Ion Exchange Membranes Market Report Scope & Overview:

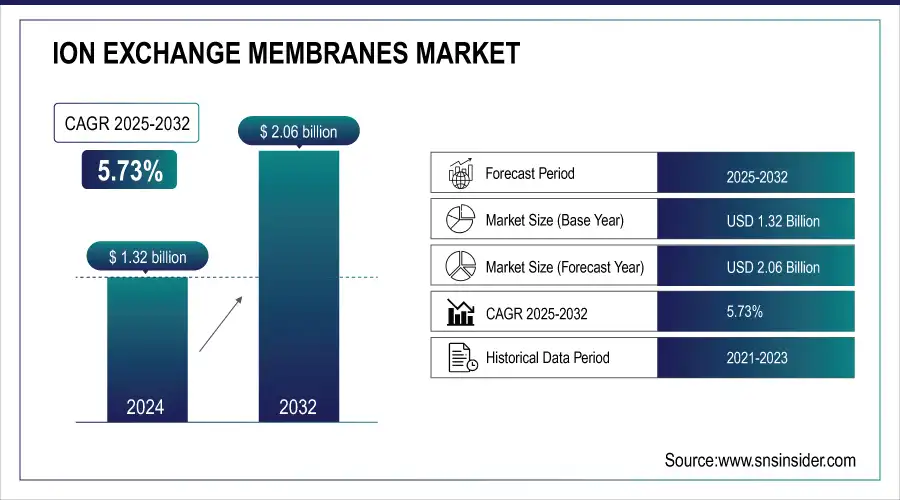

The Ion Exchange Membranes Market size was valued at USD 1.32 billion in 2024 and is expected to reach USD 2.06 billion by 2032, at a CAGR of 5.73% from 2025-2032.

The ion exchange membranes market is experiencing significant growth, driven by advancements in water treatment technologies, energy storage systems, and the burgeoning hydrogen economy. A key factor propelling this expansion is the increasing demand for efficient and sustainable solutions in various industries. For instance, in December 2023, Asahi Kasei invested in Ionomr Innovations Inc., a Canadian manufacturer specializing in anion exchange membranes. This strategic move aims to enhance the production of green hydrogen through cost-effective and scalable electrolysis methods. Similarly, in February 2024, Horizon Fuel Cell announced a breakthrough in anion exchange membrane technology, developing a new material expected to operate for over 60,000 hours at up to 95% efficiency. This innovation holds the potential to significantly reduce the costs associated with green hydrogen production.

To get more information on Ion Exchange Membranes Market - Request Free Sample Report

Companies are actively collaborating to develop advanced membrane technologies that address complex industrial challenges. In January 2023, Membrion partnered with W. L. Gore & Associates to create ultra-thin ceramic ion exchange membranes designed for the energy-efficient desalination of harsh wastewater streams. This collaboration aims to tackle the treatment of complex brines in industries such as semiconductor manufacturing, food processing, and mining, where traditional membrane technologies often fall short. These developments underscore the dynamic nature of the ion exchange membranes market, highlighting a trend toward innovation and strategic partnerships to meet evolving industrial needs.

Market Size and Forecast:

-

Market Size in 2024 USD 1.32 Billion

-

Market Size by 2032 USD 2.06 Billion

-

CAGR of 5.73% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

Ion Exchange Membranes Market Trends:

-

Rising demand for clean energy and hydrogen fuel is accelerating the adoption of ion exchange membranes in energy and industrial applications.

-

Electrodialysis is gaining traction as a low-energy, high-efficiency separation method for desalination, food processing, and chemical recovery.

-

Expanding renewable energy generation is driving the need for advanced energy storage systems such as redox flow batteries using ion exchange membranes.

-

Advances in nanotechnology and material science are enabling the development of high-performance, durable, and cost-effective ion exchange membranes.

-

Increasing global investments in green hydrogen production and electrolyzer technologies are creating new growth avenues for ion exchange membranes.

