Electrodeionization Market Report Scope & Overview:

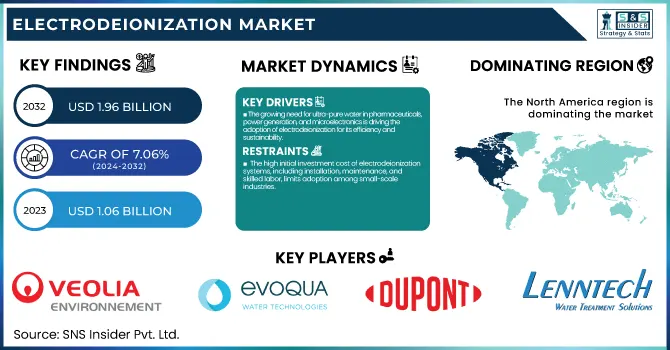

The Electrodeionization Market Size was estimated at USD 1.06 billion in 2023 and is expected to arrive at USD 1.96 billion by 2032 with a growing CAGR of 7.06% over the forecast period 2024-2032. The Electrodeionization Market report uniquely provides insights into production output trends across key regions, highlighting capacity utilization rates and system efficiency metrics. It explores technological advancements and automation trends, detailing their regional adoption. Additionally, the report presents export/import trade flows, mapping global supply chain movements. A key differentiator is its focus on downtime metrics and system performance, essential for operational benchmarking. Furthermore, it includes sustainability-driven innovations and the impact of next-gen membrane materials, making it a comprehensive industry analysis.

Electrodeionization Market Size and Forecast:

-

Market Size in 2023: USD 1.06 Billion

-

Market Size by 2032: USD 1.96 Billion

-

CAGR: 7.06% from 2024 to 2032

-

Base Year: 2023

-

Forecast Period: 2024–2032

-

Historical Data: 2020–2022

To Get more information on Electrodeionization Market - Request Free Sample Report

Electrodeionization Market Trends:

-

Growing adoption of electrodeionization for ultra-pure water in pharmaceuticals, power generation, and microelectronics

-

Rising implementation of zero liquid discharge (ZLD) and wastewater recycling initiatives

-

Increasing preference for chemical-free and energy-efficient water purification technologies

-

Advancements in next-generation membrane materials improving system performance and durability

-

Expansion of automation and monitoring systems to enhance operational efficiency and reduce downtime

-

Strong regulatory push toward sustainable water treatment solutions across developed and emerging economies

Electrodeionization Market Drivers

-

The growing need for ultra-pure water in pharmaceuticals, power generation, and microelectronics is driving the adoption of electrodeionization for its efficiency and sustainability.

The rising demand for ultra-pure water is a key driver of the electrodeionization market, fueled by its critical applications in pharmaceuticals, power generation, and microelectronics industries. Due to the heavy regulatory inspection in pharmaceutical sectors, high-purity water required for drug production and laboratory operations, this factor is maximally adopting advanced water treatment technology. Likewise, ultra-pure water is imperative for boiler feed applications in power plants to avoid scaling and corrosion, which in turn allows for the efficient production of energy. The microelectronics business also uses high-purity water for semiconductor production, as even minor impurities may affect product quality. With these sectors constantly growing, there is a growing need for efficient and sustainable water purification solutions, which makes electrodeionization a preferred technology due to its chemical-free operation and cost-effectiveness. Moreover, the growing environmental awareness and stringent wastewater discharge rules contribute further to the transition towards electrodeionization, thereby facilitating remarkable market growth across the globe.

Electrodeionization Market Restraint

-

The high initial investment cost of electrodeionization systems, including installation, maintenance, and skilled labor, limits adoption among small-scale industries.

The high initial investment costs associated with electrodeionization (EDI) systems present a significant barrier to adoption, particularly for small and medium-sized enterprises. This increased capital expenditure is spent on purchasing newer EDI modules, installation, and the integration of these modules within the existing water treatment infrastructure. So does specialized equipment, automation features, and monitoring systems. The long-term cost is compounded by routine maintenance, parts replacements, and the need for expert-grade technicians. Many industries with lower purification requirements may find reverse osmosis and ion exchange to be a more economical choice and postpone the application of EDI. While industries like pharmaceuticals, power generation, and electronics can justify the expense with their higher purity demands, the small-scale industry often finds the investment a luxury. Nevertheless, technological innovations and growing requirement for sustainable water treatment systems are likely to energize price discounts in the long run, making EDI feasible and market penetration for EDI methods in several industrial breakthroughs.

