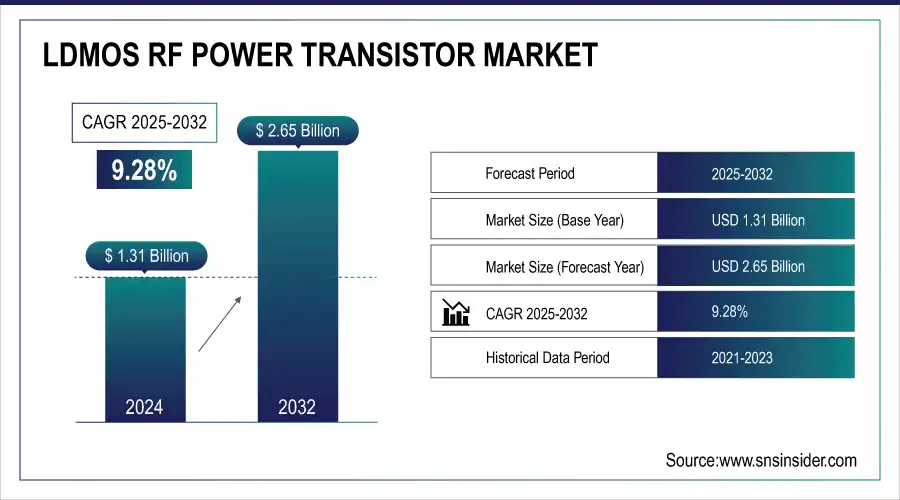

LDMOS RF Power Transistor Market Size & Growth:

The LDMOS RF Power Transistor Market size was valued at USD 1.31 billion in 2024 and is expected to reach USD 2.65 billion by 2032, growing at a CAGR of 9.28% over the forecast period of 2025-2032.

The primary factor driving the LDMOS RF Power Transistor market growth is the growing 5G networks and wireless communication infrastructure. The high-efficiency, cost-effective RF solutions for high-frequency generation have been a key factor in the increasing adoption of these components in telecom, defense, and industrial applications. Also, market growth in different sectors is driven by improvements in broadcasting, IOT, and radar systems.

To Get more information on LDMOS RF Power Transistor Market - Request Free Sample Report

The rise in solid-state RF technology will trigger the growth of the LDMOS RF power transistor market, as these products offer higher efficiency and reliability as compared to traditional vacuum tube RF communication systems. Demand is also being boosted by the growing investments in smart city infrastructure and public safety communication systems. Moreover, increasing adoption of RF energy in medical therapies, manufacturing of semiconductors, and plasma applications is expected to gain traction in the market. The emergence of driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communications technologies in the automotive sector is an additional factor that has been driving demand for LDMOS-based solutions.

-

In 2024, over 210 new hospitals globally integrated RF-powered MRI systems, each requiring multiple high-frequency RF supply units rated at 10–30 kW. Additionally, proton therapy centers expanded by 9% in 2024, necessitating RF-driven particle acceleration chambers.

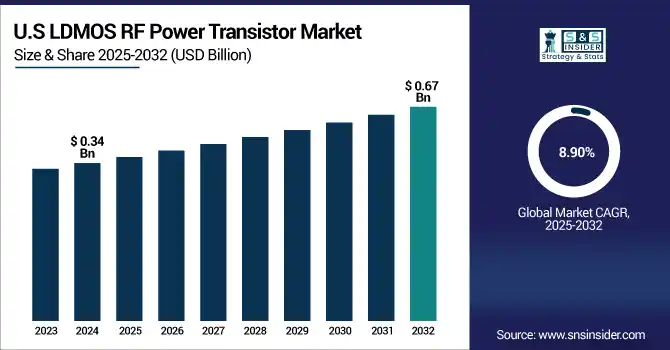

The U.S. LDMOS RF Power Transistor Market size is estimated to be valued at USD 0.34 billion in 2024 and is projected to grow at a CAGR of 8.90%, reaching USD 0.67 billion by 2032. Expanding the 5G networks deployment, rising demand for energy-efficient telecom infrastructure, and the next-generation technology in defense communication systems all are paving the way for the growth of the U.S. LDMOS RF Power Transistor market. Moreover, growing investments in smart city projects and automotive V2X technology will further propel market growth by increasing high-frequency RF component demand.