Ion Exchange Membranes Market Growth Drivers:

The increasing reliance on electrodialysis and energy storage solutions is significantly influencing the growth of ion exchange membranes. Electrodialysis, a membrane-based separation technology, is widely used for desalination, food processing, and chemical recovery. The technology's low energy consumption and high efficiency make it a preferred choice over conventional separation methods. Additionally, the rapid expansion of renewable energy sources, such as solar and wind power, has heightened the demand for energy storage technologies like redox flow batteries, where ion exchange membranes are integral components. These membranes ensure stable ion transport, enhancing the efficiency and longevity of energy storage systems. With growing investments in grid-scale energy storage and advanced battery technologies, the ion exchange membranes market is expected to benefit from continuous technological advancements and rising industrial adoption.

Ion Exchange Membranes Market Restraints:

The high manufacturing costs associated with ion exchange membranes remain a significant restraint in their widespread adoption across various industries. The production of high-performance membranes requires advanced raw materials such as perfluorinated polymers and sophisticated fabrication techniques, leading to increased costs. Additionally, these membranes often exhibit durability issues, including degradation under extreme pH conditions or exposure to harsh chemical environments, limiting their long-term viability. Many industries, particularly in developing economies, hesitate to invest in expensive membrane technologies due to budget constraints and the availability of alternative, cost-effective filtration methods. Although companies like DuPont and Fujifilm Holdings Corporation are investing in R&D to enhance membrane durability and reduce production costs, affordability remains a major barrier. The challenge of balancing cost-effectiveness with high efficiency continues to impact the market, requiring innovative approaches to improve membrane longevity and operational efficiency without significantly increasing expenses.

Ion Exchange Membranes Market Opportunities:

The global shift towards clean energy and carbon neutrality is driving increased investments in green hydrogen production, creating lucrative opportunities for the ion exchange membranes market. Electrolyzers, which rely on ion exchange membranes to facilitate hydrogen generation, are witnessing rising demand as countries focus on scaling up renewable energy infrastructure. Governments and private enterprises are launching large-scale projects to develop hydrogen-powered transportation, industrial processes, and power generation systems. For example, Asahi Kasei’s recent investment in Ionomr Innovations Inc. underscores the strategic push toward developing more efficient anion exchange membranes for cost-effective hydrogen production. With continued advancements in electrolyzer technology and supportive policy frameworks, the adoption of ion exchange membranes in green hydrogen applications is expected to surge.

End-User Industry Consumption Trends: Growth and Regional Insights

| End-User Industry | Key Application Areas | Consumption Trends | Growth Potential | Regional Insights |

|---|---|---|---|---|

|

Water Treatment |

Desalination, Wastewater Treatment |

High demand due to water scarcity and pollution |

Stable growth with emerging markets driving demand |

High demand in regions like the Middle East, Asia, and Africa |

|

Energy Storage |

Fuel Cells, Battery Technologies |

Increased adoption of green energy solutions |

Significant growth due to the push for clean energy |

Strong growth in North America and Europe |

|

Chemical Processing |

Electrodialysis, Separation of Chemical Components |

Steady growth due to industrial applications |

Moderate growth in developed economies |

Leading us in Asia Pacific and North America |

|

Hydrogen Production |

Electrolysis for Green Hydrogen Production |

Increasing demand driven by renewable energy transitions |

Rapid growth with ongoing investments in clean energy |

High adoption in Europe and North America |

|

Pharmaceutical Industry |

Drug Separation and Purification |

Emerging trend due to stringent quality standards |

Moderate growth is driven by regulatory requirements |

Growing in regions with strong pharmaceutical sectors like Europe and North America |