Electrodeionization Market Opportunities

-

Government initiatives like ZLD policies, wastewater treatment mandates, and financial incentives are driving electrodeionization adoption for sustainable water reuse.

Governments worldwide are increasingly investing in water reuse and recycling initiatives to address growing water scarcity and environmental concerns. Policies to promote zero liquid discharge (ZLD) systems, enforce industrial wastewater treatment, and conduct sustainable water technologies are major contributors to increased adoption rates of advanced purification methods such as electrodeionization. Many regions have implemented regulations to minimize wastewater discharges and encourage the adoption of high-efficiency water treatment solutions across industries. As an example, the U.S. Clean Water Act and EU Water Framework Directive impose strict wastewater treatment standards. This puts pressure on industries, where they have to adopt sustainable water purification systems. China’s Water Ten Plan and India’s National Water Mission also foster water conservation and recycling for manufacturing industries. Tax credits, subsidies, and public-private partnerships (PPPs) are financial incentives driving the adoption of water reuse technologies. Such initiatives are creating traction for the adoption of electrodeionization systems for sustainable and circular water resource management.

Electrodeionization Market Challenges

-

Supply chain disruptions in the electrodeionization market stem from reliance on specialized components, geopolitical tensions, and logistical challenges, impacting production and availability.

Supply chain disruptions in the electrodeionization market arise due to the reliance on specialized components such as ion-exchange membranes, electrodes, and high-purity resins, which are often sourced from a limited number of global suppliers. Raw material price volatility, geopolitical instability, and trade restrictions can cause production delays and rising costs. Logistical challenges, such as port congestion and transportation bottlenecks, also affect the timely delivery of essential components. The market is also susceptible to supply chain shocks stemming from economic downturns, labor shortages, and regulatory changes impacting manufacturing centers. Companies will need to adopt risk-mitigation strategies, including regionalized supply networks, supplier diversification and investments in local manufacturing, to improve resilience. Moreover, the increasing necessity for sustainable and high-performance materials also adds to the complexity, as companies need to juggle between innovation, supply chain stability, and uppermost market interaction through consistent production.

Electrodeionization Market Segmentation Analysis

By Design

The Plate & Frame segment dominated with a market share of over 68% in 2023, driven by its efficiency, ease of maintenance, and adoption in the primary industries. The modular architecture of this design improves ion removal, which maintains a steady supply of high-purity water. The open-frame configuration makes it easier to clean, inspect or replace individual components, thereby reducing downtime and operational costs. This design is particularly popular in industries such as pharmaceuticals, power generation, and electronics, where it is designed to meet stringent water quality requirements while offering long-term reliability. Moreover, its high scalability applies to small and large applications as well. These consolidated operational advantages and vast acceptance across industries make the Plate & Frame segment the front runner in market share.

By End-Use

The Power Generation segment dominated with a market share of over 32% in 2023, owing to the significant demand for ultrapure water in power plants, especially as boiler feedwater. The consequence of scaling, corrosion, and fouling in the boiler and turbine is very adverse to operation, so feeding high purity water is necessary. The continuous, chemical-free nature of EDI technology makes it a preferred technology for water purification, reducing chemical usage and hazardous waste generation, ensuring a safer and greener environment. As global electricity needs continue to grow and power generation turns to cleaner energy sources, power plants are implementing innovative water treatment technologies such as EDI to improve their operational efficiencies and sustainability initiatives. Additionally, stringent regulations on water quality further drive the adoption of EDI in the power sector, solidifying its dominance in the market.

Electrodeionization Market Regional Outlook

North America region dominated with a market share of over 38% in 2023, due to strict norms regarding water purity promulgated by agencies like Environmental Protection Agency (EPA), and the Food and Drug Administration (FDA). Additionally, the region has a widely-renowned industrial infrastructure in sectors including pharmaceutical, power generator, and electronics, which strengthens the demand for high-purity water treatment industry. The market is also growing because of the presence of key market stalls and continuous technological progress. The cost-effectiveness, sustainability, and ultrapure water achievable through its chemical-free solution are rapidly being adopted by industries in the region. North America’s experience with population growth combined with growing awareness around environmental conservation and increasing investments in advanced water treatment technologies lend further evidence to support its dominance in the market.