LDMOS RF Power Transistor Market Dynamics:

Key Drivers:

-

LDMOS RF Transistor Demand Surges with 5G, Defense, and Smart City Communication Network Expansion

LDMOS RF power transistor market trends include the increasing number of 5G infrastructure deployments, as they require high-power and high-efficiency RF solutions. This makes LDMOS an attractive choice for telecom base stations due to the low cost, thermal efficiency, and high reliability. Also, the demand is supported by the increasing adoption of solid-state RF technologies in defense, broadcasting, and industrial heating. In addition, high demands on RF infrastructure are also emerging with the rise of public safety and smart city communication networks.

-

The U.S. Department of Transportation awarded USD 60 million in grants in June 2024 to advance connected and interoperable vehicle technologies under the "Saving Lives with Connectivity: Accelerating V2X Deployment" program.

Restraints:

-

High-Frequency Limitations Challenge LDMOS RF Transistors Amid Rising mmWave and GaN Technology Adoption

The need for increased operational capabilities of RF transistors to operate at very high frequencies is one of the major key restraints in the LDMOS RF power transistor market and will pose a significant challenge as the operational device performance needs to be improved. Communication technologies are beginning to penetrate into millimeter-wave (mmWave) bands, and while LDMOS transistors are used extensively in the microwave range, their frequency response and efficiency eventually become hurdles that limit performance relative to other technologies such as GaN (Gallium Nitride)

Opportunities:

-

LDMOS RF Transistors Gain Momentum with V2X, ADAS, Medical, IoT, and Industrial Automation Growth

The significant growth opportunities arise as the (specific) V2X (Vehicle-to-Everything) and ADAS (Advanced Driver Assist System) technologies become more prevalent in the automotive domain, which heavily rely on high-speed and high-frequency wireless communication. RF energy has emerged in other sectors, such as healthcare for ablation therapies and in MRI systems. Common high-frequency RF applications also benefit from the same-day semiconductor manufacturing and plasma processing developments. Then, miniaturization and improved packaging drive further innovation, enabling fitting into medical, IOT, and industrial automation devices.

-

In 2024, over 50 million vehicles worldwide were equipped with some form of ADAS, including automatic emergency braking and lane-keeping assistance.

-

The number of MRI scans performed annually in the U.S. surpassed 40 million in 2024, with RF power systems operating at peak powers exceeding 30 kW per scanner.

Challenges:

-

Thermal Management and Integration Hurdles Threaten LDMOS Adoption in Future Wireless and Automotive Systems

The other big challenge is thermal management. Essentially switching at high power produces large amount of heat and this can destroy device reliability and lifetime if not well managed. Even though performance has been improved through advances in packaging and cooling solutions, heat dissipation must still be tightly managed, especially in a small form factor and high density system. Moreover, the complexity of integration with other semiconductor technologies may delay the development cycles. These technological difficulties could slow the adoption of LDMOS transistors in next-gen wireless infrastructure and automotive communication systems.

LDMOS RF Power Transistor Market Segmentation Analysis:

By Product Type

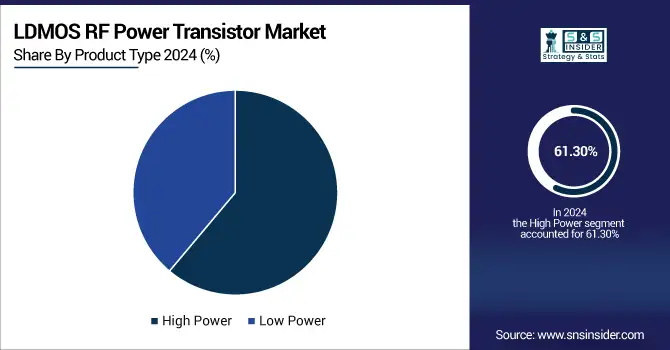

The high-power segment led the LDMOS RF power transistor market share in 2024, contributing close to 61.3% of the total market share. The dominance is influenced by the ubiquitous use of high-power LDMOS transistors in telecommunications infrastructure, particularly at 4G and 5G base-station sites, where high power handling and high thermal efficiency are imperative. High-power devices also demonstrate robust utility in applications including defense, broadcasting, and industrial heating, all of which require reliability and good performance at relatively high power levels.