The consumption trends of ion exchange membranes across various end-user industries show a diverse and evolving landscape. The water treatment industry remains a dominant sector, with an increasing demand driven by global water scarcity and pollution. Regions such as the Middle East and Asia are witnessing strong growth in desalination and wastewater treatment applications. In the energy storage sector, the rise of fuel cells and battery technologies, particularly in the green energy transition, is fueling significant demand, particularly in North America and Europe. The chemical processing industry is seeing steady demand, primarily for electrodialysis applications, with growth driven by the need for efficient separation processes. In the hydrogen production space, the push for green hydrogen production is leading to a surge in membrane demand, especially in Europe and North America. Lastly, the pharmaceutical industry is becoming an emerging consumer of ion exchange membranes due to stricter regulations and the need for high-quality drug purification. This trend is expected to grow moderately in developed regions with robust pharmaceutical industries.

Ion Exchange Membranes Market Segment Analysis:

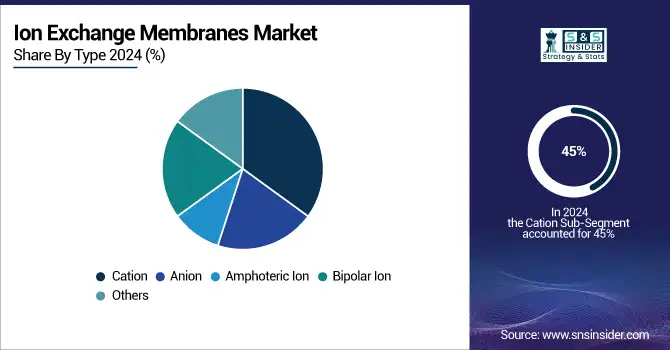

By Type

The Cation Ion Exchange Membranes segment dominated the ion exchange membranes market in 2024, accounting for a market share of 45%. Cation exchange membranes are designed to selectively allow the passage of positively charged ions while blocking negatively charged ions. This unique property makes them invaluable in various applications, particularly in water treatment, where they are extensively used to remove harmful cations such as calcium, magnesium, and heavy metals from water sources. The global focus on sustainable water management has amplified the demand for effective cation exchange membranes in desalination plants and industrial wastewater treatment facilities. Major players, including DuPont and SUEZ, have developed advanced cation membranes that enhance efficiency and longevity in harsh operating environments. Additionally, these membranes are integral to the functioning of fuel cells and energy storage systems, where they facilitate the exchange of ions, improving overall energy efficiency. The growing awareness of environmental issues and the push for cleaner water solutions further drive innovation and investment in cation exchange technology, ensuring its dominance in the ion exchange membranes market.

By Material

The Hydrocarbon Membrane segment dominated the ion exchange membranes market in 2024, with a market share of 40%. Hydrocarbon membranes are popular for their favorable balance of performance, cost, and versatility, making them suitable for a wide range of applications, including water treatment, electrodialysis, and fuel cells. These membranes are typically made from polymeric materials that provide durability and chemical resistance, essential for effective ion separation processes. The rising global demand for efficient and cost-effective solutions in water purification and chemical processing has fueled the growth of hydrocarbon membranes, particularly in regions like Asia-Pacific, where industrialization and urbanization are rapidly increasing. Companies like Ion Exchange India Ltd. and Toray Industries have been at the forefront of developing innovative hydrocarbon membrane technologies that enhance operational efficiency and sustainability. Furthermore, as industries seek to adopt greener practices, hydrocarbon membranes are expected to play a crucial role in advancing environmentally friendly technologies, thereby solidifying their position as a key material in the ion exchange membranes market.

By Application

The Water Treatment segment dominated the ion exchange membranes market in 2024, holding a market share of 50%. This segment has seen robust growth due to the escalating global demand for clean and safe drinking water, coupled with the increasing need to address the challenges of water scarcity and pollution. Ion exchange membranes are critical in various water treatment processes, including desalination, wastewater treatment, and reverse osmosis, where they facilitate the selective removal of contaminants and salts from water sources. The effectiveness of these membranes in enhancing water quality has made them a preferred choice for municipal and industrial applications alike. Companies like SUEZ and Veolia are leading the charge in developing advanced membrane technologies that improve efficiency and reduce operational costs. The push towards sustainable water management practices and compliance with stringent environmental regulations further drives innovation in this space. As global water crises become more pressing, the water treatment application of ion exchange membranes is expected to expand, reinforcing their vital role in ensuring access to clean water for communities worldwide.