Asia-Pacific is the fastest-growing region in the Electrodeionization Market, driven by rapid industrialization, expanding manufacturing sectors, and increasing demand for ultrapure water. Countries like China, India, and Japan are experiencing substantial growth. Increasing population and urbanization of the region has raised concerns for water quality in the region, leading to stringent environmental regulations and increasing adoption of advanced water treatment technologies. Furthermore, government programs encouraging clean water solutions and rising investment in industrial infrastructure are other factors accelerating the market expansion. As technology will evolve and newer methods of eco-friendly water treatment will become more popular across the world, that will rapidly replace older methods, Asia-Pacific is predicted to persist its growth pace in the upcoming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the Major Key Players in the Electrodeionization Market

-

Veolia Environment S.A. (SIRION Mega, TERION)

-

Evoqua Water Technologies LLC (Ionpure EDI Modules)

-

DuPont (FILMTEC EDI Modules)

-

Ovivo Inc. (Ovivo EDI Systems)

-

Pure Aqua Inc. (EDI Water Systems)

-

SKion GmbH (Membrane-based EDI Systems)

-

Lenntech B.V. (Lenntech EDI Modules)

-

APPLIED MEMBRANES, INC. (AMI EDI Systems)

-

Hinada (Industrial EDI Water Systems)

-

WesTech Engineering, LLC. (Continuous Electrodeionization Systems)

-

Suez Water Technologies & Solutions (E-Cell EDI Modules)

-

MEGA Group (CediPure EDI Modules)

-

Newterra Ltd. (Modular EDI Systems)

-

Aqua Solutions, Inc. (Laboratory EDI Systems)

-

Bio-Logic Science Instruments (Electrodeionization Systems for Research)

-

Hydranautics – A Nitto Group Company (Hydranautics EDI Modules)

-

ELGA LabWater (PURELAB EDI Systems)

-

Mar Cor Purification (Mar Cor EDI Water Treatment Systems)

-

RephiLe Bioscience Ltd. (RephiLe EDI Lab Water Systems)

-

SnowPure Water Technologies (EDI-XL Modules)

Suppliers for (Energy-efficient EDI modules with high salt rejection) on the Electrodeionization Market

-

Iontech Water Technologies, Inc.

-

MEGA

-

Agape Water Solutions, Inc.

-

Remon Water Treatments

-

Flocon Industries

-

EUROWATER

-

Aqua Filsep

-

DPL Valves & Systems Pvt. Ltd.

-

Nomura Micro Science Co., Ltd.

-

Lenntech

Recent Development

In March 2024: Veolia Water Technologies partnered with a top semiconductor firm to supply EDI systems for a new facility in China, improving water purity and sustainability. A plant in Changshu industrial zone will serve as a hub for deionization and mobile treatment services.

In June 2023: Ovivo Inc., a global leader in water and wastewater treatment solutions, formed a strategic partnership with E2metrix Inc. to develop and commercialize an advanced system for eliminating PFAS, known as "forever chemicals," and other emerging contaminants from water sources.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.06 Billion |

| Market Size by 2032 | USD 1.96 Billion |

| CAGR | CAGR of 7.06% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Design (Plate & Frame, Spiral Wound) • By End Use (Power Generation, Food & Beverage, Chemical, Pharmaceutical, Electronics & Semiconductor, Others). |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Veolia Environment S.A., Evoqua Water Technologies LLC, DuPont, Ovivo Inc., Pure Aqua Inc., SKion GmbH, Lenntech B.V., APPLIED MEMBRANES, INC., Hinada, WesTech Engineering, LLC., Suez Water Technologies & Solutions, MEGA Group, Newterra Ltd., Aqua Solutions, Inc., Bio-Logic Science Instruments, Hydranautics – A Nitto Group Company, ELGA LabWater, Mar Cor Purification, RephiLe Bioscience Ltd., SnowPure Water Technologies. |