The low-power segment is projected to grow at the highest CAGR during 2025–2032. Growing demand for smaller, low-power solutions for local area, 5G, and LTE-A network technology drives this market, especially concerning IoT and wearable devices that require lower power without sacrificing signal integrity. Since many low-power applications require devices that generate less heat and last longer, the miniaturization trend and increased usage of smart, connected devices present substantial growth opportunities for low-power LDMOS transistors.

By Application

The LDMOS RF power transistors market in the telecommunications sector accounted for the largest share of 47.4% in 2024. Such market leadership is driven primarily by the accelerated growth of global 4G and 5G networks, which are supported through the use of high-efficiency, reliable RF power transistors used in the base stations and wireless communication infrastructure. This sector continues its quest for better connectivity, faster data, and expanded footprint; therefore, the demand for next-generation LDMOS technology in this sector will remain.

Between 2025–2032, the aerospace and defense segment is anticipated to be the fastest-growing segment. This increase is propelled by enhanced investments in cutting-edge radar systems, reliable communication networks, and electronic warfare technologies, which demand high-performing RF components. LDMOS radio frequency (RF) power transistors are benefiting from the increasing emphasis on modernization of defense infrastructure and expanding applications of advanced aerospace technologies due to their effective inherent properties such as robustness, thermal reliability, and high performance in extreme environments.

By Frequency Range

The low-frequency segment held a market share of 46.2% to become the largest part of the LDMOS RF power transistor market in 2024. The dominance is due to the adoption of low-frequency LDMOS transistors into legacy telecommunication, broadcasting, and industrial applications that have widely deployed longer-range signal transmission and high-power transfer capabilities. Low-frequency devices provide lower cost while reliable power handling provides these applications with optimal efficiency.

The fastest growth in the high-frequency segment is anticipated over 2025-2032. The growth is rapid, and propelled by higher-frequency wireless technologies including 5G and beyond, as they promise to support higher data rates at lower latencies. High-frequency LDMOS transistors thus play an important role in new applications that have emerged in the wireless communication field, such as millimeter-wave communication, radar, and high-resolution imaging. Each step in the direction of miniaturization and better packaging of the device supports the increasing proliferation of high-frequency applications and other markets, where significant growth can still be unlocked for LDMOS solutions.

By End Use

The LDMOS RF power transistors market was dominated by the IT and Telecommunications sector in 2024, with a market share of 45.5% of the LDMOS RF power transistors market. The dominance of GaN transistors is chiefly attributed to their rapid growth in 5G networks, data centers, and wireless communication infrastructure, where high-performance, reliable, and energy-efficient RF transistors are essential. LDMOS devices are being adopted across technologies because the aerospace and defence sector continues to drive the need for more connectivity, higher data rates, and low-latency communication.

The manufacturing industry is projected to grow the fastest between 2025 and 2032. This growth is driven by greater automation and adoption of industrial IoT and by growing use of RF energy for plasma treatment, in semiconductor fabrication, and for advanced industrial heating. With manufacturers looking for compact, higher-efficient, and better-controlled production processes, LDMOS-based RF power transistors will see an increase in demand. Miniaturization and packaging advancements also allow these transistors to be integrated into complicated production systems, which is another factor boosting the market growth for this industry.

LDMOS RF Power Transistor Market Regional Outlook:

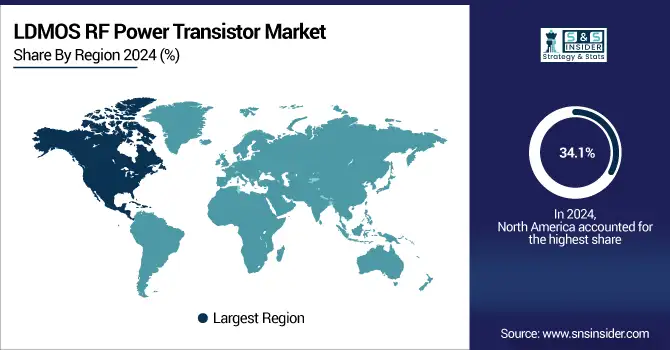

North America held the largest market share of LDMOS RF power transistors in 2024, accounting for 34.1%. This leadership comes from the widespread implementation of state-of-the-art wireless communication networks and sustained investments in telecommunications infrastructure modernization. A strong backbone of technology development, steeped in a history of research and development activity, as well as an early adoption of 5G and cutting-edge communication technologies, all contribute to the region's wealth. Furthermore, rising consumption from aerospace, defense and industrial automation industries, is augmenting the market growth.

In North America, the USA led the LDMOS RF power transistor market owing to the well-established telecommunication infrastructure, substantial investments in 5G rollout, and a robust defense sector complemented with a high level of technology innovation and RD activities.

Get Customized Report as per Your Business Requirement - Enquiry Now

The LDMOS RF Power Transistor market in Asia Pacific is estimated to be the fastest growing at a CAGR of 10.00% over the forecast period 2025-2032. The rapid expansion is fuelled by growing investments in telecom infrastructure, which mainly involve the implementation of 5G adoption of advanced wireless technologies. Apart from that, rapid industrialization, smart city projects, and increasing demand for consumer electronics will have a significant impact on the market. Demand is also further stimulated by the evolution of the automotive sector in the region, such as growth related to connected and autonomous vehicles. This dynamic growth trajectory is supported by a continuous focus on innovation and development capabilities.

China dominated the Asia Pacific LDMOS RF power transistor market, driven by massive investments in 5G infrastructure, rapid industrial growth, expanding automotive technology adoption, and strong government support for advanced communications.

The LDMOS RF power transistor market across Europe is expected to expand, owing to the growing emphasis on advanced telecommunications infrastructure and industrial automation. Continuous investments were made in the 5G network deployment, while several old communication systems are undergoing modernization that also fuels the growth in this region. Also, European aerospace and defense-driven markets are implementing LDMOS technology for radar, secure communications, and electronic warfare (EW) applications. Increased focus on smart city projects and public safety networks is another demand determinant.

Germany held the largest share of the European LDMOS RF power transistor market due to a sophisticated industrial base, strong telecom infrastructure, huge investments in 5G technologies, and innovation developments in aerospace and defense.

Latin America and the Middle East & Africa regions are emerging markets for LDMOS RF power transistors, driven by growing investments in telecommunications infrastructure and expanding wireless network coverage. Increasing focus on smart city projects, public safety communications, and industrial automation fuels demand. Both regions are witnessing the gradual adoption of advanced technologies including 4G/5G and connected automotive systems. However, market growth is moderated by infrastructure challenges and economic variability, creating opportunities for long-term development as technological adoption accelerates.

Key Players:

Some of the major LDMOS RF Power Transistors Companies are Ampleon, NXP Semiconductors, Infineon Technologies, STMicroelectronics, Qorvo, MACOM Technology Solutions, Broadcom Inc., Wolfspeed, Microchip Technology, and Skyworks Solutions.

Recent Developments:

-

In April 2025, Ampleon announced the release of the ART1K9FH, a new 50V / 55V RF LDMOS transistor delivering up to 1900 W of output power, designed for industrial, medical, and scientific applications.

-

In 2024, Qorvo announced the acquisition of Anokiwave, a company specializing in high-performance RFIC design, enhancing its capabilities in the RF domain.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.31 Billion |

| Market Size by 2032 | USD 2.65 Billion |

| CAGR | CAGR of 9.28% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (High Power, and Low Power) • By Application (Telecommunications, Aerospace & Defense, Industrial, Medical, and Others) • By Frequency Range (Low Frequency, Medium Frequency, and High Frequency) • By End Use (BFSI, Healthcare, Retail and E-commerce, Media and Entertainment, Manufacturing, IT and Telecommunications, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Ampleon, NXP Semiconductors, Infineon Technologies, STMicroelectronics, Qorvo, MACOM Technology Solutions, Broadcom Inc., Wolfspeed, Microchip Technology, and Skyworks Solutions. |