Ion Exchange Membranes Market Regional Analysis:

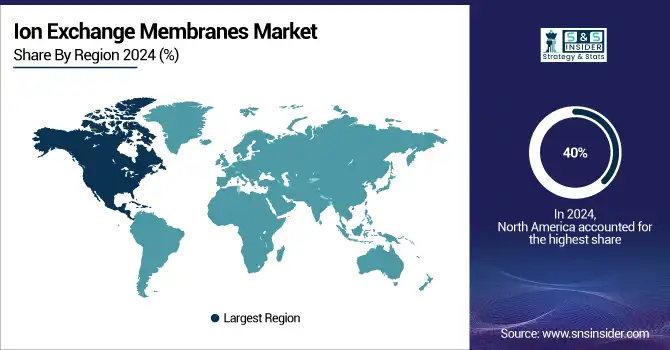

Asia Pacific Ion Exchange Membranes Market Insights

In 2024, the Asia-Pacific (APAC) region dominated the ion exchange membranes market, accounting for a market share of 40%. This dominance is largely attributed to the rapid industrialization, increasing urbanization, and growing demand for clean water in the region. Countries like China, India, and Japan have heavily invested in infrastructure development, particularly in water treatment and desalination projects, driving the demand for ion exchange membranes. China, as the largest market within the region, leads in both manufacturing and consumption of ion exchange membranes. The country’s focus on enhancing its water management systems and tackling severe water scarcity issues has contributed significantly to the market's growth. Additionally, India has witnessed substantial growth in the water treatment sector due to its expanding population and urbanization, which require efficient water purification solutions. In Japan, technological advancements and stringent environmental regulations have spurred the demand for high-performance ion exchange membranes in applications like fuel cells and wastewater treatment.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Ion Exchange Membranes Market Insights

The North America ion exchange membranes market is fueled by strong investments in renewable energy, advanced water treatment, and green hydrogen initiatives. The region’s emphasis on clean technologies, coupled with government support for carbon neutrality and sustainable industrial practices, is boosting adoption. Growing applications in energy storage, pharmaceuticals, and chemical processing further strengthen demand. The presence of key global players, coupled with continuous R&D, positions North America as a leading hub for ion exchange membrane innovations.

Europe Ion Exchange Membranes Market Insights

Europe’s ion exchange membranes market is shaped by stringent environmental regulations, strong government backing for decarbonization, and a focus on hydrogen economy development. The region’s ambitious climate goals and investment in electrolyzer technologies drive demand for advanced membranes. Rising adoption in water treatment, food processing, and energy storage further strengthens growth. Collaboration between research institutions, governments, and industrial leaders accelerates innovation, making Europe a frontrunner in implementing ion exchange membranes across diverse clean energy and industrial applications.

Latin America (LATAM) and Middle East & Africa (MEA) Ion Exchange Membranes Market Insights

The LATAM and MEA ion exchange membranes market is experiencing gradual growth, driven by rising investments in desalination, renewable energy, and water management projects. Governments are focusing on sustainable solutions to meet increasing demand for clean water and energy security. Expanding industrialization and infrastructure development in emerging economies support adoption. While market maturity is lower compared to developed regions, growing interest in hydrogen production, coupled with supportive policies, is creating opportunities for membrane manufacturers in these regions.

