Others. |