Ion Exchange Membranes Market Key Players:

-

3M (3M Ion Exchange Membrane, 3M Fluoropolymer Membrane)

-

AGC ENGINEERING Co. Ltd (Flemion, Selemion)

-

Asahi Kasei Corporation (Aciplex, Hipore)

-

Dioxide Materials (Sustainion Membranes)

-

Dow Inc. (Dowex Ion Exchange Membranes, FilmTec Membranes)

-

DuPont de Nemours, Inc. (Nafion, Amberlite)

-

Evergreen Technologies Pvt Ltd. (Evergreen Ion Exchange Membranes)

-

Fujifilm Holdings Corporation (FUJIFILM Ion Exchange Membrane, Hydrophilic Membrane)

-

General Electric Company (GE Ion Exchange Membranes, GE Water Membranes)

-

Hyflux Ltd. (Kristal Membranes, Hyflux Ion Exchange Membrane)

-

Ion Exchange Ltd. (Indion Ion Exchange Membranes, Indion Selective Membranes)

-

LANXESS AG (Lewatit, IONAC)

-

Liaoning Yichen Membrane Technology Co. Ltd (Yichen Ion Exchange Membrane, Yichen Bipolar Membrane)

-

Membranes International Inc. (MI Ion Exchange Membranes, MI Electrodialysis Membranes)

-

Merck KGaA (Sephadex, Milli-Q Membranes)

-

ResinTech Inc. (ResinTech Ion Exchange Membranes, ResinTech AM Series)

-

Saltworks Technologies Inc. (Saltworks Xtreme Membrane, Saltworks Brine Membrane)

-

SnowPure, LLC (Electropure, Excellion)

-

SUEZ Group (SUEZ Ion Exchange Membranes, SUEZ Selective Membranes)

-

Toray Industries Inc. (Torayfil, Toray Ion Exchange Membranes)

Competitive Landscape for Ion Exchange Membranes Market:

AGC, Inc. is a leading global manufacturer offering advanced ion exchange membranes under brands like Flemion and Selemion. The company focuses on delivering high-performance solutions for applications in chlor-alkali, energy storage, and water treatment. With strong expertise in material science and sustainability, AGC continues to innovate membranes that support clean energy, green hydrogen production, and efficient industrial separation processes worldwide.

-

February 2024: AGC, Inc. revealed plans to build a new production facility for its FORBLUE S-SERIES fluorinated ion-exchange membranes, aimed at green hydrogen production, at its Kitakyushu Site. The company will invest approximately 15 billion Japanese yen, with operations expected to begin in June 2026.

LANXESS is a specialty chemicals company recognized for its ion exchange resins and membranes that serve water treatment, food processing, and chemical industries. Leveraging advanced material science, the company provides reliable solutions for desalination, purification, and energy storage. LANXESS emphasizes sustainability and innovation, aligning its membrane technologies with growing demand in clean energy, hydrogen production, and environmentally responsible industrial applications.

-

February 2023: LANXESS initiated the supply of its Lewatit ion exchange resins and Bayoxide iron oxide adsorbers in France through Caldic, a distribution solutions provider. This move is part of LANXESS's strategy to streamline its distribution across Western Europe, following successful collaborations with Caldic in the Benelux region.

The Chemours Company specializes in advanced chemistry solutions, including ion exchange membranes widely used in hydrogen production, fuel cells, and energy storage systems. Its Nafion™ membranes are recognized for superior durability, conductivity, and performance in clean energy applications. Chemours focuses on enabling the global transition to sustainable energy by supporting innovations in green hydrogen and renewable power integration.

-

January 2023: The Chemours Company committed US$ 200 million to expand capacity and enhance technology for its Nafion ion exchange materials at its Villers-Saint-Paul facility in France.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.32 Billion |

| Market Size by 2032 | USD 2.06 Billion |

| CAGR | CAGR of 5.73% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Type (Cation, Anion, Amphoteric Ion, Bipolar Ion, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

|

Company Profiles |

3M, DuPont de Nemours, Inc., Merck KGaA, LANXESS AG, SUEZ Group, AGC ENGINEERING Co. Ltd, Fujifilm Holdings Corporation, Ion Exchange Ltd., Toray Industries Inc., Veolia Water Technologies & Solutions and other